Is Student Loans The Next Bubble To Burst In America?

Now in the present, 2014, America is once again facing an economic collapse of another kind, resulting in a bad economy and unwise debts. Namely, the student loan debt bubble that is ready to burst at any time. A debt that rises by billions every year, as opportunities to pay it back are diminishing.

For many years, America has it made it possible for everyone to receiving student aid and grants by backing the loans and federally backing the debt. This makes it possible for even the poorest individuals to receive a higher education to hopefully get a better job. This however is becoming a problem. Since many, if not all of these subsidized and unsubsidized loans are not backed by any collateral, the default of this debt will be astronomical. There will be no homes to foreclose on and no recourse for many debtors to receive their money back. Many college students have yet to obtain any assets, so the only way to receive any money back will be by confiscating taxes or garnishing wages.

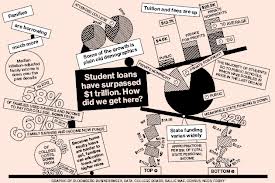

According to recent statistics in an issue of Forbes, more than half of student loans are in deferral or delinquency. Delinquency rates for federal loans made by the Department of Education in March of 2012, was 12.3%, whereas the private sector was ringing in at 5.3%. The deferral rate was at 43.5% as of March of this year for all student loans (Hardekopf, 2013).

The amount of student loan debt is now the second highest consumer debt held, just behind mortgages. The amount of student loan debt has sky rocketed and is now over 1.1 trillion dollars. Deferred loans amounts have reached 388 billion dollars, up by over 70% in the last five years. The average amount per student debt has also increased 30% in the last five years reaching over 23,000 dollars per student (Hardekopf).

A lot of the reasons why the per-student loan amount has grown so much is aptly, inflation from excessive money printing. As other cost increase, colleges are forced to raise tuition rates to try and make the same amount of profit as the years prior. Moreover, tuition has increased 104% in the public college sector and over 60% in the private sector in the last ten years respectively (Clark, 2012). Tuition is not the only thing that has went up for college students; room, board and books have also forced students to maximize their loans to pay for discretionary items as well as tuition. My online college has raised tuition rates three times in a little over two years, so going to college is just becoming more expensive.

Most would view a college education as the way out of debt, however more than half of recent college graduates are either unemployed or underemployed (Hardekopf, 2013). This is caused by a weakened economy that has still not recuperated from the mortgage collapse of 2008 where almost all publically owned investments dropped by over 40%. So a crushed economy with high unemployment and rising tuition has wreaked havoc on the newly graduated college students and default rates are close to the rates of the mortgage market prior to collapse.

Unlike mortgages that can in fact be foreclosed or even discharged by way of bankruptcy, student loans are a forever debt. This debt cannot be discharged ever and debtors can actually garnish your wages. Never in the history of the world, have such young consumers found themselves in the situation they find themselves in now. Debt has reached almost 140% of the average household’s income and all these student loans have just compounded the current economic situation.

To exacerbate the problem further for many college students, the ten year fixed rate of 3.4 percent is scheduled to rise to 6.8% in July at the start of the new federal school year. President Obama is urging congress to consider a new plan to keep interest rates locked at 2.9 percent for the life of the loan, however he will get rid of the cap on interest rates for those student that default. He also wants to focus more on work-study programs and make more stringent repayments for privatized loans, making government-backed loans more important (Nawaguna, 2013).

For those students that cannot manage the minimum payments and find themselves in default, President Obama has started a few programs to try and help. A student could try to rehabilitate the loan after the student and the Department of Education agree on a payment time and amount. This will basically refinances the loan by a private lender and any collection fees will then be added to the balance. The real benefit of this is to get the status of the loan pulled out of default, where the garnishments will stop and more options are open to the student (FSA, 2013).

Some of these benefits are forbearance, eventually loan forgiveness (after 30 years), deferment options, as well as the ability to receive more student aid from the federal government. It also releases the default status on the student’s credit report and the with-holding of any taxes due from the IRS. Although there are a few more options for students than there were even a few years ago, many economist believe that these efforts are simply too little, too late (FSA, 2013).

Some may argue that we have once again, extended the hand of credit to those who really can’t afford it and we are going to once again pay the price for that mistake. The student loan debt has also been repackaged into government bonds and once again, Americans will hold the majority of this debt, without actually knowing they do. Many Americans may be surprised to know that their 401K and retirement funds may be heavily holding these bad debt instruments. If what happened before happens again, Americans can expect another economic collapse, as well as taking a huge hit to their investments and even savings as inflation will surely occur.

REFERENCES

Clark, K. (2012, March). College tuition, other costs climb again this year - Oct. 24, 2012. Retrieved May 31, 2013, from http://money.cnn.com/2012/10/24/pf/college/public-college-tuition/index.html

FSA (2013, February). Getting out of Default | Federal Student Aid. Retrieved May 2013, from http://studentaid.ed.gov/repay-loans/default/get-out

Hardekofe, B. (2013, February). More Than Half Of Student Loans Are Now In Deferral Or Delinquent - Forbes. Retrieved May 31, 2013, from http://www.forbes.com/sites/moneybuilder/2013/02/01/alarming-number-of-student-loans-are-delinquent

Nawaguna, E. (2013, May). Obama pushes to hold down student loan interest rates| Reuters. Retrieved May 2013, from http://www.reuters.com/article/2013/05/31/us-usa-studentloans-obama-idUSBRE94U14720130531