Refinance Car Loan - Bad Credit

No matter which way you want to try to look at it, having bad credit is never a good thing and it's something that takes a long time to fix. This means that regardless of what you do and how great your track record has been since your bad credit mishap, the blemish on your credit report is going to follow you around for a while. So, what this means is that if you're considering a refinance car loan, then you're going to have to do it just a little bit differently than other people who have a good-looking credit score. This probably isn't any surprise to you, but this definitely doesn't mean that you shouldn't think about car loan refinancing as an option to cut your monthly expenses. You can still do it, it's just going to be a little tougher.

By the time you finish with this article you'll know exactly how to go about getting a refinance car loan with bad credit and how you can ensure that what you're getting is the best deal possible.

How Having Bad Credit Affects Car Refinancing

For any type of credit institution to feel comfortable lending you money for a refinance car loan they need to ensure that they are covering their own liability as much as they possibly can. This is why most of them, like most other financing companies, use your credit level to judge whether or not you're a potential customer that they'd like to have. This is why the lower your credit is, the less trust they'll have in you and more liability that they'll have when it comes to you repaying them the refinancing car loan that you're looking for.

Since most traditional lenders have to play it safe and will only deal with people who have good credit, you'll be left dealing with sub-prime and high-risk lending companies. These lenders have access to loans that are specifically structured in a way that they help deal with their additional liability. Normally what this means is that you will have a substantially higher interest rate for your refinance loan, but it should still be low enough that you'll still see a significant drop in your monthly payments (especially if you extend out your payoff schedule significantly).

Steps To Get Started With Your Car Refinancing

Besides the fact that you happen to have bad credit and will have to deal with sub-prime and high-risk lenders, the process of a refinance car loan is practically the same as it would be if you had great credit.

The following steps below will guide you through the rest of the car refinancing process. As you being to easily breeze right through them (which I'm sure you will), always keep in mind that you should research as many lenders as your time allows so that you end up in a situation that you feel comfortable with. Many people refinance their car because of something that they got talked into or didn't catch when they first got their loan, so believe me, taking your time will really pay off in the end.

- Research Lenders and Interest Rates Online: The first thing that you should do is start researching various lenders that would be willing to help you with a refinance car loan. If you Google 'High Risk Car Loans' or go to sites like MyCreditTree you should be able to find an available lender.

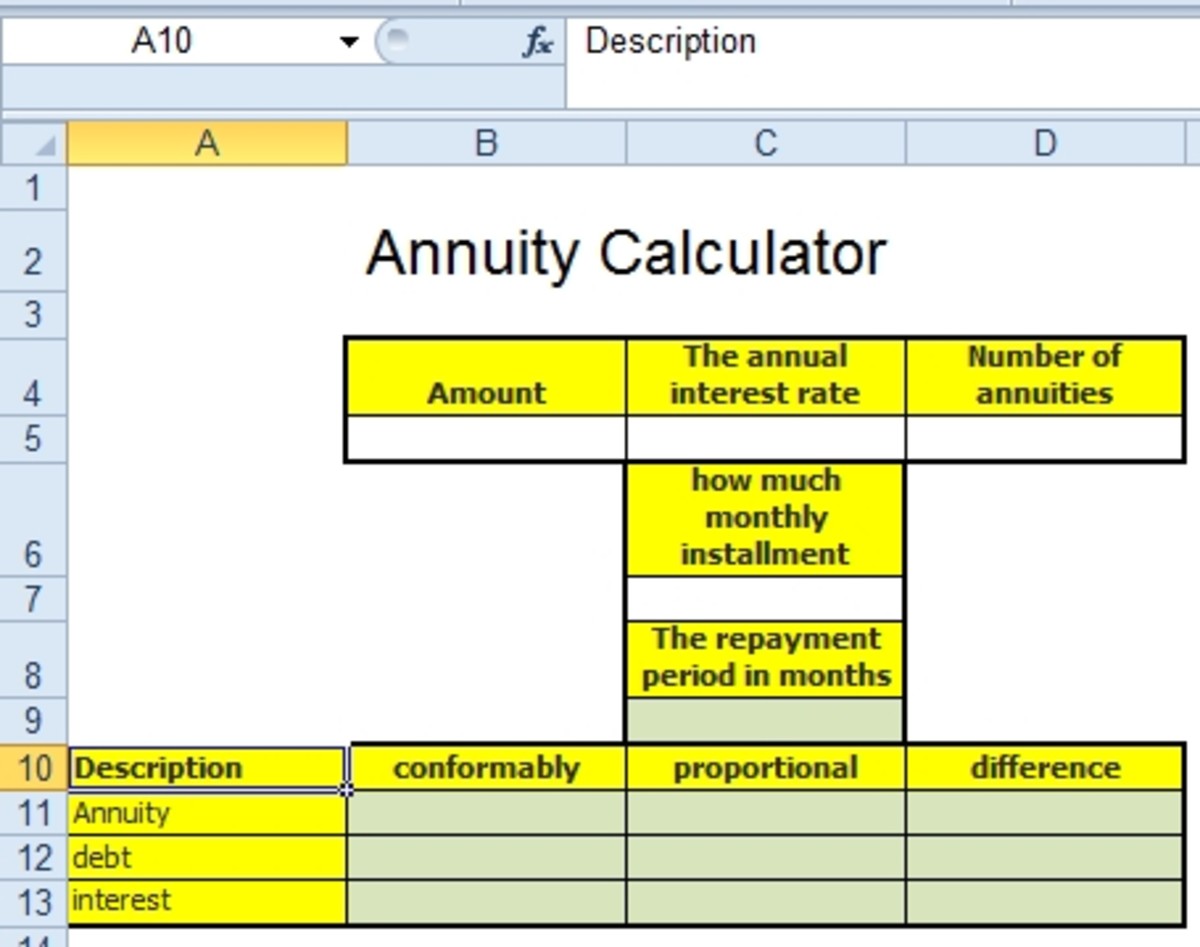

- Research Current Interest Rates: The next thing that you should is research the interest rates that are available for car refinancing. After you find some rates, you can use a refinance car loan calculator to see how the different interest rates affect your monthly payments.

- See How Much Your Car Is Currently Worth: Car refinancing is actually pretty quick and painless thanks to some smaller details that you don't have to deal with like getting appraisals. You can simply check out Kelly Blue Book to see what your car is currently worth and as long as it's greater than $8,000 you should be eligible for a refinancing loan for your car. You also need to find out what your current payout is for your initial car loan, which you can find on your last monthly statement.

- Choose A Lender And Begin The Refinancing Process: Now that you have all of the information that you need and once you get some quotes from a few lenders, it's now time to choose one and officially apply for the loan. You can usually do this right online.

- Enjoy Your New, Lower Monthly Payments: Once you have all of this completed and you're locked into the new refinance car loan, you can breathe a little bit easier and enjoy the monthly cash flow that it has now given you!