Getting Out of Debt - The Psychology of Money

Debt Busters avoid Financial Issues As Best They Can

Money is practical, spending is emotional. The link between our financial situation and our self esteem is probably a better predictor of debt risk than our credit score may reveal. Why do some people have financial troubles? Is there something about a person’s behavior and thinking that steers them towards financial failures? Some people it is believed may be more prone to gettting into debt than other people. In studies it there have been connections that have been noted to some personality characteristics. There is, however, a stronger correlation to demographics and attitudinal behavior.

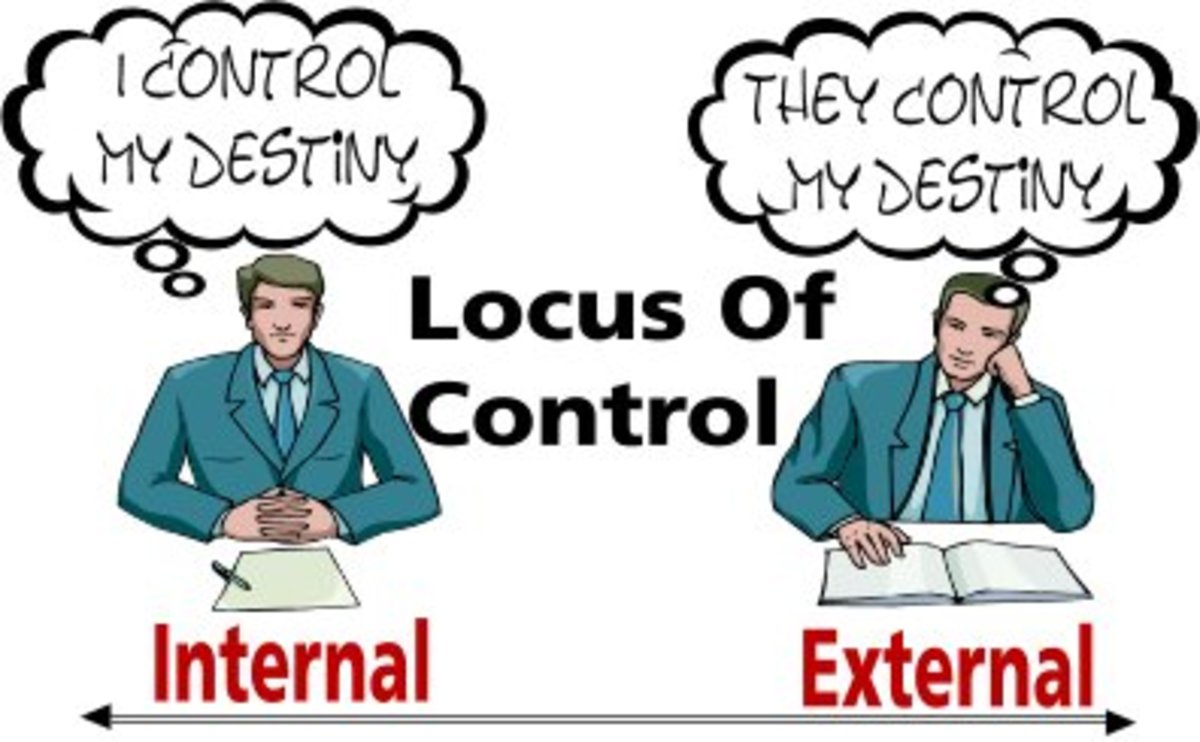

People with lower incomes are more likely to have debt. Younger individuals are more likely to have higher debt due to their lower salaries. People who know other people in debt are more likely to to be in debt also. Aside from these obvious factors, there are psychological beliefs that have an impact on a person’s debt situation. An often looked into aspect of a person’s psychology is what is called the locus of control. This is the individual’s own perception of control over the events that happen in their lives. People with an external locus of control tend to believe in fate, and luck, control more of their life circumstances. Those with an internal locus of control see their own decisions as a guiding force in their lives. People with an external locus of control tend to feel more helpless. People with an internal locus of control tend to have more self determination. Locus of control is an important aspect of personality, and behavior. There is much more to the locus of control and the good and bad of both kinds. However, there is a correlation to the attitudes you have towards your life’s situation and the circumstances that you may find yourself in. Not too much has been studied about a person’s economic situation and their psychological thinking. Research findings suggest an internal locus of control appears to help people be more focused on what they want to accomplish, seem to get better paying jobs, and as a result may be better off financially.

Debt Busters and Their Personality Characteristics

Emotional Aspects of Money

Researchers have studied students and noted that there were several connections to being in debt, mismanaging money, and financial irresponsibility to their behavior, personal expectations and attitudes. Self esteem,locus of control , and self efficacy play a major role in a person’s money manner and behavior. Money attitudes are very complex. The emotional component of money means different things to different people, from obsession, to power, to inadequacy. Debt, which gives no power, perhaps, could be caused by an attempt to mask their powerlessness by possessing things, and possibly looking like they are more successful. Debt also causes feelings of inadequacy and for people with low self esteem, this is a manifestation of how they feel. People with an external locus of control, have difficulty straightening out their financial situation because they may feel a sense of self helplessness. They believe they need luck or the universe is doing this to them, so they don’t make decisions that will lead them towards a solution. They are waiting for someone else to fix it for them. There are other factors as to why people let themselves get into debt, including age and other demographics. Those who avoid debt, may want to avoid the burdens that come along with debt. Debt busters may have different insecurities that they are hoping money will satisfy. This is why the exact psychology of debt is so difficult to pinpoint in studies. There are many variables that go along with the psychology of money.

Debt busters are clutter busters. Another correlation to debt is clutter. Having “too much stuff around” can cause more debt simply because people can’t find things they already bought or lose things they have to pay for. It is easy to forget to return a library book or a DVD rental and then owe the late fees. People who clutter may not have a good place to keep their grocery coupons,rebates, and return receipts. Returning items without a receipt usually means a lower refunded amount, or perhaps not even returning the product to the store. Failing to send in rebates and not using grocery coupons can impact even slightly the money you would have otherwise saved. If you can’t find the bill that is due you will probably have additional penalties. A habit of late payments will cause your credit score to be lower. When you want to apply for a loan, your interest rate may be higher. But there is more to clutter and debt. An uncluttered environment reduces stress, and helps you feel more efficient and a greater sense of happiness. People spend more when they are stressed and in trying to find some contentment, may buy things they do not need. People who have a cluttered house usually attempt to organize the mess and will buy containers, furniture and organizers in an attempt to neaten up the areas.

Money and Debt Busters Tips

The psychology of debt is a complicated issue. There are many reasons why people have financial difficulties. More research and studies need to be done to get a better understanding of this aspect of behavior, of why some people are debt busters, and some people are prone to being in debt. If you find yourself in debt, it may be helpful to get a better understanding of yourself or seek a professional to talk to. Stress from debt alone is a good enough reason to seek a qualified mental health counselor. Feelings from long ago affect do affect your relationship with money. How you feel about yourself, your self esteem, and self efficacy are all important parts of the debt picture. If you are feeling inadequate or deprived try to understand that spending and buying material things will not help you feel better emotionally. It is also a good idea to unclutter your environment, and have a place for everything so it becomes easier for you to find things when you need them. For everything you buy, there are opportunity costs that can affect something you may want in the future. Try to think about what you are spending your money on and what it really is doing for you and to your financial future. If you are feeling low, try to find out what you really need and give it to yourself emotionally, instead of economically.

Debt busters deal with the psychological side of debt with some of these tips:

- appreciate who you are and what you have

- try to delay spending money today

- ask yourself what you will do with what you bought

- take time each day to envision what you want for yourself

- take responsibility for your actions without chastising yourself

- compliment yourself when you show self control

- feel good about your environment

- think of the benefits of having a few dollars that you didn’t spend

- reduce your impulsive behavior by distracting your thoughts

- believe in yourself

- love yourself

- set up targets that you are aiming to achieve

- set a reward for yourself when you have reached even your smallest target

- set up a simple budget that you can realistically follow

- hold off buying what you want for a month. After the month is over, see how much you want it

- think about how long it will take you to earn the money for the items you want. See if it is really worth spending on

- add up what that daily lunch or weekly bar tab adds up at the end of the year and see if you can cut back on your expenses. Little bits of money here and there add up over the course of the year.

- note what is important in your life and you will find the material things matter very little. Keep this in mind when you are measuring the quality of your life.

- have a positive attitude and believe that you and will straighten your financial situation out and can improve your monetary situation for the better.

- do things for yourself and not to impress others

- don’t identify yourself by the brand names you think mean something that they don’t

- keep yourself, your spouse, and your kids grounded. Know what is important to you and your family, and live your life according to this healthy minded thinking

- Try not to spend money to help yourself feel better.

- Take control over your life, your expenses, and your habits. You will feel better for it.

Clutter and Debt

When your environment is neat and organized, things are more readily found. You are not spending your money purchasing something you already have. Reducing clutter allows you to feel better about yourself. You also might enjoy being in your home more, instead of running away from it and finding yourself in a store. Clutter also affects our health. The more stuff the more dust. Dust and mold not cleaned cause respiratory problems. Stuff in the way or on the floor can cause trips and falls and injuries. Additional medical costs will add to your debt.

A neat home will make you feel more efficient and better about yourself. An uncluttered environment gives you a feeling of competency and a sense of discipline. These feelings will carry over to your finances. Being disciplined will help keep you out of debt.

Another psychological aspect to debt is the individual’s coping strategy. Some people are like a “deer in headlights” when it comes to adversity. There are some people who don’t know what to do to change the direction they are going. This sense of self helplessness can make a correctable situation worse. The best way to not be in debt is to stay out of debt. If you are in debt you need to be initiative and take action.

There are also correlations to risky behavior and debt tolerance. Debt busters look to avoid debt. Some people want to put themselves in a situation, that complicate their lives. Some people are just in denial about the reality they live. Some people indulge themselves because they are afraid to deal with their feelings. Spending money is a release and the consequences of debt are not dealth with, just as they are not facing their other feelings. Sometimes debt could be a result of compulsions, or a self destructive tendency. Some people fear success and being in debt helps you not to have to deal with what these feelings me. Sometimes people grew up feeling deprived and overspend to compensate for these feelings. Some people are impulsive and don’t think about the long term or big picture.

Debt Busters Unclutter to Help Manage Their Finances

Behavior Spending and Debt

Money affects our lifestyle, and our thoughts. It is important to have a healthy attitude towards money. Your behavior, spending habits and savings reflect your thinking about money. If debt is making you uncomfortable, look within yourself to see what your internal messages are telling you. Work out the details of what your debt really means so you can get a better handle on your financial situation. Debt busters try to avoid the situations that owing too much money causes. Debts are a mistake, you can correct them and live a better lifestyle. Our monetary decisions are based more on wants than needs. Psychologically, we tend to intermingle the two.