A 16 Trillion Dollar Anniversary

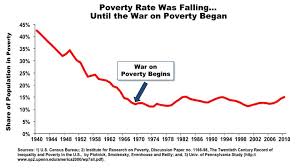

Fifty years ago today President Lyndon B. Johnson declared a war on poverty. 16 plus trillion dollars spent on expanding the welfare system and we see what we now see. It is called failure and an expensive one at that. Our national debt is now about the amount spent pursuing this failed war so maybe it is time to start connecting some dots for yourself.

That move on Johnson's part became known as the creation of The Great Society, only obviously things haven't turned out too well other than to turn the federal government into a money munching behemoth with an insatiable appetite for our money since the government creates nothing really useful for consumption.

How can we get more for less? Different voices say different things but there now needs to be a national discussion and not the one Obama has about income inequality which is no more than a divisive political ploy to try to influence the 2014 election. Obama is already a lame duck so he might now want to concentrate on other things besides dividing our nation further.

One Voice Of Reason

So how in the world does any government spend close to 20 trillion dollars and produce minimal results? Are there primarily political, voting buying reasons behind what we see? That is obviously a big slice of the pie and under Barack Hussein Obama it has worsened rather than gotten better as he promised. Karl Marx's idea of the redistribution of wealth failed then and it remains a failure now. Looking at the Obama administration over the past 5 years is an illustration of that very failure.

The Democrats claim to be the "party of the people and the down trodden." Look at how they live and not what they say. Obama lives lavishly and takes numerous very expensive vacations. The latest has him giving Michelle a birthday vacation at the tax payer's expense. Has Obama done one thing to scale back his love of the good life at tax payer expense other than talk the talk? No he has not. People need to start waking up and realizing that those ruling class politicians have them right where they want them - dependent upon them for their daily bread. We are becoming a nation of people on the dole and it is not an accident.

So about 20 trillion dollars spent has decreased the poverty level by less than 2%. Under the Obama administration's incompetence the poor people of this nation have lost ground, not gained any. He talks the talk but knows nothing about walking the walk..

Lets see how Obama commemorates the "War on Poverty" if he mentions it at all. It opens up a can of worms for him if he does since it has become worse during his tenure rather than better. He used yesterday to jump up on a soap box again crowing about how those heartless Republicans don't want a 3 month increase on "emergency" unemployment benefits. That isn't exactly the case because what they are proposing is to offset something else in order to actually pay for the 6 plus billion dollar price tag the Democrats want to spend and not just add it to the national debt which is Obama's plan. Let our children and grandchildren pay for Obama's continued incompetence is what I hear him really saying.

He also repeated the nonsense about unemployment benefits creating jobs. He has said that, parroting none other than Nancy Pelosi who has also never held a real job in her life either, without offering a shred of prove other than citing some mystical, unnamed independent economic geniuses. Are those the same geniuses who have been advising Obama during the past 5 years of dismal economic success and an exploding national debt? Those folks Barack?

You don't achieve income equality by feeding a man a fish. You achieve that, in small measure, by teaching that man how to fish and have him do it on his own. You don't address income inequality by expanding the welfare state unless you have a socialist streak a mile wide coursing through your veins. Why would Obama be out there pleading for a three (3) month extension for unemployment benefits and at the same time proclaiming what an economic success his failed administration has been. It just doesn't all add up to any intelligent person. I learned with this president long ago not to listen to what he says but to look at what he HAS NOT done or accomplished. I also know he has played 160 rounds of golf since taking office which amounts to one round every 11 days. Speaking of priorities!

People say I'm rough on Barack Obama and I am. I remember all those pie in the sky promises he made to dupe people about his lack of qualifications and experience to hold the highest office in this land. He was elected as a novelty candidate and he wasn't a good idea then or now. So rail away about income inequality Obama but those listening need to understand that is no more than rhetoric used to further divide this nation and not to solving the problems he has helped to create himself.

The proof is in the pudding or lack of it. As he rails away he seems to forget that a record 47 million Americans are now on food stamps. That's an increase of 13 million people since he took office. The making of fish eaters or fishermen? The poverty rate has stood at 15% for three (3) straight years now. Don't mention that Barack as you take those lavish vacations and shoot those endless rounds of golf.

50 million Americans now live below the poverty line. How is that defined? That is pegged to a figure of a family of 4 surviving on $23,492.00 a year. Obama's cure for this sort of dilemma is to give more free stuff to more people. Guess what? There is no such thing as "government free stuff." The government makes nothing but misery for people's lives and it should not be that way.

No I don't expect Obama to commemorate Johnson's efforts. Johnson had a vision of helping Americans become prosperous and self-sufficient by a hand up, not a hand out. 50 years later with 16 plus trillion spent we see what has been yielded and it isn't a community of fishermen. What we see is a federal government with its boot heel on people's throats who have way too many exactly where they want them. It's called control my fellow Americans.

Yes, well Obama broke another record and made history. I'm certain he won't mention that either

Vote It," "Like" It, "Tweet" It, "Pin " It, "Share It" With Your Followers. Time to let em read it and keep reading it.

As Always,

The Frog Prince