Save $$$ with Revised Tax Code!!!

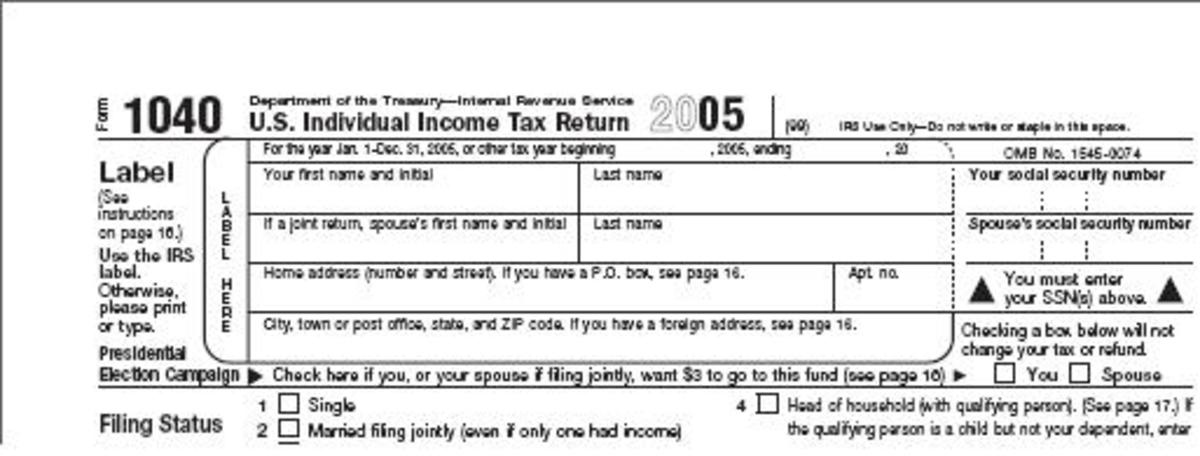

Nowadays, the current tax code is becoming more and more burdensome on every American. The present tax code is extremely confusing and complicated with its different brackets and classification system. Different families with the same income could have very different rates because of seemingly irrelevant factors. On top of the federal income tax, may people also have to pay state income tax, which adds an even bigger burden on the American worker. However, with one basic fix, the tax code can be easy to understand, universal, and equal for every single American. Read on to discover this simple fix.

Want to Lower Your Electric Bill?

The Problems with the Current Tax Code

There are countless flaws and loopholes in the current tax code. One of the biggest and most disturbing problem was released in a recent study. According to this study, 50% of Americans do not pay any taxes at all. 50%!!!!! That means that half of the entire American population pays taxes for the other half. Now the government wants to raise taxes. Unfortunately, this will just harm the hard working Americans that pay the taxes and will have no effect of the 50% who do not pay taxes. This will cause many companies to reduce salaries, lay off workers, and raise prices to adapt to the higher taxes. This will certainly not help the economy. The underlying question is: how can the government lower taxes and force all Americans to pay the taxes? The answer is actually really simple.

Need a job? How about becoming a referee?

The Solution

Ok, so what is this magical solution? Drop the income tax. That's right, you heard it right. The government needs the drop the income tax and in its place create a universal sales tax on merchandise. That way, every American will pay exactly the same rate and every American will have to pay the tax.

Problems this Solves

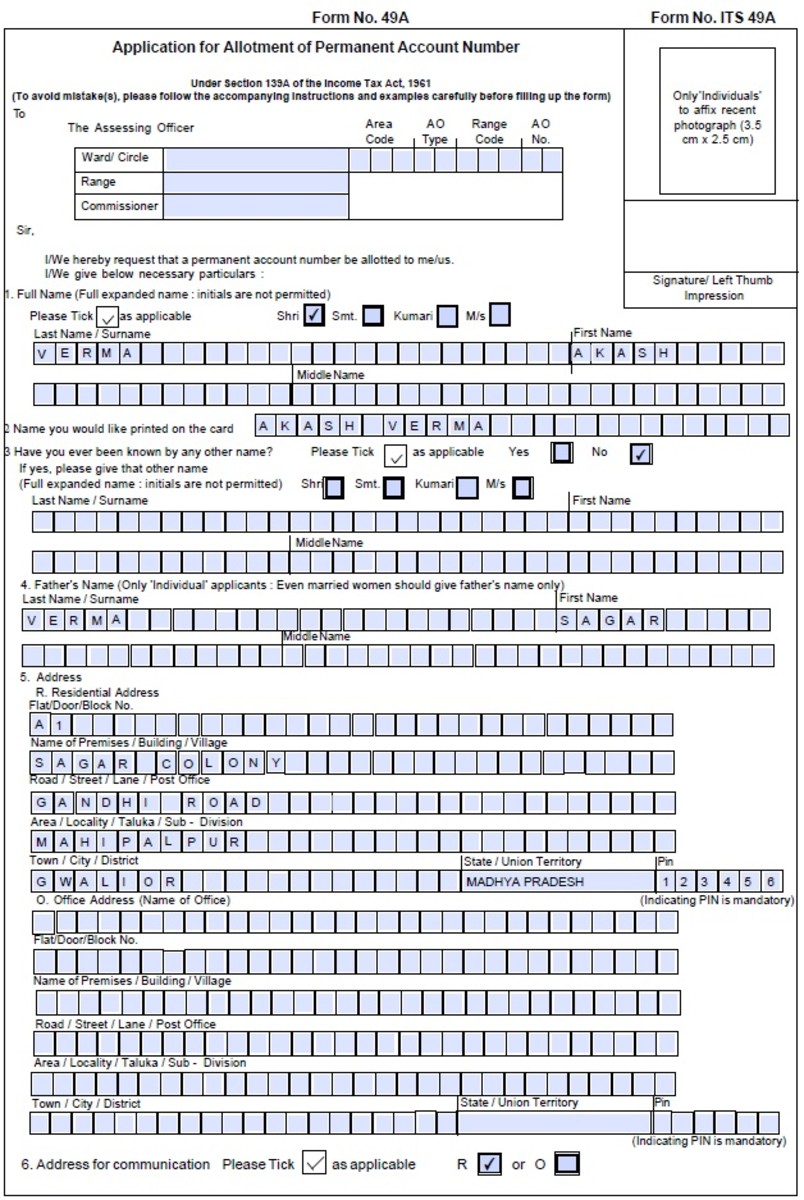

One big problem this form of taxation solves is illegal immigration. Thousands of illegal immigrants live in this country and don't pay taxes. They have access to free education, health care, and employment, but do not pay a dime towards any of these programs. Basically they are taking their money and enjoying the benefits of being an American citizen without paying taxes. However, illegal immigrants and Americans both have to buy groceries and other necessities. Since the improved tax is based on these items, illegal immigrants will now be forced to pay taxes.

Another problem this solves is the unbalanced tax rates. With the current tax law, millionaires and billionaires are paying less taxes than their secretaries and employees. Raising taxes on the rich does not solve any problems, it just makes them worse. However, the rich are not paying higher taxes with the sales tax as the tax rate is the same for everyone.

The sales tax also solves the problem of only half the population paying taxes. With the sales tax, everyone has to pay it because everyone has to purchase goods. It also will get rid of all the pesky collection calls from the IRS as the taxes are included in the price. Therefore, it is a win-win situation for both the government and the American people. Washington gets its money right away and the people don't get bothered by Washington.

Lastly, this improved tax law would help turn the American economy around. This tax code is pro-business and has the potential to create many new jobs. It will also help lower the country's debt. Since the entire population is paying taxes, not just 50%, the government will receive much more money that can go towards reducing our country's debt.

Problems this Creates

No tax law is perfect. Some potential downfalls of this proposed law is that it "punishes" people who purchase a lot of merchandise or expensive merchandise. As with current sales tax laws in place, the more items one buys or the more expensive the item is, the more you as a consumer will pay. However, this really would not have any effect on consumers. Since the prices of all the goods remain the same, the consumer will barely see the difference. Plus, the consumers will be keeping all of his salary, so the consumer will have more to spend anyways. Companies will also keep all of their profits so they will be able to invest that extra cash into more jobs, higher salaries, and lower prices.

Reader's Poll

Are you in favor of a universal sales tax instead of an income tax?

Conclusion

Although any revision of the current tax code is unlikely in the near future, there are ways in which you can help get it done. Congress, the lawmaker of the country, is the only venue through which tax laws can be changed. Therefore, as you are represented by members of both the House and the Senate, you can contact your representatives and encourage them change the tax code. If enough of their constituents contact them, there is a good chance that one might bring the law to the floor. I encourage you do contact your representative and get the American economy back on track.