American Finance Out of Control Per Warren Buffett's Right-Hand Man

Life in a Financial Bubble

Berkeley trained attorney,

Charlie Munger fears that American finance is off the rails on a crazy train. He laments that investing has become "a vast gambling culture, and people have made it respectable." He laments that Wall Street insiders have received too large of a piece of the pie.

Munger explains that before the first world war perhaps three hundred men owned half of England. They loafed about with nothing to do but gamble.

Economist Thorstein Veblen studied this upper-class productivity problem in the United States. He dubbed this slothful secret society of the richest of the rich the “leisure class.”

Charlie Munger on the The Psychology of Human Misjudgment

How Many is Too Many?

Munger explains that he is a business manager rather than a pure capitalist — who buys and sells pieces of paper and does little else. A big part of his business is controversial among academics. The portfolio allocation strategy he uses goes directly against Wall Street and ivory tower convention.

Here are four realistic stock portfolio allocation strategies. Investors can assemble a,

- 500 stock portfolio such as the The Vanguard 500 Index Fund.

- 10 Stock Portfolio such as that of Mohnish Pabrai.

- 5 Stock Portfolio such as that of Warren Buffet.

- 3 Stock Portfolio such as that of Charlie Munger.

The first is the simplest and most highly recommended investment per Buffett, Wall Street, and every Ivy League business school finance professor. An Index Fund such as the Vanguard 500 Fund (VFINX) diversifies an investor across 500 of the strongest stocks in the world. This offers a geometric expected return between 9 and 10 percent.

Buffett considers this best for the clear majority of savers. Few taxpayers enjoy the resources to invest in single stocks.

The typical saver is working a full-time job in an area unrelated to investing.

Then he or she must juggle family duties. Few individual salaried retail investors have the time, study, and risk tolerance for single stock investing in concentrated 10, 5, or 3 stock portfolios.

I recently interviewed Mohnish Pabrai at the Raul Julia Theater of the Puerto Rico Museum of Art in San Juan. He explained that he holds ten stocks. He recognized that Warren Buffet and Charlie Munger hold even fewer stocks.

Portfolio Poll

How Many Stocks do you Own?

The Dhando Investor

Mohnish warns that highly concentrated portfolios work for Warren and Charlie because they have such unusually high ability as investors.

The Buffet allocation starts by spreading 80% of capital among 5 stocks. The strongest can consume up to 25% when fully allocated and 1 stock is clearly hot.

Buffet was more aggressive when younger. He invested 40% in American Express in the 1960s.

Charlie Munger prefers to invest in no more than 3 stocks at a time.

Buffett notes that the Munger portfolio is much more volatile. Charlie explains that he decided that he was best off identifying 3 companies with the right characteristics poised to beat the market using academic knowledge, simple algebra, and common sense.

Who Is Burton Malkiel and is He Wrong?!

Munger admits he is right less than half of the time

Warren Buffet garnered 20 percent returns. These returns came from careful analysis and selection that was neither random nor indexed. He picks the 5 best stocks in the market selected by his well-trained independent thinking.

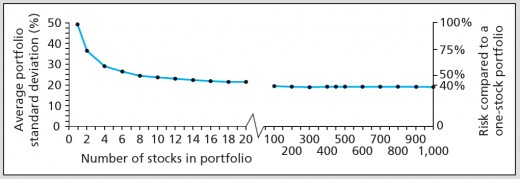

Ten randomly selected stocks represent nearly full diversification per Princeton finance professor Burton Malkiel. This figure from Meir Statman, “How Many Stocks Make a Diversified Portfolio?” shows that a well-diversified portfolio must be randomly assembled with no fewer than 30 stocks.

How Many Stocks in a Diversified Portfolio?

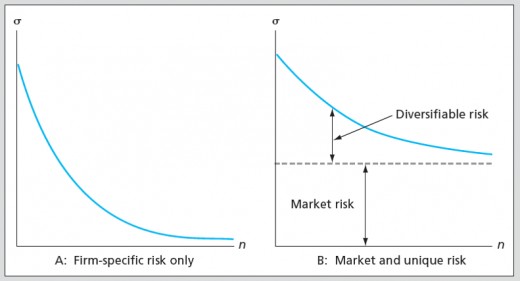

This refutes the Malkiel assertion that the random 10-stock Malkiel portfolio is diversified. The study also shows that the benefits of diversification are greatest when the second and third stocks are added to the portfolio.

This figure shows that the bulk of diversification occurs when the 2nd and 3rd stocks are added to a portfolio.

Mohnish Pabrai doesn’t follow Malkiel either when he carefully selects the 10 best stocks he can find. He applies a focused, non-random approach to asset allocation.

Buffett is willing to focus up to a quarter of his capital on 1 stock. Hence the strategy Mohnish uses is less focused than that of Buffett.

Selections are not random. Warren Buffet invests considerable time identifying the best possible candidates for stocks primed to rise.

Charlie Munger traditionally follows a non-random 3-stock asset allocation paradigm. Such intense focus is common among individual single-stock investors per University of Santa Clara finance professor Meir Statman. Charlie will test positions in up to three of the best stocks he can identify.

Focused results of Buffett, Munger, and Pabrai are atypical. Most single stocks retail investors are crushed by their own bad habit of holding losers and cutting winners per Berkeley Finance professor Terrence O’Dean (1998).

Munger focuses the entire account on a single stock if his analysis is compelling enough. But his risk in the form of potential downside volatility is even higher than that of Buffett or Pabrai.

Your Volatility-Return Trade-off

Few investors have the temperament to stomach volatility the way Warren Buffett and Charlie Munger can.

There is a big difference in the volatility of account returns between 3, 10, or 500 stock portfolios. Finance professor Mier Statman shows that the volatility of returns increases (decreases) with fewer (more) stocks.

Notice how volatility is lowest (highest) on the vertical axis when the number of stocks (n) is lowest (highest).

Munger has a steel-plated stomach. His 3-stock portfolio dishes up the highest volatility — and potential.

An index fund offers the least volatility. But diversification cuts away any possibility of extreme payoffs as returns are forced to the mean.

There is another interesting parallel. It is no surprise that John Maynard Keynes, Nicolas Darvas, Benjamin Graham, Warren Buffett, and Charlie Munger all seek high returns from focused 10, 5, or 3 stock portfolios.

Trading Around a Diversified Core

Trading around a diversified core allows us to enjoy lower volatility over the bulk of our retirement portfolio through employer sponsored plans. Then we can shoot for the moon in our self-directed retirement accounts in single stocks, corporate bonds, and call options.

This allows us to leave the door open for potential lifestyle changing gains while smoothing the ride with diversification.

Trading around the core entails mixing the diversified index strategy with the Munger 3 stock portfolio. The perfect core portfolios are employer sponsored 401(k) plans invested in the lowest cost, least turnover stock index fund.

Save up to the matching in these accounts.

Savings above the matching are contributed to self-directed retirement plans. The Solo and Roth 401(k) plans have very high contribution limits. Per the IRS, “Elective deferrals up to 100% of compensation (“earned income” in the case of a self-employed individual) up to the annual contribution limit: $18,000 in 2016 and 2017, or $24,000 in 2016 and 2017 if age 50 or over; plus.”

A Roth 401(k) is the best investment vehicle to save up wealth. Some self-employed taxpayers hesitate in opening an account because of required minimum distribution (RMD) rules. Savers in their seventies face annual forced Roth 401(k) withdrawals.

Don’t fret.

An easy fix is to roll the Roth 401(k) into a Roth IRA which does not have any RMD restrictions. That is why it is important to start a Roth IRA today.

Then set up a profitable side business as an LLC that files as a Sub-Chapter S Corporation. Don’t hire anybody but you and your spouse.

If your business grows to where you must hire salaried non-spousal employees don’t use the same LLC that domiciles your Roth and Solo 401(k) plans. Do so through a second LLC or C-Corp filing as a Sub-Chapter S Corporation.

This allows you to set up a solo and a Roth 401(k) plan for just you and your spouse. Set up both the Solo 401(k) and the Roth 401(k) at the same time.

References

Terrance Odean. 1998. “Are Investors Reluctant to Realize Their Losses?” Journal of Finance 53 (5). 1775-1798.

Meir Statman. 1987. “How Many Stocks Make a Diversified Portfolio?” Journal of Financial and Quantitative Analysis 22 (3). 353-363.