The US Real Estate Market: 2016 & Beyond

On the Path to Recovery

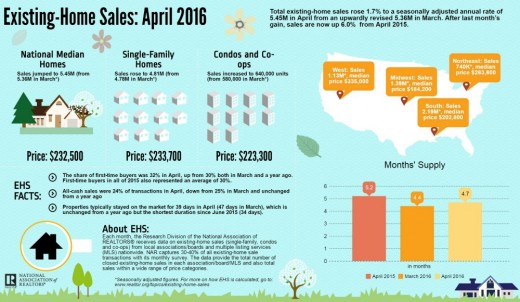

The US real estate market continues on its path to recovery. What this essentially means is that these are good days for real estate companies, as well as homeowners. Certain areas have recovered faster than others. However, the indicators for a broad recovery across the country look strong, whether you look at low unemployment, low interest rates, or low inventory levels. According to the latest figures released by the National Association of Realtors, existing home sales rose 1.7% in April 2016, to 5.45 million, from 5.36 million in March 2016. Existing home sales rose 6% in April 2016 from April 2015.

Lawrence Yun, chief economist at the National Association of Realtors, said, “Primarily driven by a convincing jump in the Midwest, where home prices are most affordable, sales activity overall was at a healthy pace last month as very low mortgage rates and modest seasonal inventory gains encouraged more households to search for and close on a home. Except for in the West — where supply shortages and stark price growth are hampering buyers the most — sales are meaningfully higher than a year ago in much of the country."

Total housing inventory at the end of April increased 9.2% to 2.14 million existing homes available for sale, but was still 3.6% lower than the 2.22 million inventory at the end of 2015. Properties typically stayed on the market for 39 days in April 2016, as compared to 47 days in March, the shortest duration since June 2015. First-time buyers were 32% of the total number of buyers in April 2016, up from 30% in March 2016.

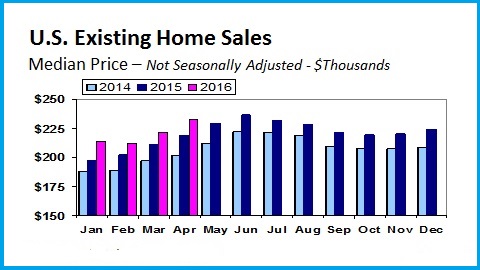

Home Prices Continue to Perform Well

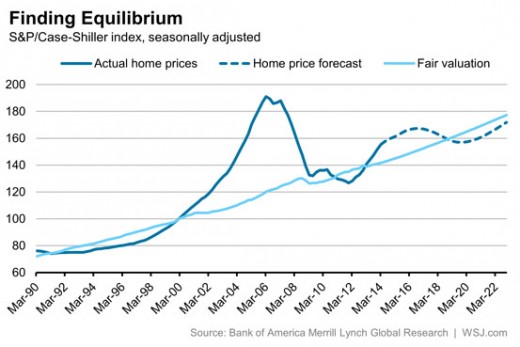

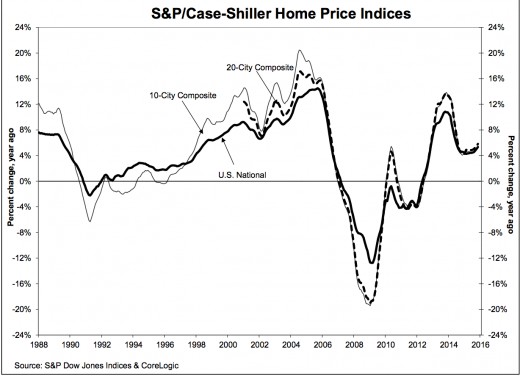

According to the latest figures released by S&P Dow Jones, the S&P/Case-Shiller US National Home Price Index, covering all the nine US census divisions, recorded a 5.3% annual gain in February 2016, the same as in the previous month. The 10-City Composite increased 4.6% in February 2016 from a year ago, compared to 5.0% in the previous year. The 20-City Composite’s gain in February 2016 was 5.4% on a year-on-year basis, down from 5.7% in January 2016. Portland, Seattle, and Denver reported the highest year-over-year gains among the 20 cities. ”Home prices continue to rise twice as fast as inflation, but the pace is easing off in the most recent numbers,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. He added, “Mortgage defaults are an important measure of the health of the housing market.

Memories of the financial crisis are dominated by rising defaults as much as by falling home prices. Today as well, the mortgage default rate continues to mirror the path of home prices. Currently, the default rate on first mortgages is about three-quarters of 1%, a touch lower than in 2004. Moreover, the figure has drifted down in the last two years. While financing is not an issue for home buyers, rising prices are a concern in many parts of the country.”

Regional Differences in the US Housing Market

According to an article on TheStreet.com, the housing markets in the US West and Midwest are doing very well. San Francisco-Oakland, Vallejo-Fairfield, and San-Jose-Sunnyvale in California take up three of the top five spots on the Hottest Markets Index, with Denver, Colorado and Fort Worth, Texas taking up the remaining two places in the top five. High demand and low inventory are the leading causes for these markets to be so popular, according to experts at Donnelly Real Estate.

The warm weather of California is another reason why the real estate industry is booming in this state. Some even contemplate that many are relocating to Denver due to the legalization of marijuana.

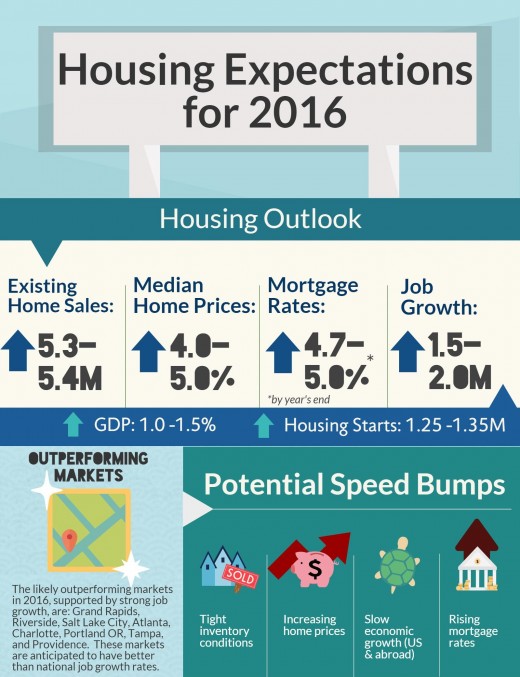

The Recovery is Not Likely to End Soon

According to an article on Business Insider, the increase in hourly wage earnings and the continued low unemployment rate will continue to boost the housing market. While the Federal Reserve does plan to raise the benchmark Fed Funds target rate, interest rates remain low enough to keep housing affordable. So, there is good news all around. This could be a good time to both buy and sell homes, given that although prices are on the rise, they are still affordable.