How to start saving money and get richer

This is a very hot topic ‘Saving Money’ if only we all heeded advice given by our parents and financial experts we would all be in a better position and therefore the downturn in the economy may not have affected so many of us this bad.

The fact that spending is hard to control for many of us, is not our fault it is the system that we live in, it drives people to craving for material things beyond ones financial capacity. Gone are the days when people saved up for something that they wanted, now it is an ‘age of buy now think later’.

This attitude to life and material acquisition has led to money troubles for many in society to the extent where they have family breakdowns, mental illnesses, financial ruin and so on.

It is therefore important that we as individuals accept the truth that spending uncontrollably is not beneficial to ourselves or the society. We must accept that our spending habits need to be moderated. It is only then can we really benefit from saving, if you are still interested in saving and getting richer over time then read on.

Read and Learn how to live zero debt and manage money.

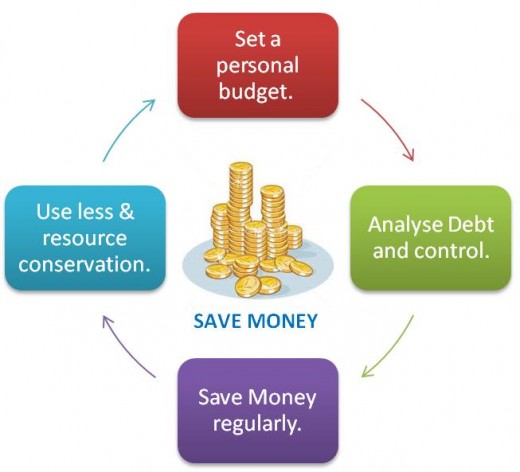

Once you adopt the strategy below make sure that you follow it and monitor your progress it is only then, you can see the benefit, otherwise you might as well carry on what you’re doing fighting and struggling from one pay cheque to another. Don’t get me wrong you may not be struggling in which case you’re a lucky person, you don’t need to read anymore sit back and chill. For the rest of us read on....

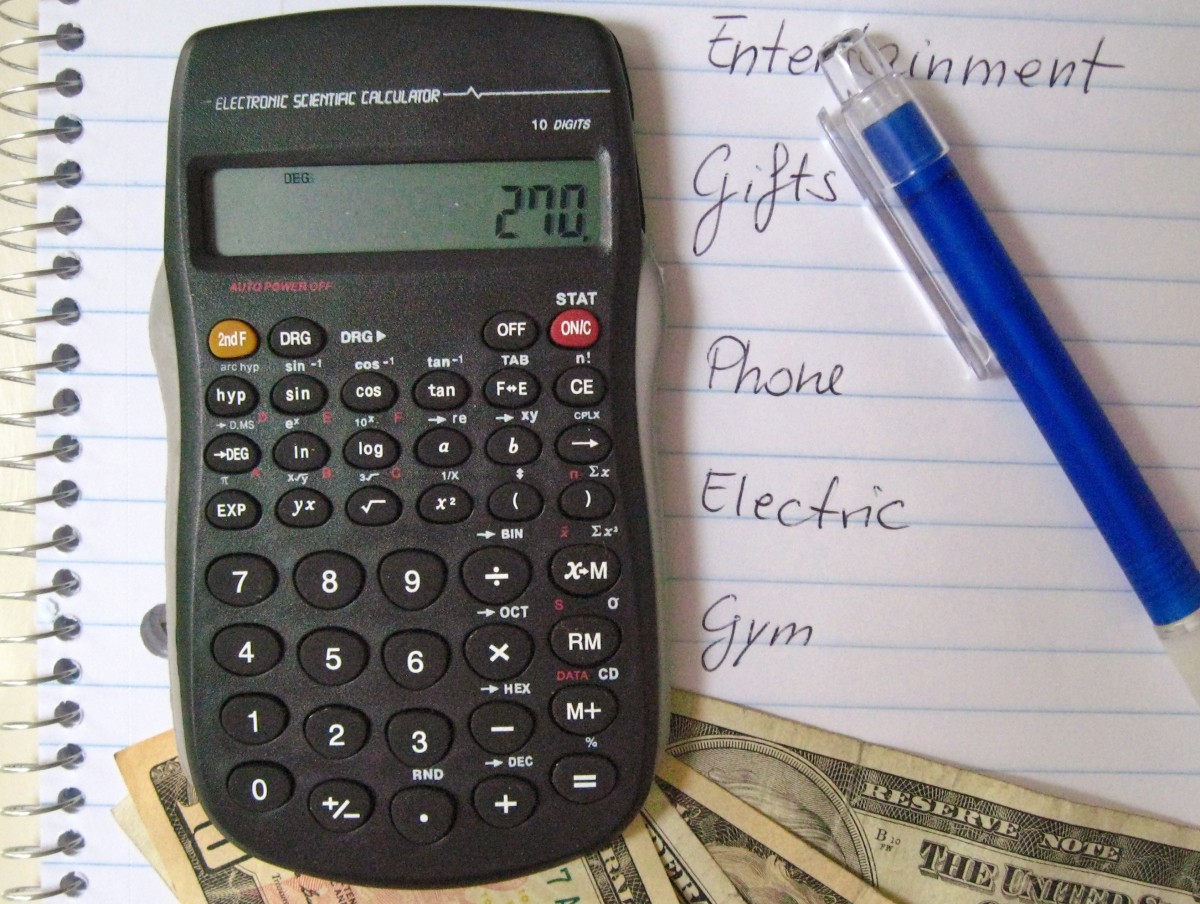

Setting a personal budget is important for many reasons, some people don’t even contemplate having one simply because they don’t care or they would rather navigate their financial affairs without knowing, as having knowledge of their financial position will necessitate change, some people do not want change and therefore ignore the basic of personal money management task – creating a personal budget.

When you create a personal budget you will instantly see your earnings (incomings) and expenditures (outgoings). You cannot save money unless you know how much money you have coming in on a regular basis, and list how much money you have going out. With a personal budget or personal financial plan you can see at a glance all your income and expenses, from that data you can quickly identify areas where you may be able to save money or cut back on expenses.

Related Reading...

- 3 Steps to making money with Google Adsense

You may have seen many adverts on web pages that allude to people making huge sums of cash using Google Adsense. Naturally you will click on those ads to find that you need to pay something first, you then get a booklet which tells you how to start. - Personal budgeting tips

This is where personal budget planning comes in, if you take the time and start to list all your income, expenses and savings then you can manage your earnings with ease and therefore avoid falling into the trap of financial difficulties.

Manage your finance the easy way...

Without a personal financial budget it is difficult to plan and save money over a period of time. Now that you have read this far it shows me that you are concerned about creating a personal budget, a budget is the first step to your financial freedom and the start of your journey to becoming a richer person in the future (I say future because no one achieves financial freedom without hard work and patience, not unless they win the lottery or receive wealth through inheritance).

I used Microsoft Excel 2007 to create and maintain my personal budget it gives me complete flexibilityin how I keep track of the information. If you are not an Excel person and cringe at the mention of the word spreadsheets then don’t worry there are many software products on the market that allow you to quite easily create, maintain and monitor your own personal financial budget. I would recommend you use Quicken Starter Edition it is very easy to use and manages all aspects of personal finance and money management. Tracking your money matters becomes easy with this tool and you can even get really nice graphs so that you can pin-point how much you spent on buying gifts for your mother-in-law last year as an example.

Read & Learn How to Make money!

Analyse Debt and control

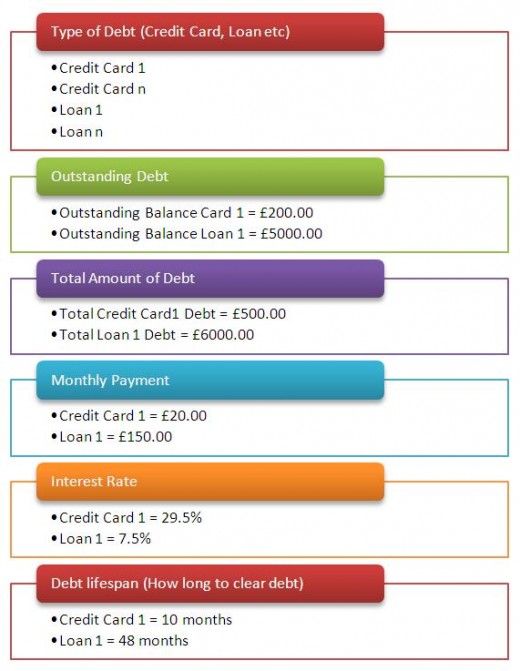

We all have some debts and need to carry it through the best part of our lives, things like a mortgage to purchase a home or finance to purchase that much loved BMW. I would draw a line under the mortgage, the rest of life’s debts like credit card for that extra clothing item which you purchased before payday or that little summer break you took even though you had no money, the loan that you took out to buy that expensive kitchen or conservatory are things that you could really do without. To save money from now on you will stop spending on credit cards, taking out loans, buying unnecessary material objects (clothing, electrical items, gifts etc). That is, until you get to the position where your income is greater than your expense and you have savings sitting in a bank account. You can then live the lavish lifestyle you wish.

Some financial experts usually say that you can use your credit card as long as you make it an absolute rule to pay off your outstanding credit card balance every month before incurring any interests, therefore saving you money – I don’t accept that. We all like to think that we have the discipline to do this unfortunately many of us do not really have that ability to resist temptation when out shopping, in which case we need to refrain from using credit cards full-stop. Otherwise we end up in debt paying extortionate interests rates.

You can download and use the free excel spreadsheet above to list and monitor your debts, or if you prefer use Quicken to monitor your debts over time. To start with listing your debts I would recommend you draw up a list as follows:

Save Money regularly

Saving money does not have to be that difficult, if you plan and make it a habitual activity. Try to save each week or month get into the habit of putting a manageable amount aside, it does not have to be a huge amount, start small and build up when you can.

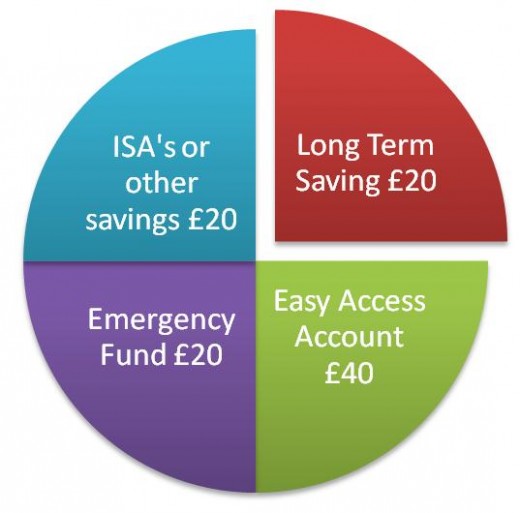

Once you have completed you personal budget you will be in a position to determine how much disposable cash you have in hand each month. Take a portion from that assume you have left £100 per month spare after all your expenses, I would recommend you divide that money up and distribute it in the following way:

Saving Money Advice

The difficult part is to take the first step and start saving money, if you find that it is impossible for you to save money once you have it in your hands then consider having money deducted from your pay direct each month. By saving money on a regular basis you will quickly build up a reserve and you will gradually feel motivated to save more.

I have setup my account so that, soon as my salary comes in to the account a set amount is distributed to my other accounts including my savings account, each month I am comfortable in knowing that I have some money put aside for my future and for those unfortunate rainy days.

I also have a salary direct share savings account it takes a chunk of my salary and invests it into my employers share scheme, using this method, saving money and achieving financial freedom becomes that much easier.

Be Debt FREE learn how!

Use less & resource conservation

Use less and conserve resources - what does that mean? ...

All of us live in a consumer society where over spending, over eating and waste is a huge problem. This saving tip is a lesson we all need to learn so that we can become better money savers.

So how do you use less and save money?

Think for a moment – your electric bill, are you paying more this year per month or quarter than you did last year? Most likely the answer is YES, in which case you need to evaluate resource conservation methods. There are many ways and I am not going to list all of them here. For a starter consider using less electric:

(a) By investing in low energy light bulbs,

(b) Only boil water that you will use in your electric kettle,

(c) Taking shorter showers especially if it is an electric shower.

If we could all use and consume less there would be less waste, less power consumption, and the benefits for you are MONEY SAVING. This is just one example if you analyse your resource consumption then you will very easily identify many more and if you work on reducing excess consumption you will start to see savings through smaller utility bills, shopping bills and so on.

![Quicken Starter Edition 2011 [Download] [OLD VERSION]](https://m.media-amazon.com/images/I/41UwDPQ3vuL._SL160_.jpg)