Three reasons why people can not save money

A lot of people may ask themselves, "Why is it so difficult to save money or economize better". It is something that can be so troublesome for some that they simply give up and continue on their money wasting habits.

There are a lot of articles you see on TV, Magazines which may look suspicious however they all tend to focus on one main point. They usually emphasize that you will be saving money without even realizing and you can because a lot more affluent than you think. This statement is very true, people are actually missing out on a lot if they fail to maintain decent savings.

Another popular statement is, "If you think about starting to save tomorrow, tomorrow will never come, you need to start right now".

Reason 1 - Setting Strict Limits on Saving

There can be many reasons why one has failed to save money until now. People will often blame themselves for not having the patience or perseverance needed to save money. This is not the correct attitude to have, also willpower and other similar mental preparations will not help you in your quest to save money.

The most important thing is to set very strict boundaries on money control, this means defining a strict border of what you can and can not spend.

For example, if you want to diet, you will never lose weight with willpower and mind over body control. However you will lose weight if you put strict control over the amount of food you eat, control the amount of times you eat out and set a limit to what you buy when you go shopping.

Reason 2 - Not having a concrete plan

This needs to be executed in steps as per below:

STEP 1: Write down your monthly salary and expenditures

Every single expense for the month needs to be noted. Try to put as much details into the expenditures as you can so you can make easy references to it later on.

STEP 2: Decide how much you want to save

The amount you want to save should be clearly stated in the early stages. So you should write how much money you want to save every month.

The main point here is, don't write down how much money you can save, but write down how much money you would like to save and work backwards with the calculations.

It's not really about wanting to save a certain percentage of your salary, it about defining a savings goal and working backwards with your daily expenses calculations. This is a very good way of determining what you really do and don't need in your monthly expenditures. It will become very clear to you want you need to cut out on in order to achieve the set goals.

The best way to think is for example, in two years if I want to buy a car for $10,000, how much do I need to safe per month, or moreover how much do I need to cut my current costs down.

STEP 3: Divide your expenses into four categories and single out the higher one

For example:

- Living costs (Rent, food, utilities)

- Society costs (Education, transport, insurance)

- Leisure (Clothes, travel, eating out, drinking etc.)

- The amount you would like to save

Now once these have been divided we can check to see how much money is really necessary. The way to do this is the subtract the amount you would like to save first, and then divide the rest with the other three categories. For example, if you are earning $2,500 a month but would like to save $300 dollars per month then the division will look like the below.

- $1,500

- $500

- $200

- $300

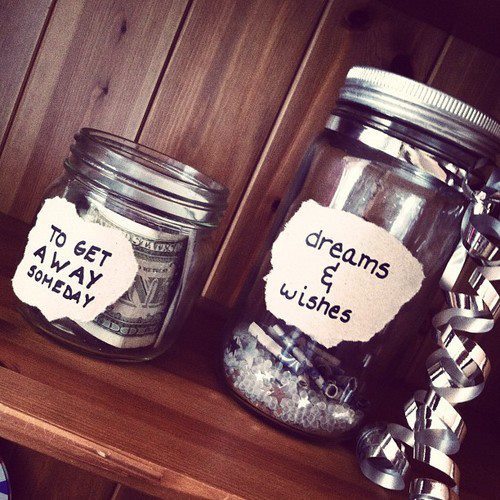

STEP 4: Divide the money into separate bank accounts

This is the ultimate way to put and boundary and limit on your expenditures. It may sound like a hassle to open four bank accounts but this is a very recommended method. Each of the points above should go into a separate account.

Please also note that there may need to be slight adjustments as realistically, expenditures can suddenly change. e.g. Summer vs Winter utility bills, events, parties, accidents.

Reason 3 - Withdrawing your savings

If you stick to this pattern monthly then you will naturally save money without even thinking. This method should get you into the habit of buying only what you need. It is very important that you never touch the saving account (Part 4 of the divided income).