The Invisible Hand that Guides the Market

Adam Smith (5 June 1723 – 17 July 1790)

Foundation of modern economic philosophy

The modern economic theory is largely based on the observations made by Adam Smith in the late eighteenth century. While analyzing the behaviour of producers and sellers in an unregulated market, he came up with the theory that the markets have an inherent potential of being efficient, if just left alone. He referred to this inherent property of the markets as the 'invisible hand'. Even after more than two centuries, his theory has remained the cornerstone of our understanding of market behaviour.

Adam Smith & the theory of Invisible Hand

In late eighteenth century, Adam Smith who undertook an analysis of the markets came up with a conclusion that if the market is left free and unregulated, with no restrictions on production or consumption, then the demand of people for different goods and their production by the market will be equal, leading to a general welfare of the society. To put in different words, Mr. Smith suggested that the invisible hand of market, consisting of forces of demand and supply will achieve an efficient level of production, consumption and distribution of goods in the society.

This idea of unregulated markets achieving efficiency on its own, as if guided by an invisible hand, has created a very strong argument in favour of free markets, and against governments controlling production or consumption in any form that interferes with the free market.

Advocating Economic Freedom

In many ways, Adam Smith's Invisible Hand theory is the economic counterpart of democratic theory. His concept of Free markets is based largely on the condition that there should be no restrictions on economic activity, with everyone left alone to exercise her choice of production, consumption and exchange, as per her best judgement.

Just as people are supposed to be capable of choosing the best leaders for themselves, in a democracy, the Invisible Hand theory of Adam Smith presumes that people will be able to produce and consume in a manner that is most efficient if they are given a free hand. Adequate information is as essential for the free markets as it is for the success of a democracy. Lack of information or Information Asymmetry can result in an inefficient market. Similarly,as in a democracy, restriction on competition, as happens in case of monopolies, can defeat the whole process and prevent the markets from achieving efficiency.

In real life, markets may not be perfectly efficient, but that does not negate the importance of Adam Smith's Invisible Hand theory. Markets can often fail because of many different factors, but in spite of them, they still provide the best option we have for achieving an efficient system of human economic activity.

Interesting Hubs For You

- Why do we Worship or Pray to God ?

After all why do we pray to God? Is it to please him and get rewarded by him in return or is to bring greater calmness and peace to our own self? - Two bullets that changed the history of the world

The story of an assassination that precipitated one of the worst chain of conflict and destruction ever witnessed by humankind. It is a story of two Bullets which thrust the First World War on the world. - The Future of Egypt after Hosni Mubarak : Democracy, Military or Sharia

The future of post Hosni Mubarak Egypt will be decided by the struggle between three forces, the military, the Muslim brotherhood and the pro-democracy people.

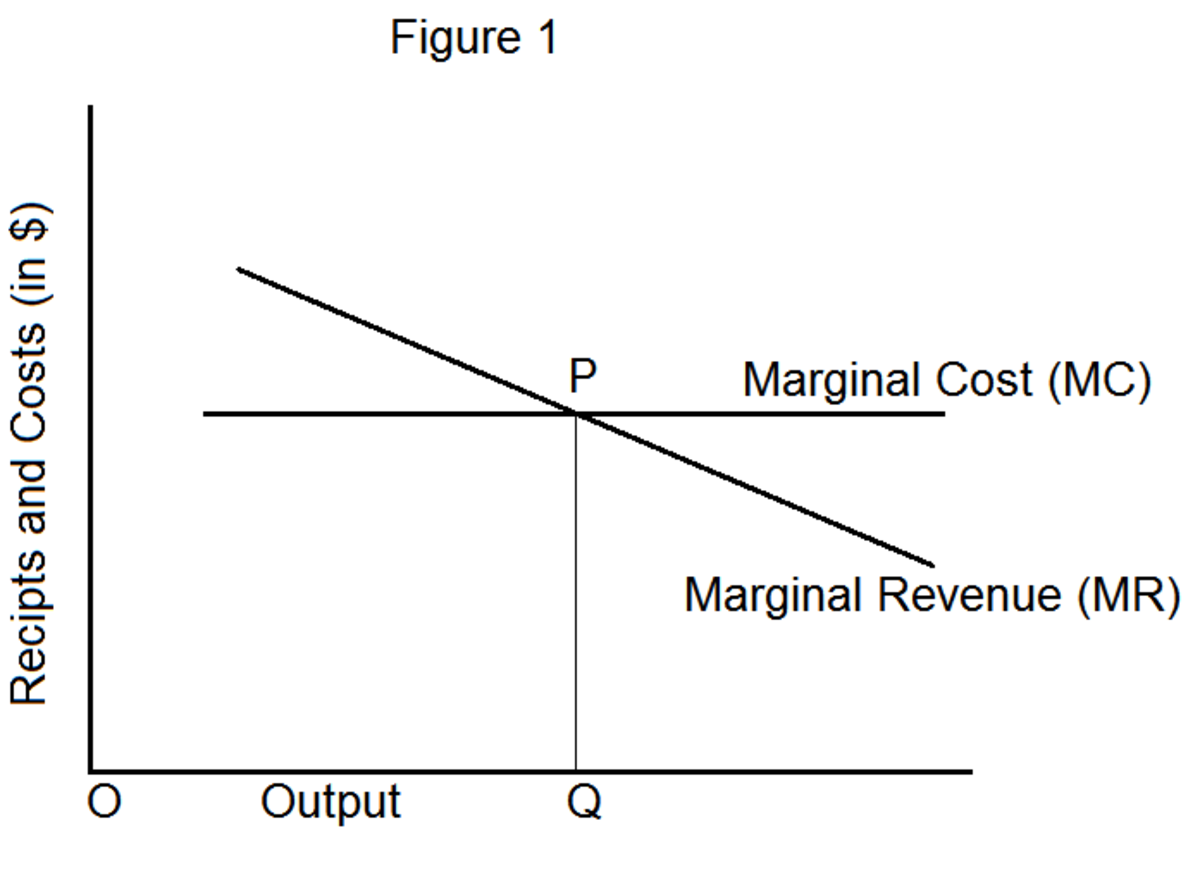

Introducing the principles of demand and supply

The real contribution of Adam Smith was to introduce the concepts of Demand and Supply and identify them as the prime movers in the free market. Demand refers to what the people are willing to pay for a particular good. As the price rises, demand of the product falls, giving rise to a down-sloping curve. On the other hand, Supply refers to what the producer or supplier would be willing to produce at a given price. The interplay of demand and supply leads to pricing of a good in the market.When the demand of a good is more, the market price of a good rises, thereby attracting more producers to the market, which increases the supply, and in turn reduces the prices, thereby maintaining a stable equilibrium. This continuous adjustment of market prices by addition or exit of new producers is the basic mechanism by which the invisible hand of the free market operates.

Though Adam Smith did not go in to graphical representation or the mathematical derivation of the Demand as a relationship between price and quantity, he discussed the concept with great clarity in his book, An Inquiry into the Nature and Causes of the Wealth of Nations, first published in 1776. He summarised the concept of Invisible Hand in the following words,

"As every individual, therefore, endeavours as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this , as in many other eases, led by an invisible hand to promote an end which was no part of his intention . Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good."

Adam Smith's theory is the basic pillar of modern economics. during the last two centuries, the markets have been observed to fail, as happens in case of monopolies, public goods or information asymmetries between the consumers and the producers. However, we also know that in spite of their limitations, markets do deliver. Most importantly, this knowledge ensures that we have a sound and logical argument against authorities who might be mistaken into excessive regulation and restriction of economic freedom in the garb of political idealism or some other excuse. The fact that a Communist China adopts the principles of market efficiency to become a global economic superpower may be the greatest tribute to Adam Smith and his Invisible Hand theory.

Demand and Supply in Modern Economics

Other interesting Hubs...

- The Man who Created Modern Woman's Wardrobe

Yves Saint Laurent is one of the modern fashion wear designers, often credited with ushering in the current trends that define the modern woman's wardrobe even today. - Tax Deduction on Home Mortgage Interest

Interest deduction on mortgage can reduce the cost owning a home. Here are all basic details of this deduction.

ECONOMICS QUIZ

view quiz statisticsWhat do you think about markets ?

Do you agree with the Efficiency of the Free Markets ?

© 2011 V Kumar