Practical Cost-Saving Tips for the Senior Lifestyle

Will you Have Enough Retirement Income?

Author Lilian Jackson Braun worked from the ages of 17 to 97 (in 2010), writing with a thick pencil on legal pads and shunning electronic technology. How many of us will be able to do any of that past retirement age?

Producing one or two Cat Who mysteries per year since the mid-1980s at a goodly income, Lilian did not likely worry about or rely upon a monthly Social Security check. However, most of us in America do so in our older years.

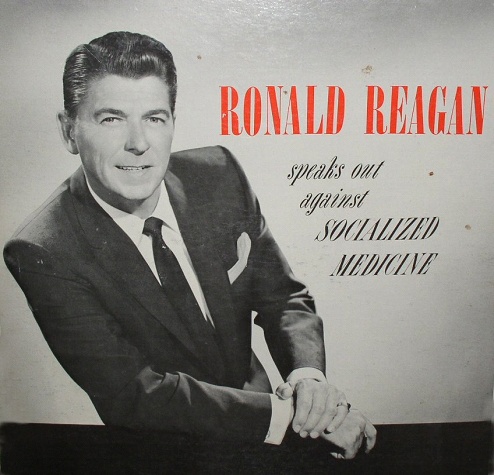

Several changes were made in Social Security Retirement regulations for 2011, but most Americans will not need to work to age 97 to collect full benefits. They may need to work until age 75, however, suggested by legislation handled by Reagan Administration (1981-1989). Professors taught about his in Preventive Medicine and Microeconomic Courses in the OSU Department of Medicine in Ohio during the later 1990s.

Increasing Retirement Ages

Generations coming to retirement age after the Boomer Generation will find themselves required to work to older ages in order to retire with full and partial SS benefits. The second half of the Boomers are already experiencing increased age requirements.

Some individuals have been notified already that age 70 is the age for receiving full benefits. The related goal of our nation is to retire Americans at age 75, with Millennials and younger generations receiving gradually older ages for retirement benefits. Lilian Jackson Braun made that a moot point by working to age 97, but some other changes likely make her shake her head today.

At the same time that retirement ages are increasing for each successive generation, many older workers today are being downsized or experiencing cuts in weekly work hours and pay between ages 40 and 55. This places them in precarious earning jeopardy and many have been unable to return to work at all after layoffs during the Recession of 2008 - 2010.

High school and college graduates in the 2010s need to carefully plan their careers and investments to provide for middle- and older age. They can benefit from a determined effort to devise some sort of passive income stream(s) long term in addition to their well-planned careers.

Lilian's First Cat Who

Long-Term Unemployment Among Seniors

Given the number of long-term unemployed I have encountered among individuals 40 through 60, I would like to advise younger workers to secure enough investments and retirement income by age 50 to maintain themselves until age 90 or 100.

This sounds drastic and unrealistic. However, in the face of layoffs between ages 40 - 55 and retirement far off at 75, what is to be done in the 20 or 30 gap years? In 2010 - 2011, we have experienced 12-14 million unemployed workers, with half this number or less of advertised job postings (with a few more in the hidden job market). New industries and jobs are emerging through the sustainability and green businesses movement and through privatized space travel (commercial and tourist). However, this expansion of jobs may not double the number of available job listings, which is needed in early 2011.

Consistent income and a reasonable budget that can be maintained in middle age and retirement are necessary goals for the generations retiring from 2010 - 2050.

Some Answers

We cannot all work 80 years, as did Lilian Jackson Braun.

One answer to the income gap between layoff or downsizing and Social Security Retirement income is to cut daily costs. This is easier if, in early working years, we can be determined not to be led into conspicuous consumerism and unreasonable levels of credit card debt, mortgages, and student loans and their interest rates. If this lifstyle has become a habit, then reducing and keeping costs lower during senior years will be simpler.

Several senior citizens has reported useful ways of reducing costs. Some of this advice includes:

- Stay Healthy - Aging includes susceptibility to the "diseases of aging", but planning to be healthy and following health, nutrition, and exercise practices proven to be effective can reduce many health related costs.

- Purchase Used Instead of New Automobiles - I first heard 30 years ago that depreciation is enormous in the first year of car ownership and that it is wise to wait until the 4th quarter of the year and purchase the new autos that have not yet sold. They will be discounted in price. Some buyers wait until January and purchase them at a larger discount.

- Mass Transit - As drivers age and mass transit increases in quality and expanse, some drivers sell their autos and take the bus or light rail. In some cities, transportation fares for senior citizens are greatly reduced and in a few cities and towns, transportation is free. Senior centers in some towns offer free van transportation for shopping and entertainment outings to those aged 50 or 55 and over.

- Senior Discounts - Discounts and free items and services for senior citizens are offered by various businesses, but not always advertized by a sign in the estabishment. Don't hesitate to ask if a senior discount is offered at restaurants, coffee shops, movies, airlines, and many others. As an alternative, review the databases of senior discounted and free products and services below.

Senior Discount Directories

- SeniorDiscounts.com - Over 150,000 Discounts for People Over 50 - Deals, Bargains and Savings

SeniorDiscounts.com is an online resource of over 150,000 discounts available to people 50 years and older. SeniorDiscounts is a Member program that provides exclusive senior discounts and is accompanied by the SeniorDiscounts Guide Book, a 580 page - Canadian Discounts for Seniors

Database of Senior Citizens Discounts across Canada in a number of establishments - goods and services.

- Homesharing - Homesharing is a grant supported program in some cities that matches senior citzens with younger people looking for a room to rent and willing to work a bit for a partial discount in rent. This provides companionship, increased safety, and financial help for the senior and an affordable, pleasant living environment for the younger individual. Background checks and a set of interviews are required and supervised by a case management persoin, usually a social worker.

Selected Home Sharing Programs

- HomeSharing, Inc. > Home

HomeSharing, Inc. of Somerset and Hunterdon County - New Jersey - Home Sharing

- Home Sharing | Community Living British Columbia

- Faith Based Repair Services - A Brethren Church in Franklin County OH maintains a men's service group of volunteers that come to the aide of female senior citizens and widows of any age. This is based on scripture that advises us to help the widow(culturally, the original language means to include older single women as well and some local churches include widowers) This group will go into the homes of these women that need repairs completed and do the work that they are equipped to complete for them at no charge -- A number of churches and synagogues supervise youth groups that will help senior citizens in their homes at no charge. Jobs included that would normally cost fees include lawn mowing, snow shoveling, and many other tasks. Seniors can call local faith based organizations and inquire about such services and groups.

- For additional services and tangibles offered to senior citizens at reduced cost or free, contact your local social services hotline number. In Central Ohio, the name of the hotline has been CalVac and FirstLink. If you are unable to locate your hotline, call you city's mayor or city manager's office or what qualifies as your City Hall and ask if there is a social services hotline locally.

Try Writing For Income

One reason I joined HubPages was to write in order to earn a continuing income that might supplement or replace Social Security Retirement if that program should end. Today, long before retirement, I earn over half of my monthly income from HP affiliate programs, contests, etc. You can do as well or better!

A number of members have been offered writing jobs through exposure via their Hubs (articles and stories). Some are writing their own books right now. You may not want to work to age 97, like Lilian Jackson Braun, but you may be able to earn income at HubPages.

© 2011 Patty Inglish MS