Finances, How to Make It Work

Finances; Managing Your Bills

Everyone has problems with their bills; if you can't manage them, you cannot pay them. If at this point this is the case, STOP! Stop right now and help yourself. Help relieve the pain and stress, drop the worry level and give yourself some calm.

Gather your bills together--ALL of them! Put the bills in alphabetical order and make a calendar chart. Write down the total pay that you bring home at the end of the week/month. If you are in the military, and though you get paid monthly, you can still do this same chart.

Say you get paid each Thursday of the month. NO ONE likes getting slammed with large paym'ts on pay day; it makes you feel overwhelmed & weak in the knees.

For each month, across the top of the page write down the dates of the 4 wks that you will be paid. The total cost of each bill is to be divided into 4 (because there are 4 wks in a month)-- (if military, still do this; this is the amount that you will have to put aside each week instead of buying that icecream cone or that toy that your child doesn't need). Try to round off your figures where you can. Don't worry that there are some months that will have 5 wks. These I consider "freebies" & I can use the money if i fall short due to unforeseen events. For expences that vary from week to week/month to month such as fuel & groceries, estimate the largest cost scenario and start there. As for doc app'ts, i write down my largest co-pay (even though I may not visit but every 3 mos) and divide it by 4. If it's not used, you'll have extra for unforeseen events and/or monies that you can take from it in case you fall short of funds; it allows a little bit of breathing room--and try not to spend it, for heaven's sake!

For monthly insurance pay the minimum am't due for each policy. In our case we have our house, motorcycle and 3 other vehicles, so label it as such (see chart below). I pay the house one week & the bike the next; and for 3rd & 4th wk I split the cost of the minimum due on my autos. REMEMBER: The date due on your bill may fall short of your scheduled calendar pym't date. To compensate, take the total minimum payment amount & divide it by 2. This will allow the added few dollars to each weekly pym't to get yourself that one payment ahead that you will need so that you will never fall short on a due date.that you have already scheduled on the chart or use that extra week in a month to pay the minimum pym't in full to get yourself that pym't ahead. (if your pym't due will be $96, divide by 4=$24per week; either add $24 to your wkly pym't (i prefer to do this) or pay the whole $48 on one of the extra wks of a 5-wk month. You have now accounted for one payment. You only have to do this one time in order to keep your payments on schedule (until the policy renews). Speaking of which, when you have a policy that has a 2-month break between renewal, be sure to keep on schedule (by putting the money aside) or you'll be slammed with the 2 mos total on the 1st renewal pym't.

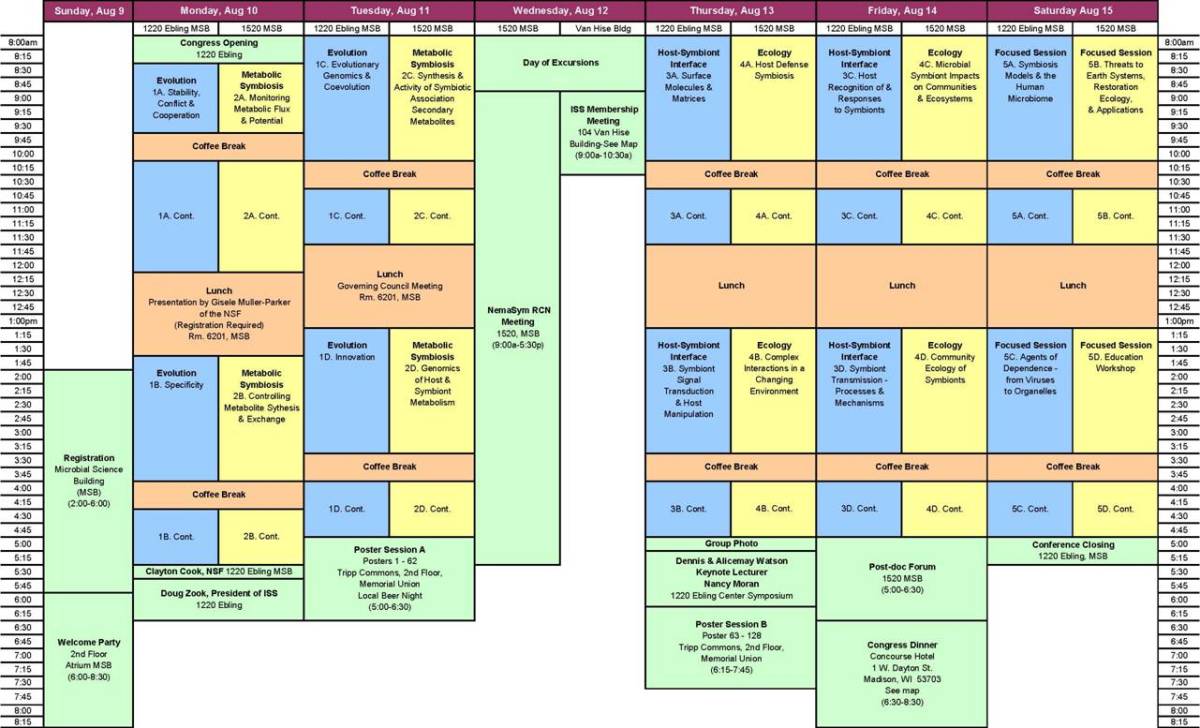

Total your list of bills for each week. Note below that on some weeks your bill totals will be different due to the amount such as on your insurance policies and fluctuating fuel cost. The "Xtra" on the list will provide cash for activities or to tuck away for holiday expenses. The Hypothetical chart below will consist of 6 columns (bill name, date of each week of month), list appropriate bill cost under the appropriate week heading:

APR 2009--Net income=$850

Name of Bill - 2nd - 9th - 16th - 23rd - 30th

AOL -$7.50 (each week)

Dish/Cbl $15.38 (each week)

Doctor $12.50 (each week)

Electric $50.00 (each week)

Fuel, Auto $50.00 (each week) except write $60.00 under the 30th

Groceries $100.00 (each week)

Ins, Auto/Bike $31.45 wk1 H.O. $62.00 wk2 Auto $48.00wks 3&4 Ins,Life $50.00 (each week)

Meds $7.75 (each week)

Mortgage $175.00 (each week)

Phone $40.00 (each week)

Taxes, Auto/yr $40.00 (each week)

Taxes, hse/yr $8.50 (each week)

Visa $50.00 (each week)

Water $30.00 (each week)

Xtra $75.00 (each week)

Totals should match weekly payout $743.08(wk1) $773.63 (wk2) $759.63 (wks 3 & 4) $769.63 (wk5)

In the above example, each week you can have anywhere from $80.37 to $106.92 left (after bills) in the bank to save or spend. If you try to be frugal, you can save it for things that you really want/need: gifts, fix-its, going out, vacations--or gas, groceries, unforeseen bills, baby's new shoes. Allow a month or two without spending this leftover income; it adds up--add it--see for yourself. Using even the smallest amount left over each week, in the least, you'll have saved $321.48/mo. (Didn't think it was that much, did u?) In 2 mos that could be half of a house payment or a trip home! Don't sell yourself short; you can do it. When it comes to your "other half" --simply say, "NO! We don't have it!" and stick to your guns! If you can't trust yourself (or those also using the checkbook), pull the money, label an envelope & store the cash in your file folder or someplace safe from sticky fingers. You'll have the money you need when bill time rolls around.

Your total wkly amount should NOT be more than your weekly pay. If it is, you are living beyond your means. Cut down on your grocery bill, gas bill & "Xtra" funds by using less (such as groceries) and staying home more. Eat hearty but simplify the foods. You can even cut down on your water bill by turning off that water when you brush your teeth, wash dishes & water the lawn, use ceiling fans instead of A/C. Also revise your phone and dishnet pkgs that ring up the cost. Unplug your flat screen TV when not in use; did you know it uses $38/mo in electricity simply because it's plugged in? (aren't they the sly ones!) These things add up.--Were you amazed to see the wkly amt you only have to put aside for property taxes? I wanted to kick myself when I calculated it! Round off your $438/yr property tax to say, $450/yr. Divide by 12 (mos); divide the $37.50 by 4(wks). I'm sure you had to sit down when i told you that you only have to save NINE DOLLARS AND THIRTY EIGHT CENTS PER WEEK!! Sounds stupid, doesn't it?--figure it out: $9.38x4/wks=$37.50x12/mos=$450/yr. We panic at the end of the year because we see this huge number that we have to pay--usually right at the holiday season. Isn't it easier to save $9.38 each week?--Make life easy for yourself--you pay more for a movie!! Get your act together. Get some peace! Save the monies for your mortgage and taxes and make it priority.

Now...if you had $1500 what would you do with it (beside spend it frivolously)? If the above pym'ts were yours, you could save this much in only 4 and a half month's time, did u know that? Know your priorities beforehand.

Let's see: $1500.00...I need to: take my children on that campout--$200

replace a tire--$150

replace that siding on the house--$400

replace the rotted post on the porch--$150

Wow! $600 left--woohoo! Now...let's party!

Ok, pay chart has been made and you are living beyond your means. Oops! What to do:

Call each creditor and ask for a deferred pym't plan to ease your finances. DON'T be embarrassed; hard times befall most people--you don't know them and they don't know you, you'll never meet them--and they can't see you over the phone! Ask if they will freeze your account until you are caught up so you won't accrue further finance charges. Be sickening sweet if you have to, but remain cool, no matter what! It'll make the difference between getting that deferment or them sticking it to ya & hung out to dry! BE SURE to: Record the date & time, who you spoke with (even if there are 7 of them), their name title, what department they are from, get their phone number AND extension (in case you are disconnected--you don't have to go thru the details again) WHAT THEY SAID--and then read it back to them and record the confirmation number. They will treat you with caution because you can tag them if they do something wrong. Be sure that you inquire & insist (several times) that they note this conversation in their files. If they are speaking in circles, be firm and ask to speak to a supervisor. Don't forget to write down even any rift or disrespect! They cannot fault you if you are willingly making payments (although they will call 2-4 times per day, 7 days per wk). DON'T let them bully you. Try to be nice. Let them look like the horses a**; it makes you feel better. Later if they continue, when you see "Mr. Tollfree" on the caller ID, just don't answer; you'll only upset yourself. It is only necessary that you speak with them each month. If you have extra money, pay them a few more dollars--even if it's only $5. It will show them that you are trying. Some companies such as the electric & phone companies require that you call on EACH due date to 'remind' them that you are on or have arranged a payment schedule--don't fail to do this or you will accrue an astronomical bill (been there, done that!) and/or utility is turned off--but the meter is still running!); be sure to tell them what you can pay and when; (just make up a minimal amt you can be sure of paying on that date and you can pay them more when the time comes; they just want to write something down, so humor them. Some reps demand that you pay no less than $25...if you can't do that--TELL THEM SO and pay what you can; don't forget to record the conversation on paper--and tell them so (you've got to cover your butt every step of the way)!

By the way,--can't understand that person on the other line? Do they keep repeating over & over what you've already told them? Isn't this aggravating! Don't hang up and don't throw the phone. Firmly, but pleasantly, request that you "please speak with an American-based agent". They are lying if they say there is no such thing. We know that they "can help" us (yeah, get aggravated)--so keep repeating your request--just like they do! lol

It's easy to fall behind; stay on track, pay what you can, feel free--and breeeathe! By the way, does it really matter who racked up the bills? Let there be no blame/shame--we're in it together--FIX IT!!

- Fireplace and Chimney Supplies : Home Gas logs, Fireplace screens, chimney caps : Home

Fireplace tools, Gas logs, Chimney caps, Top-sealing dampers, Fireplace screens, stainless steel chimney caps, and copper chimney caps.