FY2011 Budget - Treasury Department - GOP v Obama

March 08, 2011

FY2011 Budget

I have started to go through the budget and put together charts which

compare the GOP and Obama budgets with the FY2010 budget. The next

section of the budget comes from the Department of the Treasury which includes the IRS. It comes from the Financial Services and General Government section of the budget. The Subcommittee on Financial Services and General Government is a subcommittee of the Committee on Appropriations, though it has no current membership. I feel like I have been biting off too big of chunks so am not going to do the entire committee at once.

The information comes from the House Appropriations Committee1 which breaks the budget up by congressional committees. I am not following their groupings exactly in all cases.

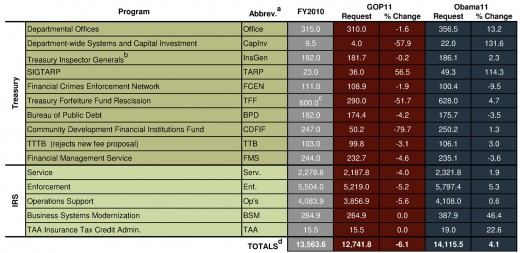

In millions of dollars.

a: abbreviations not necessarily official.

b: includes both the Treasury Inspector General and the Treasury Inspector General for Tax Administration.

c: as far as I can tell the money in this fund comes entirely from forfeiture revenue so this isn't really a budget cut it is a raid. The $600 million is an estimate of the funds total value from the following source: http://www.treasury.gov/about/budget-performance/budget-in-brief/Documents/Forfeiture%20Fund%20CJ%20508.pdf

d: I have removed the TFF numbers from the totals. See note above for explanation.

Graphs

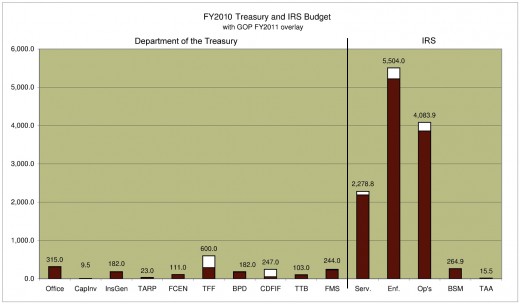

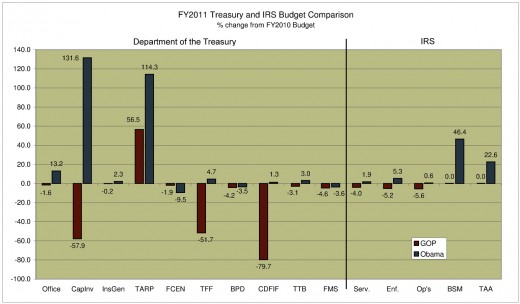

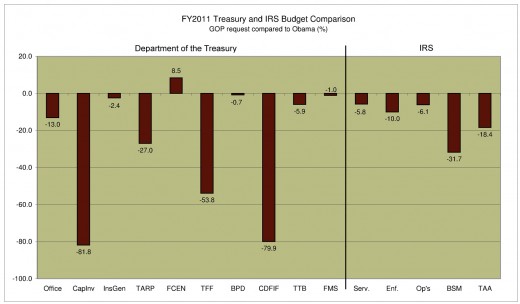

The first graph below shows program funding levels for FY2010. The white bar represents the 2010 budget level while the overlaid red bar represents the budget level requested by the GOP. The still visible white component therefore represents GOP proposed budget cuts. The second graph compares the Obama and GOP budgets to the FY2010 budget. The third graph shows the percentage difference between the GOP and the Obama budgets. The fourth graph shows the dollar difference between the GOP and Obama budgets.

Department of the Treasury and IRS graphs

Analysis

A number of important priorities are set forth by Obama for the Department of the Treasury.2 These include funding for new legislation such as the Affordable Care Act, Dodd-Frank Wall Street Reform, and the Consumer Protection Act, as well as improvements in service delivery through modernization, and a ramped up effort to collect unpaid taxes.

Departmental Offices

The Department of the Treasury manages U.S. Government finances. The Departmental Offices serve as the headquarters for the department. More specifically, it addresses areas of finance, tax, and terrorist and financial intelligence policies. The Democrats might sacrifice their budget request for this program for the sake of others.

Department-wide Systems and Capital Investment

The Department has requested funding for two programs; Enterprise Content Management (ECM) and Financial Innovation and Transformation. The ECM project is considered a key priority and appears to be partially complete already. I expect it to receive its $5 million request. The Financial Innovation project is intended to develop government-wide streamlined processes for financial transactions. This program seems like a no-brainer to me. I'm not sure why the Republicans would be opposed to it. I expect this program to receive the full funding request.

Inspector Generals

I have combined the budgets for the Treasury Inspector General and the Treasury Inspector General for Tax Administration. The purpose of the Inspector Generals' is to ensure accountability and transparency, and to help improve the efficiency and effectiveness of Treasury operations and programs. The GOP cuts are modest. I expect they will go through.

SIGTARP

SIGTARP is the Special Inspector General for TARP (Troubled Asset Relief Program). TARP is the program which bought junk assets from financial institutions during the 2008 crisis. This is one of the few programs where the GOP has actually requested a budget increase, but still not as much as requested by Obama. I expect the GOP request to be authorized.

Financial Crimes Enforcement Network

The FCEN's mission is to safeguard the financial system from criminal activity. This is one of the few programs where the GOP request is actually greater than the Obama request. I think the GOP will accept the larger cuts.

Treasury Forfeiture Fund

This fund is a deposit account for revenues generated though the seizure of property and assets. Funds can then be used by multiple agencies to finance programs. As far as I could tell this fund does not receives any money through appropriations, so this technically should not be considered a budget cut. Being that I don't know exactly what is going on here, I can not make any prediction.

Bureau of Public Debt

Borrows money for the government and then manages the debt. Budget proposal differences are minimal. Expect the GOP cut on this program.

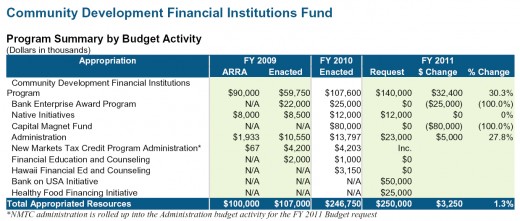

Community Development Financial Institutions Fund

The CDFIF is one of those programs that can probably induce instantaneous seizures in Republicans. The Fund "expands the availability of credit, investment capital, and financial services in distressed urban and rural communities".3 Two new programs are being proposed to begin in 2011. The Bank on USA Initiative designed to expand access to financial services and credit products to households which currently lack access, and the The Healthy Food Financing Initiative, intended to increase the "availability of affordable, healthy foods in underserved urban and rural communities".3

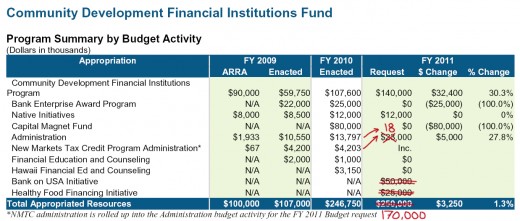

It is pretty interesting what is happening with this fund (see picture below). You can see two main programs are being cut, the Bank Enterprise Award Program and the Capital Magnet Fund ($105 million combined), as well as two smaller programs. Some money is being shifted around and then Obama is proposing the two new programs mentioned above (which are combined, $75 million).

My suspicion is that something like the following is what will happen. Those two new proposed programs are a tough sell at any time, in the current situation, I just can't see them getting through.

Alcohol and Tobacco Tax and Trade Bureau (TTB)

The TTB is the primary regulator of the alcohol and tobacco industries. They are also responsible for collecting excise taxes on alcohol, tobacco, firearms and ammunition. There are minor differences in the two budgets. Expect the GOP budget for this program.

Financial Management Service

The FMS is the governments financial manager and oversees a daily cash flow of $60 billion dollars ($694,444/second). The FMS collects money due, disburses payments and performs central accounting functions. Very similar budget proposals. Expect GOP budget request.

Internal Revenue Service

The IRS is the government tax collector. Their budget contains two strategic goals - to improve services and to enforce the law. The largest piece of Obama's requested budget increase is to carry out new legislative mandates as well as increase enforcement efforts.

IRS Services

This section of the IRS is responsible for processing tax filings, assisting taxpayers, and printing forms and publications. Improving services should ultimately save money, but whether it does or not the Republicans are slashing and burning. Expect their cuts to go though on this one.

IRS Enforcement and Operations Support

The enforcement division collects from tax evaders and performs audits. In 2009, they increased these efforts, focusing especially on offshore tax evasion schemes. They also increased audits (especially on the wealthy). Their efforts generated far more revenue than was spent.

Operations Support handles logistics, IT services, Human Resources, infrastructure, etc.

I have listed these two together because they both have the same fiscal reality. Implementing the Affordable Care Act (ACA) and increasing enforcement efforts should both generate more revenue than what is spent. Of course this isn't a fiscal issue - it is an ideological one. Republicans oppose taxes (theoretically) and bigger government and really dislike the ACA, so for them this is fighting a three headed monster.

The democrats on the other hand have to fight equally hard for their health care reform package. And they need money. So far in my budget analysis, I think this is the most important fight the democrats have. I expect them to come out ahead, but probably not with their full funding request.

Business Systems Modernization

This division of the IRS has a number of modernization efforts planned which they consider to be critical. Originally they requested a $123 million budget increase for FY2011 to try and complete these efforts for the 2012 filing season. This hasn't happened yet, and their FY2012 budget shows them holding 2010 budget level through 2011 and then having an increase in 2012 of $69.7 million which leads me to believe that their new plan is to complete these efforts over the next few years. Dividing the $123 million over FY2011-FY2013 seems a likely scenario.

TAA Insurance Tax Credit Administration

Provides a refundable tax credit to purchase health coverage for eligible taxpayers under the Trade Act of 2002. I think this program was expanded by the American Recovery and Reinvestment Act of 2009 and that eligibility is based upon job loss due to international trade. Seems like a likely program to get the GOP axe. Note, the actual name of the division in the IRS is the Health Insurance Tax Credit Administration.

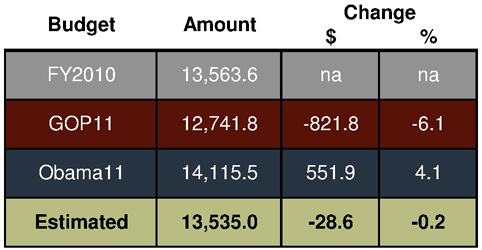

Prediction

My estimate for the Department of the Treasury budget for FY2011. For what it's worth.

Notes

1. FY2011 Continuing Resolution Reductions. The U.S. House of Representatives, Committee on Appropriations , n.d. Web. 22 Feb 2011. <http://republicans.appropriations.house.gov/_files/ProgramCutsFY2011ContinuingResolution.pdf>.

2. "Budget of the United States Government, FY2012, Department of the Treasury." The White House Office of Management and Budget, n.d. Web. 8 Mar 2011. <http://www.whitehouse.gov/sites/default/files/omb/budget/fy2012/assets/treasury.pdf>.

3. "Department of the Treasury - Budget in Brief FY 2011." United States

Department of the Treasury, n.d. Web. 8 Mar 2011.

<http://www.treasury.gov/about/budget-performance/budget-in-brief/Documents/FY%202011%20BIB%20%282%29.pdf>. Page 37.