Krugman on Friedman - A Critique

Paul Krugman is the New Populizer of Government Economic Control

With the passing of the late John Kenneth Galbraith (1908 - 2006) the job of popularizer of the economics of government economic control of the economy has been taken up by Paul Krugman. Like Galbraith, before him, Krugman writes for the masses and he does it with a writing style that is both clear and understandable. Anyone, regardless of their ideological leanings, desiring to improve their writing style would do well to read Krugman. As a former New York Times columnist and now both a Professor of Economics and International Affairs at Princeton University and contributor to the Times, Krugman is not only knowledgeable but is able to convey that knowledge to his readers in an interesting and understandable manner.

The Issue is Freedom vs Control

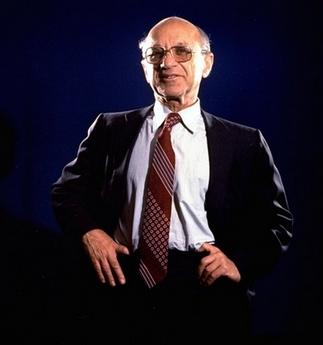

Krugman recently published a long essay, entitled Who Was Milton Friedman?, in the New York Review of Books, which reviewed the life and legacy of the late Nobel Prize Winning economist Milton Friedman (1912 – 2006). Written in a style similar to that of Mark Anthony's Funeral Oration in Shakespeare's Julius Caesar, Krugman criticizes Friedman and his ideas while appearing to praise him. Krugman makes it clear that he would have preferred that Friedman remained secluded in an ivory tower writing scholarly works on monetarism for other economists rather than confusing the public with ideas that were contrary to the liberal status quo. Apparently, Krugman's distaste for competition in the free market extends to competition in the marketplace for ideas as well.

After attempting to compare classical economics to the Spanish Inquisition, Krugman moves on to the liberal myth that the Great Depression proved that the classical free market don't work in the modern industrialized world. The problem is that governments all but outlawed the free market and then used the fact that the shackled economy could not respond to the crisis as evidence it was dead. But, given an economy in which retailers were forbidden to sell products below a certain price, workers were forbidden to take jobs below a certain wage, rules limited competition among businesses, farmers were told what crops they could grow, how much they could grow and what price they could sell, etc. it is not surprising that the market was unable to pull us out of the Depression.

For an example of the extent to which President Roosevelt's New Deal attempted to micromanage the economy from Washington, consider the 1942 Supreme Court case of Wickard v. Filburn and Justice Robert Jackson's majority opinion in that case that attempted to explain how the Constitution's Interstate Commerce Clause (Article I, Section 8 of U.S. Constitution, which gave Congress the power to regulate commerce between, but not within, the states) applied to Ohio farmer Roscoe Filburn. Filburn had planted more wheat than Washington bureaucrats allowed and produced an additional 241 bushels which, rather than selling, he used to feed his chickens. According to the tortured logic of Supreme Court Justice Robert Jackson's opinion for the majority, Filburn, by using wheat grown and consumed on his farm, which lay entirely within the borders of the state of Ohio, did involve interstate commerce (and was thus subject to regulation by Congress) because, if Filburn had not grown that wheat, he would have had to purchase it on the open market and there was a possibility that at least some of the wheat he purchased could have been grown in another state. In Justice Jackson's defense, this opinion was handed down after President Roosevelt threatened to increase the size of the court and pack the new positions with appointees who would create a majority that would support him unless the present Court bowed to his will.

Krugman then moves on to dismiss the concept of Home economicus ... the hypothetical Economic Man (who) knows what he wants;. Krugman appears to be dissatisfied with this concept. Just because people don't sit down and run the calculations found in economics textbooks before making every economic decision doesn't mean that the economic decisions people make are not rational and are not based economic considerations. Like his predecessor, Galbraith, Krugman does not seem to be comfortable with the idea of letting people make their own decisions. Robert Skidelsky in his review of Richard Parker's 2006 biography entitled John Kenneth Galbraith, His Life, His Politics, His Economics published in the Journal of Economic Literature and reprinted on the Galbraith website, writes:

Parker writes of Galbraith’s political position: ‘A pragmatic balance between the opposing ideological ideals lay at the heart of Galbraith’s reasoning. The market has value, but so does the state when it acts in the democratic interest’.There is a huge unexamined assumption in that last clause. What is that interest? How is it to be discerned? How is the state to be held to it? Galbraith was clear that the existing power holders distorted the economy for their own ends; but he was blind to the ‘public choice’ critiques of so-called democratic policy-making, and even blinder to the fact that governments have vastly greater powers over the lives of citizens than do private bodies. His position seemed to be: as long as the Democrats are in power and advised by the right people the state can be trusted.

The above statement nicely sums up the difference between the outlook of liberals like Krugman and Galbraith and conservatives like Friedman. Krugman himself expresses a thought similar to Skidelsky's comment about Galbraith when he writes, later in the essay,:

...fiscal policy involves the government much more deeply in the economy, often in a value-laden way: if politicians decide to use public works to promote employment, they need to decide what to build and where. Economists with a free-market bent, then, tend to want to believe that monetary policy is all that's needed; those with a desire to see a more active government tend to believe that fiscal policy is essential.

The thing that separates liberals, like Krugman, and conservatives, like Friedman, is the question of freedom. Should individuals be allowed to decide what is best for them or should elites in Washington dictate how people live their lives? Krugman obviously believes that elites in Washington can do a better job of running our individual lives than we ourselves can do.

Krugman's harshest criticism comes in the fourth section where he discusses Friedman in his role as a popularizer of free-market economics. He starts off immediately with Friedman's co-authoring, with George Stigler, in 1946 of a pamphlet entitled Roofs or Ceilings?, which attacked rent controls on housing, by asking whether Americans wanted roofs over their heads or ceilings on rents. Krugman attempts to imply that there was something sinister about the pamphlet saying it was released under some rather odd circumstances. What were these odd circumstances? Well, according to Krugman, the pamphlet was published by an organization called the Foundation for Economic Education which Krugman describes as spreading a libertarian gospel so uncompromising it bordered on anarchism (Krugman attributes this quote to the book Before the Storm, by Rick Perlstein who the Village Voice fondly describes as a 30-year-old left-leaning Milwaukee native). In an attempt to further discredit the Foundation for Economic Education, Krugman adds that Robert Welch, the founder of the John Birch Society sat on FEE's board, neglecting to add when Welch served on the board and that the John Birch Society wasn't formed until 1958, twelve years after the publication of the pamphlet (he also neglects to mention that during the 1960s both the conservative movement and the anti-communist right disassociated themselves from the John Birch Society because of its radicalism). I believe the technique that Krugman is employing here is called guilt by association.

Regardless, Roofs or Ceilings?, did launch Friedman as popular writer and one of the leaders of the free market movement in the U.S. (it also continues to be read and quoted today). However, the real damage done by Friedman, according to Krugman, is the fact that even more striking than his achievement in terms of actual policy changes has been the transformation of the conventional wisdom: most influential people have been so converted to the Friedman way of thinking that it is simply taken as a given that the change in economic policies he promoted has been a force for good. But has it?

Good question, but, let's see how Krugman answers this. His first example is the economic growth that the nation enjoyed between 1947 and 1976. However, this growth occurred during a period when the more radical New Deal policies were abandoned and the economy freed up to a certain extent. It was also a period of frequent strikes and other labor unrest, continuing inflation (slowed, but not reversed during the Eisenhower years) and a sizable portion of Gross National Product (GNP) being consumed by military production for the Cold War. It must be remembered that one of John Kennedy's big campaign themes in the 1960 election was the need to get the economy going – political rhetoric for sure, but obviously the Democrats at the time viewed the situation different than Krugman does now. With the passage of the tax cut by President Johnson which drastically cut marginal rates by 21%, from 91% to 70%, the economy did take off and we enjoyed a few years of very good growth. However, the flood of spending unleashed by Johnson's Great Society program (which to date has cost the taxpayers over a trillion dollars and has left us with about the same number of people living below the government's poverty line as before the program was launched) coupled with the spending for the war in Vietnam resulted in not only run-away, double-digit inflation but rising unemployment as well. By the end of the Carter term in 1980 the nation was mired in inflation and unemployment.

After conveniently forgetting the not so bright spots in the years 1947 – 1976, Krugman tries make things look even better by an apples to oranges comparison with the period 1976 – 2005, by stating that median income increased by 23% between 1976 and 2005 and implying that this was much lower than the previous period before Friedman's ideas were widely accepted. Despite the fact that the percentage (which Krugman fails to provide) rise in income in the previous period was probably higher, Krugman chooses to ignore the falling prices during this period due to the near disappearance of inflation and vast increase in output per worker hour. For a consumer, the real question is not so much how much money do I have? as how much will my money buy? Yes, wage increases were higher in the period 1947 – 1976 but so were price increases – if my pay increases by 10% and prices by 9% my net improvement in purchasing power has been 1%, not 10%. On the other hand, if my wages increase by 3% and prices fall by 2% my net improvement in purchasing power is 5% making me better off than I was in the first example. Yes, we still have poor people (but with very few exceptions they are the richest poor people in history) and all of us could use more money. But compare the quantity and quality of the goods and services that the average American has today with what we had in the 1960s and there is no contest.

Krugman ends his litany of the alleged failure of Friedman's ideas by citing the so called failure of electricity deregulation in California as his example. Here again, Krugman tries to claim that an easing of government control results in the creation of a classical free market. In the case of California, the state deregulated prices in wholesale markets (the markets where local energy companies buy the electric power they sell to consumers) while keeping price controls on what local power utilities can charge consumers. The result was a rise in the wholesale price while retail prices stayed low. As any first year economics student quickly learns one of the main roles of prices is to ration scarce goods. When the price of a good increases, people reduce consumption and look for substitutes. However, if suppliers are unable to raise prices in the face of decreases in supply, consumers will continue their consumption at the old rate and shortages will result. Another concept that first year students learn is that rising prices encourage suppliers to increase production. Well, in California, price controls at the consumer level resulted in shortages while environmental controls prevented the power companies from increasing output. Instead of the free-market that Friedman advocated, this was the state planning that Krugman is so fond of.

As I said at the beginning, Krugman is an exceptional writer but, based upon the ideas he expresses in his writing, he obviously has the elitist view that the masses are not only incapable of making their own economic decisions but also should not be exposed to the dangerous ideas of people like Milton Friedman, least they get the idea that they are capable of independent thought and decision making.