Use a "Lease Option to Buy" to Purchase or Sell Your House

There are a few ways to buy or sell a house: 1) a cash purchase; 2) a mortgage purchase; 3) rent-to-own, and; 4) lease with the option to buy. These all have their advantages and disadvantages. However, a lease with the option to buy has the most perks for both Buyer and Seller.

Definition and Description

A lease option to buy (also called a “lease option”) consists of simply leasing a property with terms and conditions that permit for purchasing the property at a time in the future as agreed between the Seller (Landlord) and the Buyer (Tenant). The lease contract includes a separate rider with terms and conditions for the future sale. There are some legal and formal lease option contracts offered by Blumberg forms. All the details of the transaction must be clearly stated within the lease contract and rider. (A separate purchase contract will be presented at the time of the actual purchase.) Keep in mind that this form of purchase includes first renting the property over time and then purchasing the property at (or before) a set future date. There are many terms and conditions associated with the ethical and accurate execution of a lease option to buy that are presented here in detail. A procedural guide to conduct such a purchase is below.

A Buyer of a property must requests from a Seller (or Landlord) to conduct a lease option to buy for the underlying property. Sellers who may consider a lease option sale would have advertised to sell or rent. There is no harm to the Buyer for asking. The Seller must agree to conduct such transaction, as opposed to then selling to another Buyer with a mortgage or cash payment at that time. Once the Seller has signed the lease for such a transaction, he/she is bound to satisfy at minimum the term of the lease with the Buyer. The Seller can no longer show the property to other potential Buyers. In other words, the Seller is not able to sell the property to any other potential Buyer for the duration of the lease agreement. The contracted Buyer will receive “first rights” to purchase the property at any time before or at the end of the lease contract. If the Buyer fails to purchase the property during the term of the lease or fails to renew the lease contract at the end of its term, the Seller can then offer the property to another potential Buyer for sale.

The Buyer usually presents a description of the intended transaction for the Seller’s approval. For example, the Buyer (Tom) will informally request a lease option to purchase a property from the Seller (Mary & Burt) for a price of $350,000 any time before or at the end of the expiration date of a 2-year rental lease. Mary and Burt can accept or reject Tom’s request. The lease expiration date is also called “lease-end”. Buyers may consider lease options to buy when the demand for their property is low or their property is on the market for more than 120 days. Technically, Buyers must then submit a contract to purchase the property at least two months before lease-end or try to renew the lease option contract with the Seller at that time. If the Seller refuses to renew the lease option contract at lease-end, the Buyer must vacate the property at lease-end. All security deposits will be returned to the Buyer (Tenant) as applicable. However, if the Buyer of the property submits a purchase contract for the property, then the Seller must accept the contract and down-payment.

Terms and Conditions

Since the lease option to buy is technically a lease with a rider that provides an option for a future purchase, the Seller and Buyer must first discuss the viability of such transaction with the help of their agents. The Buyer may possibly endure a rigorous application process to ensure that the Seller is taking a rational risk on the Buyer (Tenant) for the duration of the lease, hoping that the Buyer actually executes a purchase. Most Sellers will not lease to a Buyer who is not ardently committed to eventually purchasing the property. It is important for the Buyer to present all the essential documentations and payments for renting any property: a) completed rental application; b) a signed lease agreement; c) good credit report and score; d) good background check results; e) employment verification documents; f) Landlord reference; g) a picture identification card; h) the applicable security deposit, and; i) any application fees (including the Option Consideration fee). The Option Consideration fee is simply a fee the Buyer pays to enter into this type of purchase with the Seller. The fee is usually small (ethically the amount of security deposit), but will not be returned to the Buyer whether he/she buys or sells. Most option contracts of any type usually require a fee to the Seller for taking the risk. Since the property is to be purchase in the future, some Sellers may also require (optionally): a) a pre-approval for a mortgage from a bank; b) tax forms from the last three years, and; c) a bank statement from the last year.

The lease option agreement is a standard lease agreement. Prior to entering data into the lease, the two parties (Buyer and Seller with their attorneys) should informally negotiate all necessary terms. When both parties have agreed on all terms and conditions, the final and formal terms will be included within the final and formal lease contract to be signed. If not already attached by the Seller with a list of his/her additional terms and conditions to the lease contract, the Buyer MUST attach a rider to address any issues with any clauses of the lease agreement or to add clauses for the purchase to the lease contract. The Buyer may want to add the maximum future purchase price of the property to the rider as agreed with the Seller. (This must be negotiated in accordance with forecasted market values.) The Buyer may consider including the option to purchase the property before lease-end as well. Discussions pertaining to the state of the property, any repairs or removal of any furniture, décor or landscaping, the utilities usage, etc., should be completed and included within the rider as well. It is strongly recommended that the Buyer discusses any possible breaching of the lease option including loss of income or in medical emergencies, changes made to the property (i.e. painting, landscaping, etc.), reassignments, transfers and subleasing of the property, and the current financial status of the property (i.e. possible liens against the property, possible foreclosures, bills due, taxes due, etc.) - which can also be conducted by the Buyer's attorney. The Buyer may choose to add clauses for all individuals who will be living in the property along with the Buyer. Clauses in the rider should be all-encompassing, clear and specific. At the lease signing, the Buyer must first submit the security deposit for the rental (with any Option Consideration fee) and receive a receipt for the funds. The lease is then signed by both parties and the keys for the property are provided by the Landlord (Seller) to the Tenant (Buyer). As opposed to a lenghty sale, the Buyer will now have immediate access to the property.

Lease Option to Buy Strategies

Preparations and Procedures for the Purchase

Upon completion of the leasing process the Buyer officially moves into the property. The remaining portion of the purchase of the property is now underway. The Buyer can then get the house informally (or formally) inspected with the Seller’s approval. With clearance from various external agencies and legal departments as necessary, the Buyer completes the formal purchase of the property. The Buyer has the duration of the lease term to complete the purchase of the property with no additional pressure during this time. Since the Buyer has already pre-approved for a mortgage, the Buyer can accept the pre-approval and formally make all necessary submissions for the final mortgage application to the mortgage bank. The Buyer can also choose a different or additional payment options at this time as necessary to satisfy the purchase. The Buyer must also consider both renter’s insurance and property insurance service providers. When the Buyer's party has completed and gathered all components of the purchase contract, the documents should be submitted to the Seller’s party for acceptance. The Seller cannot reject the application and contract for the purchase at this time, since the verification for the purchase/sale should have been completed by the Seller prior to signing the lease. The Seller and his/her attorney will review the purchase contract, but must accept the contract for the purchase.

With an accepted purchase contract, the deed of the property is ready to be placed within escrow (usually by an escrow agent until the purchase/sale is complete). Prior to this time the Buyer can choose to use the security deposit held by the Seller as a portion of the down-payment, since this must be returned to the Buyer in full at this time. The Buyer will pay the difference between the total down-payment due and the total security deposit prepaid. (Keep in mind that the Option Consideration fee collected at the signing of the lease is not returned to the Buyer.) The Seller may also choose to reduce the down-payment by the cost of any outstanding repairs undone (as contracted by the lease) or payments owed to vendors on the property. Sellers may reduce the entire down-payment by a percentage or all of the rental payments previously paid – zeroing out the down-payment due in many cases. The final purchase price of the property will be indicated within the formal purchase contract prior to both parties signing the purchase agreement and prior to the escrow of the deed.

Buyers should negotiate decreases of the final purchase price based on payments made to the Seller (i.e. rents paid, repairs made, Option Considerations paid, etc.) and contracted payments owed by the Seller (i.e. repairs owed, taxes owed, security deposits owed, etc.). Lease options allow the Buyer and Seller to negotiate over the purchase price of the property efficiently. When the purchase agreement is final and signed, then the down-payment is made by the Buyer. In many US States, the Seller pays the agent commissions for both parties, which is usually derived from any profit from the sale of the property. (It is important to verify if the Seller is paying the Buyer agent's commissions for the leasing of the property as well prior to signing the rental lease. Some transactions only require one payment to each agent for the overall transaction.) Applicable payments to be made for “closing costs” (which is satisfied prior to the transfer of the deed) may include: real estate agent fees, attorney fees, appraisal fees, escrow fees, loan fees, deed and mortgage fees and insurance. After the down-payment is made (based on the price indicated within the purchase agreement) and any applicable mortgage loan is finalized (payment is transferred), the transaction comes to its end. The Seller receives payment from the Buyer for the property (against the Buyer's mortgage debt, if not with the Buyer's full cash payment). When all applicable payments have been made by the Buyer at closing, the deed for the property is finally transferred to the new owner of the property from escrow.

Recommendations

The following are only suggested actions or steps to be taken by the Seller and the Buyer.

Recommendations for the Seller. The Seller should always ensure that payments on the lease will be received in total and on time via the lease agreement. The property should be advertised and sold “AS IS”. Certain minor repairs or enhancements within the property can increase the property value, if the Seller chooses. The purchase price for the property should be negotiated and included within the rider of the lease contract, which can protect both the Buyer and the Seller in the future during a volatile real estate market. The Seller should require an Option Consideration fee for the risk taken over the period of the lease. The rider must be signed by both the Seller and Buyer. The Seller should indicate that the property will be checked occasionally during the rental of the property and that the Buyer should make the property accessible when necessary. The allocation of costs for damages and repairs to the property during rental must be clarified by the Seller of property. The Seller must ensure the safety of the Buyer during the rental of the property to prevent issues of liability.

Recommendations for the Buyer. The Buyer must ensure that all the details of the purchase are indicated within the rider of the lease contract. The lease contract should be clearly understood by the Buyer. The rider must be signed by both the Buyer and Seller. Negotiate paying the Option Consideration! It is not entirely necessary to pay since the Seller is still gaining rental payments in exchange for his/her risk levels. The purchase price for the property should be negotiated and included within the rider of the lease contract, which can protect both the Buyer and the Seller in the future during a volatile real estate market. The property must be fully inspected and cleared for outstanding liabilities before being purchased (i.e. utility payments, taxes, etc.) and perhaps before even being leased. Repairs and substantial changes prior to and during the leasing of the property should be conducted by the Seller only to minimize liability. It is strongly recommended that the Buyer discusses any possible breaching of the lease including loss of income or in medical emergencies, changes made to the property (i.e. painting, landscaping, etc.), reassignments, transfers and subleasing of the property, and the current financial status of the property (i.e. liens, foreclosures, taxes, etc.). The Buyer should ensure that there is written flexibility within the lease contract for financial setbacks, which is common for most individuals during the term of a lease agreement. If the lease contract is broken by the Buyer during rental of the property, the first right or first option to purchase the property before or at lease-end is also terminated. The Buyer must be able to prepare and execute the purchase transaction in the duration set within the lease, since many Sellers may not want to renew the lease contract. Rental agreements should not be longer than 2-3 years, since the market can change substantially during such length of time. Longer rental terms in a lease option to buy will more likely by rejected by a Seller, since the objective of the Seller was initially to sell the property. When negotiating the purchase price for the property in the future, consider the amount of rent to be paid prior to the purchase. Negoatiate with the Seller to reduce the price of the property by the rental payments. The rental payments plus the purchase price should be close to the total value of the property at lease-end.

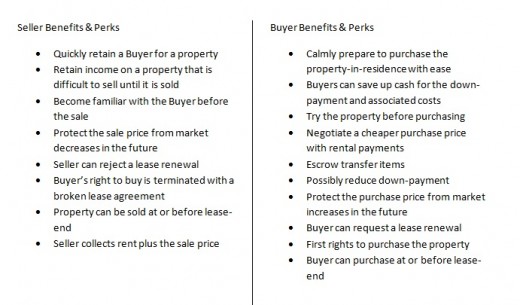

Benefits and Perks of a Lease Option to Buy

A lease option to buy is a very beneficial payment option for both the Buyer and the Seller. The benefits for the Seller and Buyer are listed below.

Summary

As you can see, the lease option to buy is an excellent method for a Buyer to purchase the house of her/his dreams or for a Seller to retain income from a property when the potential for an immediate sale is unavailable. The lease option to buy is very useful for home-buyers, as they are allowed a chance to become familiar with the property first. Buying a house is a substantial investment. How amazing that everyone can now get a chance to know exactly what they are paying for. The process can flow well as long as the Buyer and Seller ethically adhere to the requirements of their roles. The key to smooth and simple purchases/sales of houses is excellent real estate agents!!!

Read more about my financial hubs at: http://missinfo.hubpages.com

Will you recommend a Lease Option to Buy to your home-buying friends?