Price Earnings (p/e) Ratio Stock Valuation Explanation

Some stocks are cheap -- look at the P/E ratio for an indication

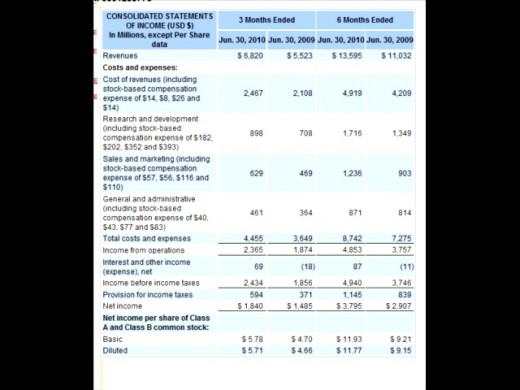

The price to earnings ratio (P/E) of a stock is the price of stock divided by the Earnings per Share (EPS) of the stock for the full year. After all expenses have been paid, a company will usually earn a net income to be distributed among common shares. The net income/weighted average of common shares (weighted by time outstanding) will give EPS. The market price of a given stock divided by the calculated EPS is known as the price-to-earnings ratio or P/E. Normally, the P/E ratio is available on finance sites that offer stock quotes. However, be careful to note which period the P/E ratio is referencing. P/E ratio for the last twelve months should have a footnote ttm next to it, meaning "trailing twelve months." Forward P/E is based on stock price divided by projected earnings for the next twelve months. There usually isn't a consensus forward P/E ratio, because different sites have varying estimates.

Publicly traded companies must file certain periodic reports with the Securities and Exchange Commission

Yahoo Finance Stock Quote (GOOG) -- with the P/E ratio

Making sense of all this information -- What is the P/E ratio, and why is it so important?

Note that yahoo reports an EPS of 23.03 with a P/E ratio of 21.73. This means, if Google reports the same earnings year after year, it would take ~22 years for the shares of stock to justify their quoted price of ~$500.00. The EPS of 23.03 is actually how much was earned per share, and yet it seems to be at odds with the price quoted for the shares. It would seem, people expect Google to show earnings growth, or they want to wait 22 years on Google (this is theoretical). What if the EPS was $50 instead of $23.03? Now, Google would have a P/E ratio of just 10. That is, $500 would be 10x the earnings per year, for the most recent information. The P/E ratio is not even close to a sweet summary, but it can provide context, together with more information about Google and its industry competitors.

On that note, analysts had been enthralled with a darling stock, Baidu, roughly analogous to Google in China. It was on a tear at one time, so for your follow-up research assignment, look up the financial information for Baidu (ticker BIDU).

A few articles on the fundamentals

- A concise overview of the stock market

Q1: So, where is the stock market -- how do I get there? A: The market has shifted online, for the most part and; most "trades" are processed by machines. It is more of a virtual marketplace. ... - Concise Overview of Accounting Principles and Assumptions

Q1: Is accounting a difficult subject to learn? To do well at accounting, you must have a genuine interest in the subject, or you must be able to pay attention to details and minutiae. For the bad rap it...

Some useful links to aid in your research -- Securities and Exchange Commission, Electronic Data Gathering and Retrieval Database (EDGAR), Yahoo finance, and MS

- Company Search

- Yahoo! Finance - Business Finance, Stock Market, Quotes, News

At Yahoo! Finance, you get free stock quotes, up to date news, portfolio management resources, international market data, message boards, and mortgage rates that help you manage your financial life. - http://moneycentral.msn.com/detail/stock_quote