Another Attempt to Convince Conservatives it is Safe to Increase Taxes on the Rich a Little Bit

The Face of a Surcharge

What is 5.6 Cents Between Friends?

THAT IS IT FOLKS, 5.6 CENTS ON EACH DOLLAR EARNED IN EXCESS of $1,000,000.; that is what all of the Conservative "sky-is-falling" rhetoric is about ... slightly more than a nickel, WOW!

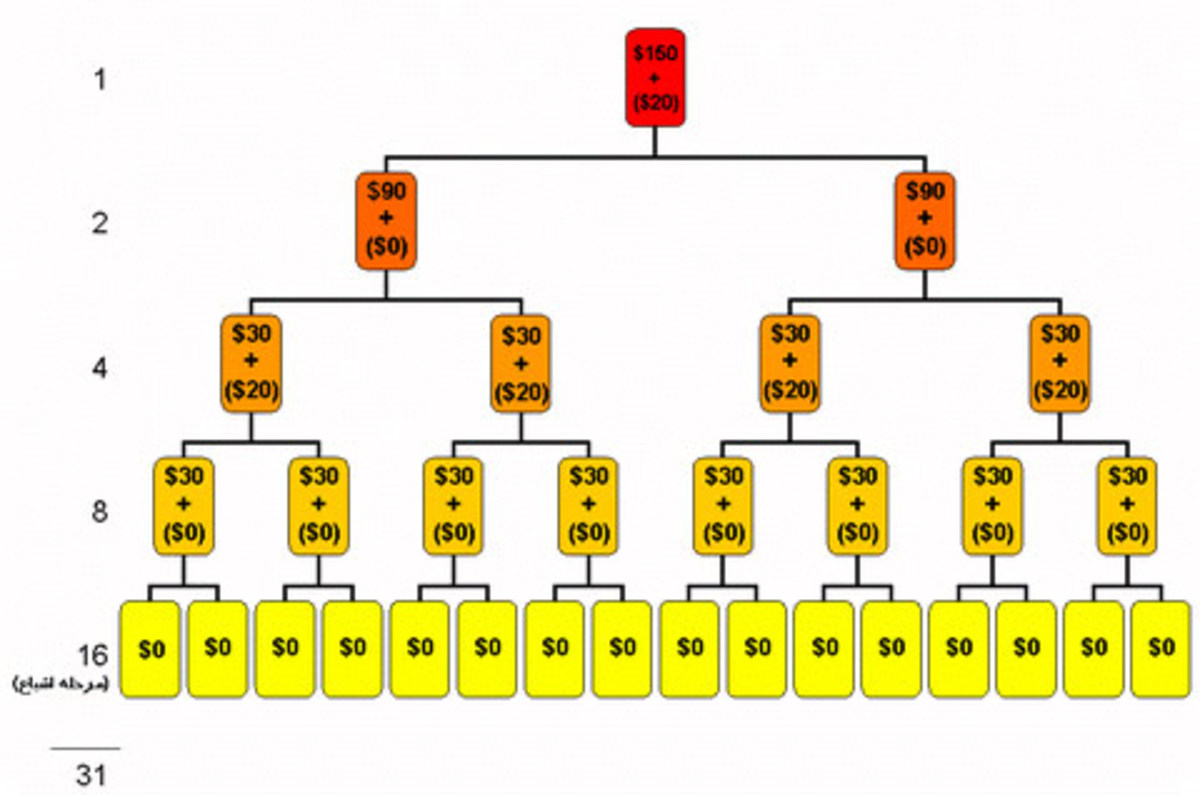

This is the surcharge that President Obama is proposing to ask millionaires and billionaires to pay to help bring down an astronomical national debt. In defense of their position in opposing this almost 6 cent surcharge. Conservatives and Tea Party members loudly, frequently, and incorrectly claim that millionaires and billionaires will somehow end up "killing jobs" because they won't have this extra change to invest in American companies or purchasing American goods and services.

This is a viable argument IF AND ONLY IF, ALL of the millionaires and billionaires spent or invested their extra 6 cents in AMERICAN companies and on AMERICAN goods and services. The Right's position begins to crumble the moment the rich and super-rich begin to 1) pay down debt, 2) invest in foreign companies, 3) buy foreign goods, 4) simply buy stocks in an American company from someone other than the company itself, which is 99.9% of all stock transactions, 5) give to charity, 6) buy political leverage, 7) save the money, and/or a host of other things. Any of these actions reduces the amount of the 6 cents which might have been used for direct investment in American businesses.

And guess what? They do do all those other things! Millionaires and billionaires, most of them anyway, are Multinational! They invest in foreign companies as well as American companies and they buy foreign goods and services as well as American ones. They also save by buying bonds of one sort or another, which may or may not go back into a company for growth. Given this new knowledge, how much of that 6 cents do you really believe goes toward the American economy in the first place? Probably very little; clearly not 6 or 5 or even 4 cents. What the real impact of the surcharge will be is to bring back to America, money flowing overseas; isn't that what we all want?

This is why virtually every economist doesn't believe this surcharge will negatively impact the economy at all and will be of overall benefit to the Nation.

A logical question, however, would be "what is the distribution of use of each taxable dollar earned in excess of one million taxable dollars?" (remember, the first million dollars is exempt from the surcharge) It is the answer to this question that would determine when a tax on the very rich would begin to be bad for the economy. Common sense, though, is enough to tell you 6 cents is not big enough.

To be Fair, or Not to be Fair; that is the Question

JUST A FEW WORDS on this question of the "fairness" of increasing the taxes on the very rich. First, let me say that I do think the Democrats are barking up the wrong tree by saying the very wealthy need to pay "their fair share"; that sound bite is as much fluff as the Conservatives "raising taxes during a recession is a bad idea."

"Fairness" really has nothing to do with it. The nation needs revenue, so where do you get it? There are several ways to get new revenue, one is growth in the economy and the other is in taxes. The growth of the economy takes time, and the country needs new revenue now, so that leaves taxes. Who is in the best position to afford it? The very rich, of course; it is as simple as that.

Now, if Conservatives start complaining that the poor and middle-class should pay their "fair share", which they have, by the way, Democrats can quickly counter with many examples of where the millionaires and billionaires have access to money-making opportunities simply because they are very rich and for NO OTHER REASON; how is that fair?? Why shouldn't the poor and the middle-class have the same access?

I am not even a millionaire but I can afford to meet arbitrary minimum investment balances that give opportunities to certain types of stock trades not available to those who work for me; how is that fair; why should there be minimums that exclude the less wealthy? There are other investment opportunities that are not available to me because I am simply not rich enough; I don't find that fair at all!

Therefore, Conservatives and Democrats, get off your "fairness" kick; it is just smoke and mirrors and hyperbole.

DEMOGRAPHIC POLL #1

Do you believe you are more closely aligned with -

DEMOGRAPHIC POLL #2

Are you -

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2011 Scott Belford