How We Got out of Debt

You've seen How we got into Debt

In the last hub you saw how we got ourselves way over our heads into debt. It happened just a little bit at a time and we ended up with no idea at all how we could get ourselves back out.

With increasing debt, no money, and two young children the pressure was tremendous. The pressure was taking its toll on our relationship and on our health.

The only time we seemed to have problems at that time was over money and our views on money.

I would want to follow my mum’s way of doing things. Like my mum I did not want to buy anything that I couldn’t pay cash for. I had seen at first hand how well this approach had worked for my mum.

My husband's philosophy at that time was more of the 'live now pay later' leaning. My husband was a much stronger personality than I was, and still is come to that.

Back then I always deferred to My husband. After all he went to work to earn the money we were spending. So I thought it only right that he should have the main say in how we should spend it.

No Money

Something Has To Give

Things became so bad and we owed so much money that none of the money that my husband earned was ours.

We had so much debt that we hadn’t got even enough money coming in to pay off the minimum amount due on the our credit cards.

After we paid the minimum allowed each month on the cards we had no money left to live on.

Something had to change, something had to give we couldn’t go on living like this.

We also couldn’t just do nothing, because the situation was getting worse all the time.

We would go no further

A Line in the Sand

My husband and I had a chat and we decided that it was time to draw a line in the sand and say this far and no further.

We knew that if we didn’t take back control of our lives and money we were going to end up with less than nothing.

We had got ourselves into a a real mess and if we were not careful the mess we were in could end up with us losing our house. Then all the others who had a claim on our money would swoop in and take the rest.

We were already losing control of how to spend our own money. The first thing we had to do on pay-day each month was to pay off what we owed on cards.

We could also see that if we didn't do something soon we could end up also with a bad credit rating.

We knew that if that happened our ability to survive in the modern world would be so much harder.

Mortgages and hire-purchase agreements were the way of life and so a bad credit rating would hurt us.

We needed to keep our good credit rating. It is one thing not to have something because you do not want it . But it different if someone else is saying that you cannot have it.

No More

The Line was Drawn - No More

After talking long into the night my husband and I decided that drastic measures were called for.

The first thing we acknowledged was that all the cards had to go. As long as we had any of the cards there was always the possibility that we would use them again.

There would always be something that could come up where we could feel that we needed to use a card of some sort to fix it. We did not need that sort of temptation.

I knew using a credit card wasn't the answer. It was an illusion, cards didn’t so much give us credit but rather the ability to amass debts.

Debts that we of course would have to to repay.

We were in a mess and we were paying off the minimum each month on our cards.

Each time we bought something on a card we paid much more in the end for the item than if we had used cash. We knew this and if we had taken the time to see just how much more we might not have got ourselves into this mess.

So that night our line in the sand was drawn we decided no more credit or store cards.

So we couldn't chicken out at the first hurdle, we knew we had to do something drastic. We got all our credit and shop cards together and we cut them up into small pieces and threw the pieces on the fire.

With that action we made sure that spending any more on the cards was not an option. Using cards was no longer a way open to us no matter what the emergency.

A drastic measure? YES! Was it scary? You bet it was scary. Yet cutting those cards up was also a liberating.

It was a great feeling watching the cut pieces of all the cards go up in flames. We sat there watching until there was nothing left of them at all.

We now had a Budget

The next payday we paid off as much as we could on all the cards that we owed money on. When we had done that we had nothing left in our account to survive the coming month on.

We then drew out a further £30 in cash, which was the limit that our bank would allow us to go overdrawn.

This £30 was all the cash that we would have to survive the coming month on. If we couldn't get it within our budget of £30 then we couldn't get it at all.

At last we began to slowly take back control of our lives and money, and of course the banks £30 as well.

This worked out at a £1 a day unless it was a month with thirty-one days in then it was slightly less.

I divided the £30 up so that I had so much money each Monday morning to spend that week. On top of the £30 each Tuesday I received my family allowance which was about a further £6.

My disposable income was £12.60p a week or £1.80p daily. With this I had to feed and clothe two adults, two children and feed my daft dog Henry.

Even in the 1970s £1.80p daily was too small a sum to do that. But it is surprising what you can do when you have to.

It took determination and a lot of ingenuity but as they both cost nothing we had plenty of both.

Reduced Items and Jumble Sales

Reduced Items Jumble Sales and Flea Markets

Now that I had a budget to live within one of the first things I did was not to buy any more branded items.

From that day on if I wanted Cornflakes I would buy the store's own brand of cornflakes. Often the store's own version was nearly half the price of the branded item.

I found that the quality and the value of the store brand goods very good. I found that I didn't really miss the big brand named stuff.

Next I found out where every supermarket in the town had their reduced items space.

This is the space where they put their items that were the end of a line or close to the sell by date. They sold everything that ended up on these shelves at a much reduced price.

Shopping like this actually improved our diet. There were lots of things that we usually could not afford that would end up on the reduced shelves.

Often I was able to buy something like a nice piece of steak near its sell by date for the same price I would pay for sausage,

I also made it my business to find out when the staff usually put that kind of stuff out. Some did it early in the morning some did it late in the afternoon.

Once I found out I made it my business to be there as soon after they did it as possible.

If I got there soon after the assistants put the things on the reduced shelves I got first choice. This way the best bargains of the day ended up in my shopping cart.

I went into town to shop everyday on my bicycle. Sometimes I went in more than once and I would walk from one end of the town to the other just to save a few pennies.

I also went to the library to read the local papers to see if there were any Jumble Sales advertised in the area. I also looked to see if there were any Flea markets Car-boot sales coming up.

Jumble sales, Charity shops and Flea Markets became my go to places for clothes and shoes.

Most of the time the shoes and the clothing at the Jumble sales were in good condition. Often when the previous owners were children they had just out grown their things.

Young children grow so fast and most of the time their outgrown shoes and clothing still has lots of wear in them.

In these places I paid anywhere between 20 and 50p for a pair of children's shoes. This was a huge saving, 50p instead of the £20 I had been paying for a pair on my credit cards.

The Church Jumble sales were always the best. We had many churches in our area. The Church of England churches always had the best quality jumble.

All My Own Work

The Pyjamas

I am not one of those mums who is good at sewing or making things. But when my son needed some new pyjamas I thought I would try making them.

I thought to myself that it was worth a try. After all it was pyjamas and nobody but us would see them.

I had a piece of material that some one had given me and we had a sewing machine.

I didn’t even know how to thread a sewing machine but I soon learnt. My husband use to joke about my lack of skill when it came to sewing. He used to say that I could sew buttons on inside out Lol.

Any sewing needing doing and it was usually my husband that did it. My husband learned to sew in the Navy of all places.

Also his mother was someone that could make just about anything. She made all her own clothes and knitted all her own jumpers and cardigans etc.

He had grown up around this so he had much more idea about these things than I did.

Still not having the brains to know how hard it is to make patterns I set out to make my son a pair of pyjamas.

The first thing I did was to get the piece of material and folded it in half inside out. Then I placed it on the floor and made my son lie down on top of it.

I took a felt tip pen and I drew an outline around him leaving about three-quarters of an inch extra space all around.

I sewed around the outline I had drawn twice so that the material wouldn’t fray.

I then hemmed the bottom of the top and the trouser bottoms. Finally I hemmed the waist leaving a space so that I could thread the elastic through.

I cut around the stitching leaving about a quarter inch between the stitching and where I cut. I hemmed the neck and then I turned it right side in.

Much to everyone’s amazement including mine, the pyjamas looked like pyjamas. In case you are wondering my son loved them.

My little helper

Living Within Our Means

I would buy the cheapest cuts of meat one such cheap cut was Breast of Lamb. I would buy breast of lamb and bone it make my own stuffing mixture.

I would put the stuffing on the boned breast and then roll the breast up and tie it. I would roast it in the oven with potatoes around it. Boning the breast of lamb was fiddly and it took a lot of time but it was worth it because it tasted delicious.

Even after we got out of our financial mess we still used to have breast of lamb as it was delicious.

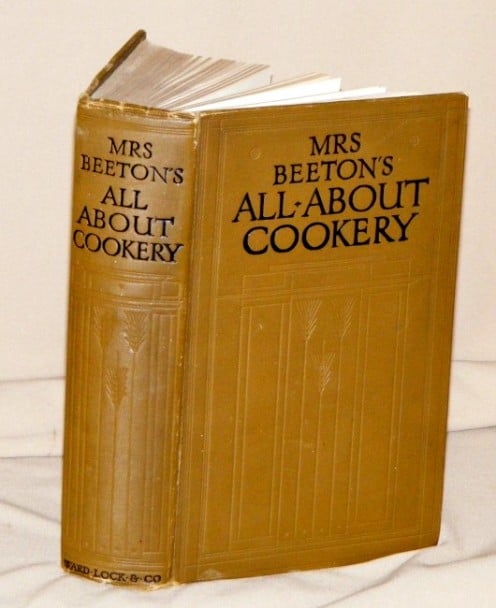

I had a copy of Mrs Beeton's All-About Cookery. This was an old cookery book that was re-published in the 1920 and it had many money saving recipes.

This book was so much more than just a cook book. It taught you how to do so many other things besides cooking. Things like mending shoes or getting rid of every kind of stain.

It taught how to manage the household servants and this I found particularly useful(Lol.. I wish ).

We were soon living within our means once again. Some weeks much to my amazement I actually had a little left to carry over to the next week.

Debt Free At Last

One by one the cards got paid off. As each card finished we put the extra money towards paying off the next card. This went on until in the end everything was fully paid up and we owed nothing.

At long last we were debt free, it had been a long time getting here but in a way I am glad that I had to go through this.

That may seem a strange thing for me to say. But the reason I say that I am glad that I went through it is because I learned so much in the process.

I think that the best thing I learned was not everything that I thought was a necessity was in fact a necessity.

Many of the things that I thought we could not live without we did live without, and do you know what we still lived well.

Our values and priorities changed what we considered important changed also.

I am glad we got into money trouble because we found out we didn’t have to live like victims. We also found out that we were far more resourceful than we thought we were.

Strange as it seems it ended up being a positive experience. An experience through which both my husband and I grew and our relationship strengthened.

I am not advocating that you get yourself into the mess we got ourselves into. But if you are there already, let me encourage you. You too can take back control of your life and money and turn this thing around.

Don’t be afraid, if we could do it anyone can. We found that we loved living the way necessity first forced us to go. We loved it so much that once we were free of debt and free to choose it became it became our chosen way to live.

My husband had a couple of pay increases and we got to the point where we didn’t need to go into the red any more.

Soon we had money coming into our hands instead of the hands of all our creditors. We were free now to buy new where we chose rather than where we could get credit.

I did buy new sometimes when I saw something that I liked. But I liked finding bargains at the Jumble sales and charity shops.

I like it so much that even when I had the choice often I would still choose to buy second hand.

Once out of debt we never put ourselves into that situation again. We did get another credit card but only for convenience sake.

We use our credit card to book flights or to pay for hire cars etc., when we go on holiday.

That way the things that we pay for on the card are covered by insurance. This has proved useful on more than one occasion.

The day after 911 we were due to fly out to the USA on holiday. Of course they cancelled all flights to America. We got all our money refunded because we had used our credit cards when we booked.

But now we never put anything on the card that we can’t pay off in full when the bill comes in.

As we found out to our cost credit cards are good servants but very poor masters.