Payday Loans

You used to be able to go to your local bank to ask for a small, short term loan when you had sudden, unexpected expenses, like needing new tires on the car or covering unanticipated medical bills. But today people use credit cards to act as short term loans, which means few banks will offer this kind of financial assistance. Even if you need cash, you can use your credit card in an emergency to receive a cash advance.

For people who either do not want to use their credit cards, are in credit card debt, or simply do not have credit cards, one of the only options left are Payday Loans.

ConsumerAffairs.com - Are Payday Loans A Good Idea?

- FDIC: Guidelines For Payday Lending

The Federal Deposit Insurance Corporation (FDIC) website provides guidelines for payday lending, including procedures, guidelines, significant risks, and safety issues for payday advances. This page offers background information on payday loans in t - CFSA - Community Financial Services Association of America

The Community Financial Services Association of America website provides information about the regulations of the payday loan industry. The site also includes a list of payday lenders who do follow the CFSA’s best practices guidelines. - PayDay Loan Consumer Information

The Consumer Federation of America (CFA) provides a website with information about payday loans, a calculator tool to help you figure out payday loan costs, as well as providing a link for consumer help.

What is a payday loan?

A payday loan is a short term loan between the day you need the cash and your next payday. These loans are intended for people who need to borrow money for a short period of time. They should only be used for unexpected expenses or temporary income reductions.

Payday loans are usually for amounts under $1500. If you need to borrow more than $1500, you should look into other kinds of financial assistance (like personal loans).

Payday loans are meant to provide short-term credit, but are not intended for frequent use. However, this doesn't mean a payday loan lender will turn you away if you choose to use these services often.

How do you qualify for a payday loan?

Each payday loan agency varies in the requirements from borrowers, but the most common qualifications include:

- Proof of steady income

- Proof of an open bank account

- Proof of identity

- Proof of residency

Credit history is rarely a factor when it comes to being approved for a payday loan, which is one of the reasons why it is so appealing to many people in need of an advance.

How do you repay a payday loan?

Most lenders require you to write a post-dated check when you make the loan. The check will not be posted to your bank account until the date on the check. You can also make cash payments on the loan before it comes due. Some lenders will set up automatic payments, allowing them to debit the amount out of your bank account.

What is the interest rate?

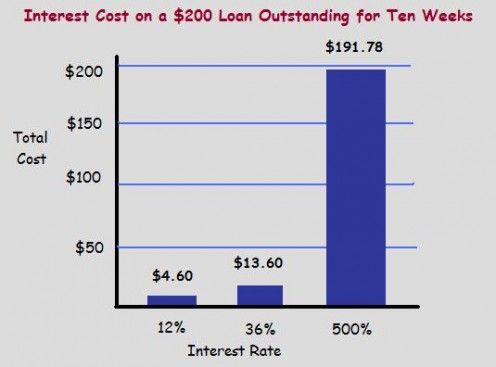

Interest rates are usually pretty high, but they vary depending on where you live. Some states have passed bills that put a cap on how high payday lenders can make their interest rates.

While a high interest rate isn’t a huge problem if you pay the loan back right away, it can really cost you a lot of money if you need to extend the amount of time to repay the loan.

How does a payday loan work?

Once you are approved for a payday loan, you write a check for the amount you need, plus the fee for the loan. The loan agency either gives you cash for the amount you borrow or deposits the amount into your bank account.

Here is an example of how a payday loan works:

You need to borrow $150 for two weeks, until your next paycheck, so you decide to get a payday loan. You can either go to a payday loan agency or fill out an online payday loan application. Once you qualify for the loan, you will promise to pay the agency $175 (the $150 that you need to borrow, plus a $25 fee to borrow the money). This promise is made either by you writing a personal check for the amount or by providing the lender with your bank account information to set up an automatic payment.

When your next payday comes, you have a couple repayment options:

- The lender deposits your check, and the money comes out of your bank account.

- You pay the lender back in cash, and they return the uncashed check to you.

- You extend the loan, and the lender charges you another financing fee.

- You agree to electronic payments, and the lender automatically debits the money out of your bank account.

Where do you get a payday loan?

There are many physical payday loan locations you can visit to fill out the paperwork. Most of these places advertise their services as “cash advances.” There are also many payday lenders available online, so you can easily find a list of them when you do an internet search for payday loans.

Payday Loan Testimonials

"I have used them and always regretted it. They get you out of a fix, only to get you into a bigger one. I would find myself taking out another PDL in order to pay the "interest" on another. I used my entire income tax refund to pay them off. They do serve a purpose, but there IS A PRICE." - Debra

"I do work place investigations and on two of them people that got these juice loans ended up stealing from their job and they both got fired. They still have the loans to pay off at about 400% and now they have no job either." – Brian T.

"I was broke four days before payday, and had a ton of bills to pay. It was hard to resist getting another payday loan. When I was in this situation before, I used to go to the nearest payday loan place and write a postdated check for $575—and leave with $500 in cash to help me out until I got paid. But the interest rate was 391% on the two week loan, so I would have to take out another loan to pay back the existing loan. I knew I was in trouble when I had six different loans with fees of almost $1000 a month. Now I know to resist the payday loans.” – Christi

Payday Loan Tips

- Only use payday loans as a form of short-term credit.

- Only borrow the amount that you will be able to repay from your next paycheck – do not borrow more than you can pay back.

- Use a payday loan to cover an unavoidable cash shortage between paydays.

- Always choose a lending agency that is licensed and well-reputed within the industry.

- Payday lenders craft user protections - USATODAY.com

This USA Today article describes the new (as of Feb. 2007), voluntary consumer protections offered by payday lenders in the face of legislative pressure on the lenders’ regulations and practices. - Payday Loan Industry Watch

Pliwatch.org is run by independent observers with the goal of providing objective information regarding the payday loan industry, as well as reporting on legislative regulations regarding the industry and consumers. - Payday Loans

An interesting article about payday loans and advances from the State of Wisconsin’s Department of Financial Institutions website. Learn more about how much these appealing loans can really end up costing you in the long run. - ConsumerAffairs.com: Knowledge is Power! Consumer news, reviews, complaints, resources, safety recal

ConsumerAffairs.com acts as a consumer news provider and information center, as well as a forum for consumer complaints. The site is completely independent without any government agency or corporate affiliations. Searching their site for “payday lo - Fact Sheet On Payday Loans

The Consumers Union, a non-profit publisher of consumer reports, provides a fact sheet about payday loans, providing problems with, alternatives to, and legislation about payday loans and advances for consumer use. - Americans for Fairness in Lending

The Americans for Fairness in Lending (AFFIL) website provides consumer information on payday loans, as well as other loan agencies (like credit card companies). AFFIL is a non-profit organization that promotes government regulation of the lending i - Payday loan - Wikipedia, the free encyclopedia

Here is Wikipedia’s take on payday loans. This article offers definitions and descriptions of payday loans, as well as providing information about government regulations and legislation on the loans. Wiki also provides information for loans from so

Check into Cash Commercial - What's Your Story?

Should you get a payday loan?

If you are getting a payday loan to cover a night out on the town, you probably should not take that loan. But if you choose to get a payday loan instead of having insufficient funds in your checking account, you might find that the loan fees and interest end up being less than what your bank will charge you for having a negative balance.

You need to stop and consider your options if your only choices are:

- Take a payday loan

- Don’t pay your bills on time

- Overdraft your bank account

Each of these options will cost you more than if you simply had the money available, but you need to figure out which will cost you the least. Consider the following when making your decision:

- Payday loans have fees and interest.

- Not paying your bills on time will create late charges, could result in having services turned off, and/or could affect your credit score.

- Bank overdraft charges can be pretty high. Plus, some banks will charge you an overdraft charge for having insufficient funds to pay the original overdraft charge. Depending on your bank, other fees could include a charge for having a negative balance (which could be charged each day you are in the negative).

You might find that payday loans could cost you a lot less than not paying bills on time or being stuck with overdraft charges from your bank. The APR (annual percentage rate) for payday loans seems high, but you have to understand that it is only set for a specific amount of time. When you compare it to other fees, it might be less. Examples:

For a 14 day term, a $100 payday loan with a $20 fee has a 521% APR. But, a $100 credit card balance with a $30 late feel has an 800% APR, a $100 bounced check (due to insufficient funds in your bank account) with $50 in bank fees has 1,304% APR, and a $100 power bill with $60 late or reconnect fees has 1,564% APR.

As long as you pay your payday loan back on time, it could end up being the least expensive alternative.

Payday Loans Trap Borrowers - Interview with Former Lender

Payday Loans – Good or Bad?

It might not be easy to choose whether you think taking a payday loan is a good idea or not. The commercials for the loans, and even the brochures and pamphlets the lenders provide, are very convincing about how helpful payday loans can be. However, there are a lot of groups, organizations, and testimonials about how bad these loans are for people.

What it comes down to is personal choice and responsibility. Payday loans can work for some people, but not everyone. In fact, they can cause even more financial troubles than if you simply went without the advance.

I’ve actually gone into a couple of payday loan agencies, and the employees are helpful, matter of fact, and friendly. The entire experience and atmosphere when you walk into some of these places feels professional. Yet, I couldn’t help but feel like I had walked into the land of used car salesmen on a mission to make a sale. I was torn between whether the places were convincing or gave me the shivers – but, if I was short on cash without any idea of where else to turn, I can see how people choose to use payday loans.

The bottom line: use these services responsibly and with caution. Payday loans can be helpful, but they can be harmful too.