Taxation and Tyranny - Repealing the 16th Amendment

While the IRS is often the butt of jokes as April 15 approaches, Americans, in increasing numbers aren’t laughing. Instead, they are reviewing the current system of taxation and the role of the Internal Revenue Service. They’re seeking alternative ways to fund a government that won’t include an income tax that seems both oppressive in the amount money it takes from taxpayers and invasive in the power that the IRS has gained in its role as federal tax collector.

Did you know?

Up to 1913 United States government paid its bills:

- With tariffs, which are taxes imposed on imports and exports

- And excise taxes, which are taxes built into certain items.

A flat tax of 3% was established during the civil war and then ended in 1866, just a year after the civil war ended.

In 1894 the Supreme Court ruled that the Income Tax Act was unconstitutional.

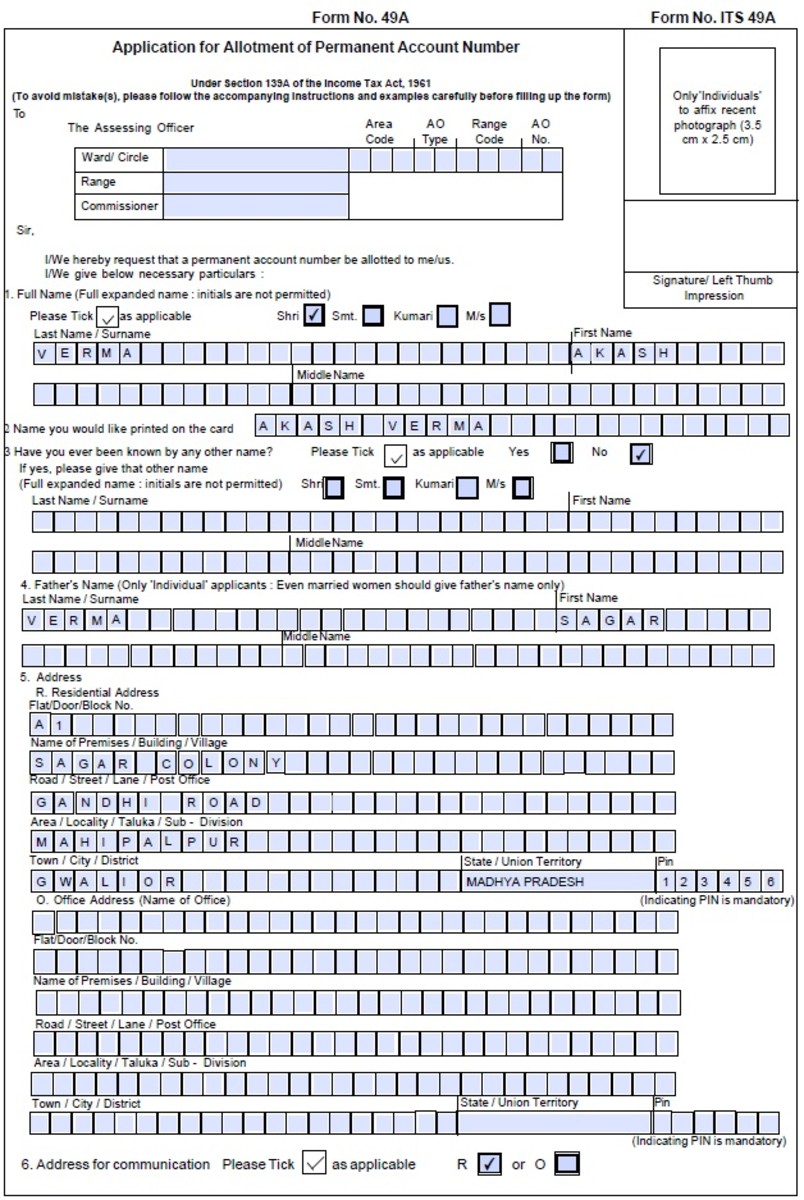

People are often surprised that the income tax has not always been part of the nation’s tax process. Until 1913, the United States government paid its bill with tariffs, which are taxes imposed on imports and exports, and excise taxes, which are taxes built into certain items. But the incomes of the citizens were not taxed. The income tax was first proposed in 1812, but not put into practice. When the Civil War began, the federal government introduced the Revenue Act of 1861, which established a flat tax of three percent on yearly incomes of more than $800. The Civil War ended in 1865, and the Revenue Act ended in 1866. When Congress returned to the idea of an income tax with a proposal to assess a two percent income tax on annual incomes of more than $4000, the Supreme Court ruled that the Income Tax Act of 1894 was unconstitutional. So far, so good, right?

As you've already guessed, it didn't end there. The 16th Amendment, which grants Congress the power to collect taxes on income, was ratified in 1913. This is the beginning of what we not-so-fondly recognize as the federal income tax. Resistance to the income tax, a cumbersome tax code, and the Internal Revenue Service has grown since that time, and in 2013, Congressman Jim Bridenstone of Oklahoma introduced a bill to repeal the 16th Amendment. As reasons for his action, Bridenstone cited the 4th Amendment of the Constitution, which protects Americans against unreasonable searches and seizures. According to Bridenstone, the 16th Amendment has been overruling the 4th Amendment, which is part of the Bill of Rights, and violating the Constitution.

Bridenstone is not alone in his quest to repeal the 16th amendment. Various groups such as the Americans for Limited Government, Americans for Fair Taxation, Tea Party Patriots, Competitive Governance Action, and Free Market America make up the Coalition to Repeal the 16th Amendment, also known as Repeal 16. Their goal is to restrict Congress and its power to impose taxation on income, payroll, dividends and estates; in other words, taxes on production. Their advocacy does not support either a fair tax or a flat tax; they simply want to get rid of the 16th Amendment. If the states would ratify the resolution to repeal the 16th Amendment, the federal government would have two years to find an alternative means of raising revenue.

Some of Repeal 16's motivation comes not merely from the current tax system, but also from the need to reform the excesses which the tax system supports. Their view is that the income tax forms which Americans submit, surrender too much personal information to the Internal Revenue Service. These concerns have been heightened by the concentrated power of the IRS, which has used its access to tax documents to unfairly scrutinize certain political organizations.

IRS gaining more power with the new Healthcare Tax

Repeal 16 supporters have much in common with advocates of the Article V Convention, but the latter movement has a broader aim as it works to revitalize the role of the states in balancing the power of the federal government. Repeal 16 intends to have the repeal of the 16th Amendment take center stage in the 2014 Congressional primaries.

SIGN THE PETITION AND TELL CONGRESS: REPEAL THE INCOME TAX NOW!

In order to bring up the passage of a bill that repeals the 16th Amendment, Repeal 16 will

-

Round up support by contacting legislators, rallying supporters, and taking part in town hall meetings

-

Require Congress to agree to co-sponsor the Repeal the 16th Amendment Bill

-

Seek the 16th Amendment's appeal via an Article V Convention of the States

-

Identify incumbents who do not support the repeal movement and marshal support for other candidates in the upcoming elections

You may also be interested in:

- April 15: What Does Your Government Owe You?

Americans spend six billion hours every year in the process of preparing their taxes--filing, saving and sorting their receipts, meeting with lawyers and tax accountants, not to mention being audited. - Bring Us Your Tired, Your Poor. . .Your Criminals?

Historically, immigrants who left their homes came to America to work hard, obey the laws, and become Americans so that their descendants would have better lives. - We the People: Yes, That Means You!

Did you know that the Constitution’s Article V was designed to protect Americans against a federal government that has expanded its power at the expense of the states?