How you can strengthen your investment portfolio with these promising companies.

COMPANIES THAT BOUND TO PROSPER IN THE FUTURE ECONOMY .

The three big commodities that have always survived under all market downturn have been Oil, Gas & Electricity. Among those three, I think we can say less future investment is forecasted towards accrued oil. In order to catalyze private efforts to build a clean energy, Obama’s administration proposed a comprehensive plan to invest in alternative and renewable energy. Quoting form the Obama’s site “Our addiction to foreign oil doesn't just undermine our national security and wreak havoc on our environment -- it cripples our economy and strains the budgets of working families all across America”. We can no longer continue to purchase fuel from foreign countries, if we must improve our economic situation, we must look into other alternatives by making a platform available for a smooth transition to be possible.

What do they mean by that? Well, let us look at our current situation. As of now, a great number of our automobiles uses petroleum gas which we know as gasoline & diesel. To have a smooth transition, we need to consider four conditions. Those conditions are: automobile design, fuel efficiency, price & quality.

Automobile design is an important condition to consider for the simple fact that we need not to produce fuel that would require a major shift from current automobile designs. It's reasonable to think that no one really wants to implement or change any part in their vehicles in order for them to use environmental friendly fuels. The transition therefore would have had to be smooth and efficient. Likewise, fuel production would have had to be applicable to all vehicle models that uses them without any modification.

The liquid fuels cells that are currently being manufactured have some similar chemical properties as natural gas & electricity. Natural gas contains methane hydrocarbons, like ethane propane, and butane as well as sulphur. Unlike NG, there are four primary fuel cell technologies and there are: phosphoric acid fuel cells (PAFC), molten carbonate fuel cells (MCFC), solid oxide fuel cells (SOFC), and proton exchange membrane fuel cells (PEMFC). According to distributed energy resource guide,” Fuel cell stacks utilize hydrogen and oxygen as their primary reactants. However, depending on the type of fuel processor and reformer used, fuel cells can use a number of fuel sources including gasoline, diesel, LNG, methane, methanol, natural gas and solid carbon."

As you can see, petroleum gas is becoming less promising to our future economic survival, and for that reason it may be beneficial for us to place our long term investments on commodities that our future depends on. The future of our energy source lies in those three commodities: natural gas, electricity & fuel cell technology. Oh! sorry two more wind energy and solar. However, the goal is how can we better use them so that their byproducts doesn’t conflict with our planet. That is the ultimate goal we should look forward to, it is one that requires a big effort from the leaders of the world.

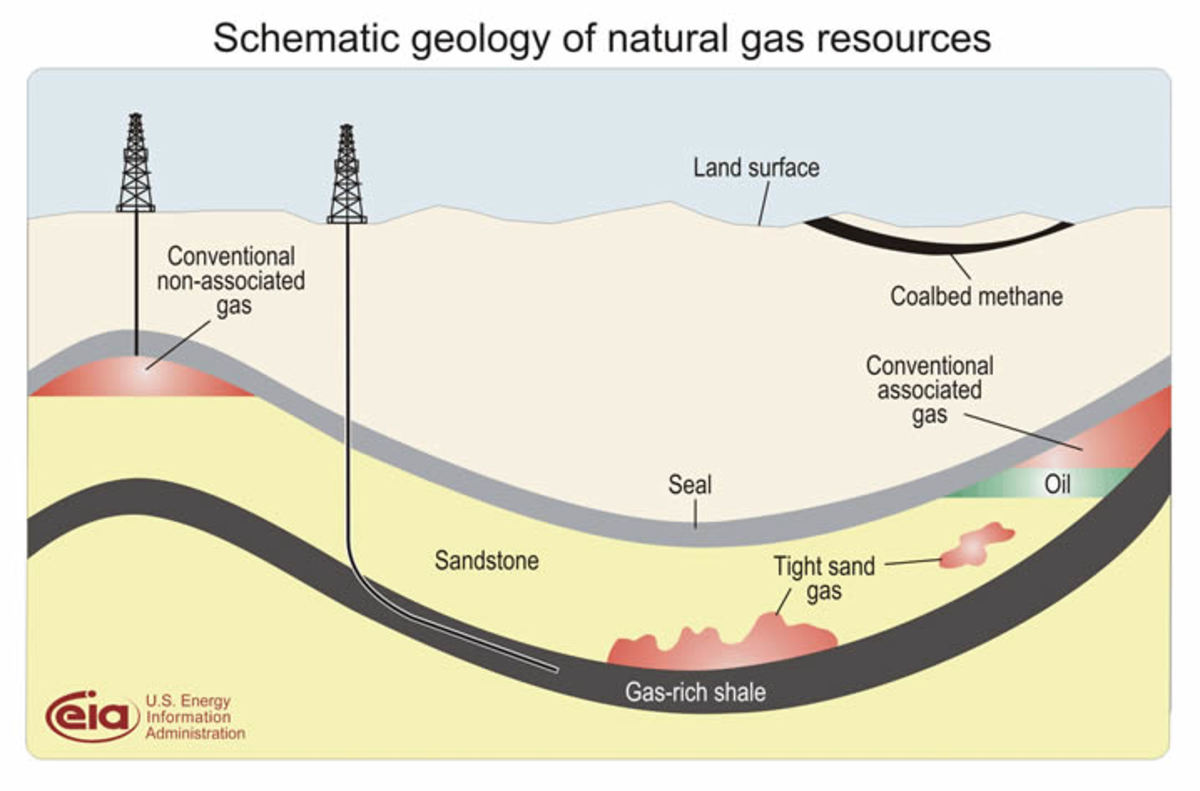

CNG - COMPRESS NATURAL GAS IS ANOTHER OPTION.

Compress natural gas (CNG) has always been an option; NG chemical properties have always been an harmony with our environment. However, two conditions has to be present in order to create a demand for compress natural gas automobiles. First, they must be more fueling stations. Second, the price for natural gas automobile would have had to be reasonable enough so that people can afford them. Compress natural gas fueling stations can be viewed as a possibility. However, it's one that if it were to be implemented could be restricted from cities that are too populated. Unless of- course new technologies eliminate all risk of potential danger that are associated with CNG being distributed locally in big cities.

However, I am afraid to say that the compress natural gas (CNG)may be face with some obstacles. The transformation of Petroleum gas fueling stations to compress natural gas may become a problem for Gas companies like National Grid who may wish to sale compress natural gas to automobiles that uses it. As of now National Grid sales CNG to commercial trucks per contract only. Maybe in the future, if possible it may become advantageous for natural gas suppliers to consider providing fueling stations across the country for cargo trucks.

National Grid (NGG) originated from UK, now doing business in the US, is a fortune global 500 company with over $55 millions in assets. The corporation is mainly a service utility company that provides cooking gas and electricity to its customers. Although, selling compress gas is a beneficial business for them, the company provides other services that are as equally necessary for our citizens.

Due to the economic crisis, many customers have experienced difficulties paying their bills on time. As a result, the company now has a lot more money pending from customers. With the Obama’s stimulus in circulation eventually more companies will be able to re-open their doors for re-hiring. As a result many people will be place back to work and companies like National Grid can once again begin to retrieve more of those monies they have pending.

What is important to know is that companies like National Grid is never really impacted by recessions. If anything these companies benefit during a recession. Think about it this way, if you're in business of selling a commodity that is considered a necessity, than in times of recessions, your commodity should be in greater demand. After all, the reason why your commodity is considered a necessity is because customers can't live without it. And come to think of it during times of recessions, people often don't eat out. They much prefer to stay home and cook so that they save money. Although they may not make their payments on time at least they won't let their gas be cut off for too long. From this observation, we can say during times of recessions, utility companies like National Grid & Con Edition increase on their revenues. Which then mean investors should also expect Utility stocks to increase during times of recession.

As of now, National Grid(NGG) is trading at $39.88 a share, that was eight months ago, now it's $48.00 a share ( I just edited this page Oct 3, 2009). It has risen $ 8.12 a share since I last posted this hub eight months ago. According to Motley Fool, "If you need words to describe National Grid (NYSE: NGG), "stable," "predictable," and "unexciting" comes to mind." What does that mean, it means that even under a poor economy like this one, the company earning rarely decrease. I’ve provided you with that much, now it’s your turn; you do more research and see if it is a company you might be interested in.

FISCHER - TROPSCH AS AN ALTERNATIVE TO PETROLEUM

Another option which has become known as an “alternative” is Fischer-Tropsch(FT) which is a mixture of hydrogen and carbon monoxide. The principal behind this fuel is to produce a synthetic petroleum substitution. If this synthetic fuel is efficient enough, perhaps it may be use to run trucks, cars, and some aircraft engines. It might even be use with oil burners to heat residential homes and commercial buildings, all that is possible as long as our engineers are knowledgeable enough, it's a matter of having the right idea at the right time.

The companies that have joined to make this development possible are: American Lignite Energy (ALE), Headwaters Energy Services (HW.N), Great River Energy (GRE), and the North American Coal Corporation (NC). Quoting from a GLE expert “The proposed coal-to-liquids project contemplates the development of a production facility that would produce approximately 32,000 barrels of fuel per day and utilize approximately 10 million tons of North Dakota lignite annually.” Well, no need to say any more, as the president said; clean coal if such thing exists, is one of the commodities that his administration will invest in. Now, I have provided you with a short synopsis on the above mentioned companies so now see if these companies are as promising as I have stated.

As for HW.N I can't say it's that much of great stock. Although it has showed some progress between the months of Aug, Sept, Oct it's not likely that this progress will continue. This is more like a quick investment stock where if you stay in it too long you'll get wet. In that case get your satisfaction through a short term investment by predicting what the lowest point for the month could be.

THEY 'S HOPE FOR GM DON'T GIVE UP

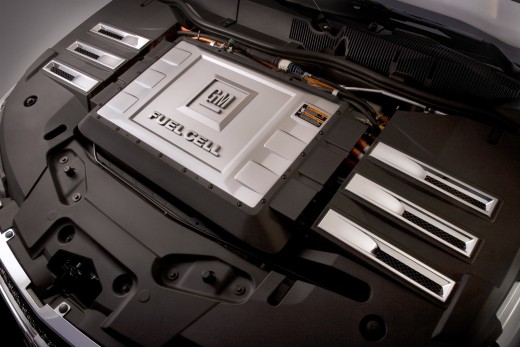

The big idea which can bring competitors to their knee is going to be the hydrogen fuel cell (FCEL) which works on a principle that combine hydrogen and oxygen to form water that create energy that can be siphoned off in the form of electricity. Fuel cell is not a new technology, it has existed before and I’m sure some of you are familiar with the term “who kill the electric cars”. Does General Motor EV1 (GM)ring a bell. I’m sure some of you might have remembered it. The president plan to re-power America will pour millions into the fuel cell technology. Anyone who wishes to invest in this technology will be a potential profiteer. Now eight months from now looking at the performance of FCEL Stock no one can say that it was a bad stock. It may fluctuate a bit but it never goes below $3.00 a share. The evidence is there, feel free to look it up yourself.

One company in the fuel cell industry that is currently doing very well under this economic frustration is Donaldson (DCI). Donaldson which is a Japanese company has demonstrated an aggressive growth within a 55 week range. Their stocks have fluctuated from $21.82 - $ 52.33; the last stock price was at $27.36. Quoting from the company’s website, “Donaldson Company, Inc. is a leading worldwide provider of filtration systems and replacement parts. Founded in 1915, Donaldson is a technology-driven company committed to satisfying customer needs for filtration solutions through innovative research and development”.

As mentioned before the Donaldson stock fluctuate a lot. Therefore anyone who has invested in that stock could have either make or break. It's a risky stock you can either make money or lose money in it. Eight months ago the range at which one can make or break was at $21.82 - $ 52.33 - it hasn't change a bit, it may not have reach $52. 33 but at leas it didn't fall below $21.80 a share, so in that case It was a well forecasted stock. As a matter fact the lowest that it has ever been was $32. 88 a share, $ 11.08 more above the lowest range.

FUEL CELL TECHNOLOGY - THE FUTURE OF THE WORLD

The next company is UltraCell, an American company situated in Livermore, California. UltraCell has announced $2.4 million in grant received from the U.S Department of Energy (DOE)to work with partners an effort to develop a system that could improve fuel cell manufacturing. Not too long ago the president was in California with Governor Arnold Schwarzenegger where he gave a speech. In the speech, he specifically emphasized on fuel cell technology, his administration plan to contribute millions into that industry. California Fuel Cell Partnership (CaFCP) maybe advantageous to watch.

Again another good stock since I last proposed it eight months ago. This stock sold at $ 14.89 a share. These stocks were forecasted base on current events that were announced to take place in the future. Anyone who did invest on these stocks probably made millions in counting.

Regardless on how much money we pour in fuel cell technology, price & quality is going to be a major factor. To compete with China & Japan, our cars will have to be just as competitive as the Japanese. If the strategy is for us to built cars for Americans to buy, we’re always going to be shorthanded. We must built cars that are affordable and reliable for the world to buy. Which mean when we manufacture these cars, we must keep in mind that we’re not building cars for only developing countries to purchase but also third world countries as well. In another word built reliable cars that the $25,000 income person can afford. If this is the way we're thinking, than Toyota & Nissan will become a competitor, otherwise they will always have the upper hand.

We should keep in mind that we’re building cars for the poor because last time CNN announced it, the middle class was still shrinking ...therefore, the automobiles we build must be affordable, reliable, well design & easily maintained. We should not build cars that a foreigner in Congo Africa cannot repair; the parts should be easily replaced and available every where in the world. It is only by taking this approach that we can begin to compete with our Japanese competitors because as it is now, their automobiles are all over the third world countries.

If you find this information to be helpful and advantageous to you, a small contribution would be helpful. Thanks an advance …my e-mail address is James_dubreze@yahoo.com