Auto Loans, Rates And What They Mean

Borrowing money and getting loans is one of the main ways that many people can afford to make some of the largest purchases that they make during their lives. One of these larger purchases is probably one of the most important things that you own (or want to own) right now -- a car. As we all know all too well, owning a car, although very important, isn't very cheap and it seems that cars are only getting more and more expensive as time goes on. Since most of us can't exactly afford to lay out the cash for our next car purchase, thankfully there's a way for all of us to somehow afford it and that way is by getting an auto loan.

Auto loans are nothing new but if you're getting one for the first time they can be be a little confusing. One of the most crucial (and confusing) parts of an auto loan, at least in my mind, are the auto loan rates of interest and more specifically how they affect how much your monthly payment will be and how long you should expect to be paying it off for. It's also good to fully understand the method of repaying your loan, otherwise know as amortization, once you get locked into an interest rate once you sign on the dotted line. I'll also explain this amortization process and tell you where you can find more information about your state's current interest rates and calculators to help you get a good estimation of what your monthly payments might be.

Overview Of Auto Loan Interest Rates

When it comes to auto loans, probably the most overused term that you hear over and over on TV commercials, billboard and signs outside of car lots is APR, or annual percentage rate. The APR is basically the auto loan rate that you're willing to pay in interest over the duration of your loan so that you can have the privilege of getting the money that you're borrowing. So basically, you could say that APR, or your auto loan rate of interest, is the cost to you of borrowing money.

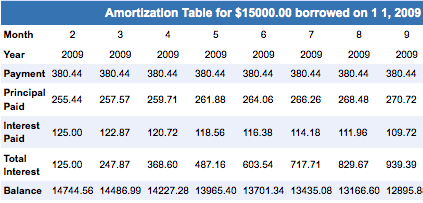

When your APR is calculated the percentage is calculated over the entire lifetime of your loan and the longer that your loan duration is, the higher your interest rate will be. Also, as I mentioned before, something that you should also become familiar with is how amortization works and how it affects how much your paying towards your principal vs. paying interest each month. Be sure to keep paying attention because I'll explain all of this amortization stuff next.

Loan Amortization And What It Means

Even though I had heard of the term amortization, I honeslty didn't really know what it meant until I looked it up on the Internet a little while ago. I had rushed through my car loans and mortgage loans so quickly (I had help with them) that I never really had to understand what affect it had on my loans. Thankfully I had other people that were with me that knew what they were doing or I could have really gotten myself into a bad deal. Now that I know exactly what amortization means and how it will influence what you're paying each month for your loan I wanted to explain it so that people like you can now understand it, too.

Amortization is defined as the elimination of liability for a lender over a specific amount of time though regular payments. In other words, it's your lender's way to get more of their interest (liability) up front so that they can have most of their money back quickly. This means that as you begin to make your payments, say of $500 each month, most of that money is being put towards interest in the first several months of your loan and not much is going towards paying off your principal, which is what you originally borrowed. As you continue to make payments the amount of interest that you pay each month goes down and the amount of principal that you pay goes up and when your contract is up you will have paid off your principal as well as the amount of the auto loan rate of interest you were given.

The image below shows you the beginning of a loan and how the amortization schedule works.

Where To Find Current Loan Rates

Of all the places that I've seen to find and calculate various auto loan's rates and availability I would say that BankRate.com is probably the best place for you to go. Below are a couple of specific links that can help you find the latest competitive interest rates for where you live and for how to calculate some auto financing (and car loan refinancing) payments that you can expect to pay once you get locked into a contract.

- Auto Loans and Auto Loan Rates

Auto Loans and Auto Loan Rates for all 50 states. Comprehensive. Objective and Free from Bankrate.com - Auto Loan Calculator, Car Loan Payment Calculator

Auto finance calculator for car loan paymentsr: This auto loan calculator figures monthly payments and shows impacts on an amortization table schedule. - Refinance Car Loan Calculator

Access to quick and easy refinance car loan calculators that will help you make your refinancing decision easy.

Need A Bad Credit Car Loan?

One last thing that I wanted to mention was that if you are looking for auto loan interest rates and you don't have great credit, there are still plenty of options for you to get the money that you need. You can check out my Refinance Car Loan - Bad Credit article and it should help get you pointed in the right direction.