America's Reality

By: Wayne Brown

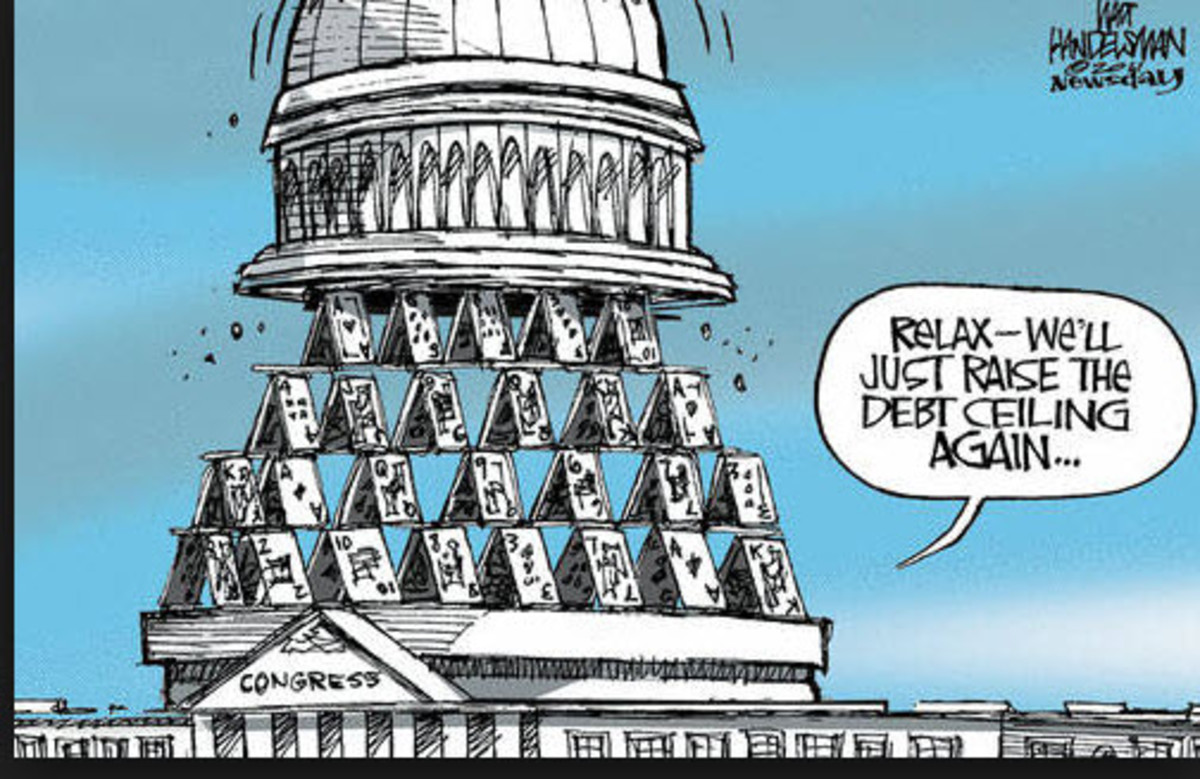

As you may have heard, Standard & Poors’ took the first step in downgrading the U.S.A’s credit rating from triple A to double A this past week. If you return to the recent debate over the debt ceiling you might recall cautions (I am being nice) which were issued by both the President and members of Congress to say that if we did not meet our debt service obligations on time, this is exactly what would happen and it would not be good for America. Of course, the implication in making such a statement is that if we do what they suggest, everything will be fine. We’ll it looks like that was a bad assumption on our part as taxpayers.

In the dramatic last hours before the debt-ceiling deadline, our leaders came together with a plan which provide enough money to meet the approximate 29 billion dollars in debt interest for 2011. In fact, they went far beyond that point by further handing the President an additional 800 billion dollars in ceiling relief along with the promise of another trillion dollars in relief when he tooled a list of spending cuts in the near future. In effect, what our Congress did was give the President permission to add 2 trillion dollars to the bulging national debt in order to find 29 billion to pay our credit obligations.

Let’s put it into an example which is easier to understand. Let’s say your property taxes are due for the year and amount to $5,000 dollars. You don’t have the money in your current income revenue stream as you are maxed out to the hilt with installment payments. So, you go down to the bank and wrangle yourself another credit card with a $100,000 credit line maximum. Immediately, you take a cash advance for the entire $100,000 dollars. You pay your property tax and then look for things to buy with the remaining $95,000 dollars. Since your property taxes were paid on time, you are looked upon in credit circles as a good risk and your financial future is now much stronger as a result of your actions. Do you get my point?

Standard & Poors’action in terms of the downgrading of America’s credit rating is not a function of the debt service obligation being paid on time. It might have come into play had we not made provisions for the payment but the fact of the matter is that we did. That matters very little in the overall picture because, you see, that payment on debt service is just “one” payment and others will come. The actions taken to secure this particular payment signaled to Standard & Poors that America was on a road which is rapidly growing the national debt burden to a figure which will exceed the gross domestic product of the country. In bank loan terms, our debts will exceed our assets as a country. In financial terms, we will be officially bankrupt. At that point, our flexibility to regain control of our finances and meet our debt service obligations will be rather weak. In turn, the economic factors induced by such a financial position will hinder and reduce the revenue streams coming into the government and further undermine its ability to pay. The only avenue at that point will be runaway taxation of the working public…if indeed there are any jobs left at that point to tax.

In this recent debate, our illustrious leadership in the White House and in Congress had an obligation to guard the well-being of America long-term. Instead, the President held out like a child for the money that he wanted to spend. The left side of the aisle did his bidding and held the party line for the most part under the heavy hand of Harry Reid. The right, well, they got duped and traded away our future financial position for some pretty beads which reflect the sunlight so beautifully. Oh, they will tell you that they only gave the President the increase when he caved in on spending cuts but look closely at the cuts that were achieved. There was almost nothing that was of immediate consequence. There was no spending freeze instituted. In fact, there was an immediate approval to increase debt. Long term, there is only the promise to “reduce the rate” at which debt is growing which would insinuate reduced spending but who is the guardian of that treasure chest?

Standard & Poors is not alone in this modification or downgrade of credit standing. Others will follow and America’s financial position will eventually affect the global economic welfare. This single step is the beginning of our inability to borrow effectively. America only has two real revenue streams…taxation and borrowing. If you cannot borrow, then you must tax and that is what the Obama legacy seems to be. He has finally lead America down the blind alley where taxing the workers is the only option and he likes it.

Our dollar will slide downward in value and inflation will rise at a faster and faster rate. Businesses, already strapped for survival, will have no choice but to raise prices in an effort to survive the inflation caused by the shrinking dollar and the intense burden of new government regulations. Investment and growth in the American economy will come to a standstill causing the job market to shrink on a larger scale. The upside for some will be that some of those “mean old corporations” will cease to exist. No longer will they be parasites on the back of the American taxpayer. The scenario paints a worsening of what is already a bad situation in America and we have our leadership in Washington to thank for all of it.

America still has more than a year left before it can take any real action to right the ship of state. The 2012 elections will be the first opportunity for Americans to use their voting power to end the nightmare that we are in and bring some effective leadership to Washington willing to shrink big government and all that goes with it. At that point and time, when the financial markets see that action, we will likely see our credit rating increased to the position it should be. Should we fail to act responsibly as voters and continue the status quo, it is difficult to imagine how deeply troubled America’s future will be and whether or not it can continue as we have known it.

With the recent debt ceiling moves, Obama is in position, with approval for continued spending, to increase the national debt by 9 trillion dollars by the end of his first term in office. In that four year period, he, along with the help of a liberal Congress, will have almost doubled America’s debt load. What we will have seen in this four year term can only get worse if he should win the re-election. His re-election will be looked upon by his administration as a “mandate” from the people and the out-of-control spending will continue on a scale never before seen until we are so buried in debt as a country that our dollar is not worth a plug nickel. At that point in time, the American public will be “humbled” and “accepting of any alternative” offered by the government and that ladies and gentlemen is exactly where this President has been taking you and I and this country since the time he put his hand up and took the oath of office. His agenda has not wavered and the outcome is certain as long as we allow him to hold the office.

There are those among our citizens who look at things with their heart; who cry for the poor and the down-trodden; who believe that most Americans do not care as much as they do. They also believe that there is a magic associated with America and that it is indestructible. They believe America will always be strong and always survive every situation but mostly they believe that too much is never enough and that living beyond your means is fine if your intentions are good. These are the people who will be the most surprised when America does stumble financially. These will be the people who cry out and want someone to take the blame. These will be the people who, up to that disastrous point, will have been blinded by their good intentions and fairy tale thinking regarding America and those who currently lead it.

Certainly one can write letters to Congress and the President and express their disappointments but I caution you that your words are falling on deaf ears. The President and the old guard of Congress populating both sides of the aisle all want the same thing…continue the status quo. Continue on the road to financial ruin. At present, they are thumbing their nose at the American voter. A recent poll suggests that up to 75% of Americans are unhappy with the way recent business has been handled in this country. Do you think the President and Congress aren’t aware of those numbers? Do you think they really care? Do you see the thumbs now?

The elections of November 2012 will be among the most historic or devastating in the history of this country. America will truly decide its fate as nation at that point. Time is running short and the debt is continuing to pile up at an alarming rate. Our leadership has done little of nothing to repair that situation other than to give it lip service in the political arena. 2012 will be the time that the last bastion of American hope takes the reins and acts in a manner to save our country. 2012 will be the election in which Americans will speak the loudest they ever have in history and hopefully the outcome will favor our future as a great country.

© Copyright WBrown2011. All Rights Reserved.