What are America's 10 Largest Corporations?

This hub highlights America's top 10 corporations as ranked by Fortune Magazine.

- Wal-Mart Stores

- Exxon Mobil

- Chevron

- Conoco Phillips

- Fannie Mae

- General Electric

- Berkshire Hathaway

- General Motors

- Bank of America Corp.

- Ford Motor

Wal-Mart Stores

Wal-Mart Stores ranked first as America's largest corporation in 2011. An all-purpose discount superstore, Wal-Mart reported total revenues of just under $422 billion and nearly $16.5 billion in profits.

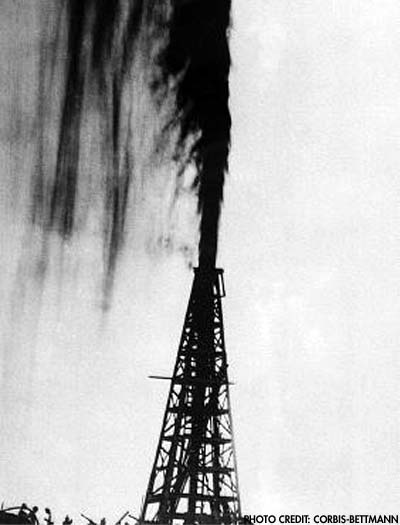

Exxon Mobil

Exxon Mobil ranked second as America's largest corporations in 2011 as ranked in the Fortune 500. Exxon Mobil is a multinational organization which majors in petroleum and petroleum based products. This petroleum-based company ranks first among America's oil corporations. As reported by Fortune magazine, Exxon Mobil recorded total revenues of nearly $354 billion and profits of over $30 billion in 2011.

Chevron

Chevron Oil Corporation is America's 3rd largest corporation and 2nd largest oil company. Like Exxon Mobil, Chevron majors in petroleum and petroleum-based products. In 2011, this large oil company reported over total revenues of $196 billion and profits of over $19 billion.

Conoco Phillips

Conoco Phillips is an other oil company that majors in petroleum and petroleum-based products. In 2011, Fortune Magazine rated Conoco Phillips as America's fourth largest corporation. For 2011, Fortune Magazine reported this company's revenues and profits as just under $190 billion and nearly $11.5, respectively.

Fannie Mae

Fannie Mae was ranked as America's 5th largest corporation in 2011. Fannie Mae is a government-sponsored organization that exists to serve potential homeowners. Their mission is to "ensure that working families have access to mortgage credit to buy homes they can afford over the long term." In 2011, Fannie Mae reported nearly $154 billion in revenues and a loss of $14 billion.

General Electric

General Electric ranked 6th among America's largest corporations in 2011. A multinational conglomerate GE majors in infrastructure, finance, and media. In 2011, GE reported total revenues of just under $152 billion and $12 billion in profits.

Warren Buffet

Berkshire Hathaway

Berkshire Hathaway is an investment firm led by famed investor Warren Buffet. In 2011, Berkshire Hathaway ranked 7th in Fortune 500's 10 largest American corporations. Warren Buffet's latest investment was in the insurance firm, GEICO. For 2011, Berkshire Hathaway recorded over $136 billion in total revenue and nearly $13 billion in profits.

General Motors

General Motors was ranked 8th by Fortune Magazine among America's 10 largest corporations in 2011. General Motors is best known as America's largest automobile manufacturer. In 2009, GM filed chapter 11 and was taken over by the American government until it could restructure. In 2011, GM recorded $135.5 billion in total revenues and $6.5 billion in total profits.

Bank of America Corporation

Bank of America ranked 9th as America's 10 largest corporations as reported within the Fortune 500.Obviously by the name, Bank of America, which ranked as America's largest commercial bank, majored in commercial banking and financial investing. In 2011, BofA struggled due to relatively recent acquisitions of CountryWide Home Mortgage company Merrill-Lynch. America's largest commercial bank recorded revenues of $134 billion and losses of just over $2 billion.

Ford Motor

Ford Motor ranked 10th of America's top 10 largest corporations in 2011. Ford Motor ranked as America's second largest automobile manufacturer and thus majors in automobile manufacturing. The company that did not benefit from gutting consumers with higher oil prices nor did it rely on government bail outs, but continued to claw forward on its own devices. In 2011, Fortune Magazine reported Ford Motor's total revenues at $129 billion and total profits at $6.5.

Hubs on American Business

- Top 10 Best High Demand Jobs - New Town, North Dakot...

New Town in North Dakota projects a need for 500 oil wells by 2015. West of Fargo, its job listings are expanding. - A Teapot Full of Big Oil

Big Oil seemingly has been at the foundation of several scandals in the history of the United States. This is one of the first of them. - Impact of the American Jobs Act of 2011 on High Dema...

President Barack Obama presented his American Jobs Act of 2011 subsequent to months of rising National Unemployment Rates of 9.1% in July and August of that year. America asked the question: Will the AJA help create new jobs and will it do so...