Student Loan Consolidation

Two out of three undergraduates will graduate with some form of student debt, on average the debt incurred per graduate is just over $20,000, not including the debt of the half of college students who never even earn a degree.

Why Consolidate?

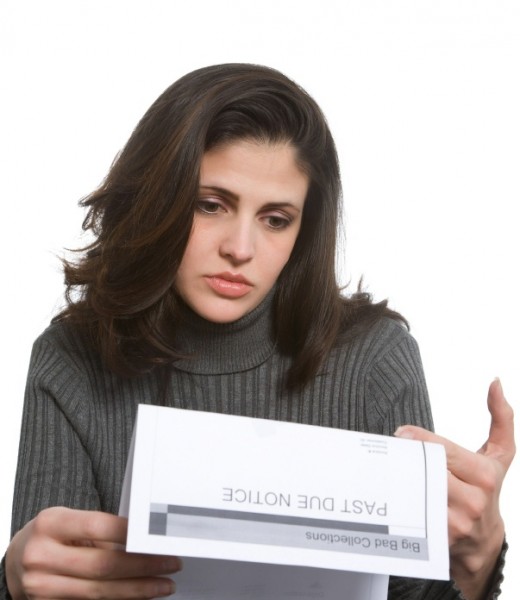

Many students who take on student loans don't think about how they are going to make payments on these loans once they graduate. Taking on student loans and getting approval for them is the easy part. The majority of college students do not even think about the fact that they have an upcoming debt, sometimes several hundred dollars a month, until a few weeks from graduation.

Graduates across the nation walk across the stage and receive their diplomas, only to be in serious debt a few weeks later. It is common for students to take on multiple loans for their education (as well as for extra spending cash), sometimes five or more. These loans come in two types, federal and private.

Consolidating loans helps lower monthly payments, yet federal loans cannot be consolidated with private ones. All federal student loans began carrying fixed interest rates in July of 2006. Consolidating private loans results in the removal of a co-signer, saving a parent or guardian from a potential liability.

Loan Consolidation Tips

- For financial reasons students will consolidate to lower monthly payments. Consolidating before the six month grace period that most loans carry can help get you a lower interest rate, so shop around.

- Some lenders will give give good discounts to those who will agree to making payments electronically.

- Check the fine print with your lenders to make sure that it will benefit you to consolidate. It could be cheaper to stay where you are. Some fine print may state that you must repay any discounts if you switch.

- Don't do business with consolidation lenders who try to rush you into signing with them. No matter who you sign with, be sure to check out any and all agreements thoroughly before signing.

- Make sure any prospective lenders are listed with the association of independent accredited consumer credit counseling lenders.

Student Loan Forgiveness

Student loan forgiveness programs can be one solution to reducing student loan debt for those who meet the application criteria. Some professions that offer to pay off college loans include: doctors, teachers, nurses, and public service jobs.

Various fields and professions participate in forgiveness programs in exchange for a promised number of years spent working for the company. The downside, most of the jobs offered for this exchange require some element of sacrifice. One example of this type of exchange would be medical professionals working for a certain number of years at inner city hospitals.

Perhaps the most popular example centers around education and teachers. With the difficulty of finding teachers to work for public schools in low income areas, it would be wise for any graduating college seniors in the teaching field to check out this option if consolidation is in your future.

Parenting Articles

- Surviving Freshman Year at College

Leaving home , possibly for the first time, is a big life adjustment for young adults starting college. Statistics show that half of all college freshmen drop out of school before graduation, and one out in... - Jobs for Young Teens

As children approach their teenage years, many are old enough to begin taking on a few adult responsibilities. Their growing financial wants can be more than the parents can reasonably afford. Many times... - Stress and the Stay at Home Parent

Stay at home parents are becoming more popular than in times past, and it's no wonder with the expense of childcare, and the hassle of finding someone trustworthy, that more parents are choosing to stay at... - Are Cloth Diapers Better for Babies?

Diapering babies until they can be potty trained is as old as time itself. The term "diaper" , or as it is called in the UK, Austrailia, and Ireland, "nappy" , is a piece of clothing worn by individuals who...