6 Steps Toward Successful Personal Financial Planning

steps for personal financial planning

Financial planning is all about how you manage your financial situation and get in control of them. At different stage of our life, financial planning will become more prudent. It is a misconception that only rich people should do financial planning. Instead everyone should do a proper financial planning in order to ensure a better life ahead. The other misconception about financial planning is that you need to have minimum amount of money, then only you can do a proper planning. Unfortunately, they are the group of people that will be very hesitated to take the next step. It is clearly that they might not understand well the financial process. Thus, I wish to share 6 simple steps to achieve successful financial planning.

1.) Define your financial goals

The most vital step in successful personal financial planning is defining your financial goal. Knowing your goal will drive you toward strategizing the proper plan to achieve them. A well defined financial goal should have below criteria:

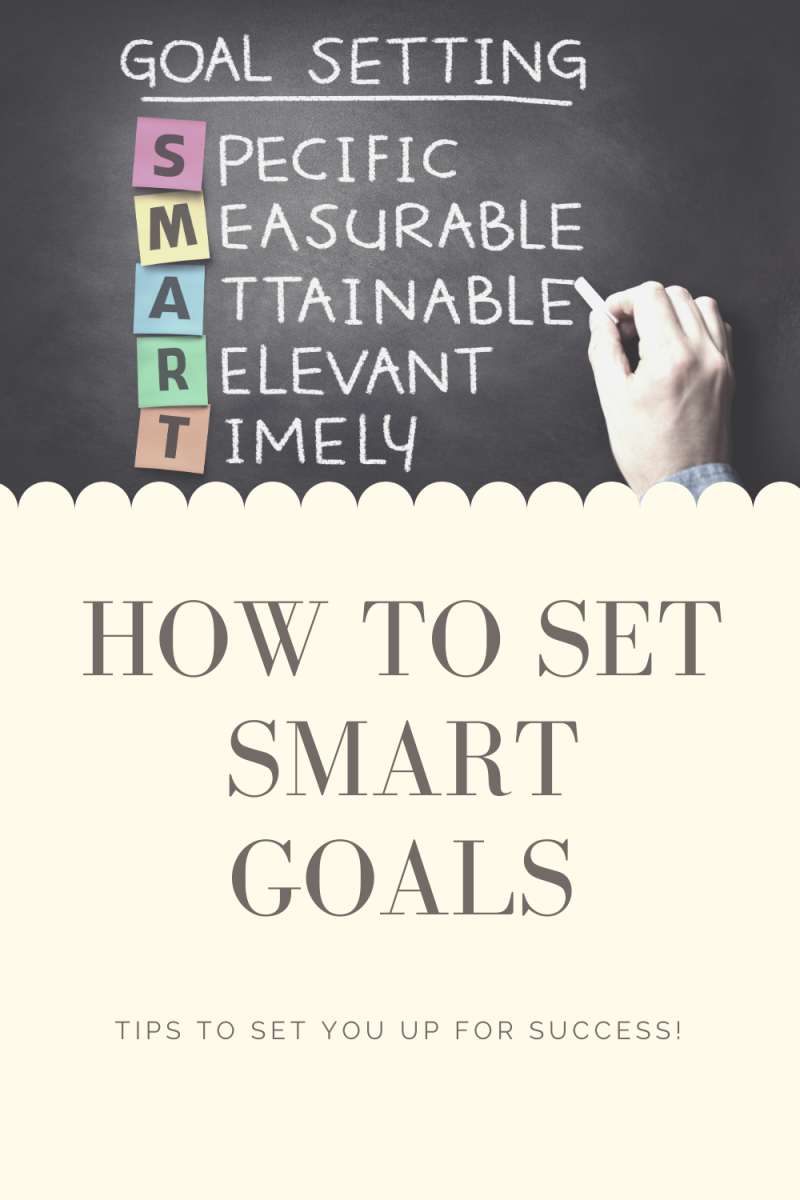

a.) Set a SMART goal.

S – Specific

M – Measurable

A – Achievable

R – Realistic

T – Timely

b.) Should cover minimum short term and long term. Personally, I felt that mid-term is an interim goal which is nice to have.

c.) Set priority on each goal

At different stage of our life, we have different needs, thus different goals. A fresh graduate might want to own a car within a year or two as his first priority goal. After working for few years, he might want to get marry. Then the priority goal of owning a house might become top of the list. This process will keep on changing when we reached different stage of our life. When setting long term goal, you need to take into consideration money future value due to inflation etc.

2.) Develop financial plan

A goal without strategy is as good as no goal being set. Developing the plan should cover various areas, inclusive tax. The primary plan should be insurance planning. Many people are thinking that the higher the coverage, the better it is for them. Actually the higher insurance coverage will required higher premium. Thus the insurance planning should be suited to you current financial ability to determine what is the optimum insurance plan for you current state. As old Chinese saying, “use money to grow money”. To achieve that, you need to create your own investment planning. There are a lot of tools outside there that can help you develop a proper investment planning that suites your needs. Another area is credit or debts planning. Some debts are good, example payable housing loan while the rest of them are bad for your financial eg misused of credit card. In the event you still not really sure on how to do that, engaging professional financial planner is one of the alternative.

3.) 1,2,3, action

After developing the best plan which you felt is the most suitable for your current circumstances, it is time to take action to follow the plan. This is the hardest part of all where sustainability of ensuring yourself to follow the plan required huge perseverance. The plan that involved family would be required much more work in the sense that every family members will play a role in order to ensure the success of implementing the plan. There is a very high tendency that you might want to change the plan due to unforeseen circumstances. Thus you need to be very firm in altering the plan. Some people would be engaging professional service to ensure them of following exact plan. Nevertheless, that would come with some cost.

4.) Monitor progress

All progress of the planning should be monitored and controlled well in order to ensure success. There are 3 major items that required closely monitoring. The three major items are expenses, income and also deficit. To assist in monitoring all these 3 items, an excel sheet to record all these information is a must. These kind of expense-incoming monitoring excel actually can be downloadable from web for free. Personally, I’m also using this method to let me understand more on what where is my major expenses and how I could manage them well in next month.

5.) Evaluate the outcome

After going through all the hassle, you still need to evaluate whether how well you are following the plan. A balance sheet should be prepared in order to give you overview of how well you are doing. A good balance sheet should cover all liabilities, assets and investment which eventually will give you a net worth. This information will be the best gauge on whether how healthy is your financial status. Some people performed the evaluation annually, but I would suggest performing the evaluation half yearly in order for you to act for rectification if required for next second half of the year.

6.) Review goals

At the end of each year, a review of goal should be performed. This is a total review whereby all the outcomes will be gauged versus the actual goal. Any goal which is not realistic or required revision should be revisited and rectified for upcoming year planning. Do involve all the family members in order to let them understand how well they performed and discuss openly on ways to improve them.

As conclusion, financial planning is just required 6 steps to make it happened. Though it is easier said than done, still the keyword is perseverance. It is also never too early to do the financial planning. So start as early as possible.