Michelle Backmann and the Idiousy of the Media ..........

- ahorsebackposted 12 years ago

0

Well girls and boys, our great American Media is at it again ! Another female presidential candidate comes on the scene and whats the first thing our fair and open minded media asks of the American public ? Can a woman who suffers from migrain headaches be of the able minded kind of leaader that America needs right now??? Answer ....? I'm moving to freakkin' Russia and joining the Politboro, renouncing my citizenship and buying a ten year subscription to the Pravda Newspaper! And I going to start lobbying to rebuild the Berlin wall ! Just to keep liberals out of my new Home.

In fairness, of course, liberal feminists have been pointing out for years how sexist the so-called "liberal" media is...

Bachmann is suffering from much more than migraines.

I'm suffering from trying to read this forum's title.

I am such an "idiout", and so is "backman"

Edit: I apparently misspelled the misspelling. Horse has it spelled "Backmann", with two "n"s.

I have a problem with her. She was schmoozing with Steve King of Iowa, a guy who was told he couldn't go to a Colorado Tea Party meeting because he was racist. Well, they were working together on a black farmer settlement that had fraudulent applicants. Couldn't be worse than the gulf settlements.

The fact that she became involved, fraud or not, and with Steve King at that, was just proof that she is not the sharpest tool in the shed, and not presidential.If you're mad at the media for marginalizing Bachman over habitual migraines, then you ain't seen nothing yet.

Ron Paul's message of "I don't want to bomb foreign countries" is translated, by the media, to mean "I'm an isolationist freak"Hey Evan I have a new article on Ron Paul in the BI political section. My teabagger friends are back. This one has comments about monetary policy. Check it out.

Thanks for commenting on my last Ron Paul article.Hey: you're getting Google.news hits on your website for people searching Ron Paul. Grats.

I do agree - these are the kind of Bachmann issues we should be discussing..

"Today, Rep. Eric Cantor (VA), the chief deputy Republican whip in the House, unveiled his proposal to stimulate the economy. His legislation -the so-called Middle Class Job Protection Act -does nothing for the middle class. Instead, it reduces the corporate tax rate by 25 percent.

At a press conference today unveiling the stimulus proposal, Rep. Michele Bachmann (R-MN) justified the conservative plan to give tax breaks to corporations -instead of working Americans -by arguing that people actually like working long hours:

'I am so proud to be from the state of Minnesota. We're the workingest state in the country, and the reason why we are, we have more people that are working longer hours, we have people that are working two jobs.

Bachmann's version of the American Dream is apparently working two full-time jobs and struggling to get by."

From - http://crooksandliars.com/2008/01/17/mi … -two-jobs/You got stones sitting there accusing everyone of making up lies. When all along it is you, I haved said so many times, show you many times how you are wrong . Well here we go again.

Did you look at the date on your source……. January 16, 2008 01:01 PM Unreal. And you try to pass this off as today

The bill H.R. 4995 was from the 110th congress by Eric Cantor. And the bill does not lower the Corperate tax BY 25% it TAKES IT DOWN TO 25% Huge difference. Guess it was a typo, NOT. You changed the words.

Congressional Research Service Summary

The following summary was written by the Congressional Research Service, a well-respected nonpartisan arm of the Library of Congress. GovTrack did not write and has no control over these summaries.

1/16/2008--Introduced.

Middle Class Jobs Protection Act of 2008 - Amends the Internal Revenue Code to: (1) REDUCE THE MAXIMUM CORPORATE INCOME TAX RATE TO 25%; (2) increase the expensing allowance for depreciable business assets to $250,000 in 2008 and 2009; (3) increase to 50% the current year bonus depreciation allowance for certain property placed in service in 2008 and 2009; and (4) allow additional carrybacks for certain net operating losses and for excess business and foreign tax credit amounts arising in 2008 and 2009.

To amend the Internal Revenue Code of 1986 to reduce corporate marginal income tax rates, and for other purposes.

Overview

Sponsor: Rep. Eric Cantor [R-VA7]show cosponsors (50)

David Weldon [R-FL15]

Addison Wilson [R-SC2]

Text: Summary | Full Text

Status: Introduced Jan 16, 2008

Referred to Committee View Committee Assignments

Reported by Committee (did not occur)

House Vote (did not occur)

Senate Vote (did not occur)

Signed by President (did not occur)

This bill never became law. This bill was proposed in a previous session of Congress. Sessions of Congress last two years, and at the end of each session all proposed bills and resolutions that haven't passed are cleared from the books. Members often reintroduce bills that did not come up for debate under a new number in the next session.

I do not have to go there on how out of context her statement is let alone it did not happen today in a press conference. It happened 3 years ago.If you do the math, you will notice that in this case, it's virtually the same thing.

The corporate tax rate varies from 15-35%, depending on various factors, but it's the 35% Republicans are always complaining about, so I'll assume that's the one Cantor was trying to reduce. 35% -> 25% = lowering the corporate tax rate by 29%. For true accuracy Doug probably should have said "it reduces the corporate tax rate by more than 25 percent" but leaving it at 25% isn't that misleading.Lets get something straight. I quoted a source and linked to that source. However, I am accused of changing the quote. Link to the original. I changed NOTHING! The accusation is a personal attack on my integrity as it suggests a deliberate act on my part to deceive. I can not object strenuously enough.

Excuse me, Kerry. My comment was intended for that nose-picking hound dog - the comment you replied to.

Doug,

Unlike what you do to me, this was not a personal attack. You clearly knew what you were doing when you used you source. If you were Quoting Bachmann you would not have included the rest. You clearly wanted to try and indicate that both those actions occured yesterday. If you had integrity, you would have commented that the article, which was not fact but someones opinion, you would have written a disclaimer, pointed out it was 3 years old, that Cantor was not dropping the rate by 25% but to 25%. And if you wanted to use that quote of Bachmann, you should have posted the whole speech. That way everyone could see that you took those few sentences out of context.

You jump all over people here for much less. THis is not the first time I exposed you for putting out false information, so do not try and explaining it as its my fault or I am attacking you. That is just a typical response when one gets caught but does not want to admit to what they are doing.So if my honesty pisses you off so much that you want to call me nose picking hound. go ahead. We all see you for what you are.

Kerry,

Not sure but in my math days lowering from 35% going down to 25% means you lowered by 10%, not 29%.No. you are wrong. Lowering from 35% to 25% is a drop of 29%.

Imagine you have 35 pineapples and somebody removes 10, you will have lost,not 10% of your pineapples, but 29%.

To drop 35% by 10% would only take you down to 31.5%That says a lot. You should re-take 4th grade arithmetic!

If you can pass a 4th grade arithmetic test, you can't be a teabagger.

no one needed to add anything more after J. Holden's post - point was made. instead, and typical liberals, someone opposed to your failed ideology makes a simple mistake, you insult and degrade. shamful people you are

BTW, the bigger issue here is Ron Montgomery missing this math mistake! What does THAT tell everyone here? ehIt's a simple mistake that makes a considerable difference. The tax rate is getting lowered by an amount nearly three times greater than he thought it was. The difference is enough to give most reasonable people pause, though probably not a modern conservative.

There just aren't enough hours in a day to correct all of your mistakes...

Sounds like a truly experienced teabagging viewpoint.

Um, you might want to take a refresher course. You need to calculate the percent lowered as a percentage of the starting value, not as a percentage of 100.

10/35 = 0.285

0.285 = 28.5%

28.5% rounds to 29%It is a decrease of 10%, but a 29% reduction.

This is one of the wondrous tricks of statistics: if you wish a bigger number to make a bigger impression, you can use the reduction instead of the decrease.Thanks for pointing that out. I want to bow to you all. I wrote the math post while angry and I was obviously wrong. Evan actually wrote what I should have said. I would have responded sooner but was unable to because a fellow hubber whined to Hubpages my post showing he was inaccurate with his posting was a threat to him. So I was in the sin bin for 3 days. One can read every post I ever made and can see I have never threaten anyone. Doing so would be childish.

It's all good, I just like math is all.

Thanks Evan. We may not agree on some things, but I appreciate you saying its all good.

Lets get this straight. The section of the quote that I found important is the section I highlighted. So the point was not that Canter is a whore for big business.

It was the reaction by the dingbat Bachmann which I highlighted.

At no time did I 'try to pass this off as today'.. which that hound dog accused me of.Really, if you wanted to show the quote, why did you not just show the quote? Because you wanted everyone to believe differently. You are just pushing your opinion. THats fine, push away, but be accurate about it. Don't push a 3 year old article as it happened todat. I uppercased it for you. You could have said I found this article, but no you wanted them to think it was a news conference today.

"AT A PRESS CONFERENCE TODAY unveiling the stimulus proposal, Rep. Michele Bachmann (R-MN) justified the conservative plan to give tax breaks to corporations -instead of working Americans -by arguing that people actually like working long hours:

'I am so proud to be from the state of Minnesota. We're the workingest state in the country, and the reason why we are, we have more people that are working longer hours, we have people that are working two jobs."

Now why did you not want to show the whole story Doug. It was right out there.

The office of Rep. Michele Bachmann responded to criticisms over her statements on Minnesota’s work ethic, statements that earned her a spot as a finalist on “Worst Person in the World” list of MSNBC’s Keith Olberman.

Were her words taken out of context? The St. Cloud Times has a transcript of what Bachmann said via Congressional Quarterly. The Times also has a statement from Bachmann’s office:

“As I said, I’m proud to be from the state of Minnesota. And I’ve always been proud of the work ethic of Minnesotans.

“We work long hours and sometimes even two jobs to provide for our families. But the families across our state and the nation are feeling anxiety. The costs of healthcare, gasoline, tuition, and other necessities are rising. That’s why it’s more important than ever to provide workers and small businesses with the tools they need to create more jobs and improve the economic future for American families.

“Yesterday, I joined my colleagues in proposing legislation to stimulate our economy and to show the American people that Washington is working for them, and not vice versa.

“Leave it to the naysayers to try to make political gain from a statement congratulating our citizens on their industriousness and strong work ethic.”

If you wanted to make a point you could have posted this

“I am so proud to be from the state of Minnesota. We’re the workingest state in the country, and the reason why we are, we have more people that are working longer hours, we have people that are working two jobs, we have more women in the workforce than any other state.

“In Minnesota, we like to work and we work hard. We’re not different from other states in our country. That’s what I love about the bill that Eric Cantor is leading the charge on today, because what he wants to do is make sure that more jobs are created for American women, for families.

“We can do that when employers have the resources that they need to create those jobs.

“My husband and I employ 40 people in our small business. And we would be delighted to employ more people. But you can’t do it when the tax man is there with his tin cup, asking for more.

“Some of the stimulus packages that we’ve heard, from Obama, from Clinton, and also from the Democrats in the House and in the Senate, have been to have the tin cup out to the American, say, “We want more of your money so that we can decide how best to stimulate the economy.”

“What we do in this bill is say, “We trust the American employer; we trust Americans to create jobs.” We do this by lowering the tax burden, by creating jobs.

“And if you look at empirical data from the last 40 years, any time you have truly stimulated the economy, it’s been through tax cuts, not through tax increases.

“That’s why I want to go with the winner. This bill is a winner.”

http://minnesotaindependent.com/2993/ba … ngest-flap

Migrains or not, we need Bachmann like we need a hole in the head!

ahorseback: this is NOT meant to be a mean spirited post.

If you want people to take your opinions seriously, then you must learn to type English in properly formatted grammar with minimal typos.I think this suffices to show my feelings towards Michele Bachmann - I'm all for a woman in the White House, but sure as hell not her.

http://motherjones.com/politics/2011/07 … en-suicideThank you for posting this, Jason.

I didn't even get to the "No homo promo" policy page. My stomach was already heaving by then and I just couldn't read anymore.

This is both heartbreaking and infuriating.

Those like Bachmann and her husband who masquerade as "christian" while playing God with people's (especially vulnerable children's/teens')lives should be given a dose of their own intolerant medicine.

Government out of our private lives -- yeah right.

Everywhere except the bedroom.

You may want to check the other post about this. Liberals didn't start the conversation about whether her headaches were cause to question her fitness for the presidency. It was someone in her own party.

Latching on to every tidbit without checking facts perpetuates the idea that many have about certain individuals not thinking for themselves..Either way , right left , most of the media IS left! Migrains are a lame excuse for any idiot to raise as an issue. She is too robotic to me but hey I voted for Macain-Palin. ......But, if Backmann is a robot ...Obama is a puppet!

Roo

Veery true,her own party took the shot acroos the bow but the media caught the football and are trying to run to the endzone(ok I threw that one in there beacuse the lockout may be over) But If I could lookup and see shows up to vote, the media could have as well instead of saying it will hamper her from being President. Seems sexist to me. She is a woman so a migrane is dibilitating. If I man gets it he suckes it up and does the job. What a double standardActually, I heard it was a former staff member of hers! Apparently, a lot of her former staffers do NOT want her to be the nominee.

I thought that to. But I read over the weekend that the former staffer now denies he said it. I think he did just refuses to take responsibility

It doesn't even begin to matter who bought it up , the entire media grabbed it and ran like a frat boy with a cheerleaders bra! Let me ask you guys this ,Seriously why isn't the FEMALE side of America outraged at the way all media has treated either Backmann or Palin either one??? Where is Your fair and balanced Media on this issue! And why isn't every woman in America angrry as hell?

Because Bachmann is a wingnut? Because she's anti gay? Because she wants to repeal Roe v. Wade?

America dodged a bullet with megalomaniac Hillary. Obama is a loser (like Carter), but he saved all of us from a Hillary presidency - and a first lady named Bill.

Yeah, still had to endure dopy Pelosi, her constant preening for the camera (look at me everyone, I'm speaker of the house), her stupid remarks, her refusal to allow any republicans to hv a voice in house legislation, and her brazen gender bias (The Lilly Ledbetter law, which allows workers [FEMALES] greater latitude to sue [TO BULLY] for more pay),etc. Remember, America was heading into a Depression at this time...and this is what dopy Pelosi thought was MOST important for America! I haven't seen ONE female politician in Congress that's impressed me - including Backmann .You're just a charmer all the way around, aren't you?

If straight, white, Christian men are really the only people you can stand to be around, perhaps you should spend your time inventing a time machine instead of posting in forums. That world is gone and ain't coming back, so it would be a more productive use of your time.

kerryg, time machines only exit in hollywood movies. I live in reality. You should try it

Roni, you take your valuable time out here to point out a grammar faux pax of mine, just so everyone reading could get the full rhetorical effect of my sentence, a service that you have given to no one else in this thread, I feel very special. Thank you sir. However, I was on a two hour beach run, then had lunch with some friends, then bought a new golf glove - my old one was a year old and I just felt it needed to be replaced. Then I had to get gas. I only use the full-service and they insist on doing the windows. Well, time just flies as they say. I didn't make it back within the 4 hour window to make the necessary correction - you so obviously wanted. I do apologize. As for kerryg, she is seriously delusional but I think she got - or will get - the jest of what I meant in the sentence.

BTW roni, if you want to spend some time thinking of a better way I could have stated that thought of mine, I'm willing to tinker with the words.Tinker with this.

It's "gist", not "jest".Thanks bruce. I continue to learn very valuable things here every day (first from you. Where've you been?). I appreciate all contributors, regardless of race, creed, color, religion, sexual preference, or even Polyester suits .

Thanks again bruce. I was worried. I'm sure others, like Ron Montgomery, were at the very least curious.

Oh, and re-reading your post there bruce, I just noticed something. WOW! It 's this:

"Tinker with this."

You've got a glaring semantics issue going on there my friend. I think it's called verb confusion. I honestly don't know how THAT got by me. One cannot tinker with an abstract thought that's singular. Example: I'm going to tinker around with "crux." Or, I'm going to tinker with "gist". Tinker involves things, choices. You should have said: The correct word is "gist, " not "jest." Try to be more careful, okay? Ron Montgomery would have surely pointed this out if I didn't.Here's the real definition of the verb "tinker".

I think the unskilled part particularly applies here.

Goodnight.

http://www.merriam-webster.com/dictionary/tinkerI know what tinker means. It can be a noun or verb. You seem to be implying that in your sentence "Tinker with this" you are using tinker as a noun. I'm no expert on grammar (like my pal Ron Montgomery), but I do believe in that sentence of yours, tinker is a verb. Hence, a verb confusion situation that you stumbled in to. But don’t you worry bruce, I have not lost confidence in you. You can still do fact checking and editing services for me. I appreciate your help. Just be careful confusing verbs with nouns. It’s tricky sometimes. I know. Maybe Ron Montgomary can help you on this one.

Not a good reader, are you?

I specifically stated that I was sharing the definition of "tinker" as a verb.

What an odd post.

The media is mostly five or six corporations. Find me a left wing corporation.

"most of the media IS left"

HARDLY!

Name ONE.

msnbc...the used to be left....but always had scarborough, now has ratinger and steele.

Which outlet had hard questions before the Iraq war? Even pbs was on the bandwagon.

Which one ever questioned the official version of 9/11?

None.

It's corporate media...with a few bones thrown in there for the left, like Maddow and Shultz.- ahorsebackposted 12 years ago

0

Horsebuckee! You couldnt get more liberal than Msnbc or Cnn , NPR , for gods sakes NPR spends more time in liberal la la land than twinkle toes himself ! Get real , The left wing media Still gives the Obama's wall street boys a free ride! Maybe your right in one way though , When the entire media is practicing left wing robotics There is no center or right !

That's not true. Do you ever listen to Diane Reim? She has left, right, and center...on all discussions!

She had Juan Williams on today...you know, the one who got fired by NPR, and works for Fox?

Yet---she NEVER has a show on 9/11......

Oddly enough, Fox mentioned it once! Napolitano....said Bush and Cheney should have been impeached!

wow--just remembered that....

hmmm, now that is strange.Diane Reim, , Daniel Shores , two of the most inept media pundits in history , I have to say , I listen to NPR alot and Fox news too, that makes me a conficted listener ! If one listenes to all sides and still finds no reliable source of media equality , does that make him closed minded. Diane reim may think shes fair but listen between the lines. Can you spell cool -aid , they have a new flavor of cool-aid by the way ..........its called .....Politically Correctaid ! All Media today has an agenda and you can taste it in the delivery if you are open minded . No longer is media either accurate nor is it fair and balanced. Ever listen to "Democracy Now" ? I will give them one thing and one only, they do not hide their agenda , they are as ultra liberal as Micheal Moore is ! There is an old saying that all Americans should really pay attention to when it comes to media delivery ......."Know Thine enemy well!"....Americans seem unable to decide for themselves anymore and have to be told how to think! When I see so many American people , especially! , drinking the cool-aid flavors of either side right or left I think of how Hitler and Mao got thier starts . And like Lenin and Stalin or Jimmy Jones ! We just follow along blindly .............

Diane Reim inept? Not in my world. Daniel Shore I don't know.

And I used to love Democracy Now...but it's no longer on my local station.

And, there's another one! For being so "ultra left", they NEVER touch 9/11 either!

Nor does Diane Reim.

It's a taboo on all sides....wonder why?

There's PLENTY enough to question....seriously question,and no one will touch it.Diane Rehm is more of an interview host than a pundit. She interviews a fairly broad spectrum of credible pundits. She gets the most knowledgeable people to interview.

You listen to NPR a lot? I bet you just love the "Daniel Shores" Show. (Daniel SCHORR) has been dead for a year.

Gee ......ummmm excuse my spelling there ronnie, I do listen alot and I knew when he died too! Ole Daniel the super intellectual liberal idealist. What were you a spelling teacher ? The difference between closed minded and open minded : unlike liberals, I can listen to both sides of the story and make up my own mind!

So you knowed he wuz ded an' you speaked ov him in present tensk anyhows?

Ron continues to impress me with his spell check capabilities. I think he reads every post. Be careful!

He is trying to be hood, Can you all not tell anything? Do you all have nothing to add than to pick on each others grammar? If you have nothing to say or add to the topic at hand, then say nothing!!!

Generally speaking , seeing how he always do's that , That is what happens when libs start losing an arguement , they start applying a personal edge to thier arguement! I , for one , have never seen THAT not happen! And then they postal on NPR.

Ron Montgomery, I can now delete my spellcheck , as we all know your correct quite liberally!

LMC

Napolitano was talking about Gitmo, not 911

Fox News contributor and host of Fox Business' new libertarian show Judge Andrew Napolitano said over the weekend that President Bush and Vice President Cheney should have been indicted over their administration's conduct around Guantánamo Bay.

In an interview with Ralph Nader on C-SPAN, Napolitano blasted the former administration for suspending habeas corpus.

"What President Bush did with the suspension of habeas corpus, with the whole concept of Guantánamo Bay, with the whole idea that he could avoid and evade federal laws, treaties, federal judges and the constitution was blatantly unconstitutional — and in some cases criminal," Napolitano said. "They should have been indicted. They absolutely should have been indicted. For torturing, for spying, for arresting without warrants. I'd like to say they should be indicted for lying but believe it or not, unless you're under oath, lying is not a crime."So isn't that what happens when they are sworn in?

If the us media is so left wing guess we all know what European socialism is and how their

governments work. How about Saudi Arabia how does that work?I'll never understand the liberals hate for corporations. They employ people, they generally pay into medical plans, pension plans and are - forced by the DEMS - to give females time off for child birth,etc. None of this has the least bit to do with earning a profit. The purpose of the corporation IS to earn a profit. That profit, which creates a tax base (wealth) is what the DEMS so dearly love to TAX. The earnings of the corporation belong to the shareholders. When the profits are distributed to the shareholders, then that is what should be taxed.

I thank god often I'm well off enough so I don't have to go out into today's rotten business world and try to scratch out a living. DEMS hv completely ruined america's business/economic arena.S Leretseh, I think the Dems are so power hungry--this can be seen particularly since the Civil War--that they fear corporate power. Historically to can see they go after the throat, many times even literally, of anything that stands in the way of their hold on power. Hunger for power corrupts.

Democracy Now is on at 3 in the morning where I am. I love Amy, always, but the show was much better when they were bent, leant and broke. As leading leant leftists, lmc, we should lean harder just so Americans have an actual clue as to what the left actually is.

Maybe that's why it's not on here anymore......they have stepped up in the world, have they?

Here's what Left means to me: People over Profit. Love your neighbor as yourself. Don't let the big bullies pick on the little guy.Resist injustice. Like when a certain political faction tries to sneak corporate protectionism into our constitution because their policies have no merit in a human society.

Yes, well Coburn said "Only those who are sucking off the system will be hurt."

Really? Seems more like targeted hurt to me.

Always always...go for the poor and needy...those old and feeble, mentally challenged, disabled, poor moms and kids...

all sacrificed to the Global Elite!

Mo Money Mo Money...to the top.

Wealth Distribution!

Heavens!!

AND I think they got corporate protectionism in the back door.

The Sureme Bagger Court!!Those who are sucking of the system sound more like the corporate elite to me. All helped by govt aid, most saved from disaster from bailouts. It never ends. Reagan, Bush, Clinton, Bush, all sucked off the corporate elite at the expense of the people.

- ahorsebackposted 12 years ago

0

Once upon a time folks , I too was a far left leaning son of a conservative. Idealistic to a tee , lets group hug everyone into compliance with the left social revolutions dialog. That will do it! Amy Goodman is one of my kind of people ......when I was 17 that is . Democracy now is a leftover from the sixties. Bash anything that is America, dont worry about the effects of balance or ethics , even integrety in this new left media . Yeah! Micheal Moore for president ! There is a reason its now on a three in the morning right next to the infomercial section! QVC has more ethics more balance and integrety in delivery in prime time TV, thats why! We are talking about balancing a federal tax system , and you're President has increased the debt that you're grandchildren will have to pay, By What % do you suppose. Oh, but acording to Amy ...thats President Reagens fault. Why is it that only about 50% of American households pay any fed tax at all? Thats almost a corporate rate if you ask me . An unbalanced federal spending system is relatively new ,since the seventies? We can't just throw away the credit card when its maxed out , we have to pay it back!

LOL!

"And why isn't every woman in America angrry as hell?"

I'm angry as hell that 2 women candidates (Bachmann, Palin) turn out to be such d*&che bags...and represent my gender so poorly!!This is hilarious, and I love it.

But don't be fooled: Democrats make some pretty idiotic arguments.

"Minimum wage helps the poor", "we need to increase taxes and continue to spend money".

Sigh.....

The point wasn't about spelling, it was to make reference to the obvious lie about horse*** being an NPR listener...

Never mind. This is like playing whack-a-mole where the moles never duck.They listen to a commentator who's been dead for a year?

This is Daniel Schorr coming to you from beyond the grave....

Hey! Hey Jim, is that you??? Jimmy...Oh My God!

Elvis, baby---how's it shakin?

- ahorsebackposted 12 years ago

0

Come on guys , good commentators never die, especially these NPR guys . They just talk on and on and on....and on

- ahorsebackposted 12 years ago

0

There is no sweeter cool-aid than that of political correctness, and America is drunk on it!

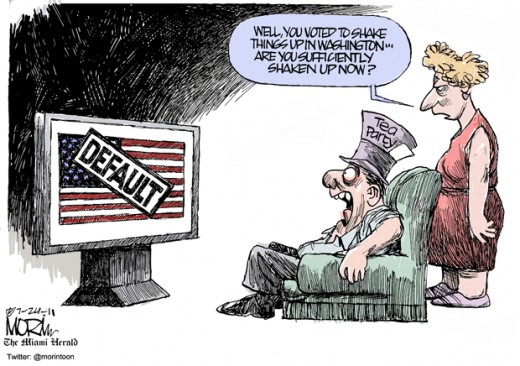

We can only hope the US will default. Hold DC to the same principles we're held to!

Can't pay your debt? You'd better find a way!

Nice one!

Has kind of an "I'll get you my pretty, and your little dog, too..." tone to it.

"These things must be done (in)delicately!!"How bout one with a donkey that says

"steal money from those who are innocent, and then spend it helping the poor stay poor and stifle businesses" ?

- ahorsebackposted 12 years ago

0

Ohhh, I don't think that you're venomous portrayal towards the right or the tea party or the budget talks is un-emotional ! The right is holding you're spending habits hostage! Poor babies......But , its okay that you haven't paid the 8.5 million dollars each of you owes on you're federal credit card! That means you , your wife or husband and each of your kids......owe 8.5 million each! But blame the right for Obama's failure for "hope and change". Can you Look your children in the eyes and say , "Oh , honey you know you can pay for my spending"!

I wouldn't take lessons in economics from somebody who does not know the difference between "your" and "you're"!

Sorry, but it does matter.That doesn't matter to me, but I do take issue with ahorsback's convenient amnesia about the facts—namely that America's debt skyrocketed with an unnecessary, unpaid-for war, a fat-cat tax cut and a deregulated financial sector.

Well, that was my point, if he can not even be bothered to say what he means at one level, why should we have any more faith in what he says at a higher level?

Myth #1: Tax revenues remain low.

Fact: Tax revenues are above the historical average, even after the tax cuts

Just for info. Tax revenues were higher under Bush than under Obama.

Tax revenues in 2006 were 18.4 percent of gross domestic product (GDP), which is actually above the 20-year, 40-year, and 60-year historical averages.[1] The inflation-adjusted 20 percent tax revenue increase between 2004 and 2006 represents the largest two-year revenue surge since 1965-1967.[2]Claims that Americans are undertaxed by historical standards are patently false.

Some critics of President George W. Bush's tax policies concede that tax revenues exceed the historical average yet assert that revenues are historically low for economies in the fourth year of an expansion. Setting aside that some of these tax policies are partly responsible for that economic expansion, the numbers simply do not support this claim. Comparing tax revenues in the fourth fiscal year after the end of each of the past three recessions shows nearly equal tax revenues of:

18.4 percent of GDP in 1987,

18.5 percent of GDP in 1995, and

18.4 percent of GDP in 2006.[3]

While revenues as a percentage of GDP have not fully returned to pre-recession levels (20.9 percent in 2000), it is now clear that the pre-recession level was a major historical anomaly caused by a temporary stock market bubble.

Myth #2: The Bush tax cuts substantially reduced 2006 revenues and expanded the budget deficit.

Fact: Nearly all of the 2006 budget deficit resulted from additional spending above the baseline.

Critics tirelessly contend that America's swing from budget surpluses in 1998-2001 to a $247 billion budget deficit in 2006 resulted chiefly from the "irresponsible" Bush tax cuts. This argument ignores the historic spending increases that pushed federal spending up from 18.5 percent of GDP in 2001 to 20.2 percent in 2006.[4]

The best way to measure the swing from surplus to deficit is by comparing the pre-tax cut budget baseline of the Congressional Budget Office (CBO) with what actually happened. While the January 2000 baseline projected a 2006 budget surplus of $325 billion, the final 2006 numbers showed a $247 billion deficit-a net drop of $572 billion. This drop occurred because spending was $514 billion above projected levels, and revenues were $58 billion below (even after $188 billion in tax cuts). In other words, 90 percent of the swing from surplus to deficit resulted from higher-than-projected spending, and only 10 percent resulted from lower-than-projected revenues.[5]

Furthermore, tax revenues in 2006 were actually above the levels projected before the 2003 tax cuts. Immediately before the 2003 tax cuts, the CBO projected a 2006 budget deficit of $57 billion, yet the final 2006 budget deficit was $247 billion. The $190 billion deficit increase resulted from federal spending that was $237 billion more than projected. Revenues were actually $47 billion above the projection, even after $75 billion in tax cuts enacted after the baseline was calculated.[6] By that standard, new spending was responsible for 125 percent of the higher 2006 budget deficit, and expanding revenues actually offset 25 percent of the new spending.

The 2006 tax revenues were not substantially far from levels projected before the Bush tax cuts. Despite estimates that the tax cuts would reduce 2006 revenues by $188 billion, they came in just $58 billion below the pre-tax cut revenue level projected in January 2000.[7]

The difference is even more dramatic with the pro-growth 2003 tax cuts. The CBO calculated that the post-March 2003 tax cuts would lower 2006 revenues by $75 billion, yet 2006 revenues came in $47 billion above the pre-tax cut baseline released in March 2003. This is not a coincidence. Tax cuts clearly played a significant role in the economy's performing better than expected and recovering much of the lost revenue.

Myth #3: Supply-side economics assumes that all tax cuts immediately pay for themselves.

Fact: It assumes replenishment of some but not necessarily all lost revenues.

Attempts to debunk solid theories often involve first mischaracterizing them as straw men. Critics often erroneously define supply-side economics as the belief that all tax cuts pay for themselves. They then cite tax cuts that have not fully paid for themselves as conclusive proof that supply-side economics has failed.

However, supply-side economics never contended that all tax cuts pay for themselves. Rather the Laffer Curve[8] (upon which much of the supply-side theory is based) merely formalizes the common-sense observations that:

1. Tax revenues depend on the tax base as well as the tax rate;

2. Raising tax rates discourages the taxed behavior and therefore shrinks the tax base, offsetting some of the revenue gains; and

3. Lowering tax rates encourages the taxed behavior and expands the tax base, offsetting some of the revenue loss.

If policymakers intend cigarette taxes to discourage smoking, they should also expect high investment taxes to discourage investment and income taxes to discourage work. Lowering taxes encourages people to engage in the given behavior, which expands the base and replenishes some of the lost revenue. This is the "feedback effect" of a tax cut.

Whether or not a tax cut recovers 100 percent of the lost revenue depends on the tax rate's location on the Laffer Curve. Each tax has a revenue-maximizing rate at which future tax increases will reduce revenue. (This is the peak of the Laffer Curve.) Only when tax rates are above that level will reducing the tax rate actually increase revenue. Otherwise, it will replenish only a portion of the lost revenue.

How much feedback revenue a given tax cut will generate depends on the degree to which taxpayers adjust their behavior. Cutting sales and property tax rates generally induces smaller feedback effects because taxpayers do not respond by substantially expanding their purchases or home-buying. Income taxes have a higher feedback effect. Nobel Prize-winning economist Ed Prescott has shown a strong cross-national link between lower income tax rates and higher work hours.[9] Investment taxes have the highest feedback effects because investors quickly move to avoid higher-taxed investments. Not surprisingly, history shows that higher investment taxes deeply curtail investment and consequently raise little (if any) new revenue.

Yet, using the standard set by some, even a hypothetical tax cut that provides real tax relief to millions of families and entrepreneurs and creates enough new income to recover 95 percent of the estimated revenue loss would be considered a "failure" of supply-side economics and thus merit a full repeal.

Myth #4: Capital gains tax cuts do not pay for themselves.

Fact: Capital gains tax revenues doubled following the 2003 tax cut.

As previously stated, whether a tax cut pays for itself depends on how much people alter their behavior in response to the policy. Investors have been shown to be the most sensitive to tax policy, because capital gains tax cuts encourage enough new investment to more than offset the lower tax rate.

In 2003, capital gains tax rates were reduced from 20 percent and 10 percent (depending on income) to 15 percent and 5 percent. Rather than expand by 36 percent from the current $50 billion level to $68 billion in 2006 as the CBO projected before the tax cut, capital gains revenues more than doubled to $103 billion.[10] Past capital gains tax cuts have shown similar results.

By encouraging investment, lower capital gains taxes increase funding for the technologies, businesses, ideas, and projects that make workers and the economy more productive. Such investment is vital for long-term economic growth.

Because investors are tax-sensitive, high capital gains tax rates are not only bad economic policy, but also bad budget policy

Myth #5: The Bush tax cuts are to blame for the projected long-term budget deficits.

Fact: Projections show that entitlement costs will dwarf the projected large revenue increases.

The unsustainability of America's long-term budget path is well known. However, a common misperception blames the massive future budget deficits on the 2001 and 2003 tax cuts. In reality, revenues will continue to increase above the historical average yet be dwarfed by historic entitlement spending increases.

For the past half-century, tax revenues have generally stayed within 1 percentage point of 18 percent of GDP. The CBO projects that, even if all 2001 and 2003 tax cuts are made permanent, revenues will stillincrease from 18.4 percent of GDP today to 22.8 percent by 2050, not counting any feedback revenues from their positive economic impact. It is projected that repealing the Bush tax cuts would nudge 2050 revenues up to 23.7 percent of GDP, not counting any revenue losses from the negative economic impact of the tax hikes.[11] In effect, the Bush tax cut debate is whether revenues should increase by 4.4 percent or 5.3 percent of GDP.

Spending has remained around 20 percent of GDP for the past half-century. However, the coming retirement of the baby boomers will increase Social Security, Medicare, and Medicaid spending by a combined 10.5 percent of GDP. Assuming that this causes large budget deficits and increased net spending on interest, federal spending could surge to 38 percent of GDP and possibly much higher.[12]

Overall, revenues are projected to increase from 18 percent of GDP to almost 23 percent. Spending is projected to increase from 20 percent of GDP to at least 38 percent. Even repealing all of the 2001 and 2003 cuts would merely shave the projected budget deficit of 15 percent of GDP by less than 1 percentage point, and that assumes no negative feedback from raising taxes. Clearly, the French-style spending increases, not tax policy, are the problem. Lawmakers should focus on getting entitlements under control.

Myth #6: Raising tax rates is the best way to raise revenue.

Fact: Tax revenues correlate with economic growth, not tax rates.

Many of those who desire additional tax revenues regularly call on Congress to raise tax rates, but tax revenues are a function of two variables: tax rates and the tax base. The tax base typically moves in the opposite direction of the tax rate, partially negating the revenue impact of tax rate changes. Accordingly, Chart 4 shows little correlation between tax rates and tax revenues. Since 1952, the highest marginal income tax rate has dropped from 92 percent to 35 percent, and tax revenues have grown in inflation-adjusted terms while remaining constant as a percent of GDP.

Chart 5 shows the nearly perfect correlation between GDP and tax revenues. Despite major fluctuations in income tax rates, long-term tax revenues have grown at almost exactly the same rate as GDP, remaining between 17 percent and 20 percent of GDP for 46 of the past 50 years. Table 1 shows that the top marginal income tax rate topped 90 percent during the 1950s and that revenues averaged 17.2 percent of GDP. By the 1990s, the top marginal income tax rate averaged just 36 percent, and tax revenues averaged 18.3 percent of GDP. Regardless of the tax rate, tax revenues have almost always come in at approximately 18 percent of GDP.[13]

Since revenues move with GDP, the common-sense way to increase tax revenues is to expand the GDP. This means that pro-growth policies such as low marginal tax rates (especially on work, savings, and investment), restrained federal spending, minimal regulation, and free trade would raise more tax revenues than would be raised by self-defeating tax increases. America cannot substantially increase tax revenue with policies that reduce national income.

Myth #7: Reversing the upper-income tax cuts would raise substantial revenues.

Fact: The low-income tax cuts reduced revenues the most.

Many critics of tax cuts nonetheless support extending the increased child tax credit, marriage penalty relief, and the 10 percent income tax bracket because these policies strongly benefit low-income tax families. They also support annually adjusting the alternative minimum tax exemption for inflation to prevent a massive broad-based tax increase. These critics assert that repealing the tax cuts for upper-income individuals and investors and bringing back the pre-2001 estate tax levels can raise substantial revenue. Once again, the numbers fail to support this claim.

In 2007, according to CBO and Joint Committee on Taxation data, the increased child tax credit, marriage penalty relief, 10 percent bracket, and AMT fix will have a combined budgetary effect of $114 billion.[14] These policies do not have strong supply-side effects to minimize that effect.

By comparison, the more maligned capital gains, dividends, and estate tax cuts are projected to reduce 2007 revenues by just $36 billion even before the large and positive supply-side effects are incorporated. Thus, repealing these tax cuts would raise very little revenue and could possibly even reduce federal tax revenue. Such tax increases would certainly reduce the savings and investment vital to economic growth.

The individual income tax rate reductions come to $59 billion in 2007 and are not really a tax cut for the rich. All families with taxable incomes over $62,000 (and single filers over $31,000) benefit. Repealing this tax cut would reduce work incentives and raise taxes on millions of families and small businesses, thereby harming the economy and minimizing any new revenues.

Myth #8: Tax cuts help the economy by "putting money in people's pockets."

Fact: Pro-growth tax cuts support incentives for productive behavior.

Government spending does not "pump new money into the economy" because government must first tax or borrow that money out of the economy. Claims that tax cuts benefit the economy by "putting money in people's pockets" represent the flip side of the pump-priming fallacy. Instead, the right tax cuts help the economy by reducing government's influence on economic decisions and allowing people to respond more to market mechanisms, thereby encouraging more productive behavior.

The Keynesian fallacy is that government spending injects new money into the economy, but the money that government spends must come from somewhere. Government must first tax or borrow that money out of the economy, so all the new spending just redistributes existing income. Similarly, the money for tax rebates—which are also touted as a way to inject money into the economy—must also come from somewhere, with government either spending less or borrowing more. In both cases, no new spending is added to the economy. Rather, the government has just transferred it from one group (e.g., investors) in the economy to another (e.g., consumers).

Some argue that certain tax cuts, such as tax rebates, can transfer money from savers to spenders and therefore increase demand. This argument assumes that the savers have been storing their savings in their mattresses, thereby removing it from the economy. In reality, nearly all Americans either invest their savings, thereby financing businesses investment, or deposit the money in banks, which quickly lend it to others to spend or invest. Therefore, the money is spent by someone whether it is initially consumed or saved. Thus, tax rebates create no additional economic activity and cannot "prime the pump."

This does not mean tax policy cannot affect economic growth. The right tax cuts can add substantially to the economy's supply side of productive resources: capital and labor. Economic growth requires that businesses efficiently produce increasing amounts of goods and services, and increased production requires consistent business investment and a motivated, productive workforce. Yet high marginal tax rates—defined as the tax on the next dollar earned—serve as a disincentive to engage in such activities. Reducing marginal tax rates on businesses and workers increases the return on working, saving, and investing, thereby creating more business investment and a more productive workforce, both of which add to the economy's long-term capacity for growth.

Yet some propose demand-side tax cuts to "put money in people's pockets" and "get people to spend money." The 2001 tax rebates serve as an example: Washington borrowed billions from investors and then mailed that money to families in the form of $600 checks. Predictably, this simple transfer of existing wealth caused a temporary increase in consumer spending and a corresponding decrease in investment but led to no new economic growth. No new wealth was created because the tax rebate was unrelated to productive behavior. No one had to work, save, or invest more to receive a rebate. Simply redistributing existing wealth does not create new wealth.

In contrast, marginal tax rates were reduced throughout the 1920s, 1960s, and 1980s. In all three decades, investment increased, and higher economic growth followed. Real GDP increased by 59 percent from 1921 to 1929, by 42 percent from 1961 to 1968, and by 31 percent from 1982 to 1989.[15]More recently, the 2003 tax cuts helped to bring about strong economic growth for the past three years.

Policies which best support work, saving, and investment are much more effective at expanding the economy's long-term capacity for growth than those that aim to put money in consumers' pockets.

Myth #9: The Bush tax cuts have not helped the economy.

Fact: The economy responded strongly to the 2003 tax cuts.

The 2003 tax cuts lowered income, capital gains, and dividend tax rates. These policies were designed to increase market incentives to work, save, and invest, thus creating jobs and increasing economic growth. An analysis of the six quarters before and after the 2003 tax cuts (a short enough time frame to exclude the 2001 recession) shows that this is exactly what happened

GDP grew at an annual rate of just 1.7 percent in the six quarters before the 2003 tax cuts. In the six quarters following the tax cuts, the growth rate was 4.1 percent.

Non-residential fixed investment declined for 13 consecutive quarters before the 2003 tax cuts. Since then, it has expanded for 13 consecutive quarters.

The S&P 500 dropped 18 percent in the six quarters before the 2003 tax cuts but increased by 32 percent over the next six quarters. Dividend payouts increased as well.

The economy lost 267,000 jobs in the six quarters before the 2003 tax cuts. In the next six quarters, it added 307,000 jobs, followed by 5 million jobs in the next seven quarters.

The economy lost 267,000 jobs in the six quarters before the 2003 tax cuts. In the next six quarters, it added 307,000 jobs, followed by 5 million jobs in the next seven quarters.[16]

Critics contend that the economy was already recovering and that this strong expansion would have occurred even without the tax cuts. While some growth was naturally occurring, critics do not explain why such a sudden and dramatic turnaround began at the exact moment that these pro-growth policies were enacted. They do not explain why business investment, the stock market, and job numbers suddenly turned around in spring 2003. It is no coincidence that the expansion was powered by strong investment growth, exactly as the tax cuts intended.

The 2003 tax cuts succeeded because of the supply-side policies that critics most oppose: cuts in marginal income tax rates and tax cuts on capital gains and dividends. The 2001 tax cuts that were based more on demand-side tax rebates and redistribution did not significantly increase economic growth.

Myth #10: The Bush tax cuts were tilted toward the rich.

Fact: The rich are now shouldering even more of the income tax burden.

Popular mythology also suggests that the 2001 and 2003 tax cuts shifted more of the tax burden toward the poor. While high-income households did save more in actual dollars than low-income households, they did so because low-income households pay so little in income taxes in the first place. The same 1 percent tax cut will save more dollars for a millionaire than it will for a middle-class worker simply because the millionaire paid more taxes before the tax cut.

In 2000, the top 60 percent of taxpayers paid 100 percent of all income taxes. The bottom 40 percent collectively paid no income taxes. Lawmakers writing the 2001 tax cuts faced quite a challenge in giving the bulk of the income tax savings to a population that was already paying no income taxes.

Rather than exclude these Americans, lawmakers used the tax code to subsidize them. (Some economists would say this made that group's collective tax burden negative.)First, lawmakers lowered the initial tax brackets from 15 percent to 10 percent and then expanded the refundable child tax credit, which, along with the refundable earned income tax credit (EITC), reduced the typical low-income tax burden to well below zero. As a result, the U.S. Treasury now mails tax "refunds" to a large proportion of these Americans that exceed the amounts of tax that they actually paid. All in all, the number of tax filers with zero or negative income tax liability rose from 30 million to 40 million, or about 30 percent of all tax filers.[17] The remaining 70 percent of tax filers received lower income tax rates, lower investment taxes, and lower estate taxes from the 2001 legislation.

Consequently, from 2000 to 2004, the share of all individual income taxes paid by the bottom 40 percent dropped from zero percent to –4 percent, meaning that the average family in those quintiles received a subsidy from the IRS. (See Chart 6.) By contrast, the share paid by the top quintile of households (by income) increased from 81 percent to 85 percent.

Expanding the data to include all federal taxes, the share paid by the top quintile edged up from 66.6 percent in 2000 to 67.1 percent in 2004, while the bottom 40 percent's share dipped from 5.9 percent to 5.4 percent. Clearly, the tax cuts have led to the rich shouldering more of the income tax burden and the poor shouldering less.[18]

Conclusion

The 110th Congress will be serving when the first of 77 million baby boomers receive their first Social Security checks in 2008. The subsequent avalanche of Social Security, Medicare, and Medicaid costs for these baby boomers will be the greatest economic challenge of this era.

This should be the budgetary focus of the 110th Congress rather than repealing Bush tax cuts or allowing them to expire. Repealing the tax cuts would not significantly increase revenues. It would, however, decrease investment, reduce work incentives, stifle entrepreneurialism, and reduce economic growth. Lawmakers should remember that America cannot tax itself to prosperity

[1] The historical averages range between 17.9 percent and 18.3 percent of GDP, depending on the time horizon.

[2] Office of Management and Budget, Historical Tables, Budget of the United States Government, Fiscal Year 2007 (Washington, D.C.: U.S. Government Printing Office, 2006), pp. 25–26, Table 1.3, at www.whitehouse.gov/omb/budget/fy2007/pdf/hist.pdf (January 16, 2007), with final 2006 revenue figures added in.

[3] According to the National Bureau of Economic Research, the 1980s recession ended in fiscal year (FY) 1983 (November 1982), the 1990s recession ended in FY 1991 (March 1991), and the early 2000s recession ended in FY 2002 (November 2001). National Bureau of Economic Research, "US Business Cycle Expansions and Contractions," at www.nber.org/cycles.html (January 16, 2007).

[4] See Brian M. Riedl, "Federal Spending: By the Numbers," Heritage Foundation WebMemo No. 989, February 6, 2006, at www.heritage.org/Research/Budget/wm989.cfm.

[5] See Congressional Budget Office, "The Budget and Economic Outlook: Fiscal Years 2001–2010," January 2000, p. xvi, Summary Table 2, atwww.cbo.gov/ftpdocs/18xx/doc1820/e&b0100.pdf (January 16, 2007). The January 2000 baseline pro-jected that 2006 tax revenues would reach $2,465 billion, and they instead reached $2,407 billion. The same baseline projected that 2006 spending would reach $2,140 billion, and it actually totaled $2,654 billion.

[6] See Congressional Budget Office, "An Analysis of the President's Budgetary Proposals for Fiscal Year 2004," March 2003, p. 36, Table 4, at www.cbo.gov/ftpdocs/41xx/doc4129/03-31- … -Final.pdf (January 16, 2007). The March 2003 baseline projected that 2006 tax revenues would reach $2,360 billion, and they instead reached $2,407 billion. That same baseline projected that 2006 spending would reach $2,417 billion, and it actually totaled $2,654 billion.

[7] While the March 2001 baseline was the last created before the tax cuts, it does not provide a realistic baseline for measuring subsequent policies. This baseline assumed that the stock market bubble would continue, and the CBO consequently pro¬jected that revenues would stay above 20.2 percent of GDP indefinitely, even though that level had been reached only once since World War II. The January 2000 baseline more accurately reflected future economic performance.

[8] See Arthur B. Laffer, "The Laffer Curve: Past, Present, and Future," Heritage FoundationBackgrounder No. 1765, June 1, 2004, at www.heritage.org/Research/Taxes/bg1765.cfm.

[9] Edward C. Prescott, "Why Do Americans Work So Much More Than Europeans?" Federal Reserve Bank of Minneapolis Quarterly Review, Vol. 28, No. 1 (July 2004), atwww.minneapolisfed.org/research/qr/qr2811.pdf (January 16, 2007).

[10]For early projections, see Congressional Budget Office, "An Analysis of the President's Budgetary Proposals for Fiscal Year 2004." For actual figures, see Congressional Budget Office, "The Budget and Economic Outlook: Fiscal Years 2008–2017," January 2007, p. 86, Table 4-3, atwww.cbo.gov/showdoc.cfm?index=7731&sequence=0 (January 25, 2007).

[11] Daniel J. Mitchell, Ph.D., and Stuart M. Butler, Ph.D., "What Is Really Happening to Government Revenues: Long-Run Forecasts Show Sharp Rise in Tax Burden," Heritage Foundation BackgrounderNo. 1957,July 28, 2006, at www.heritage.org/Research/Taxes/upload/bg_1957.pdf. This is based on data from Congressional Budget Office, "The Long-Term Budget Outlook," December 2005, atwww.cbo.gov/ftpdocs/69xx/doc6982/12-15-LongTermOutlook.pdf (January 16, 2007). These baselines do not assume that lawmakers will adjust the AMT threshold. If the Bush tax cuts are made permanent and the AMT is adjusted annually, the CBO's 2050 revenue projections are 19.8 percent of GDP, which is still well above the historical average.

[12] Congressional Budget Office, "The Long-Term Budget Outlook." The CBO's "low tax and intermediate spending" scenario projects that federal spending will reach 37.7 percent of GDP by 2050. Even that may be a large underestimate. See Brian M. Riedl, "Entitlement-Driven Long-Term Budget Substantially Worse Than Previously Projected," Heritage Foundation Backgrounder No. 1897, November 30, 2005, at www.heritage.org/Research/Budget/upload/86356_1.pdf.

[13] Office of Management and Budget, Historical Tables, pp. 25–26, Table 1.3, and Internal Revenue Service, "U.S. Individual Income Tax: Personal Exemptions and Lowest and Highest Bracket Tax Rates, and Tax Base for Regular Tax, Tax Years 1913– 2005," at www.irs.gov/pub/irs-soi/histaba.pdf (January 16, 2007).

[14] Figures include child credit outlays. Heritage Foundation calculations using Joint Committee on Taxation scores of the Eco¬nomic Growth and Tax Relief Reconciliation Act of 2001, Jobs and Growth Tax Relief Reconciliation Act of 2003, Working Families Tax Relief Act of 2004, and Tax Increase Prevention and Tax Reconciliation Act of 2005.

[15]See Daniel J. Mitchell, Ph.D., "Lowering Marginal Tax Rates: The Key to Pro-Growth Tax Relief," Heritage Foundation Backgrounder No. 1443, May 22, 2001, atwww.heritage.org/Research/Taxes/BG1443.cfm.

[16] U.S. Commerce Department, Bureau of Economic Analysis, NIPA Tables, Table 1.1.1, revised December 21, 2006, at www.bea.gov/bea/dn/nipaweb/SelectTable.asp (January 16, 2007); Yahoo Finance, "S&P 500 Index," at www.finance.yahoo.com/ q/hp?s=%5EGSPC (January 16, 2007); and U.S. Department of Labor, Bureau of Labor Statistics, "Employment, Hours, and Earnings from the Current Employment Statistics survey (National)," at www.data.bls.gov/PDQ/servlet/SurveyOutp … ol=latest_

numbers&series_id=CES0000000001&output_view=net_1mth (January 16, 2007).

[17] Scott A. Hodge, "40 Million Filers Pay No Income Taxes, Many Get Generous Refunds," Tax Foundation Fiscal Facts No. 6, June 5, 2003, at www.taxfoundation.org/research/show/207.html(January 16, 2007).

[18] Congressional Budget Office, "Historical Effective Federal Tax Rates: 1979 to 2004," December 2006, at www.cbo.gov/ftpdoc.cfm?index=7718&type=1 (January 17, 2007)."Just for info. Tax revenues were higher under Bush than under Obama."

Your first nonsensical comment. Did you expect taxe revenues to go up in the Bush-inspired deepest recession since the 1930s?

"Fact: Nearly all of the 2006 budget deficit resulted from additional spending above the baseline."

Spending for two unnecessary wars and a give-away prescription drug plan, thanks to Bush.

"Myth #4: Capital gains tax cuts do not pay for themselves.

Fact: Capital gains tax revenues doubled following the 2003 tax cut."

This is an example of post hoc, ergo propter hoc fallacious reasoning. [Because B follows A, then B caused A]

"Rather the Laffer Curve[8] (upon which much of the supply-side theory is based) merely formalizes the common-sense observations that:"

I'm not aware of a reputable economist who believes in the Laffer Curve. As I recall George Bush Sr. called it voodoo economics.

I don't have any more time or interest in pointing out the many errors in your long post. Have a nice day.Ralph,

Really? THere are no errors, you just have a different opinon, but opinion does not make facts. You and others say the Bush tax cuts killed revenues. Tax revenues were higher under Bush than any other President, Showing the tax cuts worked. The problem was Congress created a large spending budget. The wars are not part of a budget, but we have to pay for those and they add to the deficit. We spent way to much. Bush should have vetoed these increases but did not, so he is just as wrong in the extra spending. If Congress would have just stayed conservative and not gone on a spending binge, if we did not have 2 wars, if we did not have Katrina, of the 9 hurricanes that hit Florida, and the rest, well I guess the budget and the economy would have been better. But we do not live in a fairytale world. Reality happens and Presidents must deal with them. Obamas budget will have the same problems, oh I forgot, he does not have a budget. Obama has Libya, Flooding disasters, fires in Arizona, California, and more. These happen outside of a budget and create a deficit. You cannot blame a President for the natural disasters they have to step up and take care of, but the wars however, are on the heads of the President.

“This is an example of post hoc, ergo propter hoc fallacious reasoning. [Because B follows A, then B caused A]” WOW I did not know people could still talk such mumbo jumbo. The IRS and CBO are who said the revenues from capital gains doubled under Bush.

At Congress’ insistence, the 2001 tax relief was initially phased in over many years, so the economy continued to lose jobs. In 2003, realizing its error, Congress made the earlier tax relief effective immediately. Congress also lowered tax rates on capital gains and dividends to encourage business investment, which had been lagging.

It was the then that the economy turned around. Within months of enactment, job growth shot up, eventually creating 8.1 million jobs through 2007. Tax revenues also increased after the Bush tax cuts, due to economic growth.

In 2003, capital gains tax rates were reduced. Rather than expand by 36% as the Congressional Budget Office projected before the tax cut, capital gains revenues more than doubled to $103 billion.

The CBO incorrectly calculated that the post-March 2003 tax cuts would lower 2006 revenues by $75 billion. Revenues for 2006 came in $47 billion above the pre-tax cut baseline.

Here’s what else happened after the 2003 tax cuts lowered the rates on income, capital gains and dividend taxes:

• GDP grew at an annual rate of just 1.7% in the six quarters before the 2003 tax cuts. In the six quarters following the tax cuts, the growth rate was 4.1%.

• The S&P 500 dropped 18% in the six quarters before the 2003 tax cuts but increased by 32% over the next six quarters.

• The economy lost 267,000 jobs in the six quarters before the 2003 tax cuts. In the next six quarters, it added 307,000 jobs, followed by 5 million jobs in the next seven quarters.

The timing of the lower tax rates coincides almost exactly with the stark acceleration in the economy. Nor was this experience unique. The famous Clinton economic boom began when Congress passed legislation cutting spending and cutting the capital gains tax rate.

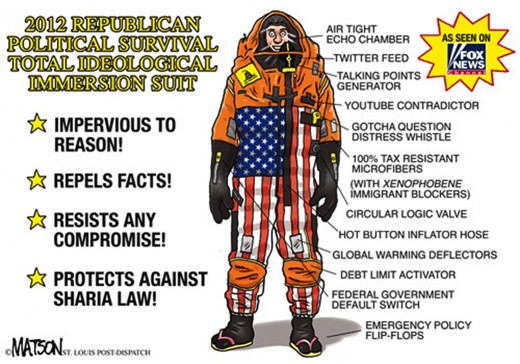

Perfect! Someone who calls them self, "American View" cuts and pastes a propaganda piece from The Heritage Foundation directly into the debate. Right Wing "Sheeple" on parade!

Agree, WoW.

Post is WAY too long for the forums. AV should have made a hub (assuming, of course, the ability to inject any original thought into the argument.Otherwise it's just plain old sheeple propaganda-speak. Baaaaaa!)Wiz is so funny, Acutally I got it from the left site Huffington Post. You are so smart. Before I made fun of you for being wrong, I actually found the same article not only in The heritage Foundation, but 10 other websites and there were more that I did not look at. So I can see why you thought I got that there. I included all the resourses to show it was not my original writings.

Now before you make statements you do not want to come back at you, becareful what you do. Like shall we say name Wiz of Whimsy( or was it whimpy) cuts and pastes propaganda likie from the Miami Herald, or from http://www.sherffius.com/toons/2011/, or even http://www.bartcop.com/norquist-kool-aid into the debate. Left wing Sheeple on Parade!!!!!! Remember, people in glass houses.

MM THis was in responce to the thread, it was not my original content nor did I say or represent it was. All my hubs are original content and would not do a cut and paste hub. It is easier sometimes to paste reports to show why some of the spouting here in forums is false. No other reasonWell AmWay, your defensiveness is telling, but besides that if you were more aware you would know that HuffPo is a clearing house that appropriates content from other sources and The Heritage Foundation is the source of your cut and past job. Regardless it was disingenuous to post that piece without giving credit to the source.

Moreover, if you thought a little longer about your rebuttal, you might have realized that cartoons have to be linked. What do you want me to do provide a distilled quick sketch of a cartoon I like? You'll also note that credit is given in the cartoonists signature trademark.

And finally, if you had any integrity or imagination whatsoever, you'd never use your atrocious pun-insult to attack me personally. I took issue with your behavior and not you personally.WIZ,

Guess I hit a cord, for I took offense to you. Do not give me your BS that you did not attack me personaly. You know nothing about me or who I am. You could not even hold a candle for me. It was no pun.

Sheeple (a portmanteau of "sheep" and "people") is a term of disparagement, in which people are likened to sheep.

en.wikipedia.org/wiki/Sheeple

People who unquestioningly accept as true whatever their political leaders say or who adopt popular opinion as their own without scrutiny

en.wiktionary.org/wiki/sheeple

people of no free will who mindlessly follow a slow and indiscriminate society

www.eldonk.com/jive-glossary/

A cross between the terms “sheep” and “people” referring to people that just follow the heard so to speak. They generally give up the ability to think for themselves thereby thinking mostly “in the box”. Reference: TheSurvivalPodcast.com

boxjumping.com/terminology/

A word that combines ‘sheep’ and ‘people;’ typically used to describe followers of MckMama.

mwopblog.com/glossary/

I am not defensive as your response just was. If you could read I put in all the resorces so there was no doubt where It came from. And Huff pro is an expensive clearinghouse as you call it. You should have been so sucessful. And it is where I got that info from. And cartoon do not have to be linked, people do create their own. THe cartoonist name is not a reference, you need to cite it or post the souce. Look you do not like being called on the carpet, you need to not attack people for some of us will attack back . Your childish actions here only reveal who you really are. So grow up or go away.

@John Holden, I won't even respond tp your eletist mentality , there is no arguing or debating with wannabe- grammer teachers,! Is that all you've got?

The Bush years ruined this country and Trickle down doesn't work.

Moderndayslave, If the Bush yaears ruined this country , Then Obama years are ruining our future.

I am not so pleased with him either,all of these problems didn't happen overnight. The whole govt needs to be ,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,ah, un corrupted

1. Yes.

2. I beg to differ. Trickle Down works perfectly! Wealth "trickles" down from the multi-billionaires to the regular billionaires to the multi-millionaires. No further. By design. .

.- ahorsebackposted 12 years ago

0

If you lived through the sixties , seventies and eighties in America then you know that Reaganomics works, Any intelligent person knows that the Bush- 1 and Clinton years economic success was due to Reagan ! Not perfection but way better than the result of Clintons deregulation years! Face it 'your' [for John} statistics are just oppinion! No one , No one is spending or wants to spend more than Obama!

Prosperity came from progress not Reagan,we used to make things ,remember.We did get Iran-Contra,Oliver (I don't recall) North, George "read my lips" Bush, Dick "I told them to stand Down" Cheney and Donald "We seemed to misplace 2 Trillion Dollars" Rumsfeld. Reagan gave us a lot.

- ahorsebackposted 12 years ago

0

Yes , he did give us alot to the eighties and ninties were prosperous years , of course Reagan left in 88 , Bush and Clinton rode his economic coatails , like it or not! Talk about Iran contra, whats this news today about Obamas secret weapons trade with the mexican underground? And then someone lost track of the planted weapons!!!!!!. Obama's entire staff are 'weapons of mass destruction'!

Please ,I am not a fan of Obama. I am not a Democrat or Republican. I am an American getting screwed out of mine and my sons future by the status quo corporate BS. If you are not good for America ,I don't like you,period.

Horseback is partly right. The Regan tax cuts amond other things, truned the Carter disaster economy aroung. And Regan did raise some taxes as well. During Bush1 at the end of his Presidency the economy was going down. He lost to Clinton for that and the Read my lips comment when he raised taxes during his term Those increases started the downturn. Funny part waqs Clinton campaingned on raising taxes. He did and the economy kept crashing. He worked with repubs, cut taxes and more and Clinton oversaw the largest economic expansion in history. The link shows it all

http://historyrepeatingitselfav.blogspot.com/

- ahorsebackposted 12 years ago

0

No Incumbant President enjoys the benifit or the crapstorm of thier own economic policy. Thats elementary! Bush I and Monica's He man enjoyed the positive effects of Reaganomics. Guess what kiddies , It did trickle down !!! So far, given all my life experience all I have seen lately ; Obama's working on trickling up! Wall Street has more of a revolving door policy [of employees ]with Obamas white house than the mall of America!

- ahorsebackposted 12 years ago

0

Until we re-regulate corporate America , and reverse Clintons dismantling of the regulatory process, Wall Street will continue to lead this Congress and White house , AND the supreme court by the nose as they run full speed ahead over your future! Republican~ Democrat: it doesn't change if we play the same old rhetorical horse manure politi-speak! Vote all incumbents out next election !,send a messege......is that spelled right John Holden?

- ahorsebackposted 12 years ago

0

You sure are Mr Wizard , 'NEWSFLASH' Most conservative realists don't like either one of your clowns .........Obama or Soros.

- ahorsebackposted 12 years ago

0

Wisard of Whimsy, you really shouldn't say anything at all, we have you down,your views are from the eight percent rule!

Horse I think you need to go further back in the horse's anatomy to yourself.

Incidentally, "eletist " [sic] is misspelled intentionally because that is the way you have been spelling it.

(So I have been poking fun at you—just so you know.)

sic 1 |sik|

adverb

used in brackets after a copied or quoted word that appears odd or erroneous to show that the word is quoted exactly as it stands in the original, as in a story must hold a child's interest and “enrich his [ sic ] life.”

Related Discussions

- 97

Corporations are Ruining America.

by Kathryn L Hill 11 years ago

How?

- 26

MSM News is tearing America apart

by Ken Burgess 2 years ago

The first thing to consider is that our mainstream media is no longer free or independent. Decades ago (in the 70s) there were hundreds of individual outlets none beholden to the other. Today there are but five 'institutions' that control everything you see or read in MSM News.In...

- 72

Have pro-war 47 finally crossed Rubicon & turned America again them.

by Scott Belford 9 years ago

47 conservative Republican Senators signed a letter to Iran intended to undercut Presidential foreign policy. This breaks over 200 years of precedent, and probably violates the separation of Powers part of the Constitution. Should Americans, after puking over their blatantly unAmerican...

- 38

Do you predict that America will become more conservative or more

by Grace Marguerite Williams 9 years ago

liberal within the next 50 to 150 years in terms of the sociopolitical and sociocultural indicators such as marriage, gender roles, religion, the role/definition of family, LBGT issues, sexuality, social programs, education, and the government? Explain your reasons therein.

- 89

Would you vote for Obama if you discovered he had committed treason?

by Rod Martin Jr 11 years ago

A recent YouTube News report by WXIX Fox19's Ben Swann reveals something you're not like to find out about on the evening news. Obama is ignoring a federal court order regarding his actions under the NDAA (National Defense Authorization Act).http://www.youtube.com/watch?v=PZjXHjkzMD4I supported...

- 27

Do you realize that the mainstream media is lying to you about this election?

by Virginia Allain 7 years ago

Do you realize that the mainstream media is lying to you about this election?Because I'm a librarian & skilled with the Internet, this election has disillusioned me with trusting network news like CNN, MSNBC & even PBS. They obviously have their own agenda & it doesn't...