The Ever Declining U.S. Dollar and Viable Alternatives

$100 Federal Reserve Notes

The United States Dollar (USD), as of the time of this writing, is the most trusted and respected currency in the world. It is held by many foreign governments for purposes of foreign exchange and is used as a store of value and a standard for pricing commodities such as gold and oil. As of 2014, 62.3% of foreign exchange reserves were held in USDs. Additionally, countries such as El Salvador, Panama, and Ecuador have gone so far as making the USD their official national currency as a way of reducing hyperinflation fears and circulating more money into one’s national economy. Prestigious though it is, the USD does not maintain a consistent value and since the gold standard was abandoned in 1971 has not been backed by anything. One must therefore look for alternatives to paper money if wanting to preserve wealth.

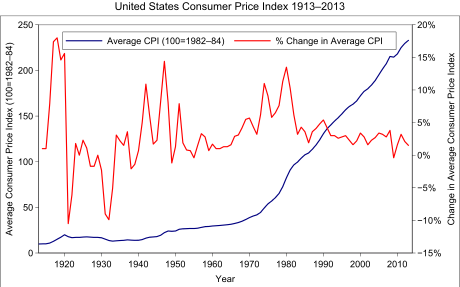

When backed by hard assets, currency has served as a solid, long term store of value. Up until the time the Federal Reserve was founded in 1913, the U.S. maintained a strong economy while the dollar’s value actually increased. In the 1836-1913 period, the U.S. Treasury issued a gold and sometimes silver-backed currency, maintaining a peg of $20 5/8 dollars per ounce of gold. The value of the dollar was adjusted to $35/oz. of gold in a failed attempt to stimulate the economy during the Depression in the 1930s. The Bretton Woods conference after WWII set the $35/oz. price of gold as the standard by which the world financial system would operate. Over time, government policy weakened this standard, and the U.S. finally abandoned the gold standard in 1971. This brought about what we now know as “stagflation”, the simultaneous occurrence of high inflation and high unemployment. Stagflation persisted throughout the 1970s, and this was a time of the declining prestige for the USD and the United States as a whole. Overall the dollar would lose more than 50% of its value in this decade. The loss for gold was even more brutal. The value of the USD finally found some stability with actions by the Federal Reserve Bank in the early 1980s. In 1981, Paul Volcker raised the federal funds rate to a record 20%. Inflation came down from a peak of 13.5% in 1981 to 3.2% by 1983. In that year, stagflation finally began to ease. The period from 1983 until the early 2000s was characterized by low levels of inflation. In a bid to stimulate the economy after the 9/11 attacks the dollar weakened vs. gold. This eventually culminated in the financial crisis of 2008 and an unprecedented level of central bank stimulus by every major central bank in the world brought gold to as high as $1,911/oz. in 2011. It has remained well below that level since but gold is unlikely to return to the $300s/oz. level where it remained from the early 1980s to the early 2000s.

The lesson here is that paper currencies do not maintain their value over time even with reserve currencies such as the U.S. Dollar. If one wants their wealth backed up by hard assets, they must set out to do so on their own. Many options exist to invest in hard assets. Those who have larger amounts of cash often look at real estate assets. Buying physical gold, silver, platinum or other metals is a common option. Even foodstuffs and energy assets can be investible, though those have storage, spoilage or other logistical challenges that only a producer is in a position to exploit. And all of the above can be the basis of investment vehicles indirectly through mutual funds or exchange traded funds. They are paper assets that trade like stocks, and for that reason information on asset reserves is indirect and can be unclear. For most wanting a physical asset without leverage to store wealth, precious metals provide a clear option. Plenty of educational materials and advisors are able to help with both educating oneself and providing solid financial advice in asset preservation. With some research and ability to look outside of cash, preserving wealth can be both effective and possibly even profitable through