CHASE Bank Account Hacked: Banking Fraud

Taking Precautions to Prevent Chase Bank Fraud

There's one main thing you can do, immediately to take preventative measures - SIGN UP FOR TEXT MESSAGE ALERTS. I have alerts set for everything - my alerts are sent immediately to my cell phone via Text Message; I know when any payment is withdrawn, when any check clears and even when AN ODD WITHDRAWAL is attempted - and these alerts saved me in major ways.

Of course, if you are reading this article because you believe you have already been hacked, you will want to IMMEDIATELY cancel your card. A new card, through CHASE, should be free and sent to you in 5 to 7 business days. Of course, in the meantime you can still withdraw or deposit money into the bank itself during normal business hours, so you are not completely "blocked" from your account.

REAL CREDIT CARD FRAUD OR A SCAM?

I NEVER, NEVER, EVER log onto Chase through emails. If I ever choose to login I go directly to their banking website. I also have a Security Question in place, which provides me an additional level of protection.

If you have gotten any form of email asking you to login and verify / update / change passwords or any other information, DO NOT DO IT. Instead, log directly in through the CHASE website. If there is any form of issue with your account, it will specify such.

SECOND, be VERY cautious of FAKE / SCAM "telemarketer" calls from your "bank" - there are many red flags of this -

1. Broken English

2. Random Calls which ask YOU to verify information. There is NO information the bank should ever ask for besides the verification of your name. The bank will NEVER ask you for your card number, expiration date, CVC code, social security number, address, postal code, account number nor routing number - keep in mind that CHASE BANK can see all of this information on their end!

3. Blocked calls / No Number Available - CHASE bank calls from a non-blocked number.

4. If you have ANY suspicion of the call being a fraud, or even if you just got off the phone with someone and are now a skeptic, contact CHASE directly - phone is my #1 suggestion if you feel you may have been duped - (1-877-242-7372).

How My CHASE Bank Theft Was Caught

MAY 10th, 2013: The whole situation was like a dream - I woke up early to a text message from CHASE that asked if I had just made a $2 purchase at a Sports Shop in Arizona. Mind you, I do order items online and I have used this business card to pay for purchases relating to my business...however, at this time I was very ill and had been in bed for two days. Equally, I do not have anyone else on this account, nor do I purchase sporting goods (let alone in a $2 amount). I immediately replied to the message stating the purchase was not authorized.

I, literally, immediately got a phone call from CHASE. Not only were they able to look up the transaction but also provide me with the location of the purchase, the merchants (seller / stores) identification number, time of attempted purchase and more.

They then asked if I wished to cancel this card and they would immediately reship a new card to the address they have on file.

THE FOLLOWING DAY:

Another of my CHASE accounts was attacked. What was exceptionally odd was this account was actually my personal account, which I DO NOT, and NEVER HAVE USED (as shown by proof of statements). This account does not require any form of activity - it was "free" with one of my business accounts from years ago. I do not even need to use the debit card for any reason; back when i got this account, there was no requirement for "minimum account usage" and such. So anyway, I got a text message stating that this account was used to purchase everything from airline tickets to gaming goods - of course, since this account has never been "active" this was a major Red Flag

BUT the main thing here is this -

How Payment Processing Works / Merchant Accounts

All we need to do, as a CHASE member is simply "swipe your card". for security purposes (as of 5-17-2013) we are required to type in the last four digits of your card number - this is for your security; it ensures that the information in the strip on the card matches the actual card. We DO NOT need to enter your address, CVC code or other information.

After we "swipe your card", you sign one slip (so we can prove you made the purchase) and you are then given a copy of your transaction along with your receipt.

The data is NEVER "screened" / "viewed" by anyone who works at the establishment. This data goes directly from your card, to our swipe machine, to the bank we use. We do not even have a way to "view" card numbers or anything of the sort.

HOW DOES CHASE CATCH CARD FRAUD?

In my case, thankfully, not only did I register for text message alerts, but CHASE is also VERY, VERY on top of potential scams, which include MANUAL KEYED entries. A Manual Key Entry in when a card is not present or cannot be "swiped", which means the store / retailer has to use their machine and actually "type in" the data from the card (see photo below):

As a merchant (seller), instead of using the swipe, you can manually enter the credit card information. But the manual entry triggers a potential FRAUD ALERT through CHASE bank.

When resisted for their ALERTS, you will get a text the moment a manual credit card entry is entered. This allows you to either APPROVE of DENY the charge. In my case, I denied charges and not a penny was ever taken from my account(s).

WHAT HAPPENS AFTER BANK FRAUD?

Based on this article, you should be able to determine if you have been REALLY defrauded or someone spammed you and tricked you into fraud.

Either way:

1. Call CHASE (number and website was previously provided, or go to Chase.com then "Contact US"

2. If you HAVE your card on you, your card was likely NOT "stolen" (unless you have odd circumstances, such as a roommate, child or spouse that could have taken it, used it and replaced it into your wallet). If you do not fall into "odd circumstances", then it is most likely your card number was somehow obtained. REMEMBER: Your CARD NUMBER IS NOT YOUR BANK ACCOUNT NUMBER. There is no reason to "close your bank account" if your card number was stolen. All you need to do is:

3. Cancel the card through CHASE right away and report any activity you are unsure of. As mentioned, your new card will arrive promptly. ***TAKE INTO CONSIDERATION: when canceling a card, all auto-bill payments you have through this card WILL BOUNCE. So be sure to log onto CHASE right away (through Chase.com) and see what is debited directly from your card then contact the companies in question right away. If you are awaiting a new card to be sent, offer to pay your bill using your direct bank account routing number and account number or request an extension and note the fraud, including employee names of the reps you have spoken to at CHASE.

4. Examine your bank account statements through the CHASE website. Look for any prior activity that may be explainable.

5. Contact via phone, or go into, your nearest CHASE location and address all of the above issues - EVEN IF they have already been addressed. Again, be sure to get business cards, employee name and / or employee ID numbers of everyone you speak to for your records. Although no charges were ever removed from my account(s), it took two calls to cancel the first card and only one call to cancel the second.

PROTECTING YOUR IDENTITY

Theres a few key things you can do to prevent any further transactions, made against your will:

1. Stay away from using a multitude of cards. For example, if you make a lot of online purchases, stick with one card: it is much easier to cancel one card and try to track the "source" of the "hack" versus using multiple cards.

2. Keep your TEXT ALERT amounts set low. While this can seem like an annoyance, it is well worth it, should anything ever go sideways

3. If you can't figure out how to set up FRAUD ALERT texts, call CHASE using the number provided in this article.

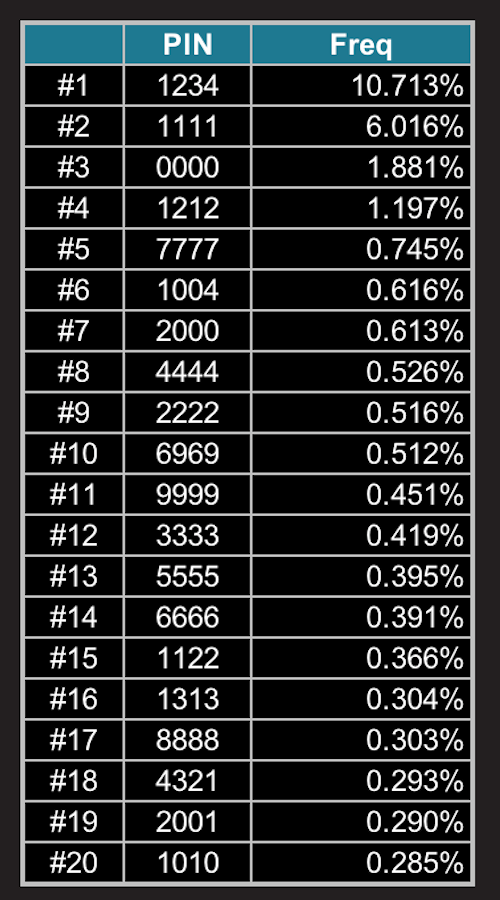

4. Do not use common information as a PIN for debits; See next section -

BAD PIN CODE CHOICES

The worst PIN codes you can select:

Your Birthday (i.e: 4180)

Child's Birthday

Address (i.e: 1475)

Easy Codes: (i.e: 1234, 4567, 7890,1111,2222, 3333 etc)

Check out the list below -

ATM PIN CODE SUGGESTIONS

The best way to make a PIN is to:

1. Invert numbers

2. Use the alphabet to determine numbers. Take each letter of the alphabet and assign it a number with A = 1. Then come up with a 4 letter word you can easily remember.

3. Select a date relevant to your family, such as the day you purchased your home, or the amount you paid for your home a month (i.e: 1250) or even the amount you pay for a bill