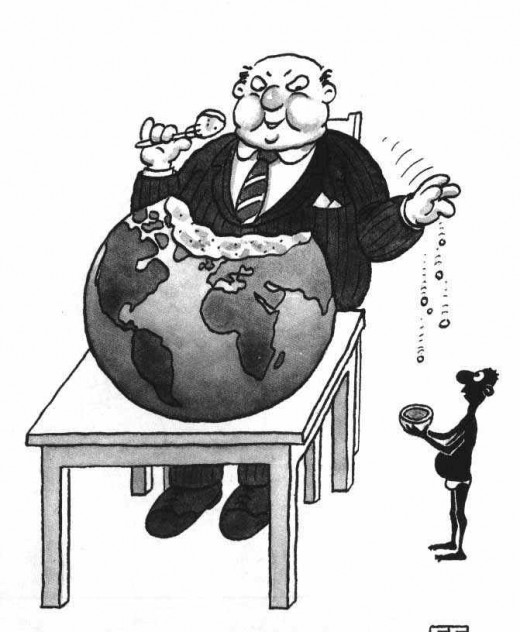

Is It Class Warfare or is That What the Greedy Corporations,Big Banks and Wall Street Want Us to Believe

Wikipedia Definition of Greed

The inordinate desire to possess wealth, goods, or objects of abstract value with the intention to keep it for one's self, far beyond the dictates of basic survival and comfort. It is applied to a markedly high desire for and pursuit of wealth, status, and power.

How do you define greed? Does there exist a greed-o-meter that you feed in the facts and it will register and quantify the greed in question? Does the desecration of the American middle class and the country's housing market qualify as excessive greed. Most likely, if such a thing existed and the facts were fed in, the greed-o-meter would simply implode because it would not be capable of handling the input. I get so tired watching and hearing the loud booing when a politician is demanding more transparency of the Federal budget, tighter regulations on banks and Wall Street as well as those in the way upper stratosphere income brackets to pay a small percentage more in taxes. I have to pinch myself to make sure I'm not dreaming this and then try and figure out where do these people get their news from. Are they unaware of facts such as the recent outing that the Feds actually gave the big banks an extra $16 trillion in emergency funding in addition to the bailout monies that were disclosed publically? Were the "booers" aware of the $139 billion bailout to GE and for which the CEO, Jeffrey Immelt was paid a total compensation of over $21 million the very next year. Mr. Immelt's $21 million came from bailout monies paid by US tax dollars. The bigger piece of dirt here is the fact that once GE got the bailouts, they added new jobs. That's a great thing; right? Not when many of those jobs went overseas rather than here in the US where they are desperately needed. My favorite AIG. This company insured bank loans on mortgages that were set up and destined to fail. These were the credit default swaps or hedge bets. The banks were giving loans or rather inviting those to sign loans with the single requirement that they had a pulse. Bets were then placed on many of these loans that they were in imminent danger of defaulting. Bets were placed with AIG that if the loan did in fact default, AIG paid out. You didn't need to be a real estate genius or accountant to figure out that AIG would soon be in deep financial dodo. Of course, that is exactly what went down and once the dodo got too deep; the Fed jumps in to bail them out to the tune of $182 billion tax payer dollars. Where was some of the money immediately spent; private elaborate parties, private jets, bonuses and lots of other fun cool stuff. Hey why not, the average joe tax payer is footing the bill.

Good Reading

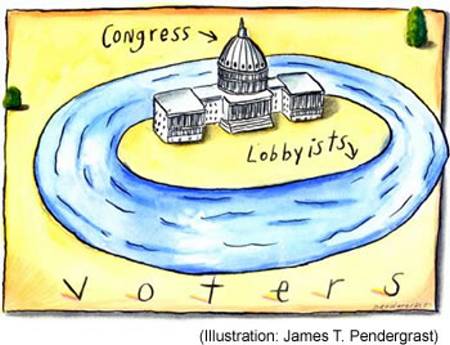

My Favorite - Special Interest Groups

In case one might wonder, the capsule subtitle is my form of sarcasm. I still don't get why special interest groups are allowed to participate in politics and be permitted to spread money like cow manure at campaigns and congressional members. This country has some very bright individuals that can surely come up with a much more neutral way of choosing candidates. Everyone involved in any manner is subject to payoff invites from Capitol Hill to columnists and editorial writers not to leave out the lawyers relentlessly trying to rewrite or water down regulations lobbyists seek to change or remove altogether. An attempt at genuine reform quickly returns to politics as usual. Right now as this piece is written, the President is trying to push through the "Volcker" Rule. Based on over $16 trillion given to banks for bailouts is reason enough to demand more protection and oversight of our banking industry. This bill is to simply provide more protection of your bank deposits and makes it more difficult for banks to use your money to gamble with on risky investments. Of course, this is creating quite a stir and we should not be surprised that the investment community is fighting to have the "Volcker" Rule overturned. Look at it from all of the hedge fund managers who collectively earned over $14.4 billion last year in salaries and bonuses. They don't want their money faucet turned off - who would? The Wall Street Beast; the top of the financial universe, find nothing morally wrong with taking Gargantua tax bailouts to keep up their royal lifestyles while helping to push the economy off a cliff while taking out the middle class at the same time. When all is said and done, opponents of a tough "Volcker" Rule received $66.7 million in funds to defeat it, whereas, advocates received $1.9 million to try and get the Rule passed. So yes, money does buy anything, even the green light to make it easier for your money to be gambled away by the banks you think it is secure in.

Corporations that earn billions of dollars a year and pay absolutely zero federal tax. Corporations that receive bailouts from US taxpayers only to move jobs overseas while our unemployment rates keep rising. Insider CEO's take huge bonuses just months prior of the corporation filing bankruptcy. Why then do so many believe these corporate fairy tales of jealousy and class warfare on the part of anyone who dares to question or criticize the total wealth of the country now belonging to the largest corporations, banks and Wall Street. Why do we have Americans booing those that are trying to bring some balance back to a failing economic system that has been eroded by pure greed and gluttony at it's worst. To witness those Americans who have been so taken in and fooled by these greed mongers should be a lesson and insight in to how monsters such as Hitler rose to power. So many believed his fairy tales even though they saw the truth with their own eyes.

Some Corporate Numbers and Facts

I found this list compiled by Bernie Sanders, and thought that I would share it. Readers who still drink the corporate kool aid might be a little curious about confirming the accuracy of the list. Hopefully, those who still believe the corporate fairy tales may start to question, why, they believe the fairy tales when facts are right at their fingertips. I hope that if nothing else, this hub will make people take a good hard look at what is happening to what was once the greatest nation. It is not too late to take back America.

1. Exxon Mobil made $19 billion in profits 2009. It paid no federal tax and received a $156 million rebate from the IRS, according to SEC filings.

2. Bank of America received $1.9 billion tax refund from the IRS last year although it made $4.4 billion in profits and received a tax bail out of $1 trillion.

3. General Electric made $26 billion in profits in the US and received $4.1 billion refund from the IRS. It also shipped many of it's jobs overseas to up their profitability.

4. Chevron received a $19 million refund from IRS after making a $10 billion profit.

5. Boeing, which received a $30 billion contract from the Pentagon to build tankers, then got a $124 million refund from the IRS.

6. Valero energy, the 25th largest company in America with $68 billion in sales last year, received a $157 million tax refund from the IRS along with a $134 million tax break from the 'oil and gas' manufacturing tax deduction.

7. Goldman Sachs in 2008 only paid 1.1 percent of its income in taxes even though it earned a profit of $2.3 billion and received almost $800 billion in tax bail outs.

8. Citigroup last year made more than $4 billion in profits but paid "zero" federal taxes. In addition, it received $2.5 trillion in bail outs from the fed and treasury and are currently asking for more.

9. ConocoPhillips, the fifth largest oil company in the US, made $16 billion in profits while also receiving $451 million in tax breaks through the 'oil and gas' manufacturing deduction.

10. Carnival Cruise Lines made over $11 billion in profits while only paying a federal tax rate of 1.1 percent.

This is just a few examples of the American Corporate World. I am not against capitalism, however, one must wonder with our country in such economic distress, how do these greedy corporations think that the ever so shrinking middle class can pull up the monetary weight needed to get the country back on it's feet. In my opinion, they don't think about it or care. They just want to grab as much as they can as fast as they can and the rest of the country can sink. Those that have stood up and continue to fight for some semblance of equity are called "Un American". I think those doing the name calling should take a good hard look in the mirror.