Save Money in College: College Money Tips

How to Save Money in College the Real way.

I hate those articles that claim to feature “500 ways to save money in college”. They are overwhelming, quick fixes that you will forget within the next five minutes. Also, they tend to urge you to spend money by giving you some great ideas of things to do on the cheap. I swear they are marketing ploys disguised as "How-To" articles. While those ideas are cheap and and may better your college experience, items on these catch-all lists still cost something.

The best way to save money in college is to have a long term plan before attendance, be ready to make sacrifices, and put your pride on the shelf. You don’t always have to do something to save money, sometimes it’s what you don’t do that will help you keep your cash intact.

Recycle Your Essays.

Might I add that you can re-use your admissions essays for more than one application, or you can change a few key points to tailor your application another perspective school. Be sure to save the variations so you can refer to them and reuse them as needed. This is a big time saver and you will be more organized for doing so.

Quick Reference: Money for College.

Scholarship: Financial help for students that you do not have to pay back. The money is awarded to help with tuition, living, books, travel, and supplies. Most times this money is given directly to the institution and you will not be able to use it outside of its intended purpose.

Grant: A grant is similar to a scholarship. Again you do not have to pay the money back. The most common is the Federal Pell grant that you will apply for through FASFA.gov. Grants, like scholarships, are given to the university, but if there is left over money, it will be refunded to the student via check or direct deposit. Usually, schools require you fill out the FASFA (Free Application for Federal Student Aid).

Loan: A loan is money taken out through an a bank or lending company with interest to pay for educational expenses. You must pay this money back, unless of course you die.There is a bit more freedom with a student loan, as you can spend them how you want, as long as your tuition has been paid for.

Plan Ahead.

You already know you are going to college. Before you even graduate, you are preparing for the big transition of living on campus and gaining a new-found freedom. While these things are important and fun to think about, you need to think about the future; and trust me, it isn't that far off.

- If you have to opportunity to earn extra money before you attend, take it! You will not be sorry. After-school jobs and summer jobs are ideal for growing a good sized spending stash or emergency fund. If you can’t hoard all of your earnings, save a percentage of your paycheck each time you get one. Keep a savings account that earns interest. Student accounts are available at most banks, so shop around, or ask someone who has already used these services.

- Don’t underestimate the power of scholarships. There are grants and scholarships out there for everyone from south-paws to members of the LGBTQ community. You just need to know where to look. Schoolsoup.com has served me well and you can search according to your needs.Check your college’s website and talk with a financial aid counselor about applying to scholarships through your university. It will take a little work writing essays, but the work is well worth the chunk of money you could qualify for. By the way, I gained several thousand dollars through my university's scholarship programs, so don't think that you won't be good enough, because you are.

- Stay away from any “scholarships” that don’t require you to do anything: ie “No Essay Scholarships”, points programs, and anything you need to provide your credit card or social security numbers for. These are typically marketing schemes and spam. If it looks too good to be true-you bet it is.

- Take a look at class requirements and see if you can opt to test out of a class. Talk to your adviser about this. Why pay for a class you can test out of?

- Consider becoming an RA, (resident advisor). You can get free room and board while living on campus. Just be sure that you are willing to take the responsibility the job title comes with. If you have a problem with being an authority figure, this one may not be for you.

The Future of Your College Furniture.

Household Savings.

- You might be tempted to buy all new furniture and appliances for you new digs, but I urge you to re-consider. The amount you will save bringing what you have, getting a furnished dorm or apartment, or getting things second hand will be considerable.

- Chances are, after you serve your time, you will either outgrow or have trashed your furniture. By the time you earn your degree and find gainful employment, you will be considering moving away to you final destination and will be starting over anyway.

- Don’t forget that dumpster diving is still and option and you will be sure to find plenty of discarded items when you come in for your first semester. Upperclassmen will throw away all sorts of furniture and other belongings that will be up for grabs.

- You probably won’t need much in the way of dishes, so bring something from your parent’s house or pick up a solid plate or two at a thrift store. Same goes for appliances. More than a microwave and perhaps a blender, you will not use regularly enough to justify. I take that back: Get a crock-pot. You will need it. Low maintenance, freezable meals-'nuff said.

- Forego buying gifts while in school. Trust me, people understand this. Besides, if you take time to make something or write a nice letter or get a nice card for someone, and do it with thought, they will appreciate it all the more.

- Don’t get Cable! I know you are tech savvy enough to know that Youtube, HULU, NetFlix etc are cheap or free. If you are dying to see something current, go to a friends or have someone record it for you.

Bottom line: Be resourceful and don’t think you need everything all at once. Bring the basics, and the rest will fall into place.

Multitask! Keep Your Coffee Warm Using Your Computer!

Make it and Take it.

- You are likely to buy a meal plan, but avoid this if you can, or opt for a lower cost plan and be responsible by planning meals and taking them with you.

- When it comes to food and drink, you are going to be tempted to spend $5 on an expensive, calorie packed café drink at your local coffee shop. Try doing some home-brew and see if you can handle the less fancy coffee. There is more than one way to skin a cat, there is more than one way to brew a cup.

- Since we are all friends here, we can admit that college is going to be a time of beer guzzling and partying. Don’t get used to triple brewed IPAs and chocolate stouts. Opt for the cheap stuff and you will save a ton of money (but not the hangovers). Oh, and pre-gaming is the way to go. Remember to designate a sober driver before pre-gaming, and you are set to go!

- Love a certain dish? Why not have some friends over and make it from scratch. With everyone throwing down for ingredients and helping out, you are sure to save money and have a great time staying in. Also, to get your fix, if you are able to use a grill, host a few cook-outs in the nice weather. It will still give you the opportunity to socialize, but the hots and hams are cheap, cheap, cheap! The experience and friendships you forge during these times will be worth more than any fancy dinner out.

The I Love Trader Joe's College Cookbook:

Grocery Shopping.

- If you or a roommate have a membership to a bulk store like Sam’s, share it. If you have space, buy non-perishables and toiletries in bulk, these are things you will consistently need. You can also save money on gas since most have their own filling stations now. –Oh! And you can get a whole meal out of food samples!

- Grocery shop once a week, make list, stick to it, and don’t shop hungry! Don’t forget to buy store brands. Yes you will survive.

- Try shopping at a local farmers market. You will be save money on produce, shop healthier, and support the local economy all in one trip.

- Make freezer-friendly meals. Lasagna, chili, and casseroles are a good start. Farmers markets are cheaper-and support community.

Student Discounts at Major Retailers.

- More discounts for students.

Discounts for students according to your locale. - 100+ Stores That Give a Student Discount - BestCollegesOnline.com

Stores that offer discounts on school supplies, clothes, food, travel, and much more.

Try a Game Night.

Save Money Day-to-Day.

- I know it’s tempting to go out to the club or bar on the weekend, while that’s fine, don’t make an ongoing habit of it. Drinks are marked up (no joke)75%-400% their actual worth, and then you have to pay tips! These days, campuses offer more than just classrooms and housing. They have theaters, game rooms, sports, and other recreational activities right on campus. Take advantage of these, as you are paying for them with tuition anyway. You will be able to connect with other students and possibly be able to earn cultural credits as well as knowledge while you are out and about on campus. You have nothing to lose and don’t feel like it’s “uncool” to stick around campus. If it interests you, do it!

- Even though some gyms offer student rates, try out the campus gym first. You will be more apt to use it since its right there, and you will save money on gas (if you drive a car) by walking to the gym as your warm-up. Again, this is something that is probably rolled into your tuition, so consider that detail.

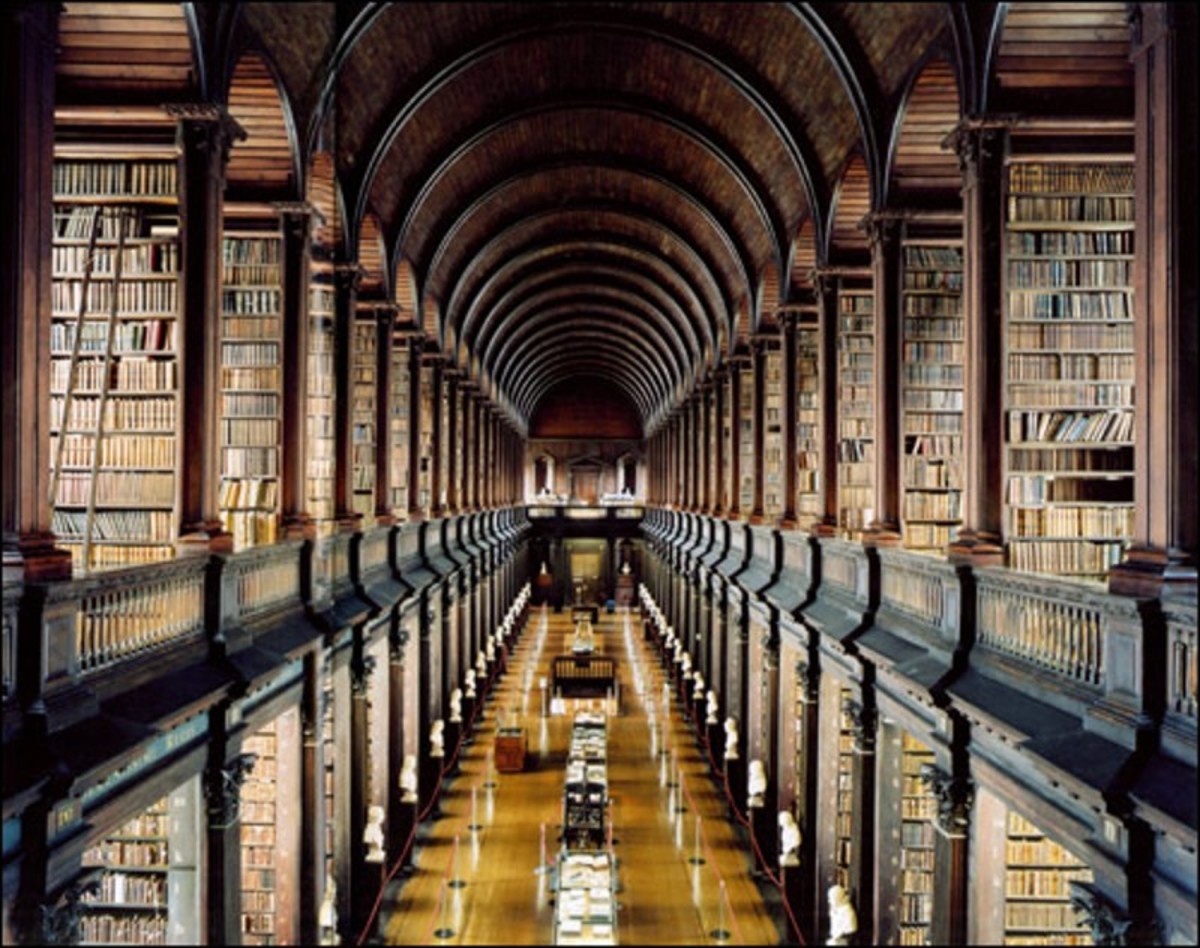

- Don't forget the library! My favorite place in the whole world! Everything there is free! You can use it for a quiet place to study (go figure), or for entertainment. Books on CD, DVDs, and of course books serve as great entertainment and learning materials. Never under estimate your local or campus library. They also may offer free tutoring, which would save you a good amount of money.

- Bike, carpool, walk, or take public transit. The benefits of getting fresh air, exercise, saving the environment, and saving on gas money are worth every penny.

- Remember that you have a school ID. This is as good as having a badge. You are able to use that little guy to get free or discounted meals at local establishments. The same goes for entertainment. Look online, call, or ask other students where the best discounts are. Remember to keep track of these with apps or by writing them down so you remember to use the discount next time you stop in for a bite or go out on the town. Just because there is a discount, doesn't mean you need buy something. If a local shop is offering a percentage off your next purchase, step back and consider if you really need anything from there at that moment or in the near future. If the answer is “no”, then skip it for now. There is no need to buy compulsively just because something is on sale.

Stay on Track!

- HowStuffWorks10 Tips for Staying on Budget

Staying on budget can be overwhelming and stressful. Find out how you can go about staying on budget without going crazy.

Budgeting in College.

- Credit? NO!!! Debit card or pre-paid card all the way. Keep track of your spending. With online banking and apps, it is easier than ever to track spending. Remember to instill an overdraft option with your bank as a safety precaution and then act as though you do not have that overdraft protection so you aren't tempted to go over spending limits.

- If you do get a credit card, make sure you get one that will pay you back or benefit you in some way.

- Don’t lend money to your friends. It doesn’t matter how much you love your bro, bff, or gal pal, this situation will cause awkward tension if someone doesn’t pay you back, or they take advantage of you.

- Avoid late fees by paying your bills on-time. Even better if you pay them early; you can sometimes get an added grace period for good behavior if you find that you can’t make a payment at some point. Remember: It doesn’t hurt to ask.

- Guide to Saving Money on College Textbooks

Textbook prices are shooting up at a faster rate than tuition. They can really eat up your financial aid or pocket money. It's best to consider alternative methods of buying or renting books.Check out my complete guide for saving money on textbooks.

Roomie or no roomie?

Do you plan on living with a roommate to save money in college?

Like This Hub?

As always, please feel free to comment with any ideas you have. More importantly, I encourage you to share my hub and the love. We are all in this together!

I love feedback and your vote is important to me. Please take a second to click that little thumb icon just below here and let me know how I am doing!