Can The Federal Reserve Print Jobs Or Just Money?

So Just Crank Up The Printing Presses?

This Isn't The Secret Sauce...But It Is One More Nudge Closer To The Edge Of The Cliff.

Obama recently did his shtick routine claiming that the Republicans didn't reveal their secret sauce to cure our economic woes. Since there is no secret sauce, other than leadership, I'm sure Obama missed it, maybe just about as much as he's been missing from the Oval Office. The question now, since he has tried every Keynesian economic trick available is what does Chairman Bernanke expect to do now that he has announced QE3. Is it about anyone's job but his own or Obama's?

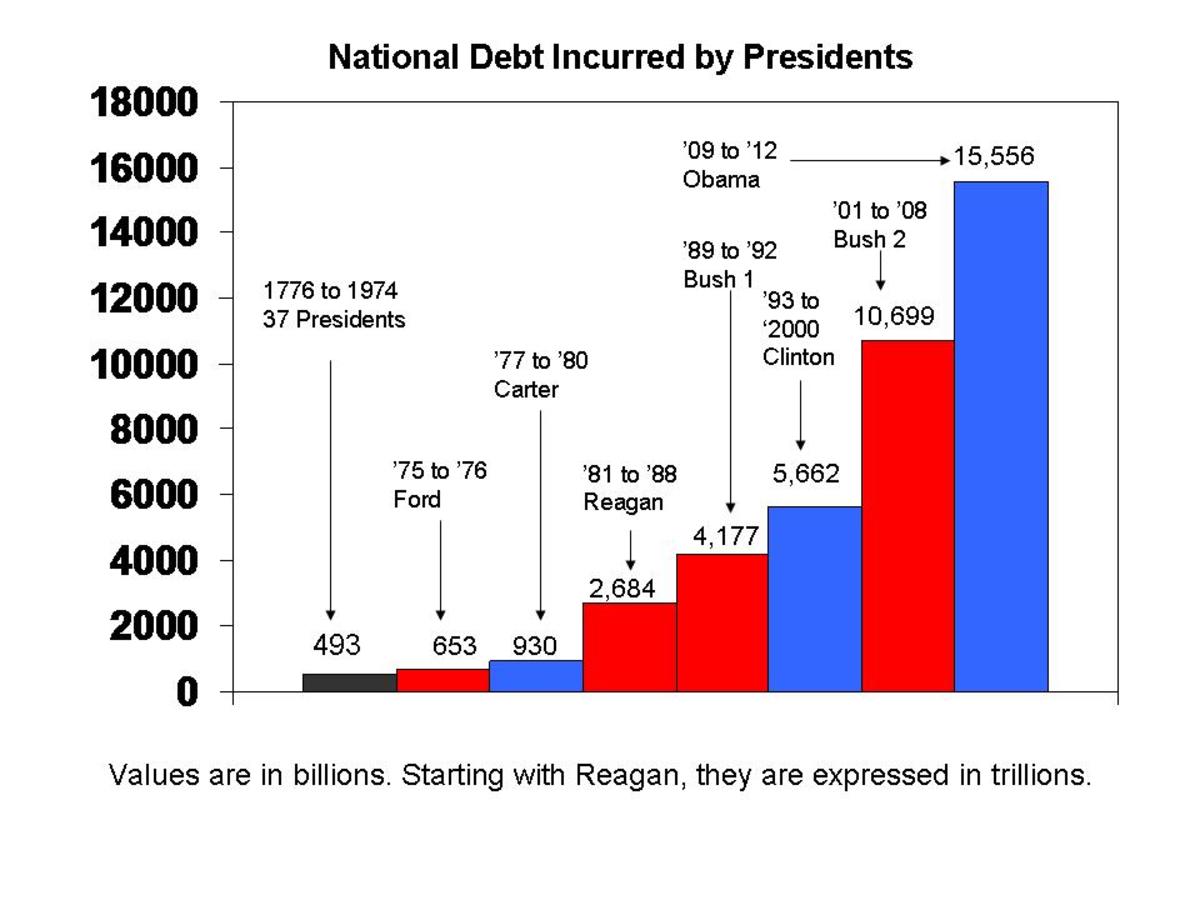

What Bernanke announced is absurd and won't create any jobs. He might save his own and Obama's but beyond that the American electorate needs to wake up, take off those rose colored glasses and smell the coffee. What this economic genius (supposedly according to some) is proposing is to print $40 billion a month and pump it into the economy to infinity until the private sector starts creating jobs. Now think about that for a minute. That will amount to another $480 billion a year on top of the already astronomical debt this nation faces. This is absolute political insanity.

Looking at the results of QE1 and QE2 undertaken by the Fed since Obamanomics came on the scene don't expect this to work either. Other than to add to the 2 trillion dollar debt that QE1 and QE2 lopped on top of the federal deficit don't hold your breath. At this point the truth is that Ben Bernanke doesn't know what else to do. He should try doing nothing.

The wording of the announcement leaves a little more definition so that the lay person can understand it. Remember all those "toxic assets" that the banks ended up holding because of the collapse of the housing market. You know the collapse of Freddie and Fannie that Clinton and his crew masterminded by thinking every American should own a home? Yes, that was the same Bill Clinton who sees himself as another economic genius. The key word there is "toxic" which was left out of the announcement. So our government is going to buy $40 billion in toxic assets, they call them mortgage backed securities (how polite of them), until the job market shows substantial improvement. Now think about that and use your brain.

One writer who covers the economic beat made the observation that until now no central bank had tied quantitative easing to job creation. I reckon Obama will now have another "historic" first. We really don't need any more firsts after close to four years of incompetence. What is odd is that anyone would believe even for a skinny minute that QE and jobs have a link. Looking at QE1 and QE2 it is obvious that they aren't kin.

Read Between The Political Lines Please

Lets talk reality for a few. There is approximately $1.5 trillion sitting in Federal Reserve banks owned by financial institutions, not the Fed. In 2007 the amount was sitting at $13.4 billion and some change. So lets factor in QE1 and then QE2 which Obama trumpeted as the salvation of job creation and someone explain to me why the majority of the scratchola is still sitting in vaults? Must be a vast right wing conspiracy I reckon. Quick! Someone ask Hillary or maybe try Billary!

Numbers crunching confuses liberals to no end so let me get to confusing them. The time line shows that the economic crisis began in August of '07. The fed's balance sheet shows an increase of $897 billion and stands at 2.8 trillion now. Do the math and determine the percentage of increase. During this same period the BLS data shows job losses of 3.5 million jobs. The real net figure is 4.3 million jobs have been lost. The reality is that the economy kept shedding jobs until January of '10. By then 8 million jobs had been lost. During the period in question (QE1) the Fed was hip deep in "mortgage backed" securities. How deep? Try $908 billion worth of deep and moving to $1.25 trillion.

So where did it go next? Having arrived at the seventy percent mark of the QE it sat at $1.3 trillion chiseling away to $1.9 trillion. This is monetary expansion for the lay person out there. It was printed money. Eleven months out from QE2 mind you the fed decided to purchase an additional $600 billion of US Treasuries. In other words, we were buying our own debt.

Doing the math, from December of 2009 until November 2010 (QE2 was announced) the economy added a meager 969,000 jobs. Using the $1.3 trillion figure each job created came at a cost of $1.3 million. What is interesting to note is the reason the correlation doesn't apply. QE2 came at $600 billion. The job market added 3.1 million jobs though it took a long time. During a seventeen month period QE1 created a fraction of the jobs. Is there a correlation? Of course not.

Some of that was hard to follow for the mathematically challenged I know. Examining the industries that QE1 should have helped is a case study in reality. Both financial services and construction should have benefited from QE1 if it was a sound policy. The inverse occurred. From September of '08 to November of '10 construction dropped a million and a half jobs and financial services shed 450K. From the bottom until now these aren't encouraging figures but see them you must. Construction has added back 59K jobs and financial services has reclaimed 103K. Sad but true.

Any job growth that the Federal Reserve wants to claim due to QE1 and QE2 is a big lie. But then so is the Obama administration with its smoke and mirrors economic policies. You really need to understand what this is all about.

After all this humma-humma $1.5 trillion is still sitting in those vaults. Surprised? Don't be. What has the fed (central bank) primarily purchased? The amounts are $840 billion of "mortgage backed" debt and another $860 billion of government debt. Neither of those are desirable but they want to keep doing it? Why? They've run out of rabbits to pull out of the hat is why?

QE3 is a vicious circle. The truth is that the Fed is freeing up $480 billion a year thereby allowing banks to loan Uncle Sugar the churned money, Keep in mind that the federal government has a need, right this very minute to borrow about $1.5 trillion a year. Now think! Where do you think that money is coming from?

There is a foreign bank element to all this smoke and mirrors but if you got this far I don't want to blow your socks off into the next county. I just want people who claim they are intelligent to think through how an economy gets out of a recession downturn. What we have seen the Obama administration attempt to do has failed. It will fail even further if he is allowed to continue to destory our economy.

Yes, as Bill Clinton himself liked to crow, "It's the economy Stupid!"

QUOTE OF THE DAY: "The only way to change Washington, is to change the people we send there."

As Always,

The Frog Prince

He Wanted To Be Historical? He Will Be...

Remember In November!