American Future

By: Wayne Brown

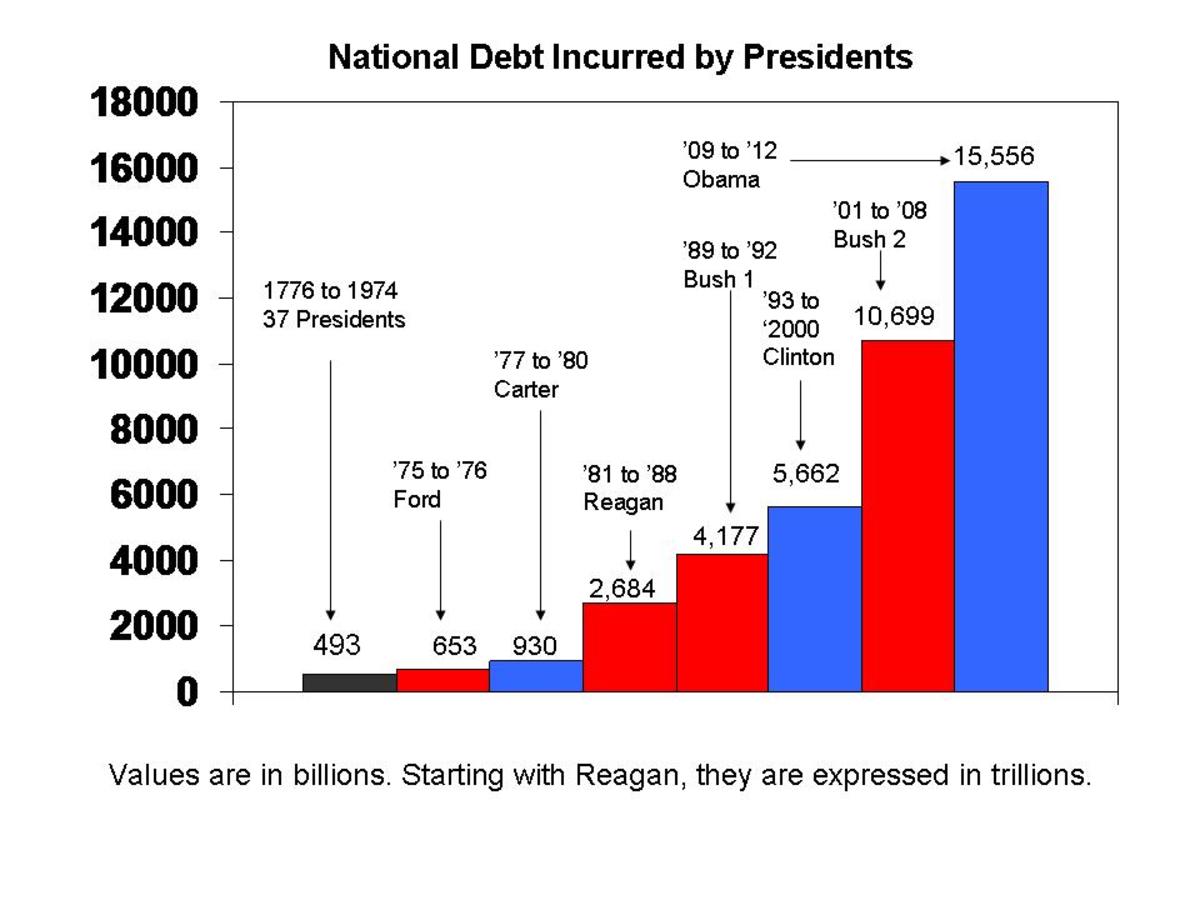

America is in the worst financial shape in terms of national debt than it has been in since conception as a nation. The Democrats say we have to blame the Republicans and vice versa. The truth of the matter is both parties have failed the American public miserably even if one had the intention of stopping the other from spending. The truth of the matter is that regardless of your orientation, the spenders won and the “stop-spenders lost.

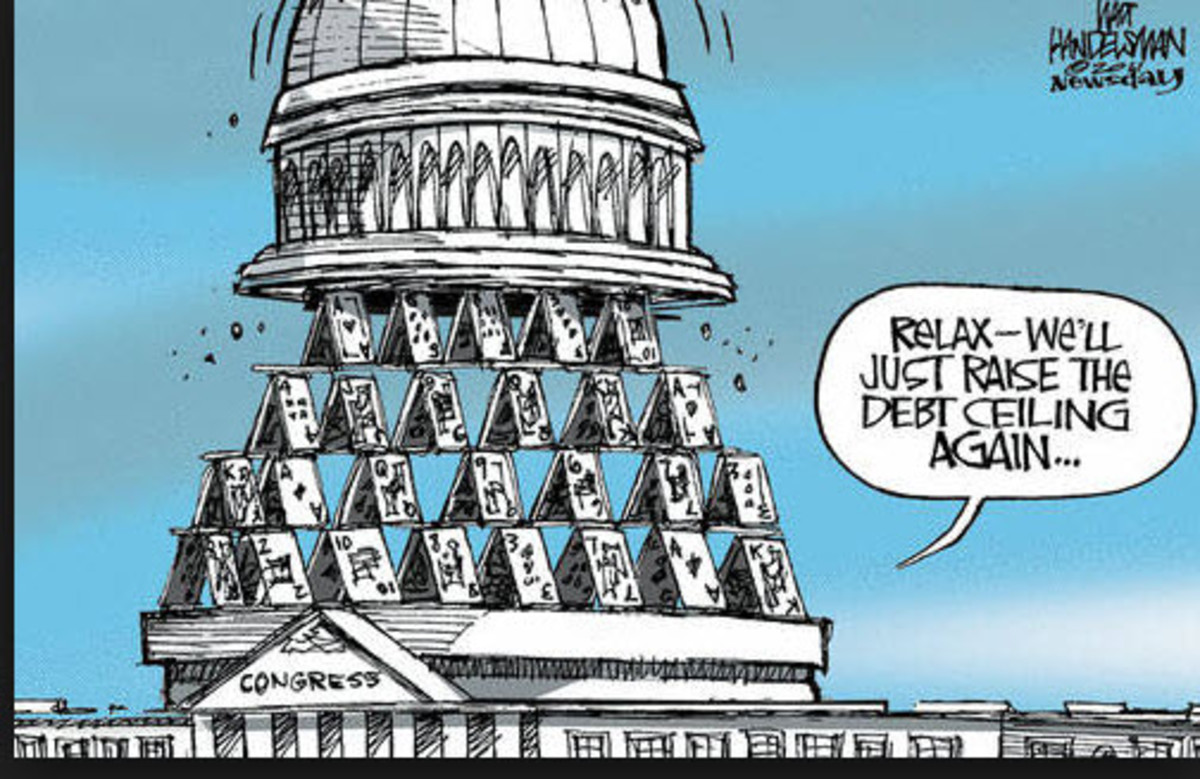

In 1925, our Congress passed laws enacting a cap on the total outstanding debt which the country could carry. At the time the laws were added to the books, that figure was $25 billion dollars…a rather paltry sum by today’s standards of debt. Keep in mind also that at the time every dollar in circulation was backed by a gold reserve not just the trust of the American people. Over the next 85 years all of that would change drastically.

Here we are at the end of the year 2010, some 85 years after a debt ceiling was imposed by law. In that time, Congress has voted to amend the debt ceiling upward a total of 73 times or an average frequency of one time every 1.16 years. When you look at it in that light, it is obvious there has been no serious attempts to quell spending regardless of who was in the White House or who controlled Congress. We have essentially raised the debt ceiling almost every year since we invoked it. The question must be raised as to what the value of the law really was as it posed no obstacle to change.

In round numbers, we now face a staggering debt of some $13 billion dollars and Congress is again talking of raising the debt ceiling yet one more time. One must raise the question at this point as to whether anyone on either side of the aisle has ever attempted to cut spending and reduce waste. I seriously doubt that they have because the ones who are responsible for our operating budgets on an annual are also the same people who are the wasteful spenders…our Congress, the entity of government which controls the purse strings. Apparently the “checks and balances” system has failed the American public in this arena.

There are those in elected office who try to shrug off the accumulated debt or attempt to rationalize it by saying there were far too many wars over the past 85 years which cut into the countries ability to manage costs effectively. On the surface that might sound like a viable excuse to the average Joe walking the street. Let’s run it through the litmus test and see how it holds up.

Obviously, we did not pay for World War I in those figures as the national debt ceiling was imposed after the war was over. Granted, some of the $25 billion in accumulated debt at the time in 1925 might have been left over from WWI but essentially, that war was spending prior to any attempt by the country to manage costs.

World War II and the aftermath Lend Lease rebuild of Europe is estimated to have cost the USA approximately $356 billion dollars. Given that cost and the accumulated national debt we hold today of approximately $13 Trillion dollars, America could have paid for WWII by a factor of 36.5 times with the value of our current debt. Three hundred billion dollars plus is nothing to sneeze at but it is a rather paltry sum in light of our current debt in America.

If we look at all of the wars since the Revolutionary War and combined their costs into 1990 dollar values, America has spent a total of $ 3 trillion 57.3 billion dollars on all of them, with WWII being by far the most expensive. Still, given the national debt, we could have paid for all of these wars by a factor of 4.25 and still been at break even on the books in terms of the debt. So, given the enormity of our national debt, we can hardly blame war as the primary factor of our troubles in America today.

At this point, we also need to stop and consider that the debt has increased by approximately $5 trillion dollars since the Democratically controlled Congress took over at the start of 2007. In that period of time, we have almost doubled our debt factor. Yes, there is a war going on with regard to terrorism but the cost of that war is yet to even closely approximate the costs absorbed by the nation for WWII. We know at least one third of that accumulation has gone to TARP and the STIMULUS Programs. Obviously, the rest must have either gone to pork-barreling / earmarking or social programs.

At this point, it might be good to ask the question as to what costs can be assigned to illegal immigration in America. Obviously, based on Washington’s effort to either suppress or eliminate it, the cost must not be too impressive. Hold on there Red Rider…that may not be the case. The shift of jobs between Americans and illegal immigrants is estimated to cost the federal government $100 billion dollars annually in federal tax revenues. It is estimated that the federal government shells out over $2600 annually for each illegally immigrant household in America. The Department of Interior spends over $ 1 million dollars annually repairing damages caused by the transit of illegals. U.S. taxpayers provide over $250 million dollars annually in payments to hospitals who provide care to illegal aliens in the country. Over 300,000 pregnant mothers illegally cross the border every year just to create an anchor baby in America at some yet undefined cost to the taxpayers. The cost of the normal birth is estimated at $6,000 dollars to the taxpayer. If there are complications, that cost could rise as high as $500, 000 per child…a burden all shouldered by the American taxpayer. The illegal children receive education and at-school meals which creates an additional annual cost of $7,000 per child to the American taxpayer. Between payments of money sent back home by both legals and illegals in America, some $80 billion dollars in U.S. currency leaves the country each year. Numerous other costs are identified but not yet valued with regard to the impact of illegals in this country. Suffice to say, even if you ignore the potential for terrorist to cross our southern border, we have a national security problem just on the basis of the cost of illegals to our revenue stream in America. Apparently Washington has no urgency with it. After all, it’s not their money that is being pissed away…it’s ours.

America currently owes China trillions in T-bills debt service and as those debts mature, China will expect to be paid with interest. Additionally, our annual trade deficit with China is over $700 billion dollars per year meaning far more of our money is going to China than is coming back to trickle into the U.S. economy. This just makes it that much harder for the government to pay the T-Bills as they come due at maturity.

How much is $13 trillion dollars anyway? Most of us working class middle America stiffs cannot visualize such a some of money nor can we visualize how anyone could find a way to spend it without stealing a lot of it from us. I have found one of the best ways to measure untold sums of money is to put it into relative perspective, so although we are suffering, let’s have some fun and see what our money would buy if we had it to spend again.

According to recent reports by Standards & Poors, the estimated value of all the commercial real estate (that used for office buildings, businesses, and retail centers) is $5.3 trillion dollars. So, right away, we can see that we could have taken our $13 trillion dollars in debt and bought every commercial property in America not just once but more than twice and we would not have even had to haggle on the price. Actually we could buy it twice and still have approximately $2.4 trillion dollars in our pocket for fix up and paint up. We could really have some nice places instead we have debt.

Let’s look in the civil aviation business which provides 5.6 percent of the Gross Domestic Product of this nation by 2007 figures supplied by the FAA. That percentage is worth $1.3 trillion dollars in annual revenue. With our debt money, we could have purchases all of the ticketing, charter, and livery transactions of the entire civil aviation industry in America for a whooping ten years. The regular flying public in America could have flown anywhere in America totally free for the next the past ten years. In terms of hardware, the new Airbus A-380 which is capable of carrying 555 passengers on one flight costs on average $275 million dollars per plane. With our debt money, we could buy 47, 272 of them and have a bit of change left over for fuel. With that passenger space, we could move 26,235,960 passengers at the same time…roughly 10% of the U.S. population.

This would not be fun unless we looked at food. According to reports, the average American spends $6,133 per year on food (groceries). Looking at an average life span of 74 years, the average Americans spend approximately $453,842 on groceries. With our debt money, we could give 28, 644, 329 people free groceries for life. Americans also like to eat out so let’s out leave fast food out of this equation. On the basis of recent studies, America is estimated to spend $134 billion dollars per year on fast food…not fancy restaurants mind you, but fast food like McDonalds and Taco Bell. With our debt money, we could buy fast food for America for the next 97 years. Bring me a Big Mac and fries baby!

What about healthcare…a very popular subject nowadays and one too many politicians want to be a free one for America paid for by American tax dollars. By 2009 figures, the average American household earned just over $62,000 and spent $3,126 annually on healthcare services and products. With our debt money, we could totally replace the average income of we could totally replace the average household income of over 2 million households in one year. We could refund the average annual healthcare outlay of over 41 million households in a give year. According to the American Medical Association, the average medical doctor entering the workforce in 2009 owed $156,000 in education costs. With our debt money, we could totally clear the educational debts of 83.3 million medical school graduates in a given year. If we our future doctors to four years of Harvard Medical School at a cost of $180,000 in tuition, we can offer free medical tuition to over 72 million students in that timeframe.

America loves cars and always has. We like them sporty, fashionable, fast and fun. Certainly one could argue that the Chevrolet Corvette ZR-1 is all of that in 2010. The average price range for one of these smoking hot babies is a cool $110,000 dollars. That’s a bit out of my budget. But wait, we have the debt money to cover it. If we don’t haggle on the price, using our money, we can give one totally free to almost 12 million Americans today. Wouldn’t that be fun to be one of those lucky 12 million.

The current debt level would make it possible to give 13 million Americans $1 million dollars tax free. Or, if we really wanted to shake up Bill Gates and Warren Buffet, our debt value has the potential to create 13,000 billionaires in America. Our national debt at this point would be capable of covering all but just over 1 trillion dollars of the Gross National Product of America…in other words, America could stop producing anything for one almost one year…if we only had the money and the tin-man only had a heart, and the cowardly lion some courage, and the scare-crow a brain.

I think you get the point and I think you now see the enormity of the size of the debt burden that America bears in the near future. Like any reckless household in America, our country has a limited number of choices. We cannot keep raising the debt ceiling for soon our debt will exceed the asset value of our gross domestic output. Essentially we would be totally bankrupt. Like any family we can choose to throw up our hands and declare bankruptcy and see what happens although I can predict that it would be devastating for every American. From an ethical and sane perspective, we can make a commitment, work out a plan, then put our shoulders to the wheel and work until we pay off every dime of what we owe. At the same time, we can take a vow to never come this way again.

What has happened to America debt-wise is no accident. We have allowed our country to be run by those who are driven by tax and spend motivations wanting to use their newly acquire power to thrill their constituents and buy more votes. Converse to good business principles they have ignored the aspect of cash flow as meaningless. No business that ignores cash flow in its spending plan lasts very long. The same will be true of America. If we continue at the same rate of spending, our debt burden will exceed $20 trillion by 2015 and will likely exceed the annual GDP. At that point, credit will become a problem because even countries like China will start to sour in light of our debt burden.

We will not get out of this situation anytime soon. At best, with spending plans adjusted to lower spending levels back to 2006 or before levels and continuing to meet our entitlements and military spending, the country will be lucky to have $100 to 150 billion in surplus dollars at the current revenue stream rates. Taking the optimists position, that amount of money will require a payout period of 86 years…far too long for America to hold its focus in terms of just reducing spending. Likely, as much as most of us do not want to hear it, a tax hike will be necessary with the stipulation that all increased revenues would go to debt reduction. Even if a tax hike doubled the surplus funding projections, the payout of the total debt would exceed 40 years. This too is not a viable solution.

The final frontier for debt reduction is the economy. If we can find methods to stimulate the economy while we are cutting spending at government levels then many things will begin to happen in parallel and a synergy will develop. Stimulus money obviously has not been the answer to moving the economy. The economy is stalled on “uncertainty” in the business sector. American business needs a five year horizon of stability for planning purposes in the least. Our current administration has fallen short of that horizon and has literally been forced to offer a two year minimal horizon which does nothing to stimulate business investment or expansion of employment. If we can move business in a positive direction, the GDP increase positively as well and the ratio of debt to asset shifts proportionally relieve at least some of the international pressures in terms of trust and borrowing if all out emergency forces the issue. Once business sees a five year window to invest and take some risk, the cash that is in reserve in many corporations will begin to pour into investment and jobs.

Secondly, we have to do something with regard to trade deficits. We have to close that window. Today, the Obama Administration is standing by while the Federal Reserve attempts to gain a gap closure by dampening down the value of the dollar in the international markets. While this may have some success in relieving trade deficit pressures, it could have the opposing effect in the domestic economy. As the dollar reduces in value on the international market, it also drops in purchasing power at home meaning the average consumer needs more of them to make the same purchases. This, we call “inflation” and it creates a tremendous and increasing effect that could easily send the country into the economic issues resembling the Carter years of double digit interest rates if not worse. We are already seeing that effect in the area of crude oil and gasoline prices. Soon it will translate to food and retail shelves. Most of it, if not all of it, will be passed to the American consumer lowering our buying power and reducing our standard of living.

As you can see, there are no easy solutions for the amount of debt our elected officials have piled up in our name. The accountability ultimately falls on the American people to repay the debt and resolve our good name in the global community. It is a requirement and a responsibility we have to the future of the county, our children and theirs, and the global community. We, as a people, are capable of that task as we have proved time and again in the past. But, we, as a people, must be remained focused and we must send elected representatives to Washington who will continue that focus and help to lead us back to a healthy and prosperous society.

As a public, we need to speak with one voice on this issue. How many sides can there be when it becomes apparent that we have overspent our abilities and our revenue stream. We must speak as one voice and demand responsible government, acknowledge the fact that government never has and never will be the ultimate cure all for mankind’s ills. We must learn independence again and count on our own responsible methods to take care of ourselves and our love ones just as our forefathers once did so effectively. An entitlement society eventually becomes a broken welfare society that produces nothing and loses all its self-esteem in the process. I do not think any true American wants to see such an outcome.

I hope this comparative discussion of debt burden has helped in opening your eyes to the serious problem that we face as a nation in the years ahead of us. Together, we can fix. Divided, we will only make it worse. Let’s do the right thing. WB

© Copyright WBrown2011. All Rights Reserved.