How to Brace Yourself for Inflation - Personal Finance

Managing finance is similar to driving and following the road signs in front of you. Yield signs and forks in the road will present themselves on a regular basis. Taking note of those signs and doing something about the signals will allow you to reach your financial destination in a more comfortable, timely and profitable manner.

The question becomes what are the yield signs and where can I view these signs. While this article is centered around macroeconomics in the United States, the same rules apply for our European and Asian readers. Look for the statistics and note the trends.

- Know the macroeconomic statistics and trends

- Learn where the statistics are gathered

- Learn how the statistics are gathered

- Access and calculate the cost of something when

- Learn five tips to brace your families finances for inflation

Inflation Ahead Caution Sign

Portfolio Parallel with Personal Finance

Running a stock portfolio is always a hard task. Running a successful portfolio through dramatic dips in interest rates and inflation seems like an insurmountable task. Yet, if you learn the warning signs, you can not just weather the storm you can actually profit from the economic changes. For managing our personal home finance, we can learn allot by listening to the stock portfolio managers.

Please note, hedging is both a science and an art. Hedging as JP Morgan has proven is even very risky for the professional traders.

The lesson: brace yourself conservatively. Use the economic indicators to help you manage. A solid investment strategy is recommended. If you wish to take excessive risks, you are no longer responsible, you become a gambler. Knowing what a gambler is and how the risks may be too high for your corporation or your families finances.

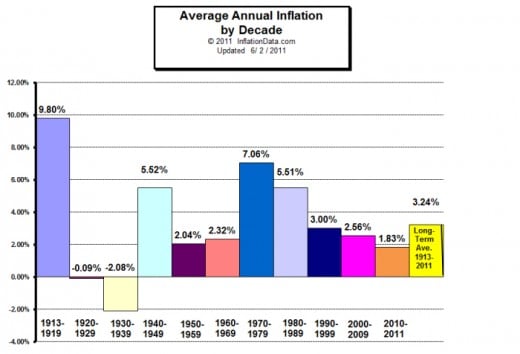

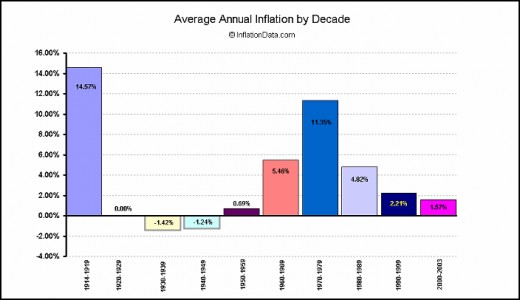

Inflation Through the Decades 1913-2011

Inflation Through the Decades

Inflation Definition

What is inflation?

Inflation is described as continuously rising prices, or the continuous fall in value of the dollar.

Hyperinflation Definition

What is hyperinflation?

Consumer Price Index Definition

What is the Consumer Price Index?

The Consumer Price Index or commonly referred to as "CPI" is a measure of the average change over time in the prices paid by consumers for a market basket of consumer goods and services.

Economic Indicators by the US Department of Commerce

- About Economic Indicators | Economics and Statistics Administration

Commerce.gov is the official website of the United States Department of Commmerce and Seceretary of Commerce Gary Locke.

Wal-Mart Predicted Serious Inflation

Credit Squeeze

Five Tips

invest in assets that produce income - spend time onyour blogs, websites, .....

invest in a home

1. Own a home

2. Invest now in long term fixed debt

3. Reduce your debt interest rate

4. Save and/or plan on delaying your retirement benefits.

5. Invest in purchases and education. If you are a farmer and have delayed investing in expensive tiling, now is the time to reconsider. The price for this major investment may be at its lowest level. Tiling your fields can return a higher yield if your soil is prone to clay and there are drainage issues. Investing in equipment is recommended only if the equipment is needed and/or there are direct yield increases anticipated. Invest in upgrading your website presence by adding a mobile website or upgrading your shopping cart or photo galleries.

If you were considering pursuing your masters or a bachelor degree, the time is now before inflation strikes.

This education rule holds true also if you just wish to add a certification such as SEO, fitness or accounting certificate to your resume.

Invest in gold and silver is the typical mandate. I don't recommend this for the standard family. for the family with a stock portfolio - yes, for a family with only a retirement portfolio, this may be more risky than wise.

Personal Finance

Smart Phone Application

Cost then

"Cost Then is a simple to use app that lets you calculate what you would have spent on something in the past. For, example, did you know that if you spend $100 today, you would have only spent $4.39 in 1913? Did you know that the dinner for two, on which you just spent $43.50, would have only cost you $9.63 in 1974?"

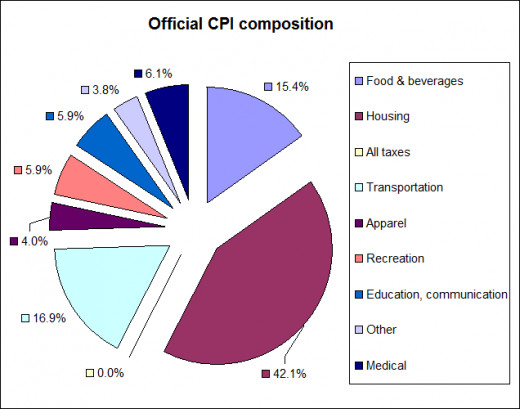

Consumer Price Index

CPI - Consumer Price Index

The CPI is managed by the United States Bureau of Labor Statistics or "BLS". The CPI is the statistic that is referenced here in the US for measuring inflation and deflation. As the BLS's website details various indexes have been created to measure inflation and deflation:

"The CPI measures inflation as experienced by consumers in their day-to-day living expenses; the Producer Price Index (PPI) measures inflation at earlier stages of the production and marketing process; the Employment Cost Index (ECI) measures it in the labor market; the BLS International Price Program measures it for imports and exports; and the Gross Domestic Product Deflator (GDP Deflator) measures combine the experience with inflation of governments (Federal, State and local), businesses, and consumers. Finally, there are specialized measures, such as measures of interest rates and measures of consumers’ and business executives’ expectations of inflation.

The “best” measure of inflation for a given application depends on the intended use of the data. The CPI is generally the best measure for adjusting payments to consumers when the intent is to allow consumers to purchase, at today’s prices, a market basket of goods and services equivalent to one that they could purchase in an earlier period. The CPI also is the best measure to use to translate retail sales and hourly or weekly earnings into real or inflation-free dollars."

CPI - Consumer's Price Index

Share Your Opinion

Do you think there is inflation in store for the future United States market?

Personal Finance and Inflation Fact Take A Ways

The first takeaway here is no one knows when inflation will rear its ugly head. Even CEOs of the world's largest retailer has no perfect crystal ball. The second item is history has taught us there will be inflation. The fact that we don't know precisely when is the third item that we simply need to be on guard.

The ultimate goal for our personal finance is solid financial planning. We must calculated inflation in what we do so that we are not caught off guard and unprepared.

© 2015 Ken Kline