Since the Fourteenth Century Tax Cuts Have Been Shown to Stimulate the Economy

Taxes are the Price We Pay for Civilization

Taxes not only raise the money needed by governments to operate, they also influence the behavior of those paying the taxes.

In essence, taxes are the price or cost of living in a particular jurisdiction or, as the late U.S. Supreme Court Justice, Oliver Wendell Holmes Jr., wrote in his dissent in the 1927 case, COMPANIA GENERAL DE TABACOS DE FILIPINAS v. COLLECTOR OF INTERNAL REVENUE, “Taxes are what we pay for civilized society…”

The economic theory of demand states that, other things being equal, as the price of a product increases, the quantity of the product demanded decreases. In other words, as the price or cost of a certain good increases people will buy less of the good.

Politicians know and use this concept when levying so called sin taxes or taxes on goods like alcohol, cigarettes, etc. which are legal but which politicians and certain segments of society are seeking to discourage the purchase of these items.

Special and very high, tax rates are applied to these items in an attempt to discourage people from buying them. The goal of such sin taxes is not to raise revenue for the government but to reduce the sale of such products.

High Taxes on a Product Reduce Demand for that Product

In the case of so called sin taxes, the tax results in a substantial increase in the price of the product which leads to a reduction in the consumption of the product.

Various types of income or property/wealth taxes are also a cost to those who have to pay them. In this case the tax increases the cost of earning an income or the cost of investing in and holding capital and other types of property.

Here, the higher the tax rate the less incentive there is for a person to work or invest. Of course everyone has to work to earn a living but, with high tax rates, people’s incentive to work and produce more or invest in more capital producing assets.

This cutting back of each individual’s production and investing not only means fewer goods for everyone to purchase but also less income and property on which the government can levy taxes.

In a nutshell, high taxes can result in less rather than more revenue for the government.

Ibn Khaldun - A 14th Century Arab Philosopher With Very Modern Economic Advice

The idea, which has been championed by conservatives in recent years, that low tax rates result in greater production and economic growth, thereby leading to more, rather than less, government revenue being collected is not new.

While many enlightened rulers in times past may have intuitively figured out that lower tax rates can result in greater government revenue, the first person who is known to put forth and explain the theory behind this was a fourteenth century Arab philosopher commonly known as Ibn Khaldun.

While he is known as Ibn Khaldun in the West, his full Arabic name appears to have been Abū Zayd ‘Abdu r-Raḥman bin Muḥammad bin Khaldūn Al-Hadrami (أبو زيد عبد الرحمن بن محمد بن خلدون الحضرمي,).

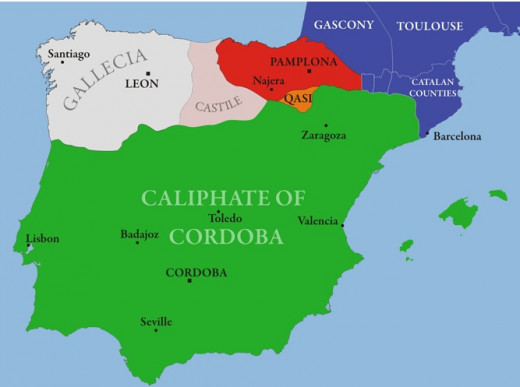

Ibn Khaldun was born in Tunis in present day Tunisia on May 27, 1332 to an upper class Andalusian Arab family which had immigrated to Tunis from Seville, Spain following the fall of Seville in 1248 to Christian forces led by King Ferdinand III of Castile.

Andalusian autonomous community covers the southwestern part of Spain. Is area where Ibn Khaldun's ancestors and parents came from.

Map Showing Maximum Extent of Arab Holdings (Green Area) in Iberian Peninsula between 711 and 1492

Note About Arab History in Spain

Beginning in 711 A.D. forces of the Muslim Umayyad Caliphate invaded the Christian Visigothic Kingdom of Hispania and eventually extended their rule over what is now modern Portugal, Andorra, most of Spain and part of southern France.

The Moorish advance through Spain and into Europe was halted in 732 A.D when Charles Martel (Charlemagne) defeated the Moorish forces at the Battle of Tours.

The next 700 years saw intermittent wars between Christian (mostly from the Catholic Spanish kingdom in northern Spain) and Muslim forces. While boundaries between Christian and Muslim controlled areas shifted regularly, the Christian slowly regained territory until the defeat Muslim forces in late 1481 resulted in a Treaty signed on January 2, 1492 in which the last Muslim ruler agreed to relinquish control of the last Moorish occupied and in Spain.

The Muslim legacy in Spain included the building of universities and libraries and it is quite possible that Late Scholastic Spanish scholars such as Navarrete and Villalobos were aware the writings and ideas of Ibn Khaldun and other Arab philosophers.

Ibn Khaldun Spent His Career as an Adviser to North African Rulers

Ibn Khaldun came from a political family whose ancestors, including his parents, had long served as courtiers and advisers to powerful Arab rulers in Andalusia and later in North Africa.

Well educated in philosophy and law, Ibn Khaldun was also well versed in economics, sociology, history and other areas of learning that have since emerged from philosophy as separate intellectual disciplines.

While Ibn Khaldun is remembered today for his writings, especially his classic, Muqaddimah, the bulk of his career, like that of his parents and family members before them, was as a courtier and adviser to North African rulers.

Ibn Khaldun was a smart, political operator who usually choose and, when necessary, changed, allegiances and employers wisely. However, he did occasionally miscalculate and, at least once, supported the loser in a dynastic power struggle and ended up in prison for a time as a result. Once freed, he quickly bounced back and continued his career as a political adviser.

Economist Arthur Laffer Credits Khaldun With Originating the Idea of Using Tax Cuts to Spur Economic Growth

Ibn Khaldun’s economic writings contain many of the basic ideas later found in the writings of Adam Smith and other eighteenth, nineteenth and twentieth century economists.

Among his many economic observations that are still relevant today are his ideas on taxation.

Writing six centuries before Arthur Laffer, who became known in the 1980s for his famous Laffer Curve which showed that government could increase tax revenue by decreasing tax rates, Ibn Khaldun described essentially the same phenomenon whereby lower tax rates result in more tax revenue for the government.

It should be pointed out that Arthur Laffer has never claimed to have originated the idea that tax revenues can be increased by reducing tax rates. From the start, Laffer has credited Ibn Khaldun and others before him with recognizing and describing how lowering tax rates can lead to higher tax revenues.

The principles behind Supply Side economic theory have been known and written about for centuries.

The idea behind increasing tax revenues by reducing tax rates is essentially the same as the idea of price elasticity which is taught in most college introductory economic courses.

The concept is that, with many products, a seller can increase his total revenue by reducing the price of the product within a certain range. In these cases, reductions in price result in proportionately larger increases in total units sold which results in an increase in total revenue and overall profit.

Here, the loss in revenue on each item sold is more than made up by the increase in the number of items sold. While lowering prices within a certain range will result in a proportionately greater increase in sales, raising prices within that range will result in a proportionately greater decrease in sales.

According to Ibn Khaldun, the goal of smart tax policy is: to lower as much as possible the amounts of individual imposts levied upon persons capable of undertaking cultural enterprises. In this manner, such persons will be psychologically disposed to undertake them, because they can be confident of making a profit from them. (source: Ibn Khaldun’s Theory of Taxation and its Relevance Today, by Abdul Azim Islahi)

Ibn Khaldun’s argument was that, by decreasing the tax burden, people are given an incentive to work and produce more, thereby generating a surplus or profit over and above what they needed in order obtain the basic food, clothing and shelter required to keep them alive.

More People Working Means More People Paying Taxes

In Ibn Khaldun's view, this surplus or profit would then be spent on either buying other things needed to make their lives better or investing it in more land or capital.

Additional purchases of what Ibn Khaldun called luxury items (things not essential to survival) will increase overall demand in the economy thereby providing jobs for more people as well as adding to the division of labor which helps to make an economy more efficient.

Of course, more people working and earning money means more people paying taxes.

Investing in additional land to cultivate or capital to increase production would also lead to both an increase in output as well as creating more jobs.

17th Century Late Scholars in Spain Describe Link Between Low Taxes and Economic Prosperity

Approximately two centuries after the death of Ibn Khaldun in 1406, Catholic theologians, mostly in Spain and known as Late Scholastics, have left us a number of letters and books dealing with economics (which was still a part of philosophy). LIke Ibn Khaldun, their writings contained many ideas and concepts found in modern day economics.

One of these writers was Pedro Fernandez Navarrete, Chaplain and Secretary to King Philip III of Spain. Navarrete published a book in in Madrid in 1619 titled Conservacion de Monarquias (Preservation of Kingdoms).

The book was intended as advice on how to preserve the Spanish Kingdom by reversing the kingdom's economic decline.

In Navarrete's view, high taxes, which were necessitated by its excessive government spending, were the source of the kingdom's economic problems.

High taxes forced many small farmers, who did not have enough income left over after paying taxes to support themselves and their families, to abandon their land and move to the cities. This emigration to cities resulted in a decrease in agricultural output causing food prices to rise.

Business suffered doubly. First, the high taxes left the majority of the people unable to afford much beyond bare necessities leaving little demand for other goods. Second, businesses themselves had little or no profit as a result of the high taxes.

Taxes had made work and production too expensive to engage in which, in the end resulted in a rapidly shrinking tax base.

Villalobos: Taxes Severely Weaken Towns...

A few years later another Late Scholastic, the Franciscan priest and scholar, Henrique de Villalobos, published a book in Barcelona, Spain in 1632 titled Summa de la Theologica Moral y Canónica

Observing the continued decline of farming in the countryside Villalobos said that the king and his government had to understand that

...taxes severely weaken towns and impoverish farmers. We can see places that yesterday were flourishing and had many inhabitants and now lie prostrated and fallow because farmers cannot tolerate high taxes.

Had Henrique de Villalobos been alive and writing today he could have easily been describing Detroit with its acres of abandoned and crumbling homes vacated by the flight of its citizens.

A robust and prosperous city of just under 2 million people in 1950, the now bankrupt city's population is just over 700,000 and falling.

Spain and North Coast of where Ibn Khaldun Lived and Worked

Following the fall of Seville, Spain to King Ferdinand III of Castile in 1248, Ibn Khaldun's ancestors left Spain for Tunisia.

Tunis, Tunisia where Ibn Khaldun was born on May 27, 1332

Were the Late Scholastics in Spain Aware of Ibn Khaldun's Writings?

While many of Ibn Khaldun's writings, including his classic The Muqaddimah, were translated into English and other European languages during the 19th century when the European powers were setting up colonial control in Africa and the Middle East, there is a question as to whether or not the Late Scholastics in seventeenth century Spain were aware of his writings when they published their works.

Ibn Khaldun had been born in Spain and there Arab learning and culture had flourished in Spain for centuries. So it is possible that Navarrete, Villalobos and other economic writers of that era were familiar with Ibn Khaldun's ideas and writings.

Looking at Spanish economic history it is clear that, while modern free market economists celebrate the seventeenth century Late Scholastics for their advanced economic insights and contributions to modern economic theory, their advice has been consistently ignored by those who have governed Spain from that period to the present.

Spain was in economic decline in the seventeenth century and despite good advice from the likes of Navarette and Villalobos, the nation's economy has remained relatively poor ever since.

Alas, the same can be said of North Africa and the Arab world where, except for the recent rapid economic growth in a few states rich in oil, that area has also stagnated economically.

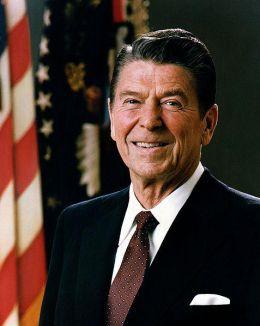

President Ronald Reagan

20th Century Proof of Ibn Khaldun's Tax Cut Theory

However, whenever governments have followed Ibn Khaldun’s advice on taxes, economic growth has surged.

In the United States we have seen this with the tax cuts enacted by the Regan administration in the 1980s, the Kennedy-Johnson administration in the 1960s and the Coolidge administration in the 1920s.

In all three of these twentieth century American examples, where federal income tax rates were cut, the U.S. government saw its revenues from income taxes increase. At the same time, unemployment decreased and working Americans saw their discretionary income increase.

Similar results have occurred in many other nations in recent decades as nations like Ireland, Brazil, New Zealand and India, to name a few, have seen prosperity following tax cuts.

Ample empirical evidence, in the form of government statistics showing increases in tax revenue and economic growth, exists to prove that the tax cutting theories of Ibn Khaldun and others down through the centuries are valid.

1990s Tax Cuts in India Paved Way for Movie Slumdog Millionaire

However, we also have evidence of this in literature and the arts.

While not mentioning tax cuts or economics, viewers of the 2008 movie Slumdog Millionaire got a glimpse of the transformation of the massive slums that dominated the Indian city of Mumbai (formerly Bombay) and other large Indian cities replaced by gleaming high-rise housing in the ten to twelve year period between the start of the movie and its conclusion.

This radical transformation was the result of a major overhaul of the Indian tax system in the 1990s. Taxes were cut and the tax system as a whole was simplified. This led to a major surge in economic growth and improvement in the lives of the Indian people as a whole.

The movie opens with Jamal Malik and his brother living in a shack in a wretched Mumbai slum surrounded by violence and despair. Following the death of their parents, Jamal and his brother find themselves forced to survive on their own as orphans.

SlumDog Millionaire Movie Trailer

Flashing forward ten or twelve years we find, the now 18 year old Jamal living in a decent apartment in a modern high-rise building sitting where the slum in which he was born used to exist.

He also has an office job and a future, even if he doesn’t win the million rupees on the Who Wants to Be a Millionaire? TV show, both of which would have been unthinkable a few years earlier as a young boy in the slums.

This 2008 global hit could not have been made a few decades earlier, before the tax cuts that created the economic growth that made it possible for an eighteen year old kid from the slums to advance the way Jamal advanced. Without this economic transformation there would have been no story line.

U.S. President Calvin Coolidge

Late 20th Century Tax Cuts Reflected in Greeley's Nuala Anne McGrail Mystery Series

A similar transformation in Ireland can be seen in Father Andrew Greeley’s fictional Nuala Anne McGrail mystery novel series published between 1994 and 2009.

In the first novel, Nuala Anne is a poor college student from the impoverished Galway area of Ireland where her parents have a small farm and live in a home with a dirt floor and a thatched roof.

Midway through the series the parents become quite rich following the sale of their impoverished farm during the land and development boom that followed the tax cuts which were a major part of the economic reforms that began in the 1980s in Ireland.

These reforms catapulted Ireland from being the poorest nation in Western Europe to one of the wealthiest within a decade or two.

I doubt that the late Father Greeley, a liberal Democrat and Obama supporter, favored tax cuts or was even aware of the role tax cuts played in the late 20th century Irish economic boom. However, Father Greeley was a frequent traveler to Ireland and the changes he observed as he traveled back and forth to Ireland are reflected in these books.

Political Progressives Prefer Crony Capitalism to Prosperity

While modern liberal politicians and thinkers, whose economic ideas come from progressives and socialists who are close intellectual cousins of progressives, give lip service to economic growth, their policies are basically statist. The objective of these policies is to maintain the status quo and freeze everyone into the economic state into which they were born.

The late William Buckley once commented early in the Kennedy Administration that President Kennedy’s economic policies seemed to be designed to ensure that Joseph P. Kennedy, the President’s father, was the last self-made man in America.

What Buckley was pointing out was the fact that the income tax with its progressively increasing rate brackets prevented middle and low income people from accumulating wealth, while the wealthy weren’t affected as they already had their wealth which, unlike income, was not heavily taxed.

Attacking the rich and enacting high taxes on the rich plays well with most middle and lower income voters and wins votes for left of center politicians at election time. However, numerous loopholes in the tax code result in the very wealthy paying little or no taxes.

In the late 1960s or early 1970s we had David Rockefeller Sr., grandson of the oil tycoon John D. Rockefeller and heir to one of the largest fortunes in the U.S., testifying before a Congressional Committee on tax reform during which he said:

You know, gentlemen, that I do not owe any personal income tax. But nevertheless, I send a small check, now and then, to the Internal Revenue Service out of the kindness of my heart.

This was one of the factors that led to the enactment of the alternative minimum tax (AMT). This tax was billed as a way of making the super-rich pay some income taxes despite the numerous loopholes that effectively reduced their tax liability to zero.

The AMT now hits many middle class taxpayers while billionaires, like Warren Buffet and his friend President Obama, brag about paying a lower tax rate than their secretaries.

It is no coincidence that the wealthy not only ignore the attacks by left of center politicians on wealth but tend to be allies and large contributors to left of center political parties because of the economic benefits they enjoy as a result of the crony capitalism practiced by progressive politicians.

High Taxes Lead to Economic Decline and Socialism

The late Austrian born economist and Harvard professor, Joseph Schumpeter (1883 – 1950), predicted that the economic success of the free market could not endure as this economic success would lead to the development of values, especially among intellectuals, that are hostile to entrepreneurship and economic growth.

This will ultimately result in an alliance between large corporate interests, labor groups and politicians moving the nation to socialism by nationalizing the means of production or by simply strangling entrepreneurship and growth with excessive taxes and regulations.

Ibn Khaldun also came to a similar conclusion about economic growth and freedom being destroyed by its success.

In Khaldun’s view, as society becomes wealthier, government expands as the rulers expand their power and wealth at the expense of the rest of society.

This expansion costs money which forces the rulers to begin continually increasing taxes which drains resources away from entrepreneurs and reduces people’s incentive to work causing the economy and the nation to decline. As production and incomes decline the tax base also declines which results in taxes yielding less revenue despite higher rates.

In his classic, The Muqaddimah, Ibn Khaldun writes:

It should be known that at the beginning of the dynasty, taxation yields a large revenue from small assessments. At the end of the dynasty, taxation yields a small revenue from large assessments.

President Barack Obama

If President Obama Had Followed Ibn Khaldun's Advice the Current Depression Would be Behind Us

As we look at our depressed economy, our government leaders might want to ditch the failed policies of John Maynard Keynes which both failed to lead us out of the Roosevelt Depression in the 1930s and have failed for the past five years have condemned our nation to suffer through the ongoing Obama Depression.

Instead of the late John Maynard Keynes, our leaders might want to dust off and read Ibn Khaldun's The Muqaddimah and Pedro Fernandez Navarrete's Conservacion de Monarquias, as for the past 600 years, the economic advice in these books has worked every time it has been tried.