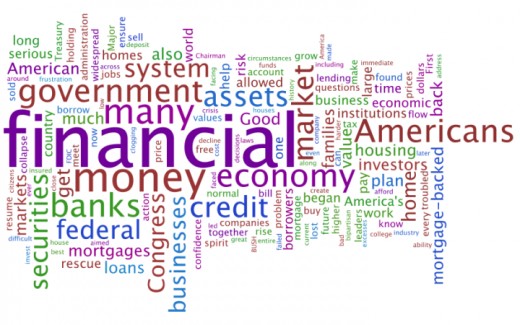

Financial Crisis - A Brief Look

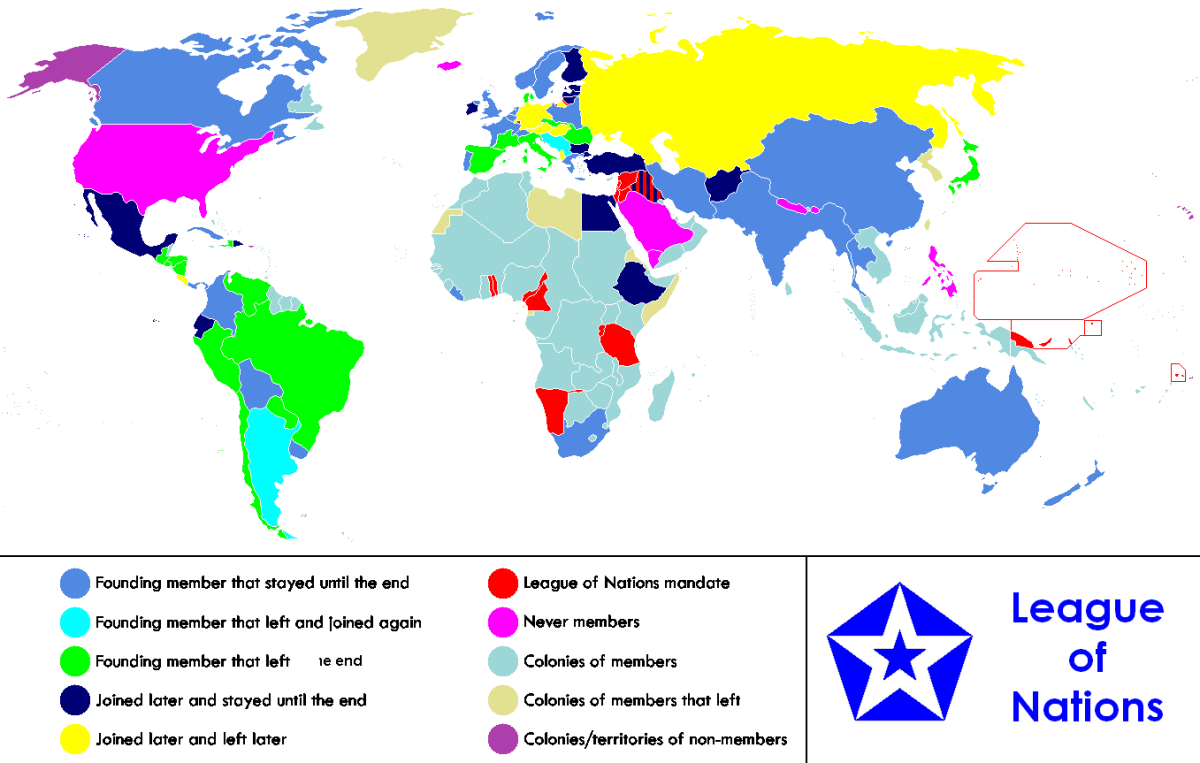

A financial crisis that started to shape up in the mid of 2007 because of the liquidity shortfall in the United States banking system, rapidly affected the whole world. Almost all the economies, whether developed or still in the phase of growth and development, suffered with this new tide of financial crisis and depression and soon it became the greatest Economic Meltdown after the great depression of 1930s.

The vicious circle of lack of confidence in the mind of investors contributed greatly in this meltdown. By the end of the 3rd quarter of 2008, the crisis even became worse and stock exchanges of all over the world started to crash and became enough volatile to keep investors away from businesses. Many governments, including the most successful in terms of economies had to come up with rescue packages and bailout plans to feed their dying economics and institutions. The United States’ government came up with a $700 billion dollars bailout package, which eventually failed to execute as some members of the US Congress objected to use such an enormous amount of the tax payers, which are already suffered by the depression and are on the verge of becoming unemployed. In February 2009, the Australian government announced its 2nd bailout package for the economy worth $47 billion.

The crisis deepened in the hearts of European and Asian economies as well. Here are some of the details of some big economies in the world.

1. Russian Economy, which is mainly supported by its oil exports, contracted very sharply. The investors withdrew a lot of money from the economy, and more people are on the verge of being unemployed or to fall within the poverty line.

2. India, which is one of the largest growing economies of Asia, experienced a 9% increase in its economy in 2007-2008. But after the depression phase, its economic growth reduced to 7.1%.

3. China is considered to be one of the most successful and rapidly growing economy all over the world. Its growth slowed down to 8%, though which is still a better position as compared to other countries.

4. In the month of January alone, Japan’s industrial productivity fell by 10%, which was really alarming.

According to an estimate of International Monetary Fund (IMF), large and renowned banks of U.S and Europe lost more than $1 trillion in January 2007 – September 2009. But these figures are expected to increase to $2.8 trillion from 2007-2010.

Unemployment hit high time records during this global financial crisis. According to a report by International Labor Organization, the recent economic meltdown might increase the amount of unemployed in the world, by 18 million people. Moreover, it also indicates the doubt that in developing countries, more than 200 million people might be pushed below the poverty line.

To read about "UK UNEMPLOYMENT IN DETAIL", click "HERE"

To overcome this global economic meltdown, many economic policies are available but their executions are always difficult in this phase of depression. Some policies include:

1. Reducing interest rates to induce investments.

2. Increased borrowings with complimented to payback at the time of growth.

3. Building confidence in the investors.

4. Spending on Infrastructure.

Many governments have already started to implement some of the policies. For example,

South Korea, Japan, England, China, India and many other countries have reduced their interest rates. Some administrations have come up with stimulus packages for their economies. But the key thing remains here to set up a unique and strong enough policy, in collaboration with all the government administrators and economics, to tackle this difficult phase.