Accounting terms: Expense versus expenditure

In everyday language, persons may use the terms “expense” and “expenditure” interchangeably.

Accounting has its own concepts and definitions, and there exists a relationship between the two terms, but they are not synonyms. The difference is not merely academic either.

The tax consequences and treatment of expenses and capital expenditure in the financial statements differ. There are also some other definitive characteristics of the two concepts that help to identify the relationship between them.

Capital versus revenue expenditure

The relationship between expense and expenditure is that the term "expense" refers to a particular form of expenditure – revenue expenditure. Expenditure is the generic term used for any outflows. This includes administrative expenses, general overheads and finance charges. Capital expenditure refers to capital outflows that lead to new asset acquisition or improvements in the earning capacity of a non-current asset. Therefore, an expense is a capital outlay that is fully utilized in the accounting period it was incurred in.

Benefit period

Revenue expenditure is used to acquire current assets and tradable assets, like production inputs, employee wages and insurance costs. Non-current assets include machines and buildings. Therefore, capital expenditure can be traced to multiple accounting periods, while expenses can only be traced to a single accounting period.

The accruals basis of accounting is the foundation for classification of expenses versus capital expenditure. In cash accounting, benefits from capital outlay are distributed within the period in which the cost in incurred. However, capital expenditure costs are spread out through concepts of amortization and depreciation. Linked to this attribute is that expenses recur frequently, while expenditure is less frequent, non-recurrent or irregular.

Expenses and capital assets

Non-current assets are typically associated with capital expenditure, but expenses can be attributed to them. For instance, cost of repairs, maintenance and depreciation are expenses (within one accounting period).

However, this can be a bit tricky, since improvements or upgrades that increase efficiency or capacity, for example, are forms of expenditure. However, if work done on capital assets does not augment their earning capacity, they should be classified as expenses.

Tax liability

Since expenses are linked to revenue within a period to establish income for the accounting period, expenses reduce a business’ chargeable income. However, capital expenditure nor is not tax deductible. Instead, taxes are charged against a business’ net profits, but not its gross profits.

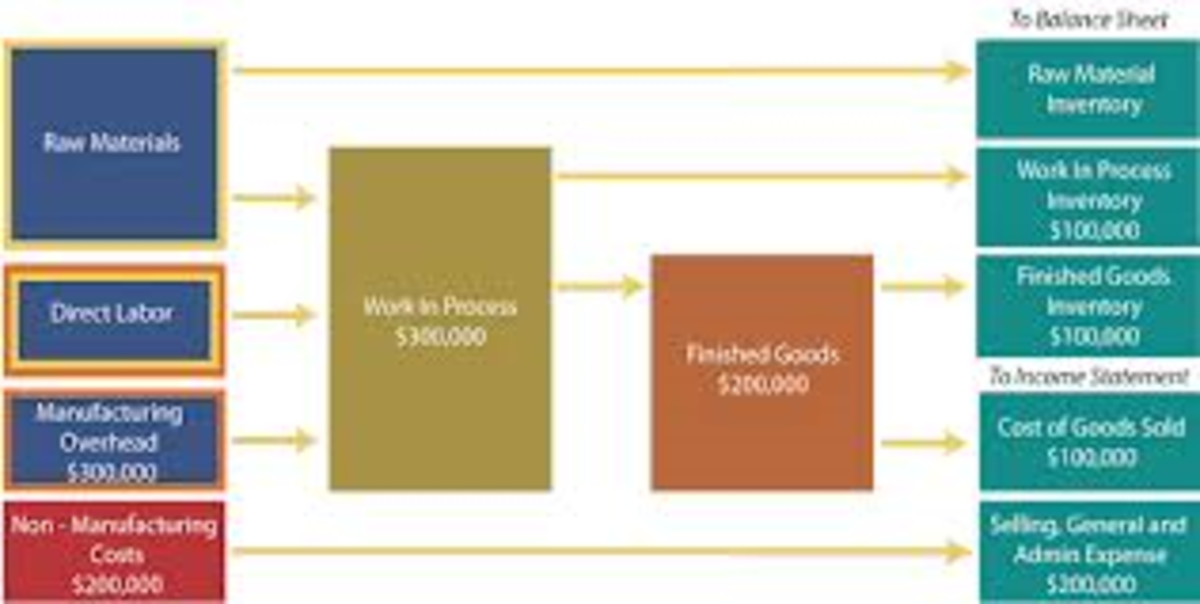

Representation in financial statements

As mentioned above, revenue expenditure dealt with in the Statement of Comprehensive Income, whereas capital expenditure is included in the Statement of Financial position. Expenses affect income, while capital expenditure affects assets and liabilities.

Conclusion

In financial accounting, the relationship between expenses and expenditure is very significant. Improper classification of these can affect the business’ income and financial position as well. As such, proper classification and treatment ensures that the principles of fair and consistent presentation are upheld.