How the GOP became the party of the rich

- Texasbetaposted 12 years ago

0

I hate to just post a link and walk away, but I cannot imagine it being put more clearly.

http://www.rollingstone.com/politics/ne … h-20111109I was going to say this is a must-read, but I suspect there are several hubbers who already know this in detail.

And the others will discount it by default. After all, Rolling Stone is the epitome of "liberal media."

Thank you for posting it, Texasbeta.

Time to withhold all sustenance from Grover Nord-beast. Starve the sucker out.The rich and the useful idiots who think that by supporting them they will catch a little trickle-down.

They will wait a long, long time for that trickle down.

The gush is going in the opposite direction.

This is absolutely INSANE! The party of the rich? Have you looked at the democrats? They are the full-on, filthy, elite rich!!! The most wealthy politicians are DEMOCRATS! Is this article a joke?!!? These wealthy democrats care about the poor? Really? All they do is spend their time exploiting people. They have no interest in protecting the American worker; they want floods of illegals to take their jobs instead. They use minorities to whine and make them victims. They make promises that are lies, i.g. if this healthcare crap is so great, how come not ONE demoncrap has signed up for it? They ALL are on PRIVATE care!

Seriously...this is so beyond ignorant. I don't even know what to say. The democrats are the super rich and the super poor. They hate the middle class and do anything they can to destroy them because they can only control the poor and exploit them.

I'm really sorry you actually believe this but, it's time to start reading history and learning more about your party and taking a REAL look a the facts. I'm not saying Republicans are perfect because they have their issues as well but, they are a far cry from being the party of the rich or hating the poor.

Oh, and what unbelievable false dichotomies that come from the left, which is so ironic because you would get your head bitten off by a liberal if you dare try and label THEM in a category. I guess it's only okay to do that if you're liberal.I, for one, would be happy to take a look at any facts that substantiate your arguments, Tuesday75.

Please feel free to share supporting documentation for your sweeping generalizations.

Do you have anything to offer other than "nuh-uh", Tuesday? This was an 8 page article with clearly verifiable points. Did you check any of them? Did you spend time even reading it? Doubt it. Try to offer a little more than what the 2nd grader down the street offers.

Did you read the article? Or are you responding to the title only?

I say that, in addition to letting the Bush tax cuts expire, we take back the money that was looted from our treasury in the form of fines related to criminal matters.

If the bailout banks did not stimulate the economy, then take the money back and finance government infrastructure jobs.

If the tax dodging and tax break corporations sent jobs overseas or did not create jobs, then take the money back in the form of fines for fraud.

Fine the oil and gas industry just on general principles.Xenon - letting the Bush tax cuts expire affects all of us. I need every penny. In trying to undo the rich, you might be spiting a lot of non-rich, including the very non-rich. Tax reform is the answer, yes, but not to tax me more.

A responsible view of what should be done about the Bush tax cuts from Bloomberg:

Nov. 8 (Bloomberg) -- New York Mayor Michael Bloomberg called for eliminating Bush-era tax cuts for the wealthy and farm and energy subsidies, and an end to what he called “tax loopholes” on carried interest enjoyed by hedge fund partners.

In advocating the U.S. return to higher income-tax rates set by President Bill Clinton, the independent mayor of the most populous U.S. city said rising deficits and political inaction have paralyzed business and discouraged investment.

Under current policies, the national debt will grow to $21.5 trillion from $10.3 trillion in 10 years, or $72,000 per U.S. resident, the mayor said. That crisis may best be averted through a combination of taxes and reduced spending on health care and Social Security as outlined in President Barack Obama’s committee headed by former Senator Alan Simpson and Erskine Bowles, once Clinton’s chief of staff, Bloomberg said.

“The spending cuts in Simpson-Bowles, plus Clinton-era tax rates, plus closing some tax loopholes and ending wasteful subsidies would save $8 trillion and effectively bring our budget into balance by 2021,” Bloomberg said in an economic- growth speech in Washington, D.C. MORE:

http://www.businessweek.com/news/2011-1 … phole.htmlLet's start with ending loopholes, subsidies and all foreign support of any kind, enonomic and military. i don't care. Leave the money here. Also, let's do what some other countries do. Money earned in this country must stay in this country.

I am far from the expert in these type of forums but just trying to learn and observe.So when you want to travel to Europe on vacation what will you spend? Isn't money property and isn't it your right to use your property as you see fit? Should we switch to the ruble?

Man, I am glad for you...but I don't have near the extra money to go to Europe. I can go to the grocery store.

So when you go to the store are you only buying American. The discount grocer where I shop is owned by a German company and some of the least expensive food in the store are imports. So the same holds. Why would that German grocer open a store here if all the money earned must stay here? The poorest most backward economies in the world are those that make everything they consume, keep all wealth in its borders and controls its markets.

Economic freedom produces prosperity and since the days of your hero, Richard Nixon, American prosperity has been increasingly endangered by a vast regulatory state.My hero is Nixon? I am a march in the street liberal. I worked on Obama's campaign dude. Are you high? Why would a German grocer open here? Because the economic buying power of the consumers here would make him more wealthy than in Germany.

AND, you are ridiculously incorrect in that market regulation was a New Deal issue, which we have dismantled since Reagan. You want a total free market economy? Go to Somalia.

I am going to be honest. Your response doesn't make sense. Maybe I have had a long day, but what in the hell are you talking about?The EPA

Earth Day

SSI

OSHA

wage and price controls

despite a balanced budget he recommended deficit spending, declaring himself a Keynesian

entitlement payouts grew from 6.6% of GDP to 8.9% of GDP

Ended the Vietnam War

Noam Chomsky remarked that, in many respects, Nixon was "the last liberal president." Indeed, Nixon believed in using government wisely to benefit all and supported the idea of practical liberalism.

Clean Air and Water Acts

Endorsed the ERA

Title IX

Title X

He and the Mrs. were pro-"choice"

And you don't think He is your hero.You mean you can have a hero and not even know it?

Richard Nixon, like George W. Bush, advanced vast portions of a liberal agenda. How doesn't that make him heroic. Isn't the common phrase when a Republican signs off on a liberal idea, "He is growing" or "He is evolving?"

Richard Nixon moved the markers for liberalism and liberals don't love him? GWB championed - along with that paragon of liberal virtues, Ted Kennedy - a massive new Medicare expansion and the huge increase in education spending - also with the swimmer - "No Child Left Behind," a program Barry is expanding not eliminating.

This is the primary reason conservatives are reluctant to endorse Mitt Romney. George W. Bush proved that one can wear the suit but it is the instincts of the man in the suit that matter most. Romney's instincts, like McCain's - Bob Dole's - George H. W. Bush's - Gerald Ford's - Richard Nixon's - and GWB's - are liberal. Their first solution to a problem is to employ the mechanisms of government. Targetted tax cuts, tax rebates, more tax deductions and complications in the tax code are all liberal ideas.

The problem with Romney and Huntsman (to a lesser degree, Perry, Gingrich and Paul) is their latent liberalism. Both parties have been pulled leftward through the last eighty years. It is no longer fashionable among Americans to devolve as much power from the centralized state to the individual. Perhaps it is finally time to declare the American Revolution, not only over but, moribund.Interesting, so if a President, a champion of authoritarian measures which violate the Constitution in favor of a conservative agenda (i.e. Nixon with COINTELPRO, illegally wiretapping and sabotaging the DNC, etc and W Bush with illegally wiretapping citizens and holding citizens with no trial) does something you perceive as a liberal measure, he all the sudden becomes a liberal huh? Interesting idea. It is ridiculous, but interesting.

By that measure, you have never had a conservative President in the history of the country. Reagan? Reagan increased taxes 11 times in 8 years, expanded abortion rights beyond any governor in history, imposed a gun restrictions bill, imposed amnesty for illegal immigrants, and raised the debt ceiling something like 13 times.

Could it be that on occasion, even the most galvanized right wingers are pragmatic, and at times, consider the benefit of the country above their idiotic ideology and only recently have we allowed the conservative agenda to be so marginalized as to only allow a 100% litmus test of ridiculous beliefs where any deviation whatsoever, any individual thinking is addressed with the slander of socialist?

By the way...you need to learn a bit more. Even supply side economic is Keynesian and your beloved corrupt Chamber of Commerce is Keynesian. Manipulating markets by tax policy is Keynesian Tonto. Things are bigger and more complex than you are allowing yourself to acknowledge.

Both parties have pulled left? YOU ARE OUT OF YOUR MIND. The spectrum has move so far right, that even now liberals are pushing trickle down theory, a theory which we have 30 years of empirical evidence proving it doesn't work and never has.

An American Revolution? You disgrace this country with your kneejerk reactionism and short sighted belief window, and a call for revolution, and I make if very clear - if one ever comes to pass, which it never will, I'll stand with my country against domestic terrorists like you.I understand that English may not be your first language so let me be clear. The only knee jerk reaction in your post is your own. I said the American Revolution is moribund, meaning that the Revolution, begun in the American colonies, is dying. Liberalism is killing it. Thanks for playing. Enjoy your snit.

Anyone with one eye and half sense would realize that the problem is too much spending. The government is out of control and with its greed wnts more. You would know that if you really paid attention to the deficits.

Spending like 2 unfunded tax cuts, corporate welfare, subsidies for oil companies, subsidies for offshoring jobs, a prescription drug program for the wealthiest Americans paid for by debt, and the wasteful war in Iraq? Yeah. Those contributed quite a bit. Thanks for adding.

Are those the same deficits that Reagan and Cheney both said didn't matter? Let me guess who you are voting for anyway.Tax cuts put money in the hands of the private sector spendomng creates jobs. Therefore, more revenue is collected and prosperity continues to increase. government spending only increases the deficit because the deficit is money that is spent beyond the revenue that is collected.

Corporate welfare as you say means that jobs are provided by corporations that continue to make a profit. If you insist on taxing those corporations at a higher rate, you accomplish one of two things: the corporation moves out of the country to avoid paying the taxes and Two the corporation raises its prices and causes a regressive burden on the poor who would benefit from the goods and services provided by that corporation.

You need to take a course in Econ 101Awww...how cute. I have taken 5 or 6 upper level classes beyond Micro and Macro (there is no Econ 101 btw) in Economics. You are displaying that you don't get the minor 7th grade economics rules. Tax cuts DO NOT CREATE jobs.Consumer demand creates jobs. It is in the first chapter of every economics books on the planet. Because corporations have more money, doesn't mean they hire more people. Demand for their product or service spurs the need for jobs. Corporations RIGHT NOW are sitting on RECORD capital, having benefited from 10 straight quarters of record aggregate corporate growth. Read a newspaper for once.

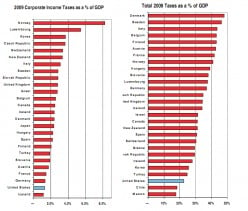

So, you are in favor of stripping programs for the unemployed, the poor, the elderly and handicapped, but you would NEVER take a dime away from the corporations, the corporations who store their profits overseas to avoid tax liability. We don't tax our corporations on profits made overseas, like other countries do. We subsidize them for shipping jobs overseas, actually paying them to leave the country. We subsidize oil companies for prospecting for oil, oil that is shipped overseas. Multinational corporations on average pay 3% in corporate tax liability. 3%. Several actually have gotten money BACK in the hundreds of millions in their taxes, like GE. Do you pay attention to the news at all, or do you just have a middle schooler's understanding of basic economics? Get real.C (consumption)+ I (investment) + G (government expenditures)= GNP was the way I learned in way back when.

And what creates consumer demand? Money. The more money people have, the more they spend. The more money taken away in the form of taxes(which do nothing to create jobs, they are just bandaids on a spending hemorrhage), the less people and businesses have to spend.

Do you know what corporations do with their money? Do you look at investor data sheets? Banks have tons of assets right now(some of them, at least), and those assets(the majority of them) are in the form of loans. Loans to people and businesses. Loans that help the economy. We can talk about individual businesses, but you know better than to group everything into one fat-cat, money-hungry, corrupt group known as 'corporations'.

It's our fault for taxing them higher than almost any other country! Taxes aren't the answer, reduced spending is.

Our problem isn't the companies. It's the government. Many of these companies simply wouldn't survive in the economic conditions we make for ourselves here. How many corporations do you know that would do well if their expeditures went up 20% with no increase in income?

And don't criticize oil either. We could drill oil, produce it, and keep it here in the US. We have plenty. But, special interests and government keep that from happening. It's not the oil companies' faults.

Multinational corporations pay their effective tax rate on all net income in the US. Not 3%.

You don't understand that story. GE actually had something like a 22% effective tax rate for its' US operations. It did receive a tax credit for GE capital(I think, not sure on the details off the top of my head), but that wasn't a total tax refund. GE did have tax liability for the year you are talking about. It's just that they make advanced payments and defer other payments, so not everything gets paid in the same year.

It's easy to argue that the news is biased... it shouldn't be your only source of information. The New York Times screwed up royally on the GE story, and now everyone thinks they got all this money back that they never did.You are ridiculous. I am not even sure you are worth the effort at this point.

The problem with the deficit is taxes? We have the lowest tax rates in 60 years. We pay companies to ship jobs overseas. "How many corporations do you know that would do well if their expeditures went up 20% with no increase in income?" We did it for nearly a century, and when we ended the average CEO made 10 times the average worker, in 1972. Today, the average CEO makes 450 times the average worker. THERE is where you excess money went.

"Multinational corporations pay their effective tax rate on all net income in the US. Not 3%."

This is ridiculous again. You are reading the advertising and not the ingredients. The average rate corporations pay in the US is below 18%, the average paid on foreign income, 2.3%. You don't understand the difference between statutory tax rates and real tax rates. Yeah, big shocker.

Dude, I hope you are in school because you have years and years to go before you get anywhere with regards to understanding. However, you won't do that unless you try a bit harder.No, you are the one not reading the information correctly. The 'below 18%' is as percentage of GDP. It's not the rate that corporations pay. The average effective federal corporate tax rate is ~25%. Don't quote taxes as percentage of GDP to show what percentage corporations pay, that's complete bull and you know it.

Let's say we do increase by 3%. You think that will fix our deficit of 1.5 trillion? An increase from 25% to 28% in effective rate would raise revenue from 225 billion to 252 billion.

You're the one quoting taxes as percentage of GDP to show what percentage corporations pay! Life is a school, and I'll never drop out. Maybe you should try to keep learning too.

I Googlrd "Econ 101" and found over a million entries. AND I did not say that TAX cuts create jobs. Supply and Demand create jobs. That's taught in Econ 101. Those who are wise with earning and spending spending their hard-earned money will invest the surplus until they have a use for it.

So why do the corporations sit on their surplus cash? Shoud be obvious. Their demand for more production is to create the jobs. They do not hire people who do not give them a return on their investment.

Does the government hire people who do not give them a return on their investment? You betcha to quote Palin. And the more government jobs at higher pay creates higher deficits.

And those poor people who want to work cannot find jopbs because the government has taxed and regulated the business out of existence. BTW, who pays the taxes that the corporations owe. The consumer? ou betcha. Logic of Econ 101.

If you have takes as many econ classes as you say, you are bound to have heard the story about the econ professor who gave the same tests every year for fifty years. His former students laughed at him because the questions were passed down from class to class. Finally the professor explained that the questions remained the same, but the answers kept changing. Perhaps you were in some of his classes.Wow. If you had went to college, you would know that Econ 101 is Macroeconomics, and the second court is Microeconomics. Only in high school do you get a combo pack survey course. Obviously, you never went to college. Sad, but still.

Your idea that the poor don't have jobs because the government has taxed business out of existence is moronic. Let me explain, because you are obviously too lazy to look anything up. In 1996, Citi and Travelers joined, in direct violation of Glass Steagall, which had been put in place for 80s years to separate commercial and investment banks. Investment banks speculate on risky commodities, and commercial banks hold your personal deposits. It stopped banks from using your personal deposits to speculate on risky investments. The repeal of Glass Steagall allowed for the creation of entities that were "too big to fail." What occurred was the allowance of mortgage lenders to sell the mortgages in bundles to investment banks, who bundled them further with every kind of risk they had on their books, student loans, corporate writeoffs, car loans, etc...slice them up and sell them to investors. The risk was allowed to pass down 3 levels and back to investors. In theory, this isn't a bad thing, but the fact that we had no regulation on derivatives (the commodities being traded) meant there was no oversight whatsoever. It became a transaction based system where the mortgage lender and the investment bank shared no risk, as they passed it down the chain. Eventually, they needed to expand the spectrum of transactions, open the pot. So, the push for allowing subprime lending occured to the point that 16% of subprime mortgages were sold illegally and fraudulently when the buyer should have gotten a normal prime mortgage. However, the transaction fees on subprime were more financially beneficial to the lender. There was no risk, so who cares if anyone pays it back? In order to make the CDOs (bundled derivatives) more appealing, the rating agencies were bribed to mark them as triple A, and there is no regulation on rating agencies so when they were caught lying, they merely said it was an opinion. THEN, we sold fake insurance in the form of credit default swaps, or insurance with no capital, in case the CDOs went under. BUT AGAIN, no regulation on credit default swaps, so they didn't have to have real capital to back those insurance policies up. Bribing the rating agencies to mark these triple A was intended, as states are legally bound to only invest in triple A rated commodities. It got so bad that the investment banks wanted MORE money, so they began to package the CDOs in a way that it didn't spread risk, in a manner where they were designed to fail, huge bundles worth billions...designed to fail. They sold them in good faith, then bet against them in what is called short selling. They committed outright fraud on not just the states, for the world, as foreign banks were heavily invested in both CDOs and credit default swaps. When the system went under, everyone went broke including the states, to which the newly elected Republican governors used as an excuse to cut the programs that their ideology was against, mass amounts of state employed workers, firemen, teachers, etc. The credit default swap industry is a $6 billion dollar industry alone...of fake insurance policies. The amount of money involved in this scam is incredible. Several other factors added to it like the banks lobbying the fed to push the ratio on speculation from 3/1, or 3 of your dollars for every 1 of theirs, to 36/1. It was a fleecing of the economy, to which they paid out in vast bonuses, because once it becomes a personal asset, when they are caught, the government can't do anything about it.

The issue that you claim where government jobs paying higher creates deficits is again, moronic. Higher paying jobs push people into higher tax brackets, paying MORE taxes on their earnings, this directly proving your point vastly incorrect. It creates a supply chain of private companies, thus adding more jobs into the mix and thus stimulating the economy.

You fail to understand what a 7th grader gets. Your down home colloquialism of s story is a tactic I see from right wingers who don't understand complex issues and don't want to put forth the effort to learn; they try to break things down to what they can understand, like what Joe Bob at the market does. The world is far more complex than that. If you would exert a bit of effort, and concern for what is really happening rather than listening to bumper sticker talking points, you might have a better understanding of what situation we are in and how to get out of it. As it stands now, however, you are merely a parrot yelping bumper sticker arguments designed for the weak minded.Well, I went to college. And if you had went to college, you would have used "had gone."

Hey, don't you know that all of that risk would have meant nothing if the economy had remaind good. do you not recall the high energy prices and high taxes making it impossible for people to make payments on their homes. and did you forget that the underwater homes had people moving out and leaving them vacant. But you pick some banking risks and blame that. Hey, Freddiy Mac and Fannie Mae were the corrupt gang. why did you leave them out. And why did you not tell about the government insisting that banks make loans to unqualified buyers. Does that not count for anything? Of course no=t because you want to blame the banks. Hey, there were a lot of other factors that caused the recession/Actually, there aren't. It is clearly accepted now, and there are countless sources outlining each step of this fraud. Obviously, you aren't putting forth enough effort to get beyond your bumper sticker interpretation. Even your response displays a dramatic lack of understanding and an apologetic role you are playing as a mere ideologue. It isn't that you are just so ill informed, it is that you don't care to be informed.

The highest risk debenture is a safe investment if it is redeemed by the lender. There is nothing wrong with risk when it pays off. The problem was that such risks were not paid. why not.? For all of the reasons I enumerated previously.

If you are looking for corruption, blame the government.When you allow the mortgage lenders and investment banks to bundle all of their risk, and then sell it off, there is no accountability, which led to the mess we are in. If you STILL think Freddie and Fannie caused the crisis, then you are sadly ill informed and I pray you put in the effort to read up. It isn't a mystery anymore. The entire planet knows what happened. Hopefully, you will consider it your duty to catch up.

as mnot the one who allowed the lenders to bunbdle such packages. What gave you that idea. And my point is not that Freddie and Fannie causwed anything. they are totally unregulated just as those that you allowto bundle packanges of risk. Now if you can';t see that, you should rethink the causes.

You know that if people pay thier bills on time, all the risk is as sound as gold. It is when people do not pay their debts that problems occur. Now why do we have the problem of not paying the mortgage? Not the rish--underwater morgages and loss of jobs.

Try this one for a sode of reality.

http://www.youtube.com/watch?v=661pi6K-8WQMichael Moore is correct. Bill Whittle is a Kochsucker mouthpiece.

So where are the jobs? I'm ready to try another approach.

Jobs are created for the same reason you hire someone to cut your grass. People employ others because that employee can and will provide something to the employer's need. If the employer doesn't need additional clerks because the demand is slow, clearks are layed off. If there are long lines at check-out counters, additional employees are hired.

Supply and demand determine the jobs that are needed.Exactly, now being that you have admitted that demand drives employment, and that we have a dramatic number of unemployed...how to do stimulate the economy? Don't tell me tax cuts or give businesses more, because you already admitted that excess capital doesn't drive employment, but demand does. So again...how? How do you get those who are unemployed, employed and spending again? What do you do when there is a catch 22?

Peope who have money to spend will spend it. Therefore, tax cuts will stimulate the economy. Unemployment compensation was putting money in the hands of people but not to the extent that they could buy cars and homes and other large assets.

People will buy new products. therefore, new inventions or denmand for additional products that are already being produced. For exmple more people need more food; therefore, more food is produced by additional farmland and added employees.

Government spending creates tempoorary jobs and increases government debt.l Police forces for one year and then the state of city takes over. Ridiculous isn't it.

The money thatpeople have will be spent for what the people need or want. why has the government wasted so much in solar energuy=y going bankrupt? Obviously production ofwhat is not wanted.

Produce the needs and wants of people and they will buy the products. Stimulus. Yes, if the peopl;e have the money to buy.Hardly a catch 22. The uncertainty of an interventionist, experimental, haphazard, overtly hostile and aggressively regulatory federal government is killing the animal spirits. Once Obama is out of office and some reason is restored to the American economy, especially regarding its interaction with the government, it will come roaring back. That is if he does not win in 2012. If he wins in 2012, we are Greece.

Yup. We try to fix our monetary problems by digging a deeper hole. Anyone with credit card debt knows how well paying off credit cards with new credit cards works.

I'm not completely anti-rich, but this country was built by the working class and survives by the working class. The reason the economy has pretty much collapsed is because we're seeing the rich get richer and the poor get poorer, but sooner or later it'll destroy the economy even more.

The government keeps making it harder and harder for people to make it. In the past, jobs were readily available, now all the work is moving overseas, crooks are paying illegals some crappy wage under the table and raising the minimum wage all those times hasn't helped either, it just made prices go up and jobs go down.

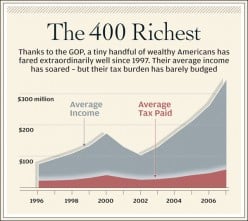

I feel bad for many of these people out there, at one time, you could get by just fine with a fast-food job, now it covers no more than extra spending money.Here's the chart from the excellent Rolling Stone article linked above.

Anybody who argues the '400 richest' doesn't understand what they are saying. The 400 richest isn't a group of people, it's a changing list. Only something like 20% are ever on the list more than once.

Even then, they still pay about 9 times a higher percentage than the bottom 50% of Americans.They pay that because they have stripped the common salaries down to the point that people don't make enough to pay taxes. The average salary in the US now is $23k. You are merely an apologist for the ultra rich, offering nothing other than the argument of "nuh-uh." When compared to the portion of income paid in payroll taxes, sales taxes, state taxes, and federal income taxes, the bottom 50% vastly outweigh the top 1% in taxes. Face it man, you are transparent.

What would it take for you to go against a corporation or one of the wealthiest Americans? What would they have to do in order for you to say, wait, too much. Not good? I doubt anything, honestly. But, anything you come up with, I can find 2 of them who did it. Go ahead...I'll wait.Texas, you always veer off tangent when you quote me.

Somebody says the rich don't pay their fair share, and I simply correct that showing how they pay 9-12 times more, percentage wise, than the bottom 50%.

Everything else is a strawman argument you create to attack.

"When compared to the portion of income paid in payroll taxes, sales taxes, state taxes, and federal income taxes, the bottom 50% vastly outweigh the top 1% in taxes. Face it man, you are transparent. "

I thought you said we were talking about personal taxes? Can you at least make up your mind on the topic? The topic is federal taxes. The top 1% pay almost 40% of the tax burden.

I've said that I don't like everything that goes on. My arguments have been about taxes, and that corporations and the wealty DO pay their fair share. You are the one extending my argument to say I am praising corporations for everything they do and kissing the ground they walk on.

Learn to focus on a topic.You can't call it the "tax burden" and only include the taxes you want to talk about. There are plenty of other taxes and as a percentage of income, the bottom 50% outweigh the rich on their personal tax burden. You want to pick and choose.

Secondly, you are deciding what is the "fair share." Legally, we have outlined measures of "fair share" that go against your interpretation. We have empirical evidence that they DO NOT pay THAT fair share. You can make up your interpretations all day about what you personally think is fair. It is still below what they are listed to pay. Buffett paid 17% in personal income taxes last year. His secretary paid 35%. You think because Buffett's volume was higher than his secretary that it was fair. I don't. In fact, most Americans don't think so either.

You are an apologist however. I would imagine that even you can see that. SO, again...what would one rich man have to do in order for you to think they were wrong? Anything at all?We've been talking about federal tax rates. You yourself said earlier that was the topic. Then, you try to discredit me by redefining the topic.

If you want to talk about all taxes, then we can do that, but don't just try and say I'm wrong about federal taxes.

What is this legal definition of fair share you want to use, and what is your evidence that they don't pay it? Talk is cheap.

"It is still below what they are listed to pay."

Pretty much everybody pays below what they are listed to pay. I've been talking about effective tax rates. Or, in other words, what they actually pay. And yet, you want to claim that the rich pay less.

You are comparing tax on capital gains to tax on earned income... comparing apples to oranges.

I'm not an apologist for anybody. I criticize false information on either side of any subject. I have personal beliefs in Deity, yet I criticize people who talk about scientific proof for/against God. I'm after the truth, I'm not on anybody's side.

Again, I'm not saying anything about how good or bad rich people are. I'm just talking about tax rates.When you get your income from capital gains, then it becomes your income, thus making the income tax on said income 15%. The richest are marked at paying 35%. Pay 35%. I mean, seriously...when faced with the tax problem your solution is to make the poor pay more? The poor have had their economy ripped away from them by the top 1%, forced to mortgage their very lives while their living wage decreased or was eliminated all together. The gap between the richest and the poor are at the highest point since 1928. The middle class has been declining since the onslaught of deregulation and trickle down theory of the late 1970s.

I think you are an apologist for the right, from your views on global warming to your apologies for the rich, your denial of outright fraud. Let's take a single point...the article from Rolling Stone, which I thought was grand. Out of 8 pages of fraud did you acknowledge a single point? They are all easily checked? No, of course you didn't. You went right in to apologizing for the rich. You aren't as objective as you believe you are. That is why I keep asking if you are a freshman in college. I know that mentality. I had that mentality. I might be wrong, hey...wouldn't be the first time. I do think you should go to the bar. College is fun. Trust me, you'll never get as many beautiful girls as you can in college. You need to get on that dude. Go to a bar, smoke a joint, hook up with a Chi O or a Tri Delt. Expand your mind. You already display a logical "if-then" structure of thinking, which is encouraging. You'll grow into new beliefs as new ideas thrust themselves around you, new threads to research. I only ask that you first question whether or or not your preconceptions are accurate to begin with, as only then will you grow. I don't tell you what you should end up with as a result, only to begin with a clear slate and actually try to seek what is true from an objective perspective. If you don't want to grow...whatever. You should still hook up with a Chi O. Chi Omegas are hot. Oh, I miss college. Join a fraternity...they just flock to you. I don't know what it is, but I miss it. Something about the greek letters, makes no sense, but it is awesome.What are you even talking about?

1 - Comparing the tax rate on capital gains to the tax rate on wage income is ridiculous. The 'poor secretary' would pay lower taxes on capital gains too. The rich billionaire pays a higher rate on wage income. Trying to say one is lower than the other when they aren't the same thing is just pointless. If you want to talk about that, then talk about raising capital gains tax, but keep apples with apples and oranges with oranges.

2 - Everybody gets a lower effective rate than what they are 'marked at'. What percentage doesn't even have an effective tax rate? I don't know off the top of my head, but I know it's a lot. We're not taxing the poor overly, and I'm not saying we should tax them more(where did I say that?). All I'm saying is the rich already pay much higher percentages.

Here you go, demonizing the top 1%. It wasn't the top 1% that caused our problems. Deal with it.

You are making me take standpoints I'm not taking. It's called creating a strawman argument. You have constantly tried putting words in my mouth.

If you want to talk about global warming, talk about it over there. You constantly ignore solid points that I make in this thread already, let's not make it more confusing for you.

Read my lips. I never brought up the topic of fraud. All I did was talk about the ridiculous point being made that the rich pay less than the poor. I didn't apologize for any fraud, but you want to make me say things I haven't said.

Firstly, I'm not in college. Never said I was. Secondly, I'm not stupid enough to think that drinking and drugs are the path to enlightenment. Your might think they help you, but in my opinion, it shows in your arguments. You can't stick to a topic. You make up arguments for other people. You are insulting and disrespectful. So don't give me that 'expand your mind' crap. I'm as open as I can be. I'm not on a side. My side is the truth, and that's all I care about.

Thank you for the valuable life lessons... I'm not some kid that needs your help figuring things out. Last time I was in Texas, people showed respect to each other.

You see, here is the difference between you and me. You say 'question whether or not your preconceptions are accurate to begin with'. All preconceptions are wrong. Maybe that is where you are getting caught up. You need to approach every subject without preconception. Maybe then you'll realize how both sides are always making lies, and both sides have truth to them.You didn't acknowledge the fraud, didn't acknowledge absolutely anything within the article except that the rich pay too much already. By disregarding 8 pages of the article, and focusing on your belief that the rich are saints, never once acknowledging a single negative act by a wealthy individual nor a corporation, you apologize for said actions, being that you defend the perpetrators without acknowledging their missteps. You want to only talk about personal income taxes while ignoring all of the other taxes the poor are slated with. I am insulting. You deserve to be insulted. I thought you were a kid because you don't offer much, prance around the argument picking and choosing little points where you can be right, without ever acknowledging the larger picture. The fact that you aren't a kid means that you aren't just young but that you are an ideologue propagandist, which is much worse. I went from feeling like you'll grow out of it as you learn more, to knowing that you could care less about what the foundations of the arguments are, you just want to promote your right wing ideology. You may come to Texas and find some common ground with several people here. I wouldn't come by my house. You won't find it here.

Stop making up arguments that I'm not making. It's juvenile. My issue is with people incorrectly insinuating or stating that the rich pay less taxes than the poor. Can you understand that?

You don't even know what you are talking about from post to post. Do you remember this bit?

Seriously, pick a topic and switch to it. You criticize me because you wanted to talk about personal taxes. Now you criticize me for not talking about other taxes. Make up your mind.

You've been trying to put arguments in my mouth that I haven't made. Go learn about logical reasoning, that's called a strawman argument. I don't 'pick and choose', I'm just sticking to the topics I'm discussing.

Right... anyone who disagrees with you is a propagandist, a republican bumper-sticker, etc etc etc... Get over yourself. You talk about acting young...

I promote truth. You are the one who can't even decide what you are talking about. Personal taxes? Corporate taxes? Sales tax? Why don't you just jump on people for not talking about something you want them to talk about?

I wasn't really tempted to. Sorry if that disappoints you.

"When you get your income from capital gains." Hedge fund operators pay capital gains tax on what is or should be considered ordinary taxable income. That is one of the most obvious gigantic loopholes. The oil depletion allowance is an even bigger loophole. It benefits EXXON-MOBIL the most profitable company in the history of the world.

Shame on you. I a free mmarket, people buy from whomever they choose. If the seller of a product charges more than the consumer wants to pay, he goes to another seller. If the productys are shoddy, the company will go out of business. Every seller wants to provide good products and services at a competitive price.

Your idea that the rich have stolen from the poor is ridiculous. The rich pay the salaries so that people can buy the goods and services they need. And don't tell me that government pays living wages to anyone other thair their own greedy employees.Who else would the government pay other than their own employees? Are you feeling well? Greedy employees huh? Like soldiers, VA doctors, aid workers....entirely greedy huh? You call the government employees greedy but apologize for every action done by the corporate class. You are merely an apologist. The self delusion is magnificent to watch.

You are great at illogical conclusions. The corporation must have satisfied customers. The government simply raises taxes. One serves the customers and the other take3s from the masses regardless the quality of their service. And you choose to tell me that I am against military pay and VA doctors. You are extremely iollogical and myopic.

Do you not see the government employees in DC starting at 6 figure salaries. The are really overpaid compared with the private sector. But you choose to compare apples and oranges. Shame on you once more.

Upward economic mobility in the U.S. has declined greatly in this country for a variety of reasons. Children born into poor families tend to stay poor and the richistani children tend to stay rich. The American dream has largely become a myth used by the rich to justify their low tax rates, loopholes and their wealth.

They still have higher tax rates than the rest of us... that seems to be the point missed so commonly. They pay higher effective taxes than almost any other developed country as well.

That's true except for hedge fund operators and those with secret accounts in Switzerland and the Caymans. But not much higher than the rest of us. Maximum federal tax rates were much higher 1945-1980 than they are now during this period of great prosperity.

MNow would you tell me about the Obamas. And how about Ophra Winfrey, and how about Michael Jackson. How about Steve Jobs.

How do people become riv=ce, they work at it. They don't sleep until noon and blame someone else for their misery.How were you a teacher if you cannot construct a sentence? Some people work at it. Some people work hard at stealing from others. Did Madoff work hard? Are you cool with Bernie? Some people pay tribes in Africa to slaughter and entire generation of another tribe, just to push them off the land so they can drill. Some people force thousands of others to labor at the penalty of death to mine diamonds. Is that working hard? Your simplistic view of the world is cute, but I would think you would have grown more wise in your age. Guess not.

So you point to those dishonest people who are rich and leave us to conclude that all rich people are dishonest. So much for your logic. The rich people pay the workers of this country. They pay them to produce products that people want and need. They sell those products at a fair price.

And you? What do you do? You blame the entire sysrtem because you know one rich crook. Shame on you and you illogical thinking.

I read most of the rolling stone article, wording is everything to liberals, My question is why the rich getting richer is of consequence to everyone else? If they were poor overnight would the "poor" be richer? We keep hearing the rich are not payng their fair share, but does anyone believe the OWS crowd pay taxes? Look at them? I don't see one on television qualified to work at a Burger King, and if they did they would not owe taxes at the end of the year! I say its time for poor people to pay at least something! Then the word "fairness" would have merit! When a group pays nothing but wants the wealthy to pay more it can only be because they somehow believe they are going to get more of someone elese income!...........isn't this what is happening in Greece, Italy and Cuba?...........how is that hope and change working out for them?

Chris Hedges provides some insights into what happened to our democracy:

http://www.youtube.com/watch?v=QRQjF1IPgKQRidiculous. Chris Hedges is blowing smoke and spinning his own ideas as to what is wrong with American Capitalism. You can believe him if you wish to, but his talk is a lot of nonsense without any proof.

That's what you offer? "Nuh-uh?" Seriously? Try again. My cocker spaniel offers more substance to the argument.

Do you realize tht we are in trouble because we overspend. Hey, that is the fault of individuals and big government. So if you think Socialism is the answer, why not look at those countries who are socialists. They are also in debt trouble. Greed and power exercised by the government is the real problem. Not the economic syustem.

"we overspend." Yes, we overspend on foolish wars, troops around the world in 150 countries, including 54,000 in Germany, and subsidies to corporate farms, international oil companies and hedge fund operators. If you want to know where our troops are click this link:

http://en.wikipedia.org/wiki/United_Sta … eploymentsThat's a cute interpretation...we just overspend huh? We have the lowest personal income taxes since Eisenhower, the average income of the top 400 Americans has tripled since 1997, while their tax burden has fallen significantly to 17%, 5 points lower than that of the guy who picks up their trash, we allow wealthy to store their money overseas to avoid tax liability, the same for multinational corporations, to the tune of hundreds of billions of dollars. I agree that we overspend, but putting the entire problem on spending is juvenile and short sighted at best. We have some of the lowest revenue per capita that we have had since 1928. Our income gap between the wealthy and the poor is at the highest point since 1928 as well. We have allowed ourselves to buy into the trickle down theory, while we have 30 years of empirical proof that it does not spur the economy, does not create jobs, and does not benefit anyone but the top 1%.

Our economic system allows for things like repealing Glass Steagall, allowing mortgage lenders to sell the risk of their debt to investment banks, who bundle it with every other risky proposition in their holdings, bribe the rating agencies to misrepresent the commodities and mark them triple A, and sell that risk off to states to the point that when the system fails, the states are bankrupt because they spent pension funds on crap, and foreign banks to go under leading to a global recession. We allowed the Fed to raise the ratio in allowing banks to use up to 36 of your dollars to invest on risky commodities compared to 1 of their own. Socialism? I doubt you can list a definition for socialism. You think regulation is socialism? Taxes? Socialist countries don't have taxes. Seriously, try a little harder to understand what is happening. If I wanted a Republican bumper sticker argument, I'd order one or listen to Sarah Palin.Let's make sure we all know who you are talking about. These are the people who make the majority of their money from investments. Investments they make with money that they already paid higher tax rates on. They aren't getting a free ride. Actually, they are helping our economy by investing. The top 1% earn 20% of the money, and pay 38% of all taxes. Don't try and say they aren't paying their fair share.

If we taxed all corporations and the top 1% at 100%, we would only break even on our spending. Spending definitely is the problem. Taxes aren't the answer to it. Not unless you want to take everyone's money away.

Who do you think makes the jobs then? If it's not the rich, then it must be the middle class or the poor... How many jobs have you had from a poor person? Most of my jobs have come from corporations...

So, your answer to the problems and corruption of government is higher taxes?20% huh?

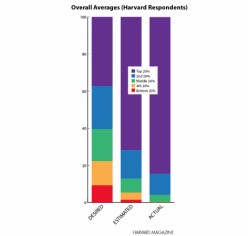

From 1992-2007 the top 400 income earners in the U.S. saw their income increase 392% and their average tax rate reduced by 37%. In 2009, the average income of the top 1% was $960,000 with a minimum income of $343,927. In 2007 the richest 1% of the American population owned 34.6% of the country's total wealth, and the next 19% owned 50.5%. Thus, the top 20% of Americans owned 85% of the country's wealth and the bottom 80% of the population owned 15%. Financial inequality was greater than inequality in total wealth, with the top 1% of the population owning 42.7%, the next 19% of Americans owning 50.3%, and the bottom 80% owning 7%. However, after the Great Recession which started in 2007, the share of total wealth owned by the top 1% of the population grew from 34.6% to 37.1%, and that owned by the top 20% of Americans grew from 85% to 87.7%. During the economic expansion between 2002 and 2007, the income of the top 1% grew 10 times faster than the income of the bottom 90%. In this period 66% of total income gains went to the 1%, who in 2007 had a larger share of total income than at any time since 1928.

http://www.cbpp.org/cms/index.cfm?fa=view&id=3309

20% own almost 90% of the wealth in this country. Additionally, your interpretation of how the wealthy already paid a higher income tax rate on the money they are investing is ridiculous. You are making the assumption that they got their initial money from personal income from a paycheck as opposed to inheritance or capital gains. Capital gains are taxed at 15%, and they take the money from that and invest it in other commodities.

Most of the jobs come from corporations? You are right. However, we are discussing personal income tax rates. If you give the CEO a percentage off of his taxes, he doesn't put that back into the company, in fact, that is illegal unless it is a private company.

What we are talking about are two different things. You are being short sighted and not trying hard enough. Fixing unemployment and taxes are two different things entirely. The tax argument is about repairing the deficit. The EXACT same thing Reagan did is what we are trying to do...raise taxes by a fraction, in fact, all that is being requested is 3% of the top 1%, bringing it back to the rate BEFORE Bush. That's all.We want to eliminate corporate tax loopholes and offshoring of revenue, also join the rest of the country in what Reagan started, which was called tax harmonization, which is a global effort to stop wealthy from hiding money overseas to avoid taxes.

You have a problem with 3% of the top 1% and don't appear to put for any more effort than a narrow and reactionary response. Corruption in the government and problems, taxes? Dude, now you are just throwing words together and trying to misrepresent, which is obviously the method of a person who hasn't a leg to stand on.I'm sorry, did you actually correct me anywhere in there? Let me read it again. No, you didn't. Why are you arguing against my 20% earned income figure with figures on total wealth? You should take the time to see what other people are saying before you start running off on tangents.

The point is, it's money that has been taxed. Most of it came from personal income at one point or another. I think it is perfectly fair to tax 15% of the income people make from investing in other companies... how many companies never would have made it without investors or loans?

First, a lot of companies are private. A lot of companies are entrepreneurs making their dream come true.

Secondly, we're not just talking about personal tax rates. You jump around from topic to topic so randomly it's difficult to know what you are talking about.(taxes - jobs - demand - taxes - corporations - personal).

CEO's invest their money, and they spend it. Not much of it goes in savings accounts. Most rich people didn't get rich by sitting on their money making no interest.

Taxes only apply to the deficit? Didn't you just recently argue something along these lines?

I've already shown that taxes are not the answer to the deficit. Fixing spending is the answer. We can tax the top 1% at 100% and not even dent our national debt.

Texas, seriously, why don't you just stick to the topic at hand. We're all(hopefully) adults, can't we act that way?

Our corporations already pay more than almost any other country. We're not going to fix the deficit by taxing them more, and we certainly aren't going to help the job situation any.Like debating a 10 yr old. When you get figures thrown back at you and a reference to check, and you come back and say the same thing with no backing, and you think you are being an adult. Dude...not worth it. If you have no desire for the truth, then why don't you just go ask yourself a question, look in the mirror, and answer it for yourself. You obviously have no desire to think beyond your preconceptions. It requires a little effort. I wish you the best in your endeavors and hope you one day decide to try to think beyond basic reaction. As for me...debating someone who just says "nuh-uh" isn't worth it.

You're just wanting to soak the rich for programs that should not be funded. You should be responsible for providing for your own if you are able bodied. If you are too old or too young to porovide for yourself, someone or the government should do it for you. But the waste is in bankrupt solar energy schemes. Look at the spending. It was not the war that caused the spending deficit. It is the programs that have fraud and waste by the government.

The next time you get your Income Tax booklet, check it out. Defense spending is at the bottom. Soak the rich because the greedy government oversopends.You are nothing more than a conservative bumper sticker reader. Not even worth much of a response. Discussing something with you is worthless. You don't put forth enough effort to even get the context of the argument much less the basic facts involved. The self delusion and lack of effort is shameful.

I think this is interesting - a post completely devoid of facts criticizing someone for being a bumper sticker, and four lines of personal attack to justify it.

Despite the 30 other posts beforehand? Yeah.

Actually, I've found the discussion here to be much higher quality than similar discussions on other sights. So no offense intended - just thought that comment (among a few others) was on a lower level.

I will admit that I can put myself on a lower level at times. I'll readily admit that. I am not sure if it is because I am so passionate, so annoyed at the lack of effort on my counterpart's behalf, or just that I am from the south and eventually, I just want to hit them in the face. However, I make no bones about it...I can be an ass. I would prefer not to be, however all of my brothers are asses too. It might be in the blood. I would love political debates with a Thunderdome on the side. If one side keeps spouting rhetoric or easily verifiable lies, then we go to Thunderdome. To be honest, Pelosi would always be in Thunderdome with someone too. I don't think Republicans alone act like that. We have plenty on our side who just spout bs. You couldn't get that woman to tell you what she ate this morning so is so full of it, much less what is really going on in Congress. I dream of a time when we can present an argument, both look up the facts, then agree on the facts, then come to a conclusion. However, that appears to have died long ago.

Oh how I would like to see that happen. Nothing aggravates me more then a person with keyboard courage.

It's not the war that caused the spending deficits is one of the most ridiculous things ever said. Taking 5 seconds to look up what Iraq added to the deficit will end that argument, along with providing an unfunded tax break during the war and a prescription drug program for the rich, all deficit funded and during 2 wars. A tiny bit of effort will end that argument...it is just sad the one, now 3 of you don't have the concern for the country, nor the intellectual curiosity to even check. Pathetic.

Well while you are looking, you might check the percentage of the national debt that the war in Iraq is. About 2 to 4 % So that is really a huge cost, isn't it? Where is the rest of the waste being spent?

""Do you think the millionaire ought to pay more in taxes than the bus driver," he demands, "or less?"

The crowd, sounding every bit like the protesters from Occupy Wall Street, roars back: "MORE!""

Um, the rich do pay more taxes than everyone else. The top 1% earns 19% of all the income, and pay 38% of all the taxes. They pay twice as much on average compared to the 99%.

Saying we should tax the rich and corporations more is just ridiculous. Rich people invest their money. Do you know where that money goes? It goes into corporations. It helps finances expansions, new projects, and new companies.

Yes, rich people can make a lot of money off of their money, but they already paid taxes on the money they are investing. If someone invests $100,000 into a new company and that company is successful, creating 50 jobs, and earning a bunch of money, the investor might make $500,000 profit off the investment...

So what? He helped a company be successful. Do you think any of those new job holders would be angry at him for making money and creating jobs?

Something that can usually help to understand a concept is taking it to the extreme. I'll give an example real quick to demonstrate 'taking it to the extreme'.

When I was in middle school, I got 2nd place in a high-jump competition. The guy that beat me only won by 1/2 an inch. He was 5 inches taller than me. We argued about height after. He said height doesn't make a difference, I said it does. To demonstrate, I said 'If a 30-foot tall man walked up to that high jump, he would just step over it.'. Obviously, height helps. Taking it to the extreme makes it very clear.

Now, let's tax the wealthy to the extreme. Let's take all of their income.

Have you ever heard of somebody starting a business or hiring someone, when they didn't have any money?"Saying we should tax the rich and corporations more is just ridiculous. Rich people invest their money."

Some rich people invest their money in useful and productive ways. Others spend it on multiple McMansions, Bentleys, expensive jewelry and in other ways to call attention to their wealth.

Do you think the poor can be a source of the taxes required to repair our schools, roads and bridges, defend our country, and perform other government functions provided by laws passed by our representatives in Washington and in our state capitols? As Willie Sutton when asked why he robbed banks said "Because that's where the money is."Yes, but that's their right. The government has no right to tell people how to spend their money.

True, but the federal, state and local governments have the right to tax the rich sufficiently to pay for schools, roads, libraries, etc. I'm tired of hearing them whine about paying their fair share of taxes. (Their fair share, by definition is whatever the legislatures say it is.)

Why should we complain that they 'only' pay twice as much, percentage wise, than the rest of the taxpayers?

Who says "they" pay twice as much as the rest of the taxpayers?

For one thing, the "rest" of the taxpayers actually pay. They pay because they work for a paycheck that deducts the taxes automatically.

That is, IF they are lucky enough to have a job.

Debatable in these times of 9% unemployment.

The rich do not necessarily pay.

Period.

Read the section on tax harmonization and how these big corporations (which, as we have been led to understand by the SCOTUS and Mr. Romney are "people") brought their $ back from hidden offshore accounts to the US and got taxed at 5% on it.

Read about GE demanding a tax refund after paying no taxes.

But again, I say, this article is not simply about taxes. It's about gaming the system over and over and over based on economic theories that have proven, over and over and over, to be false.The top 1% earn about 20% of the money, but pay about 38% of the total tax burden.

The top earners pay too. On average, about twice their 'fair share'.

Do you know why these companies go overseas? Because they save money by avoiding our ridiculous tax rates. No government should be taking one-third of anything ANYONE or ANY COMPANY makes... one-third! How would you like to have one-third of your money taken away from you?

These businesses are successful because they are run by smart people. If the US government wants to tax some of the highest rates in the world, then it's the government's fault when companies decide to do business elsewhere. Don't try and blame the corporations.

Yes, better to charge high enough taxes that you force the wealthy, and successful corporations, to move/move operations.The "quintessential student" appears to have a need for more study, and quite a bit more effort. Fail.

http://www.irs.gov/pub/irs-soi/08intop400.pdf take a look for yourself, straigt from the irs. While you are on the irs site look up tables for taxes on capital gains, note the part where it states can be as low as 0%. They go over sea because labor is so cheap, materials, low to no regulations. and their profit share is much higher. As long as they can find someone to buy whatever product they are selling, They realy don't give a damn.

... what does that have to do with anything? Are you trying to argue a point based off of my profile? Or, are you just trying to demean?

Talking about who said something instead of what they said isn't a very strong argument.

If their fair share is what ever the state defines as fair than they are currently paying their fair share, aren't they?

What if the government decides that 100% of all income is their fair share - is it right for the government to take all the property of one group of people merely because they lack sufficient numbers to politically protect that property from a ravening state?"they lack sufficient numbers to politically protect that property from a ravening state?"

Remember money=speech and corporations are people. The state is controlled by the "ravening" corporations and billionaires. As you well know, they've been doing quite well lately.Well it is well past the time to strip everyone of everything put it all in a great pile and let the state divvy it up "fairly"

UCV,

"All I want is what's coming to me. All I want is my fair share."

Sally Brownian Economics

Which side would claim Miss Brown?

Is Sally Brown looking for a Santa handout?

What if Sally Brown is a metaphor for government?

I don't begrudge anyone their money. Good for them (as long as the money is not ill-begotten:)).

And investing in McMansions and cars and "stuff" is their choice. Buying things also helps the economy.

This isn't about individual members of the 1%, tho.

It is about a systematic, multi-decade political ploy to starve and bankrupt our country -- all 99% of us -- and funnel ALL THE MONEY to the 1%.

But since the 1% control the US political system, I guess it's appropriate to target our anger on them as a class.

Did you bother to read past the call-and-respond intro?

Did you even bother to read WHICH president is being quoted?

[Hint: It ain't Obama.]Yes, I read it. The point is, the article is trying to make a point that rich people shouldn't pay less than poor people. These arguments about billionaires paying less than their secretaries and such are just ridiculous. Trying to prove a point with specific examples that are outside of the norm.

The rich pay much more than anyone else. They pay a higher percentage than anyone else.

The only times they pay less is if they lose money, get all their income from investments(investing money which they have already paid taxes on), or they don't earn anything at all(meaning they pay nothing).Did we read the same article?

The article is not about how much rich people make or how much they pay in taxes.

It's about a political strategy to continue granting tax cuts that only benefit the wealthy, systemattically and doggedly -- regardless of the economic situation of the country.

It's about how this idea started out, how Reagan and Bush Sr. actually had to retract tax cuts because they were hurting the US economy.

You can even skip the middle and just cut to Dick Cheney.

The article isn't even about rich people.

It's about a plot against America.

Dollar for dollar, the rich pay a lot more. The problem is they don't pay on all their money, only part of it. A flat tax with no loophole deductions is fair. Not (according to Deeds) what the legislature says it is. 5cents on the dollar to your state and 5c on the dollar to the feds. Sales tax? Up for another debate. Live within your means. No payroll tax, no employer paid UEI (that's akin to the unions paying pensions to non-workers out of workers union dues), no deductions except a few possible extreme conditions.

Yet their effective rate is still higher than anyone else's. They make 20% of the money and pay 38% of the taxes. Their effective rate is lower than the statutory rate because of deductions and such, but their effective rate is still higher.

If we did that, the rich would pay less taxes then they do now.

I agree... our mentality in america seems to be 'live within your means + 10%'. I took care of myself, my wife, and my child with $20,000, and we still saved money. Yet, we have people who don't seem to be able to live off of 50k, 100k, or 500k. Financial responsibility is an individual responsibility, which if more people practiced, we wouldn't be in as much trouble as we are.

I haven't heard anyone suggesting that the government should "take all their income."

Did you read what I wrote? It's a thought-experiment. The more money the government takes, the less money remains for business expansion, jobs, etc...

What do you think they do with that money kiddo? Do you think they go in the backyard, build a fort with it, and play war? It goes back into the supply chain of our economy. My man...you are quite reactionary yet confident, and display a very juvenile interpretation of thing entire discussion. Are you a freshman in college? Freshman do that quite often is the only reason I ask. Come back to me after 4 or 5 economics classes and we'll chat.

Please, try to keep the discussion mature and free of demeaning remarks.

43% of our spending(1.5 trillion, or 70% of tax revenue) goes to failing programs like social security and medicare. Another 10% of tax revenue goes to paying the interest on our debt. The remaining 20% goes toward military and mandatory spending, but doesn't cover it. None of our taxes get injected back into the economy.

Yeah, we've tried stimulus plans and such, but trying to stimulate the economy by putting in some of the money we took out is ridiculous. Just keep the money there in the first place.

Everything else that we do to try and help ourselves doesn't come from taxes! It comes from printed money(or worse, QE money).

My point has been that higher taxes isn't the answer. I'm not saying we don't have governmental problems. We do. We need to fix them, not bleed the rich dry."Yeah, we've tried stimulus plans and such, but trying to stimulate the economy by putting in some of the money we took out is ridiculous."

That's standard economics taught in every Econ 101 class in the country/world.Ralph, what I'm saying is, taking money out of the economy, and stimulating it by putting it back in, is a ridiculous idea, when you can do a better job by just leaving the money in.

Actually, it is basic economics. When there is a recession, there is a freeze on the cash flow...consumer demand accounts for the vast majority of our economy. When money isn't flowing, it must have an infusion of money into the system to continue said cash flow between businesses. That is where deficit spending comes in. You are making the assumption that all excess money is spent by all levels of tax holders, when it isn't. The middle and lower classes spend the excess money, but the higher tax bracket statistically doesn't. They keep it. Right now, not enough people are buying things, thus our economy is growing at a rate of around 1.2%, when we average 2.2%. That is significant. Consumer demand isn't calling for a higher level of hiring on behalf of the corporations, and since we have so many unemployed, they aren't spending as much as we expect. The only way to get them spending, being that there is no call for additional jobs, is to get them working. There is only one organization that can operate in the red, call it an investment in an effort to spur the economy...the government. We have tons of infrastructure projects we have ignored for 60 years. We hire them, they do jobs our country needs, and they spend the income, thus spurring the economy. Again, this is basic economics...even basic logic. The thought that if we just give corporations more money that they'll hire more people, which is juvenile and wrong. Consumer demand drives employment. When the base of consumers have no jobs, then they don't spend money, thus causing the need for more jobs. This is basic stuff man.

Listen, the idea you are quoting is that it is ridiculous to simultaneously accept the ideas of raising taxes and using taxes as stimulus. Who are we going to tax? A great portion of the top brackets are individuals, entrepreneurs, and small businesses. Taxing them doesn't help our situation.

Yes, we can do temporary, government-funded jobs, but when they run out we're not much better off. The only way to really make a difference is to get more real, permanent jobs. Then more people make money and more people spend money.

Raising taxes won't help, no matter who you raise taxes on. So many of the big corporations don't have the huge capital reserves you seem to think they do.You are dismissing the fundamental aspect of economics, a rule that AGAIN is in the first chapter of every economics book on the planet: CONSUMER DEMAND DRIVES EMPLOYMENT.

If so many people are unemployed, then they aren't spending, this driving demand. With no demand, there are no jobs. You have to get them working, with which will in turn drive demand, opening up private sector jobs due to said demand.

Look man...you are offering a simplistic and juvenile outlook on this. I don't care if you are offended. You should be offended. I am offended. This is basic economics, I mean the VERY BASICS. Businesses don't hire people just because they have extra money, hence the reason we are sitting on record capital right now with no jobs. Dude, you need some schooling.I never said demand doesn't drive employment. I was trying to clarify what I was talking about. You kept quoting a point of mine and changing topics.

1 - You talk about everyone sitting on record capital. As a generalization, that's not true. Like I said, if you want to discuss specific companies, we can go there. Broad generalizations don't do the truth justice.

2 - Businesses don't hire people just because they have extra money. I know that. They do lay people off when they don't have enough money. And, if there is demand, they have to have money to expand and create the new jobs. Taking the money away from them doesn't help. You want us to fix the problem with temporary jobs, creating temporary cash injections, creating temporary demand. We've been stimulating the crap out of our economy. Not only that, but our government has proven itself to be extremely irresponsible with money. My entire point(which you seem to miss) is that it's ridiculous to raise taxes to try and stimulate the economy more by giving it back. What we need are real jobs that will last.

Before you talk about using corporation's money to pay for infrastructure jobs, you have to see where that money would come from.Nobody is saying raising taxes will create jobs. Not a single Democrat is saying anything like that. They are two separate issues. Jobs and the debt. Raising taxes to those before Bush, closing corporate tax loopholes, and going after those who hide their taxes overseas to avoid paying taxes - ALONG with quite a bit of spending cuts is what the Democrats are saying...to help begin the repair on the debt.

Now jobs are a totally different thing. You acknowledge that demand not excess cash drives employment. SO...aside from temporary government jobs to work on infrastructure projects that we have needed for 50 years and ignored, "whatcha got?"

You admitted the demand drives employment, and nobody is buying enough because so many are unemployed. SO. What? You think lowering taxes will fix everything? How do you get them employed and spending when there are no jobs because they are unemployed? Magic? A new line of Cracker Jacks? What?Excess capital doesn't drive employment, it facilitates it. Companies can't expand into existing demand without money. I know your type likes to say the evil banks are sitting on huge stockpiles of cash, but that's just not true. You know what they are doing? They are loaning their money. They don't have enough for their loans so they borrow money to make more loans. The 'evil corporate america' stereotype is ridiculous. Do you want to talk about individual companies, or just keep painting a broad brush?

If you bothered to go look at anything, you would see that we are creating jobs. 13 months in a row.

Hi Emrldphx,

I do appreciate some of your comments even though they miss the major points of this thread. Furthermore, available data do not support all of your perceptions. Those who advocate for the very wealthy usually ignore these facts: trickle down is a myth; it doesn’t happen; ever!

The most wealthy among us continue to become more wealthy. The Great Recession of 2008 has eroded the assets of average Americans far more than it has affected the wealthiest among us. The marketable wealth of the median household (i.e. when excluding the value of their home) shrank 36.1% since the peak of the housing bubble in 2007. In glaring contrast, the wealth of the top 1% of households fell only 11.1% indicating that the gap between the "haves" and the "have nots" is much greater now then in 2007. The fat cats responsible for bringing on the current economic melt down are getting fatter much the same as they have been doing steadily over the last 25 years. Back in 1983, the least affluent 80% of US households actually owned 18.7% of the country’s total net worth. In 2007, the same population wedge owned only 15% of the total net worth after the upper 1% tier rose by about 0.7% and the next 19% of households gained 3.0% of the wealth. (1)

The foxes of big business have already raided the hen house and it has cost this nation trillions of dollars in tax breaks and handouts for those who need them the least. Handouts so huge they overshadow all of the nation's welfare programs for people. The congress has committed $11 trillion dollars to Federal bailouts and stimuli for big business (2) and some freshman in congress were still pushing to reduce Federal programs costing only $700 Billion (3) that are intended to assist the country's poorest Americans and retirees. The numbers reveal that the wealthiest among us have received the largest welfare package in history and they are still complaining about income taxes and government assistance for the struggling masses. The average American can't even get a job out of the deal. Perhaps you have not noticed banks and corporations are currently sitting on huge capital reserves accumulated from profits and government handouts, and they are continuing to reap huge savings from having sent their manufacturing and service jobs offshore. Banks, oil companies, and most of corporate America never had it so good. So, show us the data that support your praise for trickledown. Better yet, show us where the jobs are.

A careful examination of the data reveals the distribution of wealth in this country is a good reason, and not merely an excuse, for raising taxes on the rich. Those who created the economic collapse, benefited from all the recovery programs, and suffered the least from the meltdown are now being asked to contribute a little more toward regaining our former economic health. If you disagree the wealthiest in this country suffered the least then please look at the data again. Failure to acknowledge complicity in the Great Recession of 2008 and insensitivity to the hardships it has caused to the other less fortunate 99% of the population is hardly an admirable position for any person or for any political party.

But so far, none of your opinions presented here alter the sound rationale calling for the wealthiest Americans to cover a greater portion of short-term future tax hikes. After all, the very wealthy among us stand to reap the greatest rewards from a temporary tax increase that will reduce the national debt and rebuild our sinking economy.