Living BK -- a look at life after bankruptcy 3

#3 The Realities of Living BK

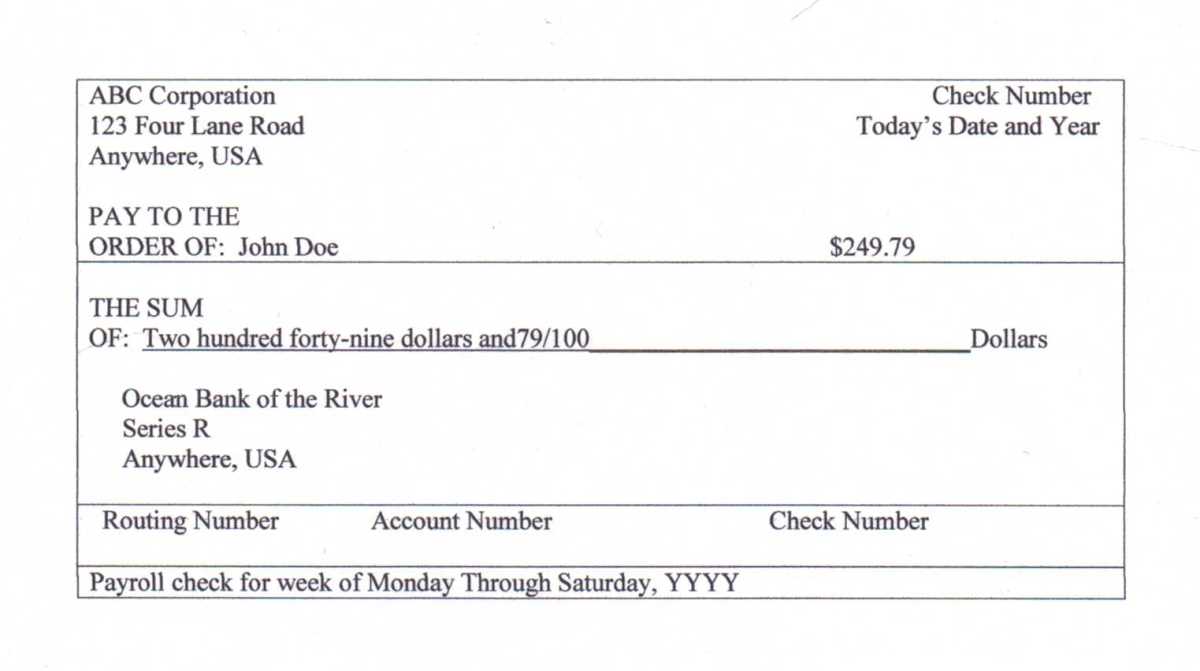

Here’s the stark reality of living under the protection of a court-confirmed bankruptcy, or what we call, “Living BK”: You are now in a “credit free zone.” You can’t put off paying for purchases – even for 30 days. Living BK means living on cash, the cash you have on hand. Nothing more. Nothing less.

How are you going to do this? Credit cards are such useful tools they’re a fact of life in the 21st Century. How is it possible to live without them? By adjusting your perspective and living completely within your means.

This will be tough at first. But when you get used to the concept, it has a lot of benefits -- the first of which is, you pay only the purchase price – no interest! The ease of whipping out a credit card masks the fact that everything purchased with it has a hidden tax – the interest fee on your purchase. Think about it. For every dollar spent on a credit card, the issuing bank gets anywhere from 7 to 29 cents. It’s like going to the counter to buy something for a buck and the merchant asks you for 29 more cents.

Every dollar.

So, making the successful transition to a cash only/credit-free lifestyle means you’re not supporting a bank any more. You’re no longer playing their game. Living BK means credit cards are a thing of the past.

So forget them!

Perhaps the easiest way to do this is to think: “Back to the Future.” This is what I mean – to experience your future, you must think back and acquire the mindset the existed back in 1950. Why 1950? Because the first credit cards started being used in 1951. Though it was years until they caught on, 1951 is when the clock started ticking on building a system of wide-spread credit card use.

Adopting the 1950’s mindset is to think of cash as the only means of paying for the items you want and need. And most importantly, it means you’ve got to realize you don’t have the safety net of a credit card if an emergency expenditure becomes necessary.

How did folks in the 50’s handle emergency purchases? They had a rainy-day fund. This was a special account dedicated to the unexpected, unintended events of life – emergencies. At worst, it was an understood portion of the savings account. At best, it was a dedicated account (or coffee can!) that money was added to every month until some agreed upon cap was reached. And if withdrawals were required, they were paid back as quickly as possible – before money went to savings.

This is the type of financial discipline that needs to be practiced while Living BK. We need to faithfully – and wisely – set aside money to provide that emergency relief. And in doing this, we are not only protecting ourselves from further disaster, we are protecting ourselves from having to pay 18 tp 20% more for getting caught in an emergency.

Remember, making any purchase on a credit card instantly levies a tax of anywhere from 7 – 29% on every purchase, unless you pay off the balance every single month. When you think about it, what sense does it make to buy something at 20% off with a credit card at 29% interest and then take a year to pay it off?

Sure, the advertisement says the item you want has been reduced 20% and is now available for low payments of $126 month for 36 months. Sounds great…and costly. The interest portion of that payment more than makes up for the 20% discount.

When all is said and done, Living BK is a mindset most people need to acquire.

Living on credit cards and paying the interest on every purchase month after month is a thought-provoking practice. Consider this: Most religions ask believers to tithe so as to support the work of their ministries/activities. That tithe is typically considered to be 10% of income.

Paying 7 – 29% of credit card purchases every month to a bank is just like paying a tithe. 7 to 29% of every dollar you use for a purchase goes to support the “ministries & activities” of a bank.

And what has that financial institution done with those tithes to help you?

Living BK is not a shameful activity. It is a more responsible way to live. It’s a better way for all of us to live. Pay as we go. Make an honest dollar, spend an honest dollar.

Living with credit meant, on average, 20% of your income when to supporting a financial institution, an institution that, quite frankly, offers nothing more in return for the investment than the continuing obligation to tithe 20%.

Think about that.

Now rejoice.

Give thanks for finally being free of a cycle that does nothing more than create more debt and induce feelings of futility.

“Pay as you go” is the best way to go. Living BK means paying the selling price, living free of the hidden taxes and being free of that ghost mouth sucking on the teat of your hard earned income.