Accounting – The Language of Finance

First, A Bit of Humor

There is an accountant's story that goes like this: Once there was a man who was the chief accountant for a major business in town. This man had a reputation for being the most knowledgeable accountant in the area and co-workers and accountants in other firms would frequently call him when they had questions or problems with the their work.

Like most stereotypical accountants, this man was predictable, numbers oriented, methodical and quiet in manner - basically dull. However, he did have one quirk that had everyone intrigued and that was his morning routine. Each morning he would arrive, in his gray flannel suit with attache case in hand, at precisely 7:55 AM and go straight to his office. Upon entering his office he would place his briefcase on the credenza and open it after which he would hang up his coat and hat. Then, reaching into his pocket, he would remove a set of keys, unlock the middle drawer of his desk, remove a slip of paper, read it, return the paper to the drawer, and re-lock the drawer before stepping out of his office to greet his fellow employees before starting work.

Everyone who knew him assumed that that piece of paper he read every morning contained some great bit of wisdom, but no one had the courage to approach him and ask to see it. This routine was followed faithfully for thirty-five years up to and including the day he retired. That afternoon on the day of his retirement his co-workers threw a little party for him and, during the party, one of the employees finally got up the courage to ask the chief accountant if he would let everyone see what was on the slip of paper in his desk. Of course was the reply. Whereupon the chief accountant unlocked the drawer and handed the mysterious slip of paper to his inquiring subordinate.

Glancing at the paper the subordinate saw two lines of four words each which read:

Debits on the left.

Credits on the right.

The Accounting Equation

While accounting can appear to be very complex and confusing, it is, at its heart a very simple and logical system. The basic concept behind double entry bookkeeping is that each transaction that a business or household enters into is recorded in at least two accounts - accounts being classification units used for reporting purposes. Recording is done in a T shaped ledger with the left side of the T being used to record debit transactions and the right side for credit transactions. For each amount entered in the debit (left) side of a ledger of one account an equal amount must be entered in the credit (right) side of corresponding account.

What is happening here is that every transaction involves an exchange or trade between the seller and the buyer. When I buy my afternoon candy bar from the snack bar at work I trade or exchange seventy-nine cents of my cash for one candy bar. If I were recording this in a double entry accounting system I would enter 79¢ on the credit or right column of my cash account which would indicate that my cash holdings have decreased by 79¢ and 79¢ a second time on the debit or left side of my expense account showing that my energy (I need the candy bar to get through the afternoon) expenses have increased by 79¢. At the end of the day when I add up all of my credits in the right column of my ledgers and all of my debits in the left side of my ledgers the totals in both columns should be equal. If they are not, I have made a mistake and not properly accounted for all of my transactions.

The bigger and more complex the operation, the more accounts it will have. However, all accounts fall under one of three categories which are: assets, liabilities and capital (also called owner's equity or net worth in the case of an individual or household). These three main categories come together in what is known as the accounting equation which is written as:

Assets = Liabilities + Capital

Assets are everything that a business or household owns.

Liabilities are what the business or household owes to others.

Capital is all of the property (including cash) that the owner of a business has invested in the business. In the case of a household capital or net worth is the property which the individual/household owns outright and does not have any outstanding loan against it).

For example, assume a college student owns a car worth $10,000, a computer worth $1,000 and a TV worth $300. All three of these are property owned by the student which makes them assets. However, assume that the student borrowed money to purchase the car and still owes the bank $5,000 on the car loan which is a liability.

The difference between the total value of the student's assets is $11,300, while her liabilities consist of the $5,000 car loan. Her net worth or capital is the difference between the assets she owns ($11,300) minus what she owes on them ($5,000) which works out to $6,300. Returning to our accounting equation we have:

Assets = Liabilities + Capital

$11,300 = $5,000 + $6,300

$11,300 = $11,300 (the equation is in balance)

Thus, while the total account debits must equal the total account credits, the sum of the balances in the asset accounts must equal the sum of the balances in the liability accounts plus the sum of the balances in the capital accounts.

What confuses many people, including me, is whether particular debits represent increases or decreases in accounts and the same for credits. Actually debits and credits can each represent either an increase or a decrease in the account DEPENDING UPON THE TYPE OF ACCOUNT.

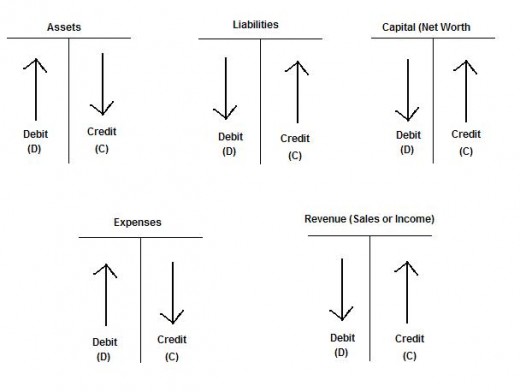

In the graphic below the five major types of accounts are shown along with an arrow showing whether the debits and credits for that type serve to increase or decrease the balance in that account. The five types include the previously discussed Asset, Liability and Capital plus Expenses in which are recorded the costs incurred by the business or household and Revenue in which are recorded any types of income received by the business or household. Notice that in Asset and Expense accounts a debit entry represents an increase in the account while in the other three account types a debit entry represents a decrease in the account. For credits the opposite occurs.

Debit and Credit Diagram - Use this simple reference to determine whether a given debit or credit will increase or decrease the balance of the account in questi

The Purpose of Accounting is Accurate Tracking and Reporting of Transactions

Good decision making requires good information that is presented in a clear and timely manner. Accounting is designed to to exactly this. The heart or basis of accounting is simple - total debits must equal total credits and total assets must equal total liabilities plus total capital. With these two basic concepts as the foundation, we can build a system that will tell owners and other interested parties the current financial status of the business (or the current status of a household's finances). It can also show which business activities are yielding the greatest revenue per dollar invested as well as which areas are the sources of greatest expense. This knowledge enables owners and managers to identify where money is being spent and take action to reduce costs as well as learn which areas are making the most money and which are marginal or losing money, then decide whether to move resources from areas that are less productive to those that are more productive.

Each of the five accounts shown in the diagram above are really master accounts which are sub-divided into smaller, more specific accounts. For instance, within the Expense account we can have a sub-account for utility expense, one for rent expense, one for materials expense (or one for each type of material used in the production process), etc. The same for the other account categories. The type of sub accounts and level of detail will vary depending upon the size of the business (smaller businesses will tend to have a simpler system than giant corporations) and the reporting needs of management. Smart business owners and managers will work closely with their accountant (or accounting department) to design the system so that it will report the information they determine that they need in order to make good business decisions.

While businesses are obviously the primary users of accounting systems, individuals and households also need some way to keep abreast of their finances. For many people a check book is sufficient. However, others who have multiple sources of income (both husband and wife work full time jobs, plus side jobs like writing for HubPages, selling Avon products, etc.) and many expenses (such as car payments, mortgage payments, tuition for children, retirement savings, credit cards, etc.) will need a more sophisticated system. While a full fledged double entry paper system is probably overkill, there are many fine computerized systems for both small businesses and households the two most popular being Intuit Corporation's QuickBooks for small businesses and Quicken for households. Both of these and other similar systems look and work like a single entry accounting system (like a checkbook) as far as the user is concerned. However, they are really double entry systems in which the computer takes care of posting each entry to two or more accounts. These computerized accounting systems are easy to learn and easy to use but, when used properly, become powerful tools for managing one's money whether that be a person's small business or just household income and expense.