What is Working Capital & How to manage it?

Financial Managers the world over are often primarily concerned with three kinds of decisions; Investing Decisions i.e. where to invest the surplus funds of the organization to earn profits, Financing Decisions i.e. where & how to fund both the Long-Term & Short-Term Financing of the organization & how to Manage an organization’s Working Capital.

In this hub I’d be talking about what is Working Capital & how does one Manage it!

What is Working Capital?

Working Capital can be defined as the net current assets that are available for an organization’s day-to-day operations. Mathematically it may be depicted by the following equation:

Working Capital = Receivables + Cash (including Cash Equivalents) + Inventory – Payables.

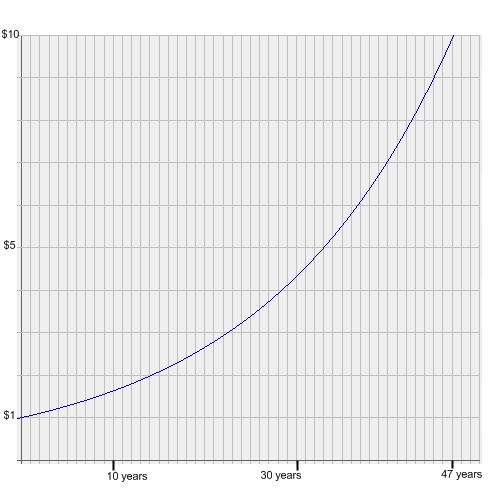

Now working capital, just like, an organization’s fixed assets like plant & equipment, requires financing. However whereas the investment in an organization’s fixed assets earns Profits for the organization such as a Bulldozer in a Construction Company directly earning Profits for the company through the performance of duties on a Job or Project, the investment in Working Capital does not earn any Profits directly for the organization.

If that is true than one might be justified in asking why not invest all the available funds in buying or leasing fixed assets for the organization instead of using a portion of those funds up for financing an organization’s Working Capital?

The problem with that line of reasoning would be that it ignores the fact that an organization would need to allow customers to buy on credit from them otherwise those customers would go to its competitors who are most likely offering goods or services on credit. Likewise an organization would need to carry some finished goods as inventory with them all the time so that they’re able to sell it to customers there & then without having to turn them away. Additionally an organization would also be required to carry some amount of cash with them all the time so as to pay-off their bills & other payables.

Alright so where do I finance it from?

Working Capital Management is essentially a trade-off between an organization’s profitability & its liquidity & it’s crucial that we’re able to manage the Working Capital properly or the organization might even face closure because it doesn’t have the cash to pay-off her payables or give goods or services to her customers on credit or doesn’t have enough spare-funds to keep some finished goods as inventory to sell to prospected customers.

So now that an organization has decided that Working Capital must be kept it must further decide on where to finance it from. It can either finance it from Long-Term Finance through Equity for example by raising money through issuing new shares or through Debt for example it can finance it through a Long-Term Bank Loan. Or it can finance it from Short-Term Finance like Bank Overdrafts or by delaying Payment to Payables.

Traditionally it was thought that Working Capital should be financed through Short-Term Financing like Bank Overdrafts because it involves current assets & current liabilities. And that the Investment in Fixed Assets should be financed through Long-Term Financing like Long-Term Bank Loans or Leasing.

But a more recent view holds that because the overall level of Working Capital called as the Permanent Working Capital remains fixed in the Long-Term, it should, therefore, be financed through Long-Term Financing whereas the period-to-period fluctuations in Working Capital called Temporary Working Capital which require additional financing should be financed through Short-Term Financing.

Working Capital Cycle

No talk of Working Capital Management would be complete without talking about the Working Capital Cycle, also known as the Cash Operating Cycle.

The Working Capital Cycle of an organization is the length of time between paying for the materials that enter into the inventory to receiving the payment from the customer for the finished goods sold to them as inventory.

Suppose you are a Company A & you buy raw materials from your Supplier X on credit on 1st, January, 20X0. You have to pay X for the raw material in a month’s time on 31st, January, 20X0. The raw material continues to sit in your inventory idle for one month’s time staring 1st, January, 20X0 till you send it for production where it takes a further three months till 31st, April, 20X0 when it becomes ready to be sold. Suppose on the same date i.e 31st, April, 20X0, all the finished goods in the inventory is sold & the payment for it is received after a further one month’s time on 31st, May, 20X0.

Now what do you think would be the Working Capital Cycle for the above example?

The answer is 4 months! How? It took 4 months from the time it took to pay for the material that entered into inventory (31st, January, 20X0) to the time it took for us to receive the payment for the inventory we’ve sold from our customers (31st, May, 20X0).

I usually find drawing a Time-Line helps.

Apart from calculating the Working Capital Cycle through such means we can also calculate it through Working Capital Ratios namely the Receivables Collection Period, the Inventory Holding Period & the Payables Payment Period.

The Receivables Collection Period = Average Receivables / Credit Sales Per Annum

The Inventory Holding Period is further divided into:

Raw Material Days = Average Raw Materials in Inventory / Raw Material Purchases Per Annum

Finished Goods Days = Average Finished Goods in Inventory / Cost of Sales Per Annum

The Payables Payment Period = Average Payables / Credit Purchases Per Annum

It should be noted that if the Periods are in Months or Weeks than the Average Receivables/Payables/Inventory would be accordingly & the Credit Purchases/Sales Per Annum would become Credit Purchases/Sales Per Month or Per Week.

The Working Capital Cycle, would therefore, be :

Working Capital Cycle = Receivable Collection Period + Inventory Holding Period – Payables Payment Period.

What is this Over & Under Capitalization I hear about?

Overcapitalization is the phenomenon whereby the Level of Working Capital kept is too high resulting in increased funds being tied up as Working Capital instead of them being invested in Fixed Assets to earn Profits for the organization.

Undercapitalization is the phenomenon whereby the Level of Working Capital is too low resulting in liquidity problems for the company.

Therefore the Level of Working Capital must be Optimal & neither too High nor too Low.