Saving Money. Advice on how to help teenagers save money.

Another hub on this issue

- HubMob of Personal Finance Parenting Advice

There's tons for adults and kids in this personal finance parenting advice HubMob. This hub is full of helpful tips on personal finance and parenting. Come on in and get some practical how-to's.

Saving Money learning to save money is a habit. Like any habit repetition of positive behaviour is essential.

The best way anyone can learn is early as possible.

In this case the teenagers want to learn what your teaching. Now the best way for this to happen is by your good example.

Teenager's and others see the value In what your doing then they will want to do it and will emulate you. In other words practice what you preach.

Now you say no not my teenagers. There will do the opposite. Well teenagers can be rebellious; As so can we adults and difficult to deal with . If teenagers or children see a hint of hypocrisy then they will be right onto it...

Just for the record my grandparents were good savers!

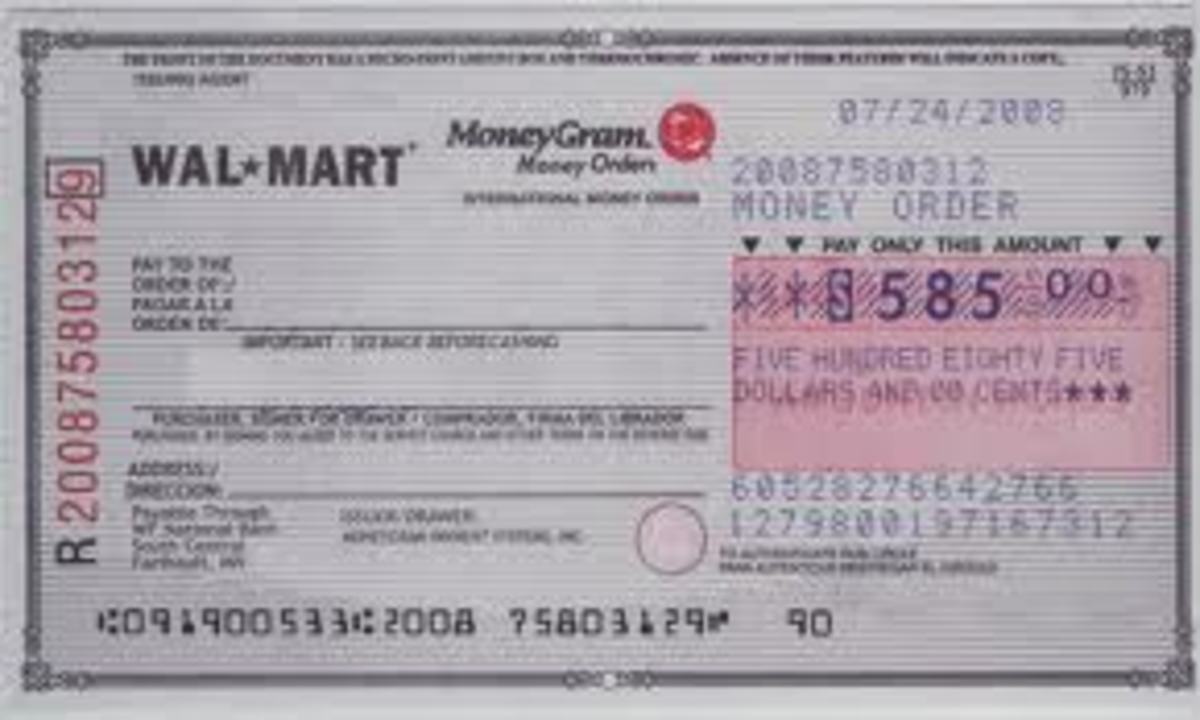

While we are talking about records here are some good tips on keeping good financial records

My mother wasn't she was a Spendthrift ! my father a Miser so you can see the trouble I had in the whole scheme of things. I tended and still do to naturally alternate between one of the other. Even though I was not taught money skills per-see I adopted the ones I knew the ones my parents inadvertently passed onto me. Now since becoming an 'Adult' I have had good binges of saving and then binges of spending. I have though at various times educated myself more and more on finance. In the capitalist system that we have one has to otherwise there is a good chance with a bit of bad luck you can quickly end up living on the street. If you get my drift..

My actual advice to parents of teenagers would be to provide learning material. Create a household budget for yourself. Set up a money journal. Make it a positive fun thing..Show your children where the money goes on a weekly basis. Have weekly house meeting's and give a prize who can come up with the best money saving idea....Also one needs to value what one has. Its no use having lots of things if you don't value them. Nature tends to work against those attitudes and you can end up losing what you have got.

That's all for now.