Repealing ObamaCare: Largest Spending Bill in U.S. History

The Patient Protection and Affordable Care Act

By far, The Patient Protection and Affordable Care Act (PPACA), or "Obamacare" is the largest spending bill in U.S. history. An unfunded reconciliation budget bill designed to obliterate our current health care system and wipe out the health insurance industry by mandating purchase of a government subsidized program. If you think that’s a harsh assessment, let’s look at some facts:

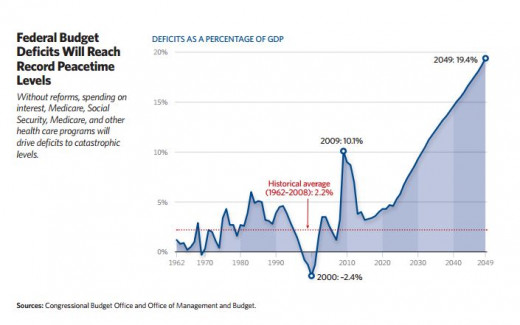

- According to the CBO (Congressional Budget Office), under the budget policies supported by the President, federal spending soars to 30% of GDP by 2027, 40% by 2040, 50% by 2060, and 80% by 2080. The budget proposes to spend $47 trillion over the next 10 years, the most in world history by far.

- Buried in PPACA regulations from 2010 is an estimate that, “the percentage of individual market policies losing grandfather status in a given year exceeds the 40 to 67 percent range.” That means the administration knew that more than 40 to 67 percent of those in the individual market would not be able to keep their plans, even if they liked them. And at last tally, over 4.7 million Americans across the country have received cancellation notices because their plans do not meet the guidelines of the new PPACA law.

- ObamaCare imposes brand new taxes totaling 800 billion over the next 10 years. This is necessary to subsidize the estimated 60 million Americans that don’t have health insurance. Roughly one-third of those will end up fully subsidized on Medicaid if the make less than $31K a year.

- To help cover its costs, ObamaCare also imposes a series of savings. Among them are measures that will reduce the increase in Medicare by $716 billion from 2013 to 2022, according to a Congressional Budget Office estimate. So coverage to seniors will be cut from an already very low reimbursement level. Medicare spending will continue to rise, however, but at a slower pace than they it would have without the law. This is equated into savings – a slowing of spending growth.

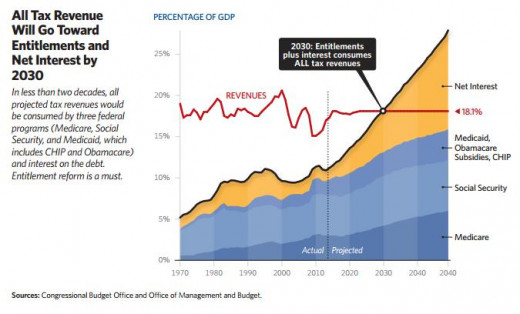

- At its current pace, all base spending, including Obamacare, will outpace revenue in 2030 unless drastic cuts or changes take place to reverse the trend. Already, Social Security ran deficits starting in since 2010 with a $74.6 billion deficit in 2013.

Deficit Spending at 18 Trillion and Counting

Towards the end of the Bush administration in 2008, the economic picture and public opinion was bleak. The housing bubble collapse set off a record number of foreclosures and banks and investment firms faced threat of insolvency and collapse. The global war on terror was in full swing along with a protracted occupancy in Iraq and Afghanistan. Recession and unemployment were looming. Some significant spending bills were passed during this time:

- 2006 Katrina clean-up was $24.7 billion, swine flu added $6 billion, war on terror cost $120.4 billion. National Debt: 13.909 Trillion

- 2007 Iraq War cost $131.6 billion. National Debt: 14.570 Trillion

- 2008 Economy contracted 3.7% in Q3 '08, 1.8% in Q1 '08. War on Terror cost $197.6 billion, Bank Bailout cost $350 billion. National Debt: 14.873 Trillion

What vehement backlash, the American public voted in a Democratic majority and President as a clear referendum on its dissatisfaction with the then Republican administration. This set the stage, to the dismay and surprise of many for even more spending:

- 2009 Economy contracted 8.9% in Q4 '08, 6.7% in Q1 '09, lowering tax revenues. American Recovery & Reinvestment Act (ARRA) “Stimulus Bill” spent $241.9 billion. War on Terror cost $79 billion. National Debt: 14.384 Trillion

- 2010 ARRA budgeted $400 billion. PPACA (ObamaCare) is signed into law March 23, 2010. National Debt: 15.058 Trillion

- 2011 Obama Stimulus Act (ARRA) spent $120 billion. National Debt: 15.587 Trillion

- 2012 Obama extended Bush tax cuts, combined with $900 billion in defense spending. National Debt: 16.066 Trillion

- 2013 Sequestration reduced government spending, Obama's payroll tax holiday ended raising revenue. National Debt: 16.872 Trillion

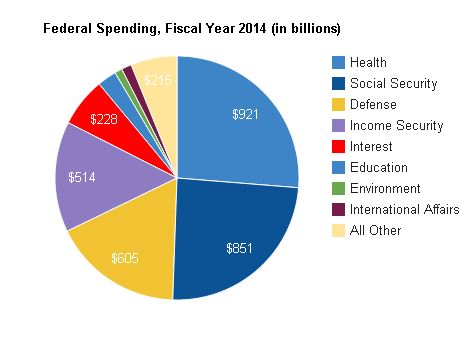

While many of these events helped add significant debt to the deficit, it’s the base spending programs that continue to add the most. These include, health (Medicare, Medicaid, VA) Social Security, Defense, Income Security (ERISA), interest on the national debt, education and others. Current health spending accounts for more than 26.3% of total dollars even exceeding Social Security spending of 24.3%. (See Chart) But as we have seen with Medicare, Medicaid and Social Security spending, the trend for entitlement is always up. As of today, the national debt sits at 17.983 trillion dollars.

Universal Health Care Proposal Nothing New

As with most bright ideas, they seem to be borrowed from someone else. And if you dig, you can find four past presidents that proposed some type of universal health care system with some earnest:

- Harry Truman. On Nov. 19, 1945, proposed national health insurance plan and called for the creation of a national health insurance fund to be run by the federal government open to all Americans, but would remain optional. Participants would pay monthly fees into the plan, which would cover the cost of any and all medical expenses that arose in a time of need. The government would pay for the cost of services rendered by any doctor who chose to join the program. The American Medical Association attacked the plan, characterizing the bill as "socialized medicine." Truman ultimately abandoned the effort after the outbreak of the Korean War.

- Lyndon Johnson in July 1965. Technically, Johnson never sought full universal health care. But he did sign into legislation Medicare and Medicaid. Not universal care for everybody, but they are universal care for large subsets of the population.

- Richard Nixon. In 1971 and 1974, Nixon offered separate proposals to expand health insurance to all, or nearly all, Americans. Generally speaking, they involved employer mandates to provide health insurance, supplemented by subsidies for poorer Americans. The effort gained some traction in Congress but faltered as Nixon became consumed by scandal.

- Bill Clinton. In 1993 and 1994, Clinton -- in a process spearheaded by First Lady Hillary Clinton -- sought to pass a major overhaul of the health care system that would have aimed for universal coverage. Even though the Democrats controlled Congress at the time, the plan did not win enactment.

So given these attempts (and successes with Medicare and Medicaid), why is there opposition to ObamaCare?

5 Reasons to Repeal ObamaCare

- Individual mandate to buy health insurance is unconstitutional - At the heart of the debate for insurance subsidized by the federal government is the idea that health care is a right, not just a privilege. Health Care a civil right? What about everything associated with good health such as food, clothing, housing and employment. Forcing people to buy government provided insurance is not what our Constitution guarantees. If you drive you must have auto insurance, but you can choose to find alternate means of transportation. With the health care mandate, you must have insurance, purchase insurance or pay a tax penalty for going without insurance. That is coercion not freedom. The Supreme Court did uphold the individual mandate as being legal under Congress’ taxing authority as “a tax on those without health insurance.” However, this opinion addresses the manner in which the law was passed (see reconciliation under #5) and the Supreme Court did not agree with the Administration’s insistence they had the power to enforce the new law via the commerce clause. And more challenges are ahead.

- The law is unpopular with the American people - The old adage "if it ain't broke, don't fix it" comes to mind when talking about the law being unpopular. Understandably millions of people negatively affected by the health care system prior to ObamaCare welcome this change. But that would be a reason to create a program designed to insure low income uninsured and under-insured indivduals - not scrap and replace our current system altogether. The Kaiser Family Foundation tracking poll found in July that 53 percent of people viewed the Affordable Care Act unfavorably with even more, 60% not in favor of the individual mandate policy to buy insurance. Also According to Gallup, 82% of Americans were quite pleased with their current health care plans. Those numbers appear to be holding.

- The law will break the budget creating deficit spending in excess of the ceiling limit – The U.S. government has always had a spending limit – a ceiling that invokes a shutdown called a sequester. Recently, in 2011, Congress passed additional law saying that if they couldn’t agree on a plan to reduce our deficit by $4 trillion, about $1 trillion in automatic, arbitrary and across the board budget cuts would start to take effect in 2013. However, lawmakers have voted to suspend the debt ceiling in recent years a total of five times raising the top spending limit: Aug 2011 $14.7, Sept 2011 $15.2, Jan 2012 $16.4, May 2013 $16.7, and now Feb 2014 $17.2 trillion dollars.

- The law will drive up health care costs and impact access and quality of care - As deficit spending reaches prescribed limits with this and other entitlement programs, the only choice will be to pass more of the cost onto the consumer. This will be by direct premium, raising of deductibles as high as $10K and slashing of benefits to providers reducing the access and quality of health care. At the heart of the law are provisions which prevent an insurance plan from denying coverage to anyone for pre-existing conditions. Insurance itself means the passing or assumption of risk for value, before an event occurs. If the risk is known and you agree to pay for it anyway, it ceases to be insurance - it's welfare.

- The Law was never voted upon by a two-third’s majority of Congress - ObamaCare was passed by a tactic called “reconciliation.” Budget reconciliation, a provision of the 1974 Congressional Budget Act, is designed to force committees to make changes in mandatory or entitlement spending and revenues. The rules for budget reconciliation in the Senate restrict the procedure to provisions dealing with the budget and debate in both houses is limited to 20 hours with no Senate filibusters (delays) allowed. But the authors of budget reconciliation never envisioned the procedure as a fast-track system to enact complicated social policy measures. Indeed, Sen. Robert Byrd, D-W. Va., the patriarch of the Senate and a master of its rules, helped design a set of six conditions under which any portion of a reconciliation measure could be removed unless it garnered at least 60 votes . Since the early 1980s, it has been used 19 times, primarily to steer controversial fiscal and budgetary policies through the Senate, including former President Bill Clinton’s fiscal 1994 deficit reduction and tax package and President George W. Bush’s major tax cuts. Using reconciliation, Democrats passed health reform legislation with a simple 51-vote majority and without Republican support. As further proof that reconciliation isn’t the right tactic for complicated social policy, the budget resolution on which reconciliation is based covers 10 years again according to the1974 Budget Act. So another vote will have to be made in Congress once the reconciliation horizon sunsets to extend or repeal opening ObamaCare up for further debate.

Attempting the Repeal

Thus far, the U.S. House of Representatives has voted to repeal ObamaCare more than 40 times since passage, but it has been blocked by the Senate. With Republicans now in control of the Senate, Conservatives in Washington are adamant that Senate Republicans should pass a full repeal of the healthcare law next year, even if it means a certain veto from President Obama. With Senate Democrats likely to filibuster any stand-alone repeal bill, conservatives say incoming Senate Majority Leader Mitch McConnell (R-Ky.) should use reconciliation to muscle through a bill with 51 votes. Sen. McConnell is on record saying that the law can be repealed with 51 votes and Republican voters expect him to keep his word." Given that Democrats used reconciliation to pass the healthcare law in the spring of 2010, advocates on the right say it’s time to turn the tables.