The LIBOR Scandal

An illustrated version of the LIBOR scandal

A Clear and Present Danger to World Economy and Humanity

Ever since the deregulation of the banking sector in 1983 under the Ronald Reagan administration when the Glass- Steagall Act of 1933 was repealed, the US and the rest of the world began its casino stage of economic speculation that was to lead to the 2008 collapse and beyond. Since the sub=prime inspired collapse of the economy world wide, there has been no slowing of economic manipulation to profit the oligarchs and their banking sector. This has enriched the few at the cost of almost everyone else with austerity measures. The elite payed less and less taxes “to stimulate the economy in the trickle down” concept of voodoo economics. Less taxes meant less services to infrastructure and social programs. The lack of regulation in the investment and banking sectors meant that all kinds of money manipulations were allowed in order to maximize profit and transfer wealth out of the hands of the producers into the hands of the owners of the means of production, their government agencies, banks, brokers and insurance schemes. During the relatively healthier stage of the economy prior to deregulation, the working people and middle class were encouraged to invest in stock options 401k and company pension programs. Later in this era as recessions hit one after another and wages froze, people began relying on high interest credit cards to tide them over to a presumed recovery. But the recovery never really came and by 2006, it was becoming clear that real trouble was brewing. The sub-prime crisis of 2008 had its roots in deregulated loan practices in the early 2000s. It only matured in September-October of 2008 when Lehman Brothers went bankrupt overnight due to a collected package of mortgage defaults and foreclosures. The overnight collapse and bankruptcy of this huge company soon dragged down the likes of AIG, JP Morgan, Chase, Fannie Mae, Freddie Mac, Wells Fargo and Western Union. In the end, the large Federal Reserve bank ended up bailing out many companies that were “too big to fail”. Millions ended up losing homes and jobs in the process of the souring economy. Big companies seized opportunity to relocate to Asia for better profits, leaving the industrial center of the US desolated.

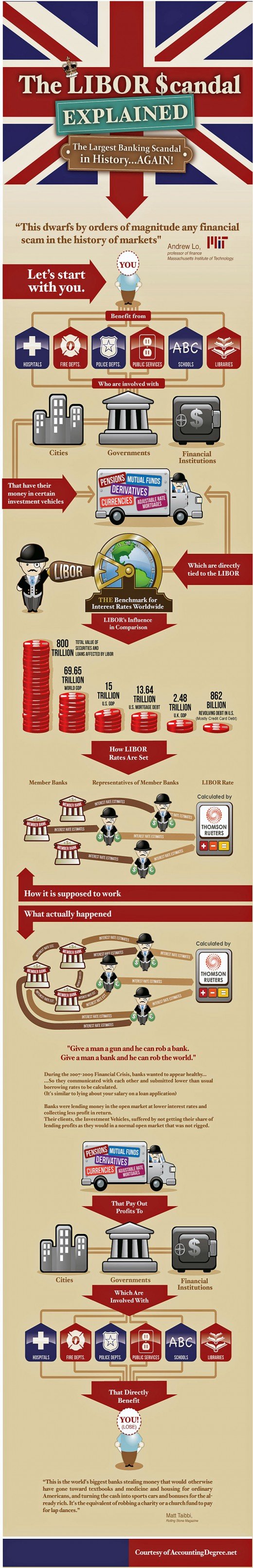

How the whole thing under regulation worked was something like this. Taxes were paid out by everyone working, like you and me, in order to fund infrastructure, the military, fire departments, the police, social or public services like, schools, parks, libraries, pensions, food stamps, ambulances and medicare. Tax money and other investments like 401ks private pensions were processed by state and federal governments from the local level to the banks and cities. These “deposits” were then loaned from bank to bank at low secured collateral interest rates based on fractional reserve banking to extend the reach of loans and generated interest income. Blocks of funds were invested in mutual funds, derivatives, pensions, currency exchanges and adjustable rate mortgages. All of this was handled through a central clearing agency known as the LIBOR which was the benchmark that set interest rates world wide. This was all highly regulated and controlled so that one loan was given from a source bank to another for a very specific investment managed by chartered accountants and actuaries. Typically, the larger bank loaned to smaller intermediary banks down to local banks at a low interest rate. These local banks financed mortgages, car loans, student loans and credit cards. Loans were classified as secured collateral based loans and unsecured higher risk non-collateralized loans. These were typically lent at higher than prime interest rates that the banks got by way of loans form larger concerns. The concept was to make profit based on interest all along the chain from high interest local loaners to low interest prime lenders at the top. Typically, large loans from the top of the pyramid were made at 2 to 3 percent and by the time it trickled down to Joe and Jane Public, interest rates at “prime” began at 7 to 8 percent and up to 29 percent for some credit cards. This was at one time highly regulated to prevent serious breaches from occurring. The one weak link in all of this was the stock market that could fluctuate wildly into which many banks invested pension funds in order to increase their return. Out of small losses due to speculation in the stock market, there would be larger losses due to in bank manipulations.

The collected financial power managed by the LIBOR amounted to $800 trillion USD for all securities and loans managed around the world. Part of the LIBOR is controlled by and invested into by the likes of HSBC, Barclays, the Federal Reserve, The IMF the World Bank and the chief banks in almost every country. By comparison, the total world GDP for a single year, also managed by the LIBOR is only $69.65 Trillion. This works out to about a 1:11.5 ratio. In that amount of time, they also have to eat and house themselves. In effect, to pay down that amount in loans and securities, the figure would be more like 23 years at half income. In other words, to generate the collateral required to cover the securities and loans, the entire population of the world would have to work for twenty three years to produce an equal amount of GDP secured collateral as well as sustaining themselves. Of this, the US was in debt by an acknowledged $13.64 trillion. So called revolving debt, consisting mainly of credit cards, amounted to $862 Billion or $.862 Trillion, a federal debt to credit card ratio of 15.8:1. A substantial portion of the debt is thus tied up in unsecured credit card debt.

One of the Biggest Bank Fraud Scandals Ever!

Under regulation, each member bank of the LIBOR is supposed to individually estimate the interest rate, which is then calculated and set by Thomson Rueters. However, the banking sector in the US, the prime economy in the world had been deregulated in 1983 and something else altogether happened in the real voodoo economic. Instead of reporting directly to Thomson Rueters, banks began fixing rates between one another first by giving one another estimates in all permutations and combinations. This has been referred in the news as interest rate fixing and this was done in secret, behind closed doors in order to maximize interest profits. The finalized estimates were then reported to Thomson Rueters. Thomson Rueters then set the interest rates, that were higher for services like pensions, mutual funds, adjustable rate mortgages, currencies and derivatives with the result of higher profits that were paid out to governments, financial institutions and cities that controlled services like hospitals, police, infrastructure, schools, libraries, police, fire depts., parks and other public services. These then were supposed to be given out to you and me Joe and Jane public.

The insider secret scam meant a higher return for the bank CEOs and oligarchs and lower returns for running services. In effect, the unregulated banks through the LIBOR managed to collectively pick the pockets of everyone on the planet. The higher profits to the top, meant austerity in reduced services, pensions, school and library closures and so on. Even whole cities went bankrupt and had to shut down services entirely. The unregulated driven sub-prime crisis of 2008 caused the response of reducing loans and raising interest rates, while at the same time wiping out 401ks and company pensions and reducing services. This effect reverberated around the world because the LIBOR is an international system. Collapses of big companies, brokers, insurance and banks spurred a bailout binge from the Federal Reserve, where a major portion of the new debt emerged. In the UK, whole countries, like Iceland became bankrupt and austerity became the new tone for the people of the UK as managed by governments.

One of the outgrowths of the LIBOR scandal as it has come to be known, was the Arab Spring that erupted on December 18th, 2010 and spread to all of North Africa and the Middle East. Though revolutionary in the beginning, drifted to becoming Islamist fascist dictatorships. The destruction of the Libyan republic was effected around the same time. Greece went on to have a huge unemployment problem and an emerging fascist movement called Golden Dawn. So to with Spain with 50 percent unemployment among the youth with no services at all to the down and out. Fascist movements that target Muslim immigrants have moved in to provide services to the desperate Spanish youth.

But the final dust on the LIBOR scandal has not settled, despite fines topping $1.5 billion USD and the arrest of top bankers. The whole scandal is still being investigated on the revelations of whistle blowers who have come forward to report the inside corruption and manipulations of fixing interest rates for the profit of the few at the expense of everyone else and the loss of needed service that have ended in death for many innocent people world wide. The corruption quickly led to an increase of unemployment by 100 million world wide. Interestingly, Iceland that had huge problems in 2008, had a revolution and ended up deliberately defaulting on massive debts due to the LIBOR scandal and arrested as many top bankers they could get their hands on for fraud. Perhaps we are beginning to see the Iceland situation writ large around the world as the whole scandal begins to unravel in public view.

This is far from over and the outgrowth has spread its infected tentacles on every endeavour known to humanity. No one has escaped as encroaching and deepening austerity engulfs the world. At this writing, governments refuse to tax the wealthiest and rig services so that most people get little to nothing. Income will shrink while cost skyrocket. When regulating banks, such as in Glass-Steagall, is threatened, governments are subject to heavy lobbying to prevent it. At this time, the same processes that fuelled the LIBOR scandal are still in place, still wrecking havoc in billions of lives. In the US alone, the citizens are looking down the barrel of the fiscal cliff where there will be a substantial cuts to the military and services that kick in automatically if the government fails to enact either a higher debt ceiling or austerity measures or both. This will reverberate with even deeper austerity around the world for 2013. The outgrowth of the LIBOR scandal has meant that there are 1.5 million acknowledged homeless, including children, in the US due to the mass of foreclosures from 2006 on. It has meant an increasing reliance on food stamps and other welfare by those on the bottom of capitalist society that includes many working poor who cannot afford to both eat and shelter. These very same people are vituperated against by the likes of Mitt Romney who recently lost the presidential race to Barrack Obama, the so called 47 percent that have to rely on some sort of services which are all under threat due to the LIBOR scandal. 2013 promises to be a year of awakening and rebellion around the world and possibly in the US due to the watershed effect of the LIBOR scandal. It may be too late for capitalist interests to do anything about this except to stay the course and if this is so, we can see a major upheaval in the US comparable to Greece and Spain. Where the LIBOR scandal drives history remains to be seen. It will either be a major correction, which is highly unlikely or to total fascism or to a socialist revolution. Change must and will come. The world cannot stay the course it is on without extremely serious repercussions. It would be wonderful if there was a mass awakening and massive corruption such as we have seen is driven into the dustbin of history. Humanity needs to take collective responsibility and not rely on the proven non trustworthiness of the corrupt few.