Making Sense of Economic Terms

Financialization 101

Since finance involves all of us to a greater or lessor extent, it is good to get a grasp not only of how money and debt work, but also how the complexities of the system work in tandem to keep things the way they are. We hear a lot about financial corruption, losses, crashes, bubbles, depression and recession and the like, but let's have a look at some basic, but less known financial shenanigans as they exist now and how they work and what effect it has on each and every one of us. Our present world economy is a fractal froth of self-affine bubbles of all sorts, any which one is set to pop and potentially cause a chain reaction of bubble popping in the froth that is the speculative economy of today. Bubbles that exist that are among the largest, are the housing bubble (again), the debt bubbles such as credit card debt and student loan debt. This is not ordinary financial term analysis, but a look at how the dark underside of the economy works and the terms that have evolved to describe it. If one wants to understand what is being said on shows as presented by Max Keiser and Stacy Herbert as well as other analysts, we need to know some basics and how they work. There are plenty of references for standard terms, so we will look at some non-standard terms and what they spell for the financial world. This is by no means a complete list as there are terms yet to be exposed to view of the general public, but this is a start of a larger analysis. We may or may not be aware of terms such as;

-

quantitative easing or QE

-

tapering

-

Non collateralized currency

-

derivatives

-

debt swaps/toxic assets

-

rehypothecation

-

fungibility

-

ponzi schemes/pyramid schemes

-

backwardization or backwardation and contango

-

Market value

-

Fractional reserve

-

cryptocurrency

-

financialization

Quantitative easing is the brainchild of the head of the Federal Reserve that became very popular post the 2008 economic crash. It is essentially printing up fiat currency notes in abundance in order to bail out banks, insurance and other financial institutions that are “too big to fail”. This says two things. Too big to fail means that the banks basically run the government and dictate the policies. It also tells us that the printing of non-collateralized currencies is essentially “pulling value out of thin air”, which of course is nowhere close to being a fact. The reality is that a floating, non-collateralized currency has no fixed value and the real value of each note is determined by the amount in circulation. The more of it there is, the less unit value each note has and visa versa. Thus to print up vast quantities of notes and hand them over to the banks means, that the value held by what each of us holds decreases, as well as the vast sums handed over to the banks. But here is the trick. As wages and other income remain fixed, and the banks get bailed out by QE by the tune of $85 billion a month, their share increases and so does their share of value of the total as a percentile of all that exists. In such a scheme, it makes no sense to save money, especially if it gets zero percent interest as the value shrinks due to exponentially expanding currency supply of which the bailouts grant in an ever increasing supply to the bankers. In short, QE means the collective pick pocketing of the masses by the elite of the banks with the aid of the governments.

A newer term to arise is tapering. Max Keiser says you can't taper a ponzi scheme and he is right! This too comes at a cost of Joe and Jane public for the net gain of the private banker. Tapering was instituted in late 2013 (though in discussion earlier) and it means that quantitative easing is being scaled back at the tune of $10 Billion a month. So at the present state, QE is now only $65 billion for February 2014. QE is still in effect, but it is gradually being scaled back in a process of tapering. This assumes that the banks are increasingly solvent and no longer need support from the Federal Reserve. Though tapering appears good on the surface, it means that stimulus to a stagnant economy is drying up. But, the stimulus never trickled down, but remained stagnant in the large banks. Large banks loan the next in line, packages at zero percent interest. This is essentially free money. The borrower then takes that and invests it in a higher yield interest loans elsewhere to the next lower customer on the money chain. As a result, investors flee a low yield situation to something that is more lucrative with higher interest rates. As currencies begin to sink in value around the world, we see one of the effects of QE as it is being shifted away from the US where it was generated and the burden is being placed on the backs of everyone else in the world. Turkey has announced an interest rate increase from 7% to 12% and this impacts all those lower on the financial pyramid. A similar situation is unfolding in South America and Canada as well as the UK. In the US, unemployment and homelessness remain high, but the bulk of the loss in US reserve currencies held around the world is losing value. Some countries are opting out, but most cannot as the non-collateralized currency is actually backed by bullets and bombs. Thus we can see that QE and tapering in tandem are at work to rob much of the rest of the world. Yes, the term robbery is legally the more accurate term rather than theft as used by others. What the banks, government and consumer get in the US are real goods in exchange for the worthless notes flooding into the rest of the world. QE swelled the currency coffers and tapering is exposing the real worthlessness of those bloated balloons. Over the last several months, the German Bundesbank requested their gold back from the Fed, but the Fed is not allowing even an inspection let alone giving any gold back. Further, they have request a stay of return of the actual gold to 2024!

We are all familiar with collateral. That real value property is what you need if you want to float a loan from the bank. Collateral means something of substance and real value like a house, car, boat or gold that you are legally titled to possess. In reality, most homes are owned by the bank that holds the title thereto until the entire mortgage loan is paid off with interest in full. The same is true for cars, but not gold as one has to usually pay outright for every ounce they procure. It follows that a collateralized loan is one that is backed by a lien on a house, car, boat or gold. There is even a term called a reverse mortgage where the titled owner of a property gets a loan based on the value of the property they own, which is then placed in a lien until the reverse mortgage is paid off including interest and other fees. Given what was said earlier, this collateralized loan may be on a mortgaged property, which is itself is a loan; so we have a loan granted on a loan. We will look at this again under derivatives and rehypothication.

If any of us have any real collateral, then there is a derivative for that. When a banker or financier creates a derivative, they are creating a tool to leverage value on some collateral like gold in order to sell it to someone in place of the real collateral. They do this to extend their buying reach, which is a form of leverage. This is not a loan. It is instead a proxy on some real value collateral that is sold in place of the real item. When the derivative is granted on some real item, the purchaser gets a piece of paper indicating that this is backed up by something real. This in essence has taken the place of gold backed currency, but a derivative, being what it is, can be produced in the same manner as QE. All those derivatives make a claim on the same item by which it is ostensibly backed. All the gold derivatives for instance, exist in a state of a 100:1 ratio of derivative to gold. If anyone, or all the holders wanted to obtain the gold in a swap for the derivative, then there would be serious trouble. First the real value of the gold would skyrocket a hundred fold and second, the derivative holder will either have to accept 1/100th of what they thought they held and/or write the whole thing off as a loss. As long as this derivative market does not all collect at once, then the derivatives can be bought and sold like other commodities, but these are merely bubbles and value pulled out of thin air. Derivatives bear a resemblance to fractional reserve banking.

Loans of all sorts are bundled into investment packages as loans accrue interest and are thus attractive sources of income and profit for the financial speculator. These then form the foundation of debt swaps which are traded between banks and other financial institutions where each gets a cut of the interest generated. This is fine as long as the holders of the loans continue to make their payments in a timely manner. If one, more or a whole group defaults, then the property that the loan was granted for, becomes a toxic asset. It is called a toxic asset because a sudden glut of anything will cause a market price drop and so an asset then becomes a liability. This is part of what happened to the 2006-2008 housing bubble when it finally collapsed. Too many bad loans were made to people who could not pay and a rash of defaults and foreclosures ensued that took out giants like the Lehman Brothers, AIG, Freddy and Fannie Mack and others. So from bundled debt swaps to toxic assets, the government was forced as the lender of last resort to bail out banks and other financial institutions at the behest and command of the banks when the bubble collapsed in late 2008. The world's working people have been footing the bill ever since with nothing to show for it. The resulting collapse of the bad mortgage bundles meant that in order to save the institutions too big to fail, government programs to feed the needy and heal the sick, had to take drastic cuts. The military was spared from the cuts initially because all the US currency, T-bills and US petro-dollars still needed the backing of bullets and bombs. Part of the cuts also included closing the government for a substantial period and closing off all government services like parks, employment services and the like. One of the outcomes of this, also related to QE, was the raising of the debt ceiling.

Rehypothecation is the practice by financial institutions where they use collateral posted by their clients for their own purposes as if it were their own. This is different from using mortgage based collateral as the banks actually own the title of the mortgaged property until it is paid in full. Rehypothecation is more likely to be performed on assets like savings or securities posted by a prime brokerage as collateral and as a hedge fund in order to gain leverage from the bank for the purposes of further investment. Clients may permit this practice so long as they get some form of compensation, but typically, clients are not aware of this and the bank use this collateral anyway for the purposes such as fractional reserve banking and derivative speculation. Typically, post 2008, this is supposed to be limited to 140% of the loan amount, but there have been ways created to work around this limit. Rehypothecation is sometimes done with property as collateral and that property may be under the terms of a mortgage to someone else. So in essence, the bank has two or more lines of loans on the same collateral. This can be a problem if one or more of the lenders defaults on payments and the bank is forced to foreclose on the mortgage. However, in legal terms, a property can only be foreclosed under the terms of the mortgage holder and not against anyone who is not the mortgage holder.

Fungibility is a term that means the ability to be readily exchanged. Some assets are more exchangeable than others and therefore more fungible. For instance, it is difficult to swap houses because of different needs and location and as a result are not fungible. But gold can be exchanged much more readily and is more divisible without losing core value than many other assets. Though a large diamond is valuable, it is not fungible, because to divide it is to lessen the value of the whole as all the pieces are less valuable than the original large undivided diamond. Thus gold is much more a fungible asset than many other forms of collateral. This makes it one of the most desirable forms of collateral. Indeed, when finance was more honest, currencies were backed by gold, which means that the bank or treasury notes can be swapped for gold without loss. But no currencies are backed by gold today. The last attempt to do that came out of Libya pre-invasion when the country was destroyed and its leader Gaddafi was assassinated. Gaddafi's “crime” was to attempt to create a pan-African union where the proposed currency, the dinar was backed by gold and lent at zero interest as in Libya pre-invasion. Big world financiers did not want this as it threatened profit and their hegemony and so they destroyed the attempt at fair competition with a literal hostile take over. Since war is one of their games too, they made a tidy profit from that venture too. Since then, the battle to maintain colonial control of Africa continues unabated with plenty of profitable wars. Gaddafi attempted to end this cruel cycle, but failed due to the mighty US and allied military machine that backs the US reserve currency of the world.

By now, almost everyone has heard of either a pyramid scheme and/or a Ponzi scheme. The later was named after an Italian scam financier who came up with the idea to involve people in an investment scam. He offered a high interest return on a short term investments. This happened in several stages where the next line of investors' payouts were used in part to pay off the line before with the interest promised. The second line of investors had to be larger in order to pay back the first line and to keep Ponzi in operating cash. The third wave was even bigger and so on. Eventually customers ran out and the scheme went bust with the arrest of Ponzi for fraud. This scheme is still alive today and its cousin, the pyramid scheme works much in the same manner, but with a slight difference. The pyramid scheme has a boss on top who offers some product of profit making system. The line below invests in this product or scheme by giving money up to the top with the idea that they can be the boss of several people below from whom they will get money, some of which they can keep as most trickles to the top. This is done layer upon layer until either investors or the population runs out and no more layers of investment are possible. When that happens, the pyramid scheme collapses and the boss at the top runs off with the profits, leaving everyone below high and dry. These schemes are illegal unless you're too big to fail and can write the laws to protect yourself from the consequences of your own actions. Many large financial institutions that rely on QE from the Federal Reserve are run like a Ponzi scheme and you can't taper a Ponzi scheme without invoking a collapse. But the neat trick here in the case of the US currency being the reserve currency of the world, is that all other currencies are all tied into it via the US currency, Treasury or T-bills or petro-dollars and when the US dollar and T-bills depreciate in value, all the currencies tied thereto also shrink in value. Thus, the losses can be transferred away from the US into other currencies and this can happen because the reserve currency is backed by bullets and bombs. Relatively, for the short term, the reserve currency holds its value, but try telling that to onshore victims now desperate and homeless due to the effects of a collapsing economy. But since the media downplays this issue, focusing on distractions like off-shore panics, sports and movies, on-shore folks still not impacted, fall for the delusion.

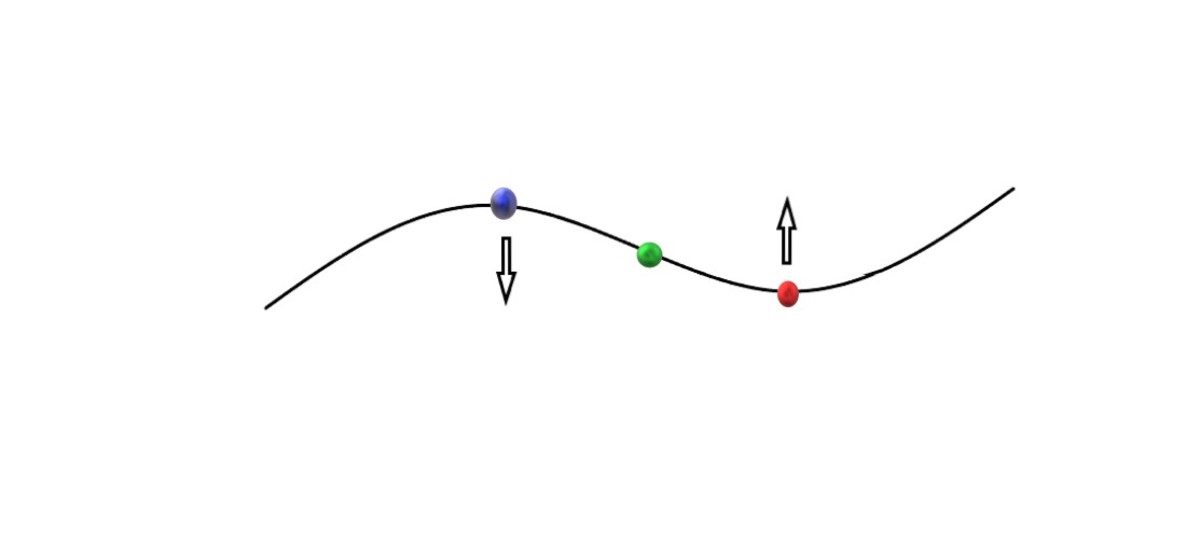

Backwardization or backwardation is a speculative device used when a futures investment is set to expire. This is particularly potent and volatile when something like gold futures are considered. As most investments are held because there is the desire to see an increase in value toward the future, this lends itself to the practice of taking profit on speculation. What this practice does is to look at the value early on in the investment futures contract and holding to that value to as late as possible in order to sell for a possible profit. This is also stated as the person who is in the short position is able to benefit the most of all by such a practice. But this practice also creates losers who do not know how this practice works and ends up shorted on an undervalued asset, made that way by the practice of backwardation. Those who manipulate the futures by this method, cream off the profit by the difference between the short and actual value. But just so one does not feel left out, there is an opposite to backwardation called contago, which can grab far more people unaware than backwardation. Contango is where something starts off with a high value and then depreciates rapidly. This can result due to a glut of a commodity. How contago works to bilk the investor or customer is that a surplus can be suddenly dumped onto the market, and this can happen by several means. This means substantial loss to the investor or customer who is not forewarned or prepared for the consequence of some form of contango. The investor may hold substantial commodities or collateral that could make a tidy profit save for some nuances of contango. The holder of said property expects to reap a reward for sale, but a volatile market intervenes and payment is held back until the value bottoms out. That bottom out can happen almost instantaneously with the market algorithms in common use now in computer assisted trades. Thus, the high value property only nets a low value and the holder loses, sometimes to the point of bankruptcy. This is how a fleecing occurs. Contango is the device by which most investors are taken, whether trading in real estate, gold, or anything else subject to volitility. It is even possible to be the victim of contango via a cryptocurrency war.

Market value sounds simple enough for anyone to understand, but even this can be rigged. Market value used to be tied into supply and demand, which in short means that more supply means less value and less supply means more value. Demand also contributes where the highest profit can be made from a short supply with high demand. That is the key! If you have too much of something and you want to profit as if there was a short supply, then, if you control availability, hide much of it to manufacture a short supply and drive up demand prices. Presently, there are two schemes in operation where this is being deliberately done to drive up market prices on artificially created short supply. One involves an overabundance of aluminium ingots, hidden in and moved around from warehouse to warehouse. This movement looks like it is being sold, but all that is happening is that the surplus is merely being shunted around and not sold. Thus, someone seeking aluminium, can be taken to an empty or near empty warehouse and sold ingots at a highly inflated price based on the apparent shortage. This also involves the trading and shipping of commodities manufactured off-shore. As there is a surplus of almost everything, some of that surplus is hidden by shipping schemes where shiploads of commodities look like they are heading to some foreign destination, but the ships head out to sea, only to return still laden with the same commodities in order to be refueled and restaffed to head out again. The same kind of system is at work as many commodities are hidden on the high seas at any time, creating what appears to be a shortage so prices will go up for greater profit. In the meantime, fossil fuels are gobbled up by ships going nowhere except to hide the truth. Off-shore workers are also paid very little and treated abominably. All this is hidden in plain sight, but few know what is really going on.

Fractional reserve is now an idea pervasive in the financial community. Originally, the banker took in deposits of gold and lent on that, by leveraging out more gold backed loans than gold in stock. As long as everyone did not attempt to collect their gold at the same time, the system worked. This became the form behind all bubbles today that has created the froth economy we all don't enjoy today. Legally, fractional reserve economics can only be ten to one. That means that for every ounce of gold or every dollar in the bank, ten can be lent out by promissory notes with an intent to payback with interest, but that is far from the norm. As too big to fail institutions now write the law, they can fractional reserve til the pigs come home. Today, there are leveraging options, derivatives and rehypothecation that complicate matters in the extreme. They often are lent in a ratio topping 100:1. Further, there is a chain of interest command that extends from zero percent interest “free money” for the too big to fail all the way up to Wonga loans at 5,000% interest for the too small to succeed. Fractional reserve lending is now on steroids and Oxycontin.

Many people are becoming increasingly aware of the desperate shape of the world economy and have opted to move to cryptocurrency, run and managed by peer to peer on the internet without fees or interest charges. There is no middleman and no bank. Cryptocurrency is ideal in the age of internet trading and it has the likes of JP Morgan and other large banks concerned. There are now several cryptocurrencies such as Bitcoin that are rapidly rising in value and taking “valued customers” away fro traditional banking that has gotten corrupt beyond measure. But the banks will not go down without a fight as the case of Libya more than adequately proves. Bitcoin is under attack and the banks are now devising their own competing forms, also peer to peer without fees and interest. But this is now and the future will show that bank cryptocurrencies will soon be incumbered with fees and interest charges. For now, Bitcoin and like currencies are generally trending up in the stock exchange.

Financialization is the process where the banks increase in size and influence around the world. This coupled with the exponential growth of all debts, whether national, corporate, military, governmental personal and otherwise, however managed and created. Debt is on the increase and we have become a world of indentured servants addicted to the froth economy. It is out of control simply because it is impossible to pay off the size of the debt with ever accumulating interest compounded annually. This interest based indebtedness is what is behind the inflating bubbles of the world froth economy. Everything, God included, appears to be financialized. It is all tied to QE, derivatives, leveraging, rehypothecation, backwardation, contango, debt ceilings, fractional reserve lending and increasingly non-collateralized, Take a student loan for instance. How does one collateralize something insubstantial like the learning accrued from an education? It is not like a house or a car that can be repossessed. Yet, the student who defaults on his loan is now perpetually indebted and will be hounded by collection agents until dead. The banks rule the world on behalf of their CEOs, CFOs and their administrators in large companies like the military industrial complex (the largest single company on the planet), the government and all production facilities. Everything has become monetized. Everyone is in servitude to a boss that they can never fully repay no matter how hard they work or how much they produce. There is another serious downside to all of this besides the hopeless debt and poverty born therefrom and that is the ruination of the planet. In order to pursue the pay down of this chimera of debt in the world wide froth economy, we ever accelerate the rape of the planet until one day, the froth economy collapses in a ruined planet. It is now a question of which will manifest first.