Mutual Funds for Dummies - 3 Main Risk Catagories

Mutual Fund Categories for Performance

This Mutual Funds for Dummies tutorial concerns the 3 main categories of mutual funds, if you want to know more about what a mutual fund is, you should first check out Mutual Funds for Dummies - What is a Mutual Fund

Mutual funds are a great choice for the investor that just wants their investment to perform and doesn't want to have to worry about keeping up with the stock market details, or the money market interest rate, or which stock index to focus on.

Sometimes better investing means letting the better investor do the work for you. Mutual funds are guided by professional fund managers that do know about growth funds and stock funds and index funds and money market funds, and on and on.

But ... you do need to know what type of investment, and what amount of risk and reward you want.

Mutual Funds for Dummies - 3 Main Categories

Mutual funds can be classified into 3 primary categories based on their content.

- Stock Funds - Sometimes called equity funds. This type of mutual fund can sometimes be the riskiest, with sharply rising, or falling, values due to stock market investor activity. Historically, if held over the long term, stock funds have been the best performing growth funds due to individual company's stock improvements. The fluctuations mentioned are generally the result of changing investor and economic conditions. But because a stock mutual fund contains stocks from many companies, not just one, they are less susceptible to wild permanent fluctuations, and generally average out to outperform other types of funds.

Some common types of stock funds include:

- Growth funds - these funds offer the most opportunity for growth because they are invested in well-vetted start-up companies that appreciate rapidly, thus returning large capital appreciation. This type of mutual fund appreciates through increased stock value and generally does not pay dividends.

- Income funds - don't provide the large potential growth opportunities as growth funds, but instead are placed with established growing companies that produce a steady income through share dividends.

- Sector Funds - this type of fund specializes in stocks of a particular industry or market segment, like technology or health.

- Index funds - these funds choose stocks intended to match the performance of a market index. The most commonly chosen index is the Standard & Poors 500 Composite Index.

2. Money Market Funds - comparably low risk as opposed to the other types of mutual funds. The most regulated of mutual funds, money market funds are limited to only very specific short-term, high-quality money market investments issued by U.S. Corporations, the US, State, and Local governments.

Generally a money market fund contains assets that will allow it to keep a NAV, (net asset value), of $1 US. This value should remain constant, barring poor portfolio performance.

In exchange for being the safest of the mutual funds, meaning very little risk of losing your money, their returns are also the lowest of the 3 types of mutual funds. But even though money market fund returns are guaranteed, this safety also carries the potential of their returns being eroded by economic inflation.

3. Bond Funds - this type of fund falls in-between Stock and Money Market funds relative to both safety and income. These funds are sometimes referred to as "fixed-income" funds because they provide a steady income through investment dividends.

Just like sector stock funds, bond funds can also be can be organized by market segment. This segmentation also allows a bond fund to tightly control risk vs income by choosing bond issues that can range from low-yield & low-risk Treasury bonds, to high-risk & high-yield junk bonds. The contents of a bond portfolio are well advertised so investors know the type of fund they are entering.

Even if bond funds are usually safer than stock funds, they do have potential risks:

- The possibility that rising interest rates may cause the value of the bonds in the portfolio to decline

- The possibility that the bond issuers may fail to pay back their debts.

Types of Mutual Funds Within the Categories

To say what "type" a fund is can have several meanings. Many times "type" is used instead of category to describe the above, or "type" is used to describe the fund contents, e.g. investments, but most correctly "type" would describe whether a mutual fund is a load or no-load mutual fund. (for a description of load vs no-load see Mutual Funds for Dummies - What is a Mutual Fund)

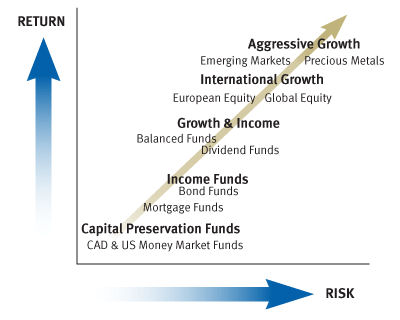

Another way to describe a type of fund would be conservative vs. aggressive. All 3 of the above fund categories can be structured for certain performance goals by the choice of investments in the portfolio.

The more conservative the investment portfolio in a fund, the less risk of loss, and of course the more aggressive the investments in the fund the more chance there is it could take a loss.

As the saying goes - "all things being equal" -

- the safest, but probably least performing fund would be a money market fund which would have its return dictated by the money market interest rate.

- next safest, with potentially better returns would be bonds funds with treasury and municipal bonds

- and lastly, very safe but with better potential returns would be conservative stocks funds

But, and there is always a but, each of these funds can vary their risk vs reward ratio by manipulating the funds investment contents.

Mutual funds don't have to be strictly one or the other category. Fund managers can mix different types of investments. e.g. a money market fund could also have some stock and bond investments to help boost return, but still maintain a very low risk of loss.