Raising Capital-Types and Shares

Stock markets around the world help companies to raise capital through the issue of stocks and shares to interested investors. Some share issues are private offerings while others are public offerings. In this article we will look at the differences between the two and also at the shareholders rights.Each market in the world is slightly different in the way that stocks (American term for share) and shares (UK term for Stock), are issued. However there are many commonalities. Below are the commonalities.

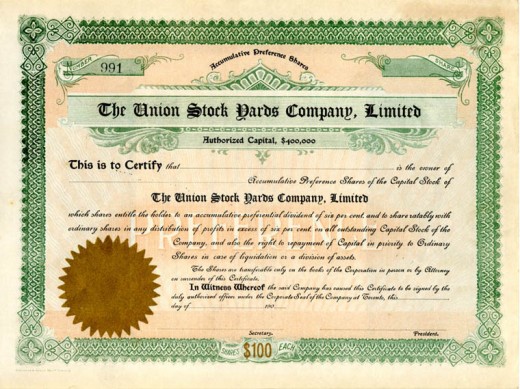

Preferred Shares tend to be a safer investment. They receive a precedence position in the distribution of assets if a company closes. Dividends are also paid to preferred stock holders before common stock holders; however dividend amounts are often limited by the specific terms of the issue. Voting rights for preferred stockholders vary depending on the country and terms of the specific issue.

Ordinary, or Common Shares take a lower precedence in dividend disbursement and disbursement of assets should the company be liquidated. However, if profits are high, dividends may be very high. Voting rights are included in Ordinary Stocks. Issues of Ordinary and Preferred shares are priced separately.

Companies issue common stock in return for consideration, generally, money. A common stock certificate is a contract between a company and its shareholders. A shareholder's rights and obligations are governed by the various corporate laws and regulations in the country of incorporation, the articles of incorporation, the bylaws of the corporation, and the stock contract.

Shareholders Rights

Residual interest in corporate assets

Because the stockholder has a residual interest in corporate assets, common stock is often characterized as the “first issued and last retired.” Common shareholders have a residual claim to earnings and assets in the event of bankruptcy or dissolution.

Preemptive rights

The right to maintain their pro-rata interest in the corporation. In simple terms, their proportion of the company the investor owns must remain the same.

Right to vote and receive dividends

The common stockholder has a right to vote on everything the company does including issuing shares, but not a right to a dividend. Some companies issue different classes of shares with different rights and privileges, for example, different voting and dividend rights.

Raising Money Through Share Issues

Companies usually issue shares to raise working capital from the public for start-up or expansion purposes.

There are mainly two types of share issue. The most common type is a public offering where shares are distributed to the market. The second type is the private placement method where the shares are offered to specific buyers.

A cheaper way of raising new capital than a public offering is the private placement. As the name implies, no public market is involved, and, consequently, no full disclosure to the SEC in the United States is required. Shares are placed with a few selective companies or individuals. In the UK a private placement is called a placement and as in the U.S., this method is a more discreet way of raising new capital.

Private placements are also arranged by investment banks. In this case they act in an agency capacity, and are not required to purchase any unsold shares. Their role is essentially to bring the issuer together with a select band of investors.

To improve liquidity in the private placement market in the U.S., in 1990, the SEC abolished a rule which had required that buyers of securities should hold them for at least two years.

The usual buyers of private placements are life insurance companies, some financial institutions and sophisticated individual investors. Buyers often find these transactions attractive because issues can be tailored to fit the buyer’s specific needs. These transactions are common in many countries.

Public Offerings

A public offering is quite different from a private one. The actual structure of the offering depends to a large extent on the country where the transactions are to take place. Generally, stock offerings directly from a company are somewhat different from stock trades between individual investors. Stock from a company is purchased in the primary market. Stocks purchased from other investors are purchased in the secondary market. The secondary market is far more active than the primary. Stocks purchased in the primary market quickly make their way to the secondary market, where they are traded between investors.

Investment Banks

n the U.S., as in most markets around the globe, corporations wishing to issue equity securities will use an investment bank. It is typical for an issuer to hear presentations from several competing investment bankers before selecting the bank to manage the offering. The investment bank chosen would work with the management team of the company to decide how much money is to be raised and what type of security is the best, given the market conditions at the time of issue. By contracting with theinvestment bank to purchase the issue at a certain price, the issuer is assured of the required funds and can begin plans to deploy the new capital.

If an investment bank agrees to buy shares from an issuer at a price of $10 ½ per share then at what price do you think the investment bank should price the issue to the public?

A) $9 ½

B) $9 5/8

C) $10 5/8

D) $10 ¾

E) $11

The pricing of the issue would depend on the market conditions at the time. Of course the price should at a minimum be slightly higher than the price paid to the issuer. So you are probably correct in thinking that $10 5/8 would be a good price.

Once the investment banker and the issuer have decided on the amount of money to raise and the type of security to issue, council for both parties prepare and file the relevant documents to satisfy the various laws and regulations governing the sale.

With this out of the way the managing underwriter begins to form a syndicate of investment banks to distribute the issue in an orderly way, and to spread the risk, in case of an adverse downturn in the market.

The lead manager’s responsibility is to assemble a syndicate that will successfully distribute the issue in a manner which satisfies the issuer. The manager would take the largest share in the offering and progressively decreasing amounts would be allocated to other members of the syndicate.

A list, which is called a Tombstone, is published in the national press of the United States and in the UK. This shows the lead manager and the syndicate members plus the amount of the issue. Every year a top twenty ladder is published which shows who have been the most successful lead managers.

Issue Pricing Derived From

· the company’s earnings record

· anticipated dividend payments

· number of shares being offered

· price/earnings ratio compared to like companies

· current market sentiment

Determining the price of a new issue is as much an art as a science. Because of the volatility of the market, what may seem an attractive price on the morning of the offer may not be so attractive when the syndicate members call their customers for firm orders? The lead manager has to balance the wish for the maximum possible proceeds with the need to price at the most salable level.

Pricing is determined by a number of factors as shown here. If the lead manager gets it wrong then severe losses may be incurred by the lead manager and the syndicate members.

Fees

Compensation to the lead manager and the syndicate members is in the form of the spread between the price paid to the issuer and the price offered to the public, and the commission fee paid to the lead manager by the issuer. If the sale is risky the underwriter will try to demand greater compensation for the increased risk.