How To Trade Shares – The Power Of Waves - Movement Of Stock Prices

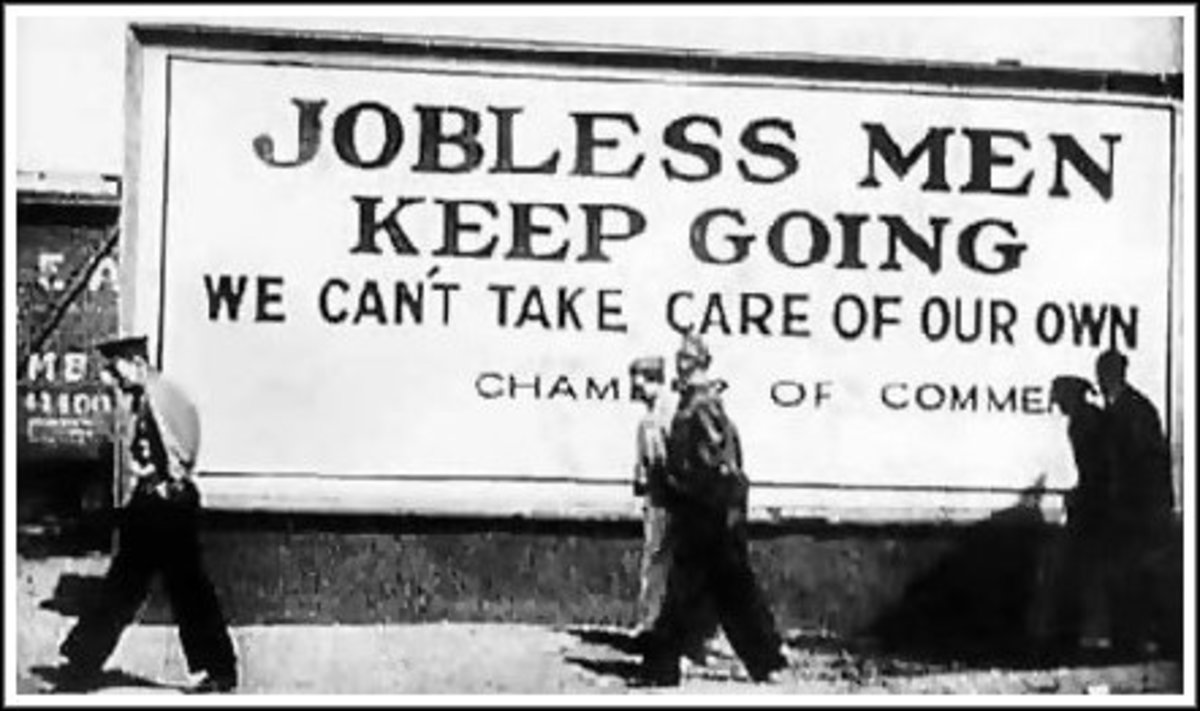

Constructive and Destructive Waves

Like a Bouncing Tennis Ball

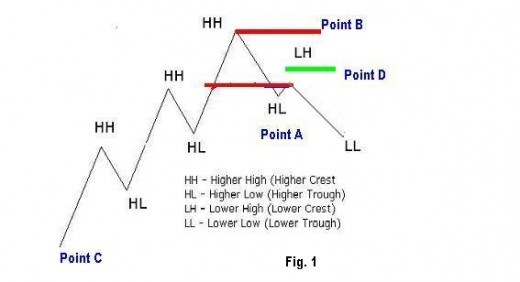

Like a bouncing tennis ball, a lower bounce than the previous bounce means the ball is coming to a halt. In the stock market, another secret of stock trading tips is that strength is quantified by series of crests where each crest exceeds the highest point of the previous crest and weakness by series of troughs where each trough goes lower than the lowest point of the previous trough.

Wave interference is the phenomenon which occurs when two waves meet while traveling along the same medium. If two crests meet up with one another the resultant net effect is of enhanced crest. This interference is known as constructive interference. If a crest and a trough meet up with one another the two pulses will try to cancel each other's effect and the resultant net effect will tend toward zero or the equilibrium position. This interference is known as destructive interference. Ever wondered why carpenters saw the wood in the directions of the grains rather than up against the grains? - The bundles are sliced clearly leaving a smooth surface with minimum defects.

The motion of a pendulum or the motion of a child on a see-saw is a wavelike phenomenon. A wave has a crest and trough and travels from one location to another. One crest is often followed by a second crest which is followed by a third crest and so on and so forth. Every crest is separated by a trough to create an alternating pattern of crest and troughs.

For the stock price to move it must vibrate. These vibrations are waves that are repetitive in form but are not necessarily repetitive in time, amplitude and neither is the axis fixed. Since these vibrations are of such complex nature and determined by ever changing real time news, economic growth reports, manipulation, fear and greed, it is therefore difficult to solve the wave's equation as we would in the science of Physics and Mathematics without imposing sizeable assumptions. And because our brains are lazy, to proceed we make this assumption: that the movement of stock market price, which is a vibration of waves that are repetitive in time and amplitude, is linear (even though we know very well it is not linear). Having made that assumption we now can proceed and use our basic understanding of Physics and Mathematics, and as you will see we shall beat everyone else hands down.

If you have liked this article, and you would want this page to keep up and improved, you can help in any way you can. A free way to help would be to link back to this webpage from your web page, blog, or discussion forums.

The Author’s page is designed to help beginners and average readers make some money as an extra income to supplement what they may be earning elsewhere - details of which you can find in My Page, if you will.