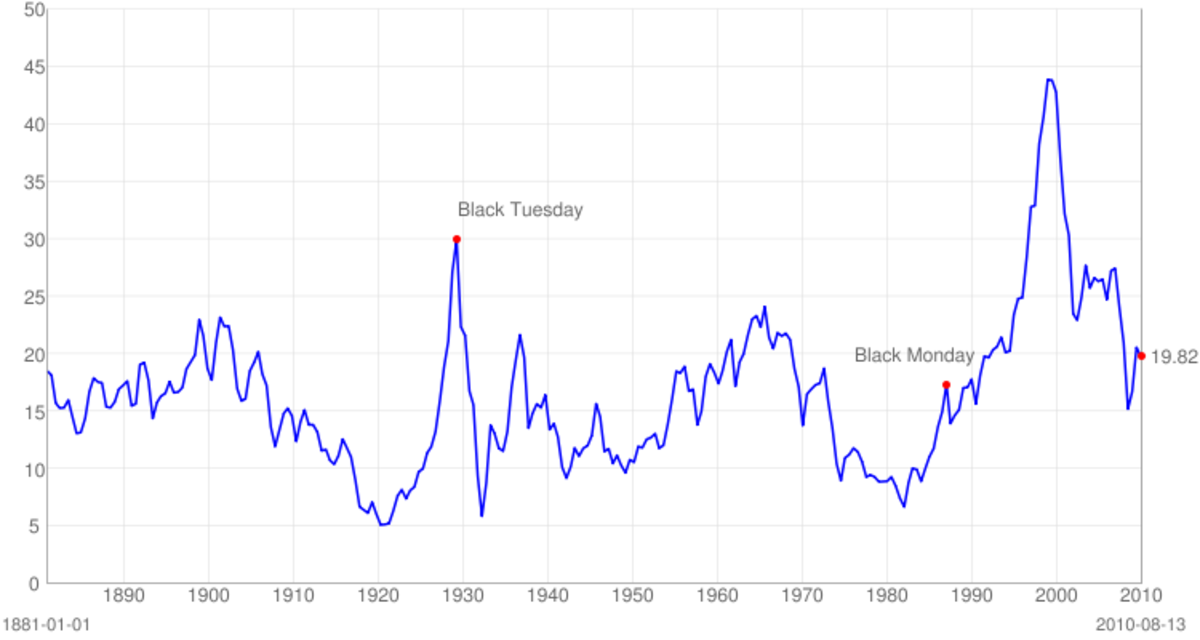

Uranium share

Figure 1. Development of the ETF URA price from 2011 to date.

A contrarian investment – uranium mining shares

A contrarian investment – uranium mining shares

Uranium is one the world’s most hated assets.

But it provides 20% of US electricity supply and 70% of French supply. Furthermore significant growth is expected in various emerging markets.

Uranium is currently in a bear market. Last time it experienced such conditions were back in the 1990s. At that time mining costs were about 20 USD while spot prices stood at around 10 USD. However from 2000 to 2007 prices rose sharply from 10 USD to 130 USD. However since then prices crashed to the current level of about 28 USD.

Even a more diversified measure – an ETF of uranium stocks Global X Uranium ETF (URA) have fallen out of favor as shown below. This performance of URA has been poor over the past couple of years, having fallen from its 2011 peak of over $65 to today’s price of $14.89 per share. At the moment the shares appear to be bottoming out, and there is technical support around $15 per share.

Similarly a major holding of URA, the uranium mining company Cameo (JJC) stock price sits close to its 2009 low levels.

The commodities sector exhibits a boom-bust cycle with periods with high prices followed by depressed prices. Currently URA consists about 25 uranium shares with the largest holdings including:

- CAMECO CORPORATION 23.4%

- DENISON MINES CORP 11.1%

- URANIUM PARTICIPATION 9.3%

- SYRAH RESOURCES LTD 8.5%

- AREVA 5.8%

- UR-ENERGY, INC. 5.3%

- PALADIN ENERGY LIMITED 4.8%

- FISSION URANIUM CORP 4.3%

- ENERGY RESOURCES OF AUST 4.1%

URA’s net expense ratio stands at a relatively low 0.69%.

URA invests in uranium mining companies globally. Mined uranium is primarily used in the nuclear energy industry. Currently the nuclear industry is exposed to uncertainty but still is a reliable base load energy source in power generation.

Uranium is an efficient fuel. A 7 gram uranium fuel pellet provides as much energy as 341 kg of natural gas, 807 kg of coal and 497 kg of oil (World Nuclear Association, 2014).

What makes uranium attractive as a fuel is its low cost and emission rate. The fuel cost amounts to about 31% of the total production cost and thus an increasing uranium price would have limited impact on the final electricity price. The emission rate is negligible compared to alternative energy sources.

However we need a catalyst for prices to move up. Everyone who wants to sell uranium has already sold. Thus there is no one left to sell. This is usually when a bottom is formed and sets up for massive gains. Situations where things go from bas to less bad is a recipe for large gains. Currently the uranium price stands around 29 USD/ lb. This level was last seen back in 2005 and 2006. Prices partly recovered in 2011 but were hard hit when the Fukushima accident occurred. As expected we observe a high level of correlation between the ETF URA and uranium prices.

What catalysts could change investors’ belief?

Firstly there is growth in emerging market for nuclear power. The BRICs China, India and Russia have about 46 reactors under construction and another 86 in planning stage (World Nuclear Association, April 2013). A high share of the world’s population is not supplied with electricity and further growth is expected going forward. The projects in the pipeline will eventually lead to increased demand for uranium but with a time delay.

Secondly, the uranium mining cost is today around 70 USD/lb. Thus miners currently experience losses. This situation cannot continue and supply will contract. Currently there is about 70,000 tons of demand versus 50,000 tons of supply. The combined impact of lower supply and higher demand will cause prices to rise.

However since mining companies currently are unprofitable it is better to invest directly in the uranium spot price. Uranium Participation Company is managed by Denison Mines and it holds uranium oxide and uranium hexafluoride to provide investors with direct exposure to uranium spot prices without the risks associated with miners. Uranium Participation Corp trades on the Toronto Stock Exchange under the ticker symbol U.

Figure 2. Development of the Cameo (CCJ) price from 2007 to date.

Figure 3. Historic uranium price development from 1988 and onwards (source: The Ux Consulting Company, LLC: www.uxc.com).