How to Invest in Real Estate Without Much Money

Return Comparisons

Investment

| Payment

| Frequency

|

|---|---|---|

RichUncles.com

| 7.5%

| Quarterly

|

Realty Income REIT (O)

| 4%

| Monthly

|

Annaly (NLY)

| 11.59%

| Quarterly

|

Fundrise.com

| 12-14%

| Quarterly

|

Washington REIT (WRE)

| 4%

| Quarterly

|

Lendingclub.com

| 8-14%

| Monthly

|

Liberty Property Trust (LPT)

| 5.5%

| Quarterly

|

Sharestates.com

| 10-20%

| Quarterly

|

A quick snapshot of the returns you can achieve through a variety of investment types

Peer-to-peer Lending

I am personally invested in peer-to-peer lending so this may be slightly biased. Basically, peer-to-peer lending is crowd funding loans. The two biggest websites are lendingclub.com (my personal choice) and propser.com are good options to start. The way Lendingclub works is through buying individual notes. You can buy a note for as little as $25. Buying more notes works in your favor, as it reduces the effect of one person defaulting and hurting your investment. You can expect to see 8-14% returns from peer-to-peer lending, mostly due to the ability to re-invest monthly. You will collect payments monthly, this means that every month you can likely buy another $25 note. The payments include both interest and principle so don't think that it is pure profit with every payment. You are able to see potential borrowers credit, past delinquencies, income, debt, and a few other measures. Through this, you can design a portfolio that is a little riskier and might give a better return, balanced portfolio with risky and safe, or go with a very high credit filled portfolio. The riskier it is and the smaller the portfolio, the more likely a delinquency will hurt you. Still, peer-to-peer lending is a good way to quickly generate money.

Investing in a REIT

A REIT is a real estate investment trust. Most REITs are traded on major stock exchanges, but there are also public non-listed and private REITs. The two main types of REITs are Equity REITs and Mortgage REITs. Equity REITs generate income through the collection of rent on, and from sales of, the properties they own for the long-term. Mortgage REITs invest in mortgages or mortgage securities tied to commercial and/or residential properties. (https://www.reit.com/investing/reit-basics/what-reit)

The great thing about REITs is that you are able to purchase as little as one share to begin your investment. The dividends are usually paid quarterly, and at a much higher rate than traditional stocks. Realty Income Corp. is wonderful because it has paid out monthly dividends for over 500 consecutive months.

There are privately traded REITs, but they can be a little harder to find and a little harder to deal with. I am invested in RichUncles.com, but you must be a California resident to invest in them. The major issue with privately traded REITs is that it can be much more difficult to sell your shares if you need to make a quick exit.

At the top, I have included a few of the best REITs and their returns.

Crowd Funding Real Estate

Real Estate crowd funding is relatively new, but it is making a big splash. Most websites will require $1000 to start, which really isn't asking too much. Once you make the initial investment on a website like fundraise.com or sharestate.com, you will be able to go in and actually select which property to invest in. In this sense, it is very much like peer-to-peer lending. If you were to look at a site like gofundme or kickstarter, you can get a good idea of something similar. This is a relatively unproven form of investment, but the fact that you can actually have a say in what is purchased makes it interesting. You can actually tell people you own part of a piece of property and describe the property, unlike a REIT that makes purchases on your behalf. All the properties are thoroughly vetted, so you should expect them to do well. They advertise returns of 10-20%, which I think might be slightly ambitious, but either way it is a more interesting way to invest in real estate without having to front a huge cost.

Take a look at the video below. It will give you a quick snapshot of how exactly crowd funding works.

How Crowd Funding Works

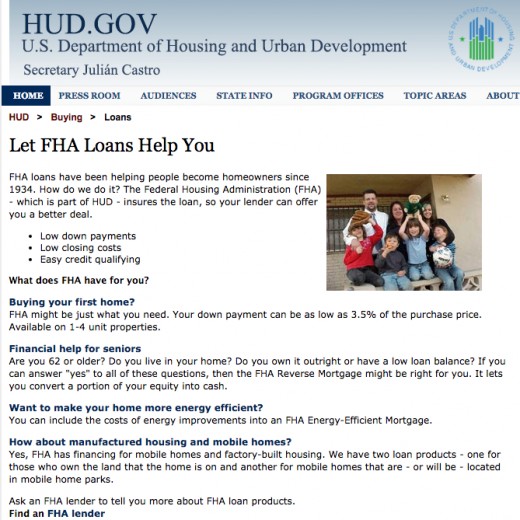

Buying a Property

If you came here to actually learn how to buy a property, I am sorry! I have market snap shots for many different markets across the country coming soon. There you will be able to get my read on the best places to invest. If you want to buy a small office in Charlotte or Milwaukee, hopefully they can guide you. Also, if you are going to buy your first home, look into FHA loans. They require only 5% down. You will end up having to spend money on mortgage insurance, but the return you get from owning instead of renting should easily cover it.

A look at the FHA homepage